Author: Lawyer Shao Shiwei

Introduction:

Based on the cases handled by Lawyer Shao in recent years and the large number of inquiries received in daily work, it is found that it is not uncommon for domestic police (especially in Hunan) to take criminal compulsory measures against relevant personnel for suspected crimes of opening casinos in the perpetual contract business of virtual currency trading platforms.

These relevant personnel include: shareholders, actual controllers, senior executives, business managers of contract modules, technical personnel, operating personnel, KOLs, and platform agents (who bring orders for exchanges and receive commissions) of virtual currency trading platforms.

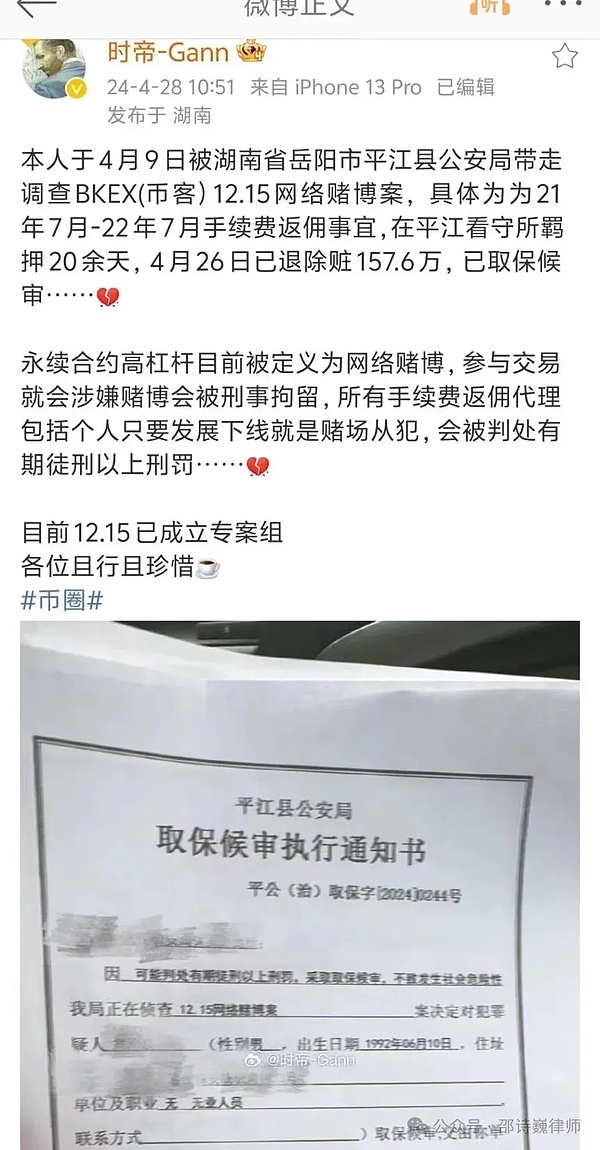

Based on the case handling in practice, the judicial authorities seem to have determined that as long as the virtual currency trading platform operates the "perpetual contract" business, it is equivalent to the platform's behavior being identified as the crime of opening a casino. On April 9, 2024, a user also posted a message on a social platform, saying that the high leverage of perpetual contracts is currently defined as online gambling, and the commission rebate agent, including the personal development of downlines, may be suspected of being an accomplice of the casino.

A recent case of opening a casino that I have handled was also because a virtual currency exchange carried out perpetual contract business, which led to the arrest of platform-related staff by public security organs across provinces.

So, does the perpetual contract business carried out by the virtual currency trading platform constitute the crime of opening a casino?

01 What is a "perpetual contract"?

Perpetual Futures, the full name of which is "Perpetual Futures Contract", evolved from futures contracts. It is a unique and common investment tool in the currency circle, which allows investors to conduct leveraged transactions in the cryptocurrency market. BitMEX, a cryptocurrency derivatives trading platform, mentioned on its official website that perpetual contracts were first created by the platform.

The difference between perpetual contracts and futures contracts is that futures contracts have a settlement date (delivery date), while perpetual contracts have no expiration date. This means that as long as the user's funds (margin) are sufficient, the contract can be held permanently and the user can freely choose when to settle.

Perpetual contracts have the following characteristics:

High leverage. Most exchanges' perpetual contracts support 100x or even 200x leverage;

No physical assets are required for trading. The user's trading target is an index based on the spot price, so the user does not need to actually own the spot to conduct two-way trading;

No expiration date, no delivery required. As long as the user does not blow up the position, he can hold it forever, avoiding the trouble of frequent delivery and position adjustment;

No interest. Only a low handling fee and potential funding rate are required (but the funding rate is two-way and may be an expense or income)

If the user determines that a certain currency will rise or fall in the future after analysis, he can go long (bullish) or short (bearish) on the currency through a perpetual contract. By amplifying the leverage ratio, users can gain higher potential profits while multiplying the risk. Therefore, perpetual contracts are a high-risk investment strategy.

02 Is a perpetual contract equal to gambling?

The logic of the case-handling unit that perpetual contracts are gambling is that one of the characteristics of gambling is to win big with a small investment, and perpetual contracts are to guess the rise and fall, to bet on the size. On the surface, perpetual contracts seem to be a way for users to obtain higher returns by guessing the rise and fall of the coin price, but is this actually the case? Let's analyze it.

What is gambling? There is no clear definition of this in Chinese law, but through the following Supreme Court guiding cases, we can summarize the characteristic circumstances that will be identified as gambling.

The Supreme People’s Court’s “Notice on the Release of the 26th Batch of Guiding Cases” (Guiding Case No. 146. The case of Chen Qinghao, Chen Shujuan, and Zhao Yanhai opening a casino) on December 31, 2020 used the Internet to solicit “investors” outside of legal futures trading venues in the name of “binary options” transactions. In this case, the court held that "members select foreign exchange products and time periods, click the "buy up" or "buy down" button to complete the transaction, and can make a profit of 76%-78% of the transaction amount by buying the right direction of increase or decrease. If they buy the wrong direction of increase or decrease, the principal will belong to the website (dealer). The profit and loss results have nothing to do with the increase or decrease of foreign exchange trading products. The transaction price and profit and loss range are determined in advance. The profit and loss results are not linked to the actual increase or decrease of prices. Traders do not have the right to exercise and transfer links. The transaction results are accidental, speculative and speculative. Therefore, Longhui's "binary options" are essentially the same as the gambling behavior of "betting on size and winning or losing". It is actually a bet between the network platform and investors, and it is a gambling behavior disguised as options."

By analyzing the court's viewpoint in the case and comparing it with the trading model of perpetual contracts, we can see that perpetual contracts are not gambling. The main reasons are as follows:

1. In the above case, the user chooses "buy up" or "buy down". Once the direction is wrong, the user will lose money. This is the concept of "buy and leave" in gambling. Once a choice is made, it cannot be changed. However, in the perpetual contract model, after buying, the user can choose to close the position and sell at any time according to the rise and fall of the market.

2. In the above case, the transaction price and the profit and loss margin are determined in advance. In the perpetual contract business, the transaction price refers to the closing price or the price of the selling contract, which is specified by the user or determined by the market price. The closing price, opening price, selected trading time, etc. may affect the user's profit or loss.

3. In the above cases, the user's profit and loss results are not linked to the actual price fluctuations, that is, in the gambling model, the gambler's profit and loss amount can be estimated by probability. Lawyer Shao once mentioned a case in the article "Is it an angel or a devil to let you fly with a single order for currency trading contracts?", in which Xi, as a global agent of Star Coin, guided customers to buy virtual currency to gamble by buying and selling, and then earned handling fees and profit and loss amounts from the gamblers. The reason why the platform's model was identified by the court as opening a casino is that users buy and sell virtual currency by betting USDT, making money if they buy right and losing money if they buy wrong, which is consistent with the model in the above cases in this article.

In the perpetual contract business, the user's profit and loss is related to the fluctuation of virtual currency. The amount of user profit and loss depends on the price difference between its buying and selling, and the specific amount of profit and loss is uncertain.

4. In the above case, traders have no right to exercise and transfer links. In the perpetual contract business, users can decide whether to terminate or add transactions at a certain time point based on their own judgment of the market situation, and can withdraw and cancel transactions at any time. In addition, users can use the "reverse transaction" function to switch short orders with long orders with one click.

5. In the above case, the online platform and investors are betting against each other. In the perpetual contract business, the exchange earns commission income, not "water pumping" from the user's wins and losses.

6. In the above case, the platform model was identified as "betting on size and winning or losing", but perpetual contracts, as a financial derivative unique to the currency circle, require investors to consider a variety of factors, conduct professional analysis and research on the trend and rise and fall of currency prices, formulate investment strategies, and reasonably allocate funds. The rise and fall of currency prices is caused by the combined effect of many factors, such as: macroeconomic trends, monetary policy, market supply and demand, participation of institutional investors, market sentiment and event impacts, etc.

In summary, lawyer Shao Shiwei believes that gambling in the crime of opening a casino is a complete bet on probability, and whether the gambler wins or loses is an accidental factor.

03 Lawyer's Tip:

The perpetual contract of the virtual currency trading platform is a financial derivative. From the perspective of its model and legal theory, it has been identified as the crime of opening a casino by some case-handling units. This lawyer believes that there is great controversy.

![]()

JinseFinance

JinseFinance

JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Clement

Clement Coinlive

Coinlive  Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph