An article analyzing how EigenDA changes Rollup economics

EigenDA is the largest AVS (Data Availability Service), leading other platforms in terms of both re-staked capital and the number of independent operators.

JinseFinance

JinseFinance

Author: Sreeram Kannan, EigenLayer; IOSG Ventures

MC: Let us now warmly welcome our esteemed guest, Sreeram Kannan, CEO & Founder of EigenLayer. He will present to us: Converting Cloud to Crypto.

Sreeram Kannan:

Thank you very much to the IOSG Ventures team for organizing this summit. I am very happy to be able to share it here. Given that we already have a good introduction to EigenLayer. I will talk about EigenDA and the topics we are exploring. When and where do we build EigenDA and bring the cloud to cryptocurrency?

When you think of Rollup, you probably think of two different goals. One of them is how to outsource the traffic of Ethereum L1 to our L2? But that’s not what we’re going to talk about today, our argument is how to bring cloud-scale computing to cryptocurrencies.

First of all, why do cloud applications need encryption?

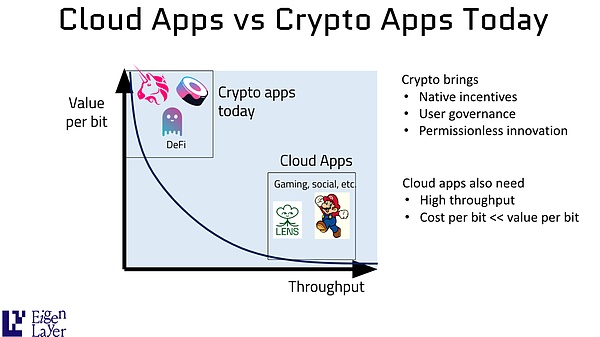

If you think about two different types of applications, they have two basically different axes. “Value per bit” is how much value your application has per transaction bit, and “throughput” is the rate at which you communicate. While today's cryptocurrency applications are running on high value per bit, low throughput per bit, cloud applications really rely on the exact opposite situation, where there is a lot of throughput but low value per bit.

How much is a tweet written by someone worth? But if there are many such tweets added together, it will bring a lot of value to the social network. For example, why do cloud applications need cryptocurrencies? Because cryptocurrencies can bring native incentives, user governance, and permissionless innovation. This last point is one of our favorite topics: permissionless innovation; how do we ensure that anyone with a good idea can build on top of all existing applications? If you're building on top of API Twitter or Facebook's API, then you're always worried about when is this API going to shut down, when is it going to be internalized into the core protocol.

But in cryptocurrencies, you have solid, immutable, and proven APIs that you can build on. But cloud applications also require very high throughput. You know our throughput today is not enough for cloud applications, we also need very low cost per bit, which is one of the two dimensions that EigenDA really focuses on.

Before we discuss this, let us first examine why use Rollup?

When you think about cloud and consumer applications, there are several dimensions that don't fit into the application deployment model we have in cryptocurrency today.

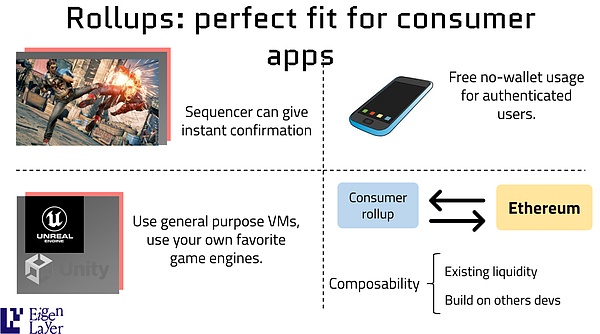

The first one is user experience. You want instant user experience, you want ultra-fast confirmation, what is better than a single centralized Sequencer?

This Sequencer is maintained through various checks and balances, where the correctness of the state transition function is checked through a valid proof or an optimistic proof, while also ensuring that Ethereum is returned L1 or transactions returned directly to the data availability layer are included. Instant confirmation completely changes the user experience.

The second one is when you want to introduce cloud native applications, we can't ask everyone to write their programs in EVM, we need new virtual machines , new programming languages, game engines, AI inference engines, all natively integrated into our blockchain infrastructure. This is what Rollup really helps us do.

Another thing that I think very few people understand is that when you have a single centralized Sequencer, you can do something that you are decentralizing There are things that cannot be done in the blockchain, which is subjective Admission Control. What is subjective admission control? You know we want authenticated users to be able to use something for free and that's not something you can do on a blockchain because you know the blockchain has to make sure there's no spam and the only way to make sure there's no spam is to charge a fee and the price It is a very difficult mechanism to differentiate between MEV robots and real users.

This is what we can do with Rollup. Why can we do this with Rollup? Because we have a single centralized Sequencer or Sequencer that can impose subjective Admission Control. For example, if you already have a Facebook or Twitter ID, you should be able to log in and use the app without having to pay anything, not even a wallet, which greatly simplifies the onboarding experience for users, so Rollup has some superpowers that few people understand , and finally, we want to get all of this without losing the benefits we're used to.

Composability with other applications in the blockchain space. We want to gain access to existing liquidity, and we also want to build on the work of other developers. One of the things we're trying to do at EigenLayer is make sure that people focus on building truly resilient systems, rather than having to work redundantly. If you look at it from a "civilization" perspective, it's going in the direction of each of us doing more and more specialized things and consuming more general things, which is exactly what we see with Rollup and EigenLayer here Where it comes into play.

Okay, Rollups are great, but they also have a lot of problems. We observed these issues with Rollup.

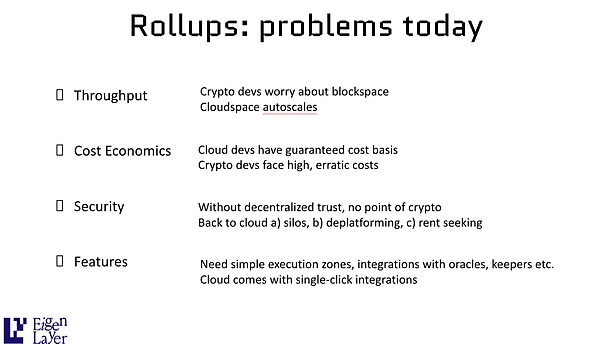

The first issue is throughput.

So if you go to any cryptocurrency developer, they are probably worried about block space. You know, if my need for block space increases, will someone else come and flood the block space? Like Yuga Lab, their next boring ape suddenly drowns you in traffic and you can't get into it.

But this is not the case in the cloud. The space in the cloud will automatically expand. If the demand increases, the cloud will have more space. This is cryptocurrency. That should be the case, but reality is not.

There is also cost economics. If you are a cloud developer, you are used to a very guaranteed performance and cost base, cryptocurrency developers face high and unstable costs, and even if the costs are low, you do not know the block space of the blockchain. When it's full, you'll face congestion costs.

We need security. We have ways to solve the first two problems and achieve high throughput and low cost. But giving up security is not an option. Finally we need new functionality. We need to be able to build new virtual machines, we need more integration.

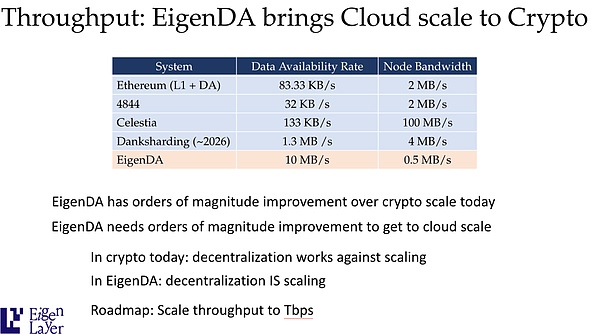

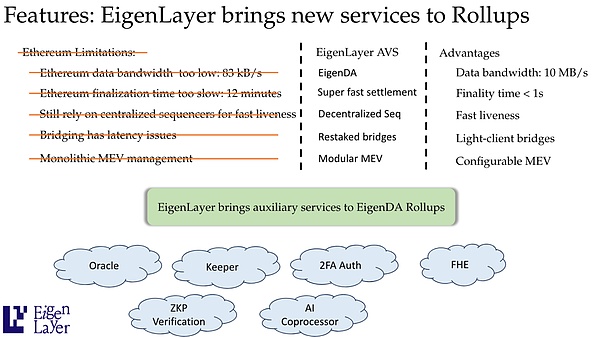

How we solve all these problems with EigenDA. The high-level idea is that EigenDA is an order of magnitude larger than anything out there. Ethereum 4844, the upcoming Dencun upgrade, at tens of kilobytes per second, EigenDA will have 10MB per second at launch, which I think is more throughput than we need for today's applications. But the next generation of developers will know how to take advantage of this scale of throughput, and EigenDA is an order of magnitude improvement at the scale of today’s cryptocurrencies. We think that's not enough, our goal is to convert the cloud into cryptocurrency, which means we need more scale, so we are working on that.

One of the things is that in cryptocurrency, nominal decentralization is the opposite of scaling, if you want more nodes to participate, you Node requirements need to be reduced, etc. So decentralization and scaling are antithetical to each other. EigenDA scales horizontally, meaning EigenDA’s decentralization is scalable. The more nodes you have, the more throughput you can send over the network, no single node needs to download all the data, this is the architecture of EigenDA.

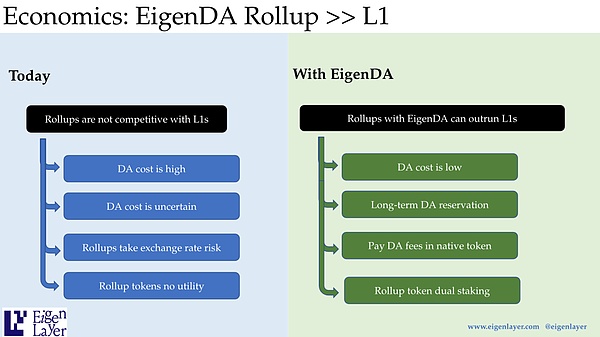

Okay, so what about economics, random price fluctuations and so on. So if you look at a Rollup and compare it to Layer 1, you'll find that Rollup has a hard time competing with Layer 1 on some dimensions.

The first is the cost of data availability, the cost of writing data to a common data repository is quite high; the second is that the cost of data availability is uncertain, even if it is low today, when 4844 is launched, you will Say, I know it's going to be cheaper in the next location, so let's just go get it. You know building all our applications out there and then someone comes up with some new Inscription and that floods your entire bandwidth.

My intuition is that 4844, even if it brings more bandwidth, will not significantly reduce the Gas cost because of this uncertainty, which is A big problem, whereas if you are L1 you don't have this problem because you know exactly what the cost basis is because you know no one else is interfering with you.

Finally, Rollup takes on the exchange rate risk, which means if Rollup has a native token and pays a fee, they don't know how much the fee will fluctuate, because you know that the Rollup token can fluctuate with ETH, so there is A Swap risk.

Ok, but for a Layer 1 this is not the case since you can just give out a portion of your own inflation. How do we do that in EigenDA? How do we make Rollup better than Layer 1?

Why? The first one is the low cost of data availability. We built a lot of data availability on a very large-scale system, so the cost is very low. The second one is that we have the ability in EigenDA to do long-term reservations, just like you go to AWS and reserve an instance that only you use and no one else touches it, you reserve a data availability channel for yourself, which in EigenDA is possible.

Next, even though you nominally pay ETH when you make this kind of reservation, you can also pay with your own Native Token, which means You fix a certain inflation of your own native token, which is actually used to run data availability, and finally, the Rollup token can be used for Dual Staking in EigenDA.

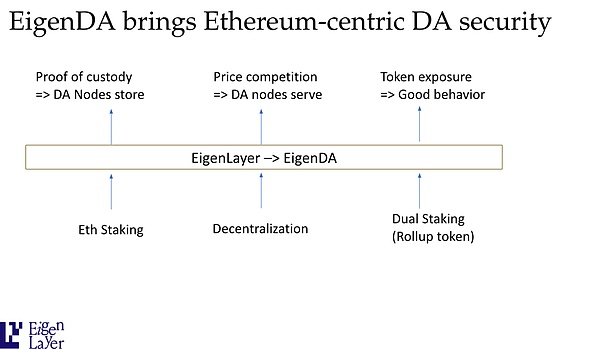

This means that the data availability system is protected not only by ETH Stakers, but also by a committee that holds your own tokens. All of this work is outsourced to the EigenLayer and EigenDA systems to manage, which is what EigenDA does for Rollup. EigenDA brings Ethereum-centric security, which is the architecture of EigenDA. ETH Stakers participate in EigenLayer and they can Restake to EigenDA. We also bring decentralization from the Operator of Ethereum nodes. Finally, we say that we Allow Rollup tokens to be used for Dual Staking.

So these all ensure that when you build on EigenDA, we have high data availability security. Finally, there are limits beyond data bandwidth.

Other limitations you see in Ethereum today, for example, the time to Finality is too slow, it takes 12 minutes to finalize a block, there are new blockchains that come up and say I will in a second Or give you confirmation in less time, which is competitive.

So what we can do, we can build new services on top of EigenLayer to solve these problems, and you can have a super-fast Finality like NEAR is building Layer, you can also do this using, for example, a decentralized Sequencer like Espresso. You can use a distributed sequencer instead of a bridge, since bridges are a flimsy and low-trust model.

When someone wants to move data from one L2 to another L2, can we have a really solid bridge, you have enough on the support bridge Stake, and then immediately accept the receipt and move the Value on the other end, so you can achieve almost instant confirmation through the Restaked bridge. Finally, you can have more powerful MEV management tools. If you are Rollup on EigenDA, you can Hook it up.

So EigenDA brings many auxiliary services to EigenDA Rollup.

Now I mentioned some limitations of Ethereum, but there is also additivity, there are new Oracles, there are new Watchers, they perform event-driven operations, Fully Homomorphic Encryption, ZK Proof Verification, AI Coprocessors, and many, many new categories that will make Rollup working with the EigenLayer ecosystem very easy over time.

A big thank you to IOSG Ventures for organizing this summit for us.

Youtube link: https://youtu.be/YDP6mvcxwdg

Medium link: https ://iosgvc.medium.com/11th-old-friends-reunion-talk-eigenlayer-coordination-layer-of-open-innovation-be3df4018bab

< em>Part.2 IOSG post-investment project progress

MakerDAO has voted to increase the DAI savings rate to 15%

* DeFi

MakerDAO has voted to approve the proposal to increase the stable rate of ETH, WBTC treasury and other mortgage assets and many other changes. The adjusted stable rate The range is 15% to 17.25%. In addition, the annual interest rate for SparkLend DAI borrowing will increase from 6.7% to 16%. The PSM cooling-off period for debt ceiling increases will be shortened from 24 hours to 12 hours, increasing USDC deposits and DAI minting throughput. The DAI Savings Rate (DSR) will increase to 15%, making holding DAI more attractive, boosting demand and easing downward pressure on prices. The GSM pause delay will be reduced from 48 hours to 16 hours to allow for faster implementation of future adjustments. The above changes will be implemented in the Maker protocol at 03:55 Beijing time on March 11.

CyberConnect launches Cyber, a social L2 network with re-staking function

* Social

Decentralized social network protocol CyberConnect announced Launch of Cyber, the modular Ethereum L2 network with re-staking capabilities, a Layer 2 designed for socialization and reset for mass adoption. Cyber, in partnership with AltLayer and powered by EigenLayer and Optimism, will act as the social layer for Web3 applications. The Cyber Sepolia testnet will go live next week. CYBER staking is now live and participants can earn CYBER Season 2 airdrops. At the end of the 3-month campaign period, the project will reward stakers with up to 1 million CYBER tokens.

Shrapnel adjusts its SHRAP token unlocking plan, reducing token unlocking volume in April by nearly 75%

* GameFi

Shrapnel, a first-person shooter on Avalanche, has announced adjustments to its SHRAP token unlocking plan, reducing the amount of tokens unlocked in April by nearly 75%. The new program has a non-linear structure, with unlocking speeds starting at a low rate and accelerating as the user base grows and the utility of SHRAP usage increases. This adjustment affects the unlocking schedule for the team, advisors, seeds, and strategy token holders, and is designed to better align with the game’s launch schedule. Shrapnel offers an early access version of the game on PC via the Epic Games Store, with plans to leverage multi-million dollar SHRAP-supported weekly tournaments to boost the gaming experience. CoinGecko data shows that the SHRAP token is currently priced at approximately $0.2858, with a market capitalization of $125 million. Over the past 30 days, SHRAP price has also experienced a 34% increase as the overall cryptocurrency market has experienced price increases. Still, the price is below the all-time high of $0.41 set in December.

Web3 API service provider Kravata completed US$3.6 million in seed round financing

* Infra

Web3 API service provider Kravata announces completion of 360 US$10,000 in seed round financing, with participation from Volt Capital, Framework Ventures, Circle Ventures, Magma Partners and SIMMA Capital. It is reported that Kravata helps users connect to Web3 and get Web2 experience through application programming interfaces, while integrating the advantages of Web3 into their services without having to bear the burden of in-house technology development.

Part.3 Investment and Financing Events

The cross-chain communication project Zeus Network announced its lineup of angel investors, with participation from Solana and Stacks Lianchuang

* Infra

Zeus Network, the communication layer between Bitcoin and Solana, announced a lineup of angel investors, including Solana United Founder Anatoly Yakovenko, Mechanism Capital founder Andrew Kang and Stacks co-founder Muneeb Ali, among others. The venture capital lineup has not yet been announced. Zeus Network, a native, permissionless communication layer built between Solana and Bitcoin, has been actively shaping the cross-chain future since December 2023. It is currently participating in the Jupiter LFG Launchpad voting and received over 50% of the votes, showing great potential to become the first launch project on Jupiter. Justin Wang, founder of Zeus Network, said: "Zeus Network's good team culture enables the realization of unique technology in the world. Through Zeus Network, we can lock in more than one trillion US dollars worth of Bitcoin circulating in the market to achieve unprecedented cross-chain liquidity. Create more use cases and benefits. Solana and Bitcoin are just the first steps in technology application, and will be expanded to more blockchains in the future."

Web3 security company GoPlus Security completed $4 million in financing, with Binance Labs participating

< em>* Security

Web3 security company GoPlus Security announces the completion of a $4 million “Private II+ ” In the private equity round of financing, Binance Labs, SevenX Ventures, Redpoint China Ventures, Avalanche, etc. participated. So far, the company’s total financing amount has reached US$15 million. In addition, GoPlus plans to launch its end-user services platform SecWareX this month.

Orion Protocol announced that it has received strategic investment from DWF Labs and will soon rebrand to Lumia

* DEX

Exchange The aggregation platform Orion Protocol announced that it has received strategic investment from DWF Labs, and DWF Labs agreed to lock the ORN tokens it purchased for 12 months. The specific amount of this investment was not disclosed. In addition, Orion is about to rebrand into DeFi infrastructure – Lumia. Orion Protocol said that over the next 30 days, it will announce a series of partnerships and integrations designed to increase the utility, adoption, and value of ORN. Previously, it was reported in February last year that Orion Protocol lost approximately US$3 million in an attack.

BTC trading application Oyl completed a $3 million Pre-Seed round of financing, led by venture capital firm Arca

* Wallet

Bitcoin trading application Oyl completed a $3 million Pre-Seed round of financing, led by venture capital firm Arca, with participation from BitMEX co-founder Arthur Hayes, Web3.com Ventures and BRC-20 creator Domo cast. Oyl is building a trading platform called “Oyl Wallet” for the Bitcoin ecosystem, providing “in-wallet” trading capabilities for Bitcoin Ordinals. The platform will be launched in the coming weeks.

Cosmos ecological development platform Cosmology completed a US$5 million seed round of financing

* Infra

Cosmos ecological development platform Cosmology completed 500 The company raised US$10,000 in seed round financing, led by Galileo and Lemniscap, with participation from Dispersion, HashKey, Tuesday Capital, Osmosis Foundation, Chorus One and Informal Systems. The company did not disclose the valuation. It is reported that Cosmosology provides a full-stack development environment, including Tendermint developer tools, Cosmos SDK and Internal Blockchain Communication (IBC) protocol. These tools, such as Telescope and Cosmos Kit, are designed to simplify the development of applications on Cosmos.

Modular Blackwing completed US$4.5 million in financing, led by Hashed and others

* Modular

Modular blockchain Blackwing completed US$4.5 million in financing, led by Hashed and Gumi Cryptos. The investment is used to develop the first modular Layer2 blockchain designed for liquidation-free leveraged trading of any asset. It is reported that Blackwing’s infinite pool provides a novel solution for liquidation-free leverage trading. By converting liquidity provider positions into collateral, the platform ensures that the original positions used for borrowed funds trades can be recreated regardless of asset price movements. With this new structure, liquidity providers can benefit from earning more fees and traders can benefit from safer leverage. Additionally, Blackwing introduces an intent resolver architecture that abstracts execution complexity and focuses on satisfying traders’ intent.

AI video generation tool Haiper completes US$13.8 million in seed round financing

* AI

Former DeepMind members Yishu Miao and Ziyu Wang launched the AI video generation tool Haiper. The tool is based on its unique AI model and is designed to solve video generation challenges. Haiper has raised $13.8 million in a seed round led by Octopus Ventures with participation from 5Y Capital. Previously, angel investors including Phil Blunsom and Nando de Freitas helped the company close a $5.4 million pre-seed round in April 2022. Users can generate videos for free on the Haiper website by entering text prompts, although there are certain limitations. The company is planning to expand its video generation capabilities and has explored commercial use cases with companies including JD.com.

Cryptozoology company Zama completed a $73 million Series A round of financing, led by Multicoin Capital and Protocol Labs

* FHE

Open source cryptography company Zama has completed a $73 million Series A round of financing co-led by Multicoin Capital and Protocol Labs. The round also includes participation from investors including Metaplanet, Blockchange Ventures, Vsquared Ventures and Stake Capital, as well as angel investors including Filecoin founder Juan Benet, Solana co-founder Anatoly Yakovenko and Ethereum co-founder and Polkadot co-creator Gavin Wood . Zama has raised more than $80 million in total funding to date at an undisclosed valuation. Zama’s technology focuses on fully homomorphic encryption (FHE), which is designed to enhance data confidentiality. The company plans to use the funding to continue developing its FHE tools, with the goal of achieving a thousand-fold increase in performance to support larger-scale applications.

Multi-chain staking platform VaultEscrow completes US$8 million in seed round financing

* Staking

VaultEscrow, a multi-chain pledge platform, announced the completion of a US$8 million seed round of financing from undisclosed investors. According to reports, the platform aims to lower the entry barrier for new DeFi users while providing tools and features that meet the needs of experienced traders and investors. The platform’s standout feature is multi-chain staking, which enables users to participate in various blockchain networks and leverage assets from different protocols to earn revenue. VaultEscrow claims that this approach not only improves the liquidity and efficiency of the DeFi market, but also opens up new areas of opportunity for both novice and experienced investors.

Part.4 Industry Pulse

Circle cross-chain transfer protocol will be launched on Solana mainnet on March 26

* Stablecoins

Circle cross-chain transmission protocol CCTP will be launched on the Solana mainnet on March 26. Circle said it has added a new pre-minting address that allows CCTP to mint USDC on Solana.

Mirror L2 announced that it will open the test network within a week

* Layer 2

BTC The second-layer network project Mirror L2 announced that it will open the test network within a week and open the public beta to all network users. Users who participate in the test have the opportunity to earn points and win MIRR call option airdrops. Mirror L2 is a decentralized Proof of Stake (POS) BTC L2 network that is EVM compatible and utilizes BTC as GAS. It previously announced the completion of its first round of financing, with participation from UTXO, Conflux and IMO Ventures. In addition, Mirror L2 is conducting node elections to generate hundreds of nodes and grant purchase rights for MIRR tokens. It has attracted more than a hundred institutions and KOLs to participate in the election.

LayerZero is now available on inEVM

* Infra

Cross-chain interoperability The protocol LayerZero was announced on the X platform and LayerZero is now online on inEVM. Launched by injective in partnership with Calderaxyz, inEVM is an EVM-compatible collection that enables developers in the Ethereum community to access injective’s network and user base. With this integration, Ethereum developers can use LayerZero to extend into inEVM. According to earlier news, Injective will launch the Layer2 Rollup solution inEVM on the main network.

Injective launches Layer2 Rollup solution inEVM on the main network

* Rollup

Injective announced Launched the Layer2 Rollup solution inEVM on the mainnet to promote on-chain composability of Ethereum, Cosmos and Solana. inEVM allows Ethereum developers to deploy applications on Injective without requiring code changes. Although Injective originally planned to launch the inEVM mainnet in the fourth quarter of last year, Injective Labs CEO and co-founder Eric Chen said that the delay was just to find the best time for everyone involved, "We decided to postpone it to this quarter, This way many developers can start the ecosystem through already deployed dApps." It is reported that projects released on Injective's inEVM mainnet include Celestia, Pyth, TimeSwap and Thetanauts.

Uniswap Labs: Multi-wallet conflict resolution EIP-6963 has been launched on Uniswap APP

* DeFi

< p style="text-align: left;">Uniswap Labs announced on the X platform that the multi-wallet conflict resolution EIP-6963 has been launched on the Uniswap APP. It is reported that EIP-6963 is designed to resolve conflicts that occur when users try to use multiple wallet providers in a single web browser. Related reading: A brief analysis of multi-wallet conflict resolution EIP-6963.DeFi TVL exceeded $100 billion for the first time since May 2022

* DeFi

The total locked value (TVL) of decentralized finance (DeFi) protocols exceeded US$100 billion, reaching US$101.36 billion, of which lending was US$32.62 billion (32.2%), and decentralized exchanges Assets were $19.97 billion (19.7%), collateralized debt positions were $12.22 billion (12%), and rehypothecation activity was $10.06 billion (9.9%). The last time DeFi TVL exceeded $100 billion was on May 11, 2022, when DeFi TVL was $112.67 billion. Analysts say surging cryptocurrency prices and increased interest in rehypothecation and real-world assets (RWA) are driving TVL higher. At the same time, Ethereum staking also hit an all-time high. According to previous news, more than 31.5 million ETH (worth approximately $115 billion) has been pledged on the Ethereum blockchain, accounting for 26% of the total supply.

OKX Web3 wallet now fully supports the ARC-20 protocol and will be launched on the Atomics market soon

* Wallet / DEX

OKX Web3 wallet now fully supports the Atomics (ARC-20) protocol and will be launched on the Atomics market soon. Users can view and transfer ARC-20 protocol assets through the OKX Web3 wallet. In addition, in order to ensure the security of user assets, OKX Web3 wallet is the first multi-chain wallet to realize the isolation of Bitcoin assets. It can provide a second reminder when users transfer Bitcoin assets to avoid accidentally burning assets to the greatest extent. Currently, users can experience it immediately by updating the OKX APP or OKX Web3 plug-in wallet to the latest version. It is reported that OKX Web3 Wallet is the industry's leading one-stop Web3 entrance. It now supports 85+ public chains. The three terminals of App, plug-in and web page are unified, covering 5 major sectors: wallet, DEX, DeFi, NFT market, DApp exploration, and supports Ordinals market, MPC and AA smart contract wallets, exchange Gas, connect hardware wallets, etc.

The 2024 ETHDenver Hackathon announced the Top15 list, including five major tracks such as infrastructure, Defi, and DAO

* ETHDenver

The 2024 ETHDenver Hackathon selected 15 top projects (Top15), which cover infrastructure and expansion (such as Verifido, Pat.io, Storylus), decentralized finance (DeFi) , non-fungible tokens (NFT) and games (including Egg Wars, Bubble Wars, Michi Protocol), decentralized autonomous organizations (DAO) and communities (A Bank For DAOS, Sekai, Tribuni), influence and public goods (Befit, EBF Network of Trust Impact, Unbound Science) and identity, privacy and security (ODIN, OOPS!, HoneyPause) five major tracks.

Grayscale, Coinbase and the US SEC are negotiating on Ethereum spot ETF matters

* Legal

Grayscale and Coinbase recently met with U.S. SEC officials to discuss rule changes for the launch of an Ethereum spot ETF. According to the presentation shared by the SEC, Coinbase provided five reasons why the Ethereum spot ETF should be approved, namely: 1. The shares of the Ethereum spot ETF can be classified as commodity-based trust shares; 2. The U.S. SEC approves Bitcoin The reasons for currency spot ETP also apply to Ethereum; 3. Ethereum “has a mechanism that can significantly limit the risk of ETH fraud and manipulation”; 4. The performance of the Ethereum spot market has highly demonstrated that the market is resistant to fraud and manipulation; 5. As with Bitcoin, Coinbase’s comprehensive surveillance sharing agreement with the Chicago Mercantile Exchange (CME) will help monitor fraud and manipulation.

EigenDA is the largest AVS (Data Availability Service), leading other platforms in terms of both re-staked capital and the number of independent operators.

JinseFinance

JinseFinanceEigenDA is the largest AVS (Data Availability Service), leading other platforms in terms of both re-staked capital and the number of independent operators.

JinseFinance

JinseFinanceEigenLayer, a restaking service for Ethereum, launches on mainnet with $12 billion in user deposits. It enables staked ETH transfer to secure other networks, expanding Ethereum's security to diverse blockchain applications. Initial launch includes EigenDA service, offering gradual rollout of functionalities.

Huang Bo

Huang BoThis article attempts to provide an in-depth look at the risks that EigenLayer has addressed, including potential pitfalls faced by the EigenLayer service and its operators, as well as the potential for systemic threats to Ethereum as a network.

JinseFinance

JinseFinanceIn the future, Celestia will be able to enjoy the incremental market gains brought by the dual trend of modularization + application chain, while EigenDA will gain more access to the Ethereum-based stock market that has higher security requirements.

JinseFinance

JinseFinanceRecommended reading for today evening: 1. Big inventory of potential airdrops in 2024; 2. Variant: Why we lead the investment in the zero-knowledge proof market L1 Gevulot; 3. How does Frax Bonds work? What are the main features? ;

JinseFinance

JinseFinanceSolana's co-founder, Anatoly Yakovenko, recently made a noteworthy revelation, characterising the protocol as an "Ethereum L2 with the Wormhole Eigenlayer." This cryptic statement, despite its technical nature, serves as an attempt to ease the intense rivalry between Solana and its larger counterpart, Ethereum (ETH).

Joy

JoyGoogle Cloud has joined the "EigenLayer Operator Working Group" along with more than 65 operators and independent participants.

Olive

OliveKevin Rose, co-founder of Moonbirds creator Proof, said that his Ethereum wallet was “hacked” after valuable assets were swiped.

decrypt

decrypt1Inch plans to expand into a largely untapped Asian market, but a lack of DeFi knowledge is preventing mass adoption

Cointelegraph

Cointelegraph