Author: Brayden Lindrea, CoinTelegraph; Compiler: Baishui, Golden Finance

Although the U.S. securities regulator withdrew its request for a court ruling on the matter as part of its lawsuit against Binance on July 30, the regulator has not necessarily let go of Solana's responsibility as a security.

"There is no reason to believe that the SEC has determined that SOL is not a security,"Jake Chervinsky, chief legal officer of cryptocurrency-focused venture capital firm Variant Fund, said in a July 30 X post.

Chervinsky's post refers to the latest response from the U.S. Securities and Exchange Commission, which seeks to amend its complaint about "third-party crypto asset securities." Essentially telling the court that it no longer requires a determination as to whether the tokens listed in the lawsuit are securities.

While Chervinsky did not elaborate on what this “litigation strategy” might be, he stressed that the SEC continues to call the same tokens securities in other crypto exchange lawsuits, including its case against Coinbase.

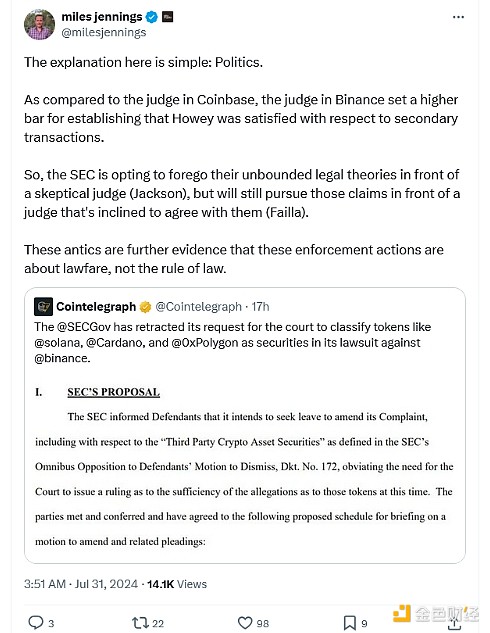

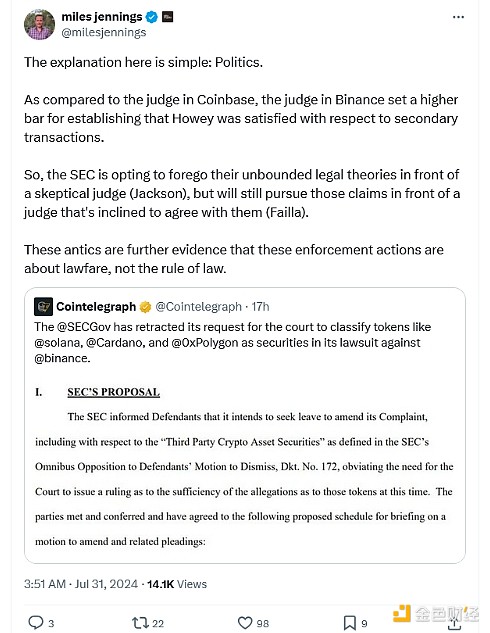

In separate posts, Miles Jennings, general counsel and head of decentralization at a16z Crypto, and Justin Slaughter, policy director at Paradigm, appeared to agree.

Slaughter argued that many people are “over-interpreting this document,” which doesn’t mean the SEC has determined that Solana and other tokens are not securities.

Jennings explained that Judge Amy Berman Jackson set such a high bar for establishing the Howey test in the Binance case that it wasn’t worth the SEC’s time and effort to prove that the tokens were securities.

Judge Katherine Polk Failla in the Coinbase lawsuit seemed more “inclined” to agree with the SEC’s position — and therefore, it wasn’t worth making the same request as in the Binance lawsuit.

Source: Miles Jennings

Jennings said he was not convinced the SEC had presented strong enough evidence to prove a link between secondary market token sales and token issuers’ management efforts.

“Obviously, I’m speculating about their political motivations, but that speculation is based on the information I have about what the SEC is doing behind closed doors,” he added.

Which tokens are affected?

In its lawsuit against Binance, the SEC claims that several tokens are securities.

The list includes Solana (SOL), BNB (BNB), Cardano (ADA), Polygon (MATIC), Sandbox (SAND), Decentraland (MANA) and Axie Infinity (AXS).

The SEC has claimed that at least 68 tokens are securities, affecting more than $100 billion worth of cryptocurrencies on the market.

Weatherly

Weatherly