Recently, there is an explosive news in the crypto industry: Singapore has recently strengthened its supervision of the cryptocurrency industry.

Simply put, the core requirement of the new regulations is: from June 30, 2025, crypto service providers that have not obtained a digital token service provider (DTSP) license will not be allowed to provide services to overseas customers.

This new regulation covers a wide range of areas, including token issuance, trading, custody, consulting and even research report publishing. The capital threshold has been raised and the KYC/AML requirements have been upgraded, which has forced many small and medium-sized players and unlicensed entities to consider transfer.

The Chinese in the cryptocurrency industry are very much like the "Jews", who are constantly migrating after being forced to leave their homes.

First they went from the mainland to Hong Kong, then from Hong Kong to Singapore, and now they are setting off again from Singapore to find their next place to live.

Everyone is speculating where the Jews in the currency circle will go next, and where is the Jerusalem of the crypto world. This article will analyze it systematically.

1. Impact assessment: How many people will the new regulations affect?

Let's do an impact assessment first.

Singapore has issued DTSP licenses to 33 companies. In addition, some companies have been operating in Singapore before the PSA (payment license) came into effect, that is, before January 28, 2020, and have been temporarily exempted. They must operate in compliance before their application for a license is approved or rejected.

So how many companies have not yet obtained a license?

According to MAS data in 2021, MAS received 480 applications for payment service licenses (including DPT/DTSP related), of which 19% (about 91) were withdrawn or rejected. By 2025, only 33 companies will obtain DTSP licenses, with an approval rate of less than 10%.

According to this application data, it can be seen that there are currently an estimated 200-300 crypto-related entities, of which unlicensed and unexempt companies may account for 60%-80% (about 120-240).

Based on the fact that each project team has about 5 to 20 people, it is estimated that there are thousands of people directly employed in the crypto industry, but it indirectly affects hundreds of thousands of users (market ecology).

For Singapore, a considerable proportion of talent and funds in the crypto industry will be lost.

2. Where will the practitioners in the encryption industry flow to?

Where will such a high density of talents and funds flow to? Where is the next destination for the Jews in the cryptocurrency circle?

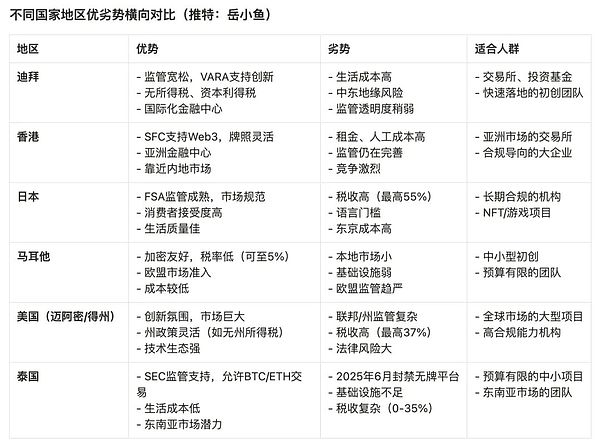

There are many different opinions. Here are several popular countries and regions with very high mention rates. We can make a horizontal comparison:

These countries and regions can be said to have their own advantages and disadvantages. So which country is more attractive?

In fact, we still have to start from the demand. We must first know what the Jews in the currency circle want?

In general, as a profit-seeking and highly liquid group, the cryptocurrency Jews will definitely give priority to areas with loose regulation, tax incentives and sound infrastructure.

Then, we can extract the core factors and make a relatively more quantitative assessment.

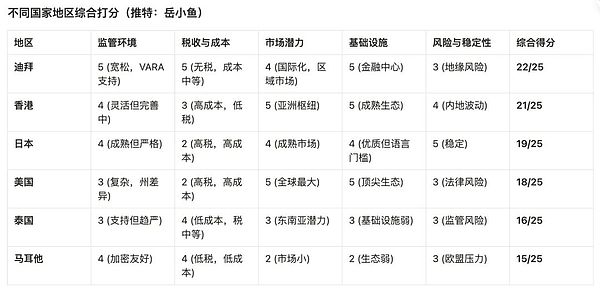

There are mainly five evaluation dimensions here,

- Regulatory environment (high weight): loose and clear regulation is conducive to rapid implementation, and strict but mature regulation is suitable for long-term development.

- Taxes and costs (high weight): Low tax rates and low living/operating costs are critical to the capital-sensitive crypto industry.

- Market potential (medium weight): Local and regional market size, crypto adoption rate, and internationalization.

- Infrastructure and ecology (medium weight): Financial, technological, legal support, and international environment.

- Risks and stability (medium weight): Geopolitics, regulatory uncertainty, and legal risks.

Each factor is scored from 1 to 5 (5 is the best), and ranked after the comprehensive score:

After scoring, we can draw the following conclusions:

(1) Dubai and Hong Kong are the first choices, suitable for rapid and low-tax landing and deep cultivation of the Asian market respectively.

(2) Japan and the United States are suitable for players with long-term compliance needs or global ambitions, but the cost and complexity need to be weighed.

(3) Thailand and Malta are more suitable for small and medium-sized projects with limited budgets. Thailand needs to pay attention to SEC license requirements in the short term.

However, different projects still need to be selected based on their own business scale, market goals and financial strength:

For large players, Dubai, Hong Kong and the United States can be selected.

For small and medium-sized teams, you can choose Thailand and Malta (short-term), Hong Kong and Japan (long-term).

3. To sum up

Will this migration of currency Jews give birth to a new "Crypto Jerusalem"? Where will become the next cryptocurrency center?

At present, Dubai, Hong Kong, Japan and other regions have initially formed a loose crypto-economic circle, which can be said to have its own characteristics. Dubai has low taxes, Hong Kong is compliant, and Japan is mature. Through the connection of the blockchain world, it is more like a crypto-federation.

This migration may be the turning point for the crypto industry from wild growth to mature governance.

We still have to understand that the real revolution is on the chain rather than geography, and the end point of the migration is not a certain city, but the continuation of belief, the pursuit and exploration of the concept of decentralization.

So, can we finally get rid of the constraints of geography?

Catherine

Catherine