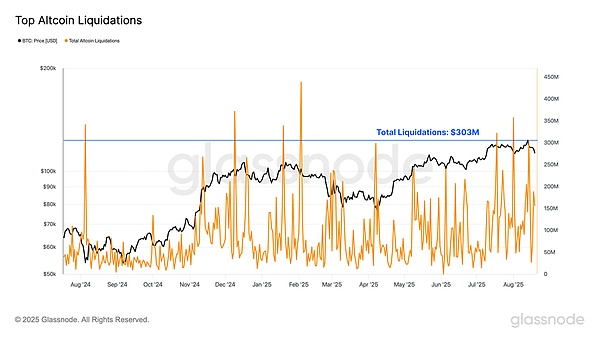

Pressure continues to build in the digital asset sector, with a broad sell-off impacting major currencies. Derivatives activity is particularly active, leading to an increasingly sensitive and reflexive market structure. Capital Inflows Slow Down After hitting a high of $124,400 last week, Bitcoin's upward momentum stalled, with the price falling to a low of $112,900, a drop of nearly 9.2%. This decline has been accompanied by a recent weakening of capital inflows, suggesting a reluctance among investors to inject new funds at current highs. Compared to previous historical highs, the current rate of capital inflows has slowed significantly: during the previous highs in March and December 2024, realized market capitalization (realized cap) grew by +13% per month, while the current peak is only +6% per month. This period of weak capital inflows highlights a significant weakening of investor demand. Recent profit-taking activity has also been declining, as can be seen through the "Volatility-Adjusted Net Realized Profit and Loss Indicator." This metric measures realized profits and losses in BTC and is normalized by the market size of Bitcoin's cross-cyclical growth. It is then adjusted using 7-day realized volatility to reflect the diminishing returns and slowing growth characteristics of mature assets. Notably, three waves of large-scale profit-taking occurred during the 2024 breakouts at $70,000 and $100,000, as well as at the previous high of $122,000 in July of this year. These events reflect both a strong desire among investors to take profits and an equally strong demand in the market to absorb selling pressure. In contrast, during this round of attempts to reach all-time highs, realized profit-taking decreased significantly. This dynamic can be interpreted as: even with less selling pressure from existing holders, the market has failed to maintain upward momentum. As local market momentum reverses and prices continue to decline, we monitor realized losses to assess whether investor sentiment has shifted significantly negatively. During this localized downtrend, investor realized losses accelerated, averaging $112 million per day. However, this figure remains within the typical range of localized pullbacks during this bull market cycle—surrenders triggered by events such as the unwinding of yen carry trades in August 2024 and the "Trump tariff scare" in March-April 2025 were significantly higher than current levels. This suggests that despite the market downturn, investor confidence has yet to be materially impacted. Leverage-Driven Decline: While on-chain profit and loss activity was relatively subdued during the recent highs and subsequent pullbacks, futures market activity has significantly accelerated. Bitcoin futures open interest remains at a high of $67 billion, highlighting the current high leverage in the market. Over $2.3 billion in open interest was liquidated during the recent sell-off, resulting in the 23rd largest notional decline in value on record. This demonstrates the speculative nature of the market—even moderate price fluctuations can trigger significant reductions in leveraged positions. A closer analysis reveals that both long and short positions saw an increase in liquidations during the formation of previous highs and subsequent price contractions: $74 million in short positions were liquidated during the previous high, while $99 million in long positions were liquidated during the downtrend. However, these figures are still significantly lower than the liquidations seen in similarly volatile market conditions this year, suggesting that recent liquidations were largely voluntary risk management measures rather than forced liquidations due to excessive leverage. The total open interest in futures contracts for major altcoins (ETH, SOL, XRP, and DOGE) surged to a record high of $60.2 billion over the weekend, approaching the size of Bitcoin contracts. However, this surge was short-lived, with prices plummeting by $2.6 billion as prices corrected, marking the tenth-largest drop in history. This dramatic volatility demonstrates that altcoins are attracting significant investor attention, significantly exacerbating the reflexivity and fragility of the digital asset market. Furthermore, the recent surge in margin calls in major altcoins has seen a surge in margin calls, reaching an average daily peak of $303 million, more than double the volume of margin calls in the Bitcoin futures market. The weekend's margin calls even ranked 15th on record, reflecting investors' growing appetite for leveraged altcoin exposure.

Speculative activity is heating up

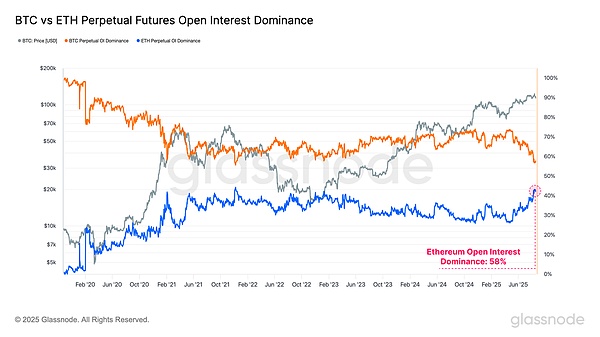

Ethereum has historically been viewed as a bellwether asset, and its outperformance cycles are often associated with "altcoin seasons" in the digital asset market.

Changes in the ratio of open interest in Bitcoin and Ethereum can be used to observe shifts in market participants' risk appetite. Current data is as follows: Bitcoin Open Interest: 56.7% Ethereum Open Interest: 43.3% Ethereum's recent rapid rise in share indicates a shift in market attention to the outside of the risk curve. Its open interest reached its fourth-highest level on record, confirming a significant increase in speculative activity. It's important to note that as the second-largest digital asset, Ethereum is one of the few assets capable of attracting institutional funding.

This trend is even more pronounced from the perspective of trading volume:

Ethereum perpetual swaps' share of trading volume soared to a record high of 67%, marking the most dramatic structural shift on record.

This significant shift in trading activity has intensified investors' focus on the altcoin sector, indicating an accelerated increase in risk appetite in the current market cycle. The Debate over Cycle Inflection Points: Measuring Bitcoin's performance from the lows of each cycle shows that in both the 2015-2018 and 2018-2022 cycles, the previous historical highs occurred 2-3 months after the corresponding points in the current cycle. While the existence of only two semi-mature cycles is insufficient evidence, this timing synchronization, combined with the wave of on-chain profit-taking over the past two years and the current high level of speculation in the derivatives market, is worthy of attention. Further supporting evidence: The duration of Bitcoin's circulating supply above the +1 standard deviation range in the current cycle has extended to 273 days, making it the second-longest cycle on record, second only to the 335 days in the 2015-2018 cycle. This suggests that the duration of the current cycle is comparable to historical cycles, measured from the perspective of "the vast majority of supply is in a profitable state." The cumulative profits (in BTC) realized by long-term holders (LTH) from the pre-cycle high to the final peak have surpassed all previous cycles except 2016-2017. This phenomenon is consistent with the aforementioned indicators and, from the perspective of selling pressure, further confirms that the current cycle has entered its late historical stage. However, each cycle is unique, and market behavior does not necessarily follow a fixed time pattern. These dynamics raise a key question: Is the traditional four-year cycle still valid? Are we witnessing this evolution? The coming months will reveal the answer. Conclusion: Bitcoin inflows are showing signs of weakness, with demand weakening even after the price hit a record high of $124,400. This slowdown in momentum coincided with a surge in speculative positions: Open interest in major altcoins briefly hit a record high of $60 billion before falling back by $2.5 billion.

Ethereum, as the bellwether of the "alt season," once again leads this round of rotation:

its open interest reached its fourth highest level on record, and the share of perpetual swap volume soared to a record high of 67%, marking the most dramatic structural shift to date.

From a cyclical perspective, Bitcoin's price trend also echoes historical patterns:

In both the 2015-2018 and 2018-2022 cycles, the previous highs occurred 2-3 months after the current point in the cycle low.

The scale of profit-taking by long-term holders is comparable to historical frenzy phases, reinforcing the market's late-cycle characteristics.

In summary, signals such as high leverage, profit-taking, and intense speculation are consistent with the characteristics of a historically mature market. However, each cycle is unique, and Bitcoin and the broader market do not necessarily follow a fixed timeline.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Joy

Joy Others

Others Nulltx

Nulltx Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx