Author: Electric Capital; Translator: Peisen, BlockBeats

Editor's Note:

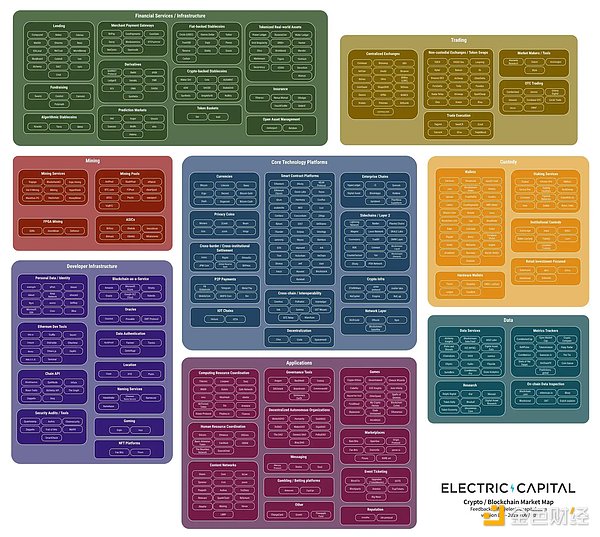

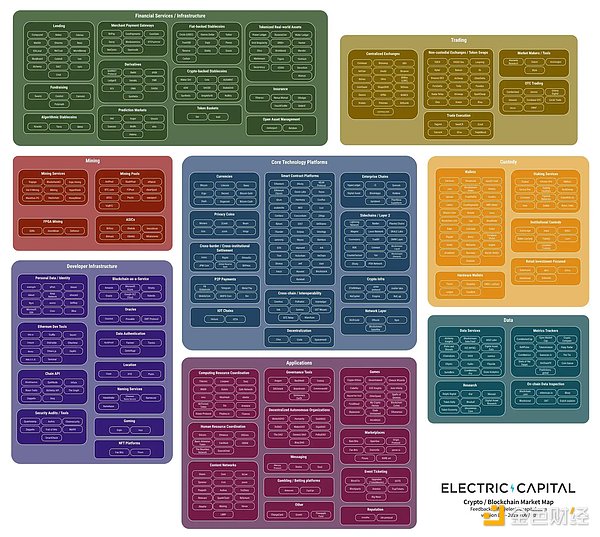

Electric Capital has drawn up a crypto market map after tracking more than 1,500 projects across the crypto space, dividing crypto projects into six technical levels, including core infrastructure, expansion, interoperability, developer tools and services, protocols, and applications. The analysis shows that DeFi has now become the main category of crypto; NFT now supports the entire crypto application; scalability and interoperability projects are maturing; consumer-oriented applications and protocols are growing; innovative technologies have moved from the theoretical stage to the practical stage.

The Crypto Market Map tracks more than 1,500 projects across the crypto space. The goal of the Crypto Market Map is to help people understand and put projects in context in the crypto environment. It clearly shows the industry structure and the roles played by different companies and projects.

The website is an important place for the community to grasp the expanding crypto space.

The Crypto Market Map is the first tool to contextualize the role of each major project in the ecosystem. The crypto market map is divided into six technical layers, from the bottom layer of infrastructure projects to the top layer of end-user-oriented projects. These layers reflect the progress of crypto infrastructure maturity.

The six technical layers of the crypto market map include:

Core Infrastructure: This base layer includes Bitcoin and other Layer 1 blockchain projects that have expanded on the basis of Bitcoin's initial design, providing improvements and different trade-offs. Mining services, hardware manufacturers, and other infrastructure-level projects are included in this layer.

Scaling: As the use of Bitcoin, Ethereum, and other Layer 1s increases, projects have emerged to solve scalability problems. This layer includes Layer 2, Layer 3, and modular blockchain projects.

Interoperability: As the number of chains increases, the ability to transmit information across chains becomes critical. Projects in this layer focus on enabling cross-chain communication, data sharing, and asset transfer.

Developer Tools and Services: This layer lists tools, services, and data providers that are critical to developers and users. It covers everything from development frameworks to data analysis tools.

Protocols: These projects are characterized by the fact that most of the rules are executed on the chain. Many different front ends can be created on top of these protocols to serve different user groups. These projects cover a variety of use cases such as DeFi, NFT & Games, Social, Identity & Data Sovereignty, Privacy, etc.

Applications: These projects are characterized by the fact that most of the rules are not executed on-chain. These projects cover a variety of use cases such as centralized finance, creator platforms, NFT & Games, Social, Identity & Data Management & Sovereignty, Privacy, etc.

The boundaries between protocols and applications are not always clear, and many projects can be considered both at the same time. This is because many applications in crypto have both off-chain and on-chain components.

In the Crypto Market Map, 138 projects are listed in multiple categories.

The Crypto Market Map aims to visually show the direction in which most projects in the crypto space are building. The height of each level shows the number of projects. The highest level has the most projects. In each level, categories with more projects are on the left, and categories with fewer projects are on the right.

As crypto technology matures, crypto becomes more specialized and complex. We created the Crypto Market Map to provide an overview of the rapidly expanding crypto industry.

Since June 2019, the Electric Capital market map has included 500+ projects. Although only important projects are taken into account, the 2024 crypto market map includes 1,500+ projects.

Since the first version of the market map was released in 2019, the crypto space has undergone significant changes:

DeFi is now the main category of crypto. In 2019, the DeFi category did not appear in the market map because it was not enough to separate from non-protocol financial applications. Projects like Uniswap and Compound were launched less than a year ago. Today, DAI, the third largest stablecoin with a circulating supply of $34 billion, had not yet been launched. At the time, the total value locked (TVL) of DeFi as a whole was less than $500 million. Today, DeFi has $85 billion in TVL and is the largest category in the crypto market map, covering 394 projects across 14 subcategories, including brand new specialized subcategories such as yield, liquid staking, liquid re-hypothecation, etc.

NFTs now underpin the entire crypto application. In 2019, the most well-known NFT collectibles like Cryptokitties were included in the "Games" category. Few standalone collectibles existed. Most applications do not use NFTs. Today, NFTs have become the standard for assets across multiple fields such as games, creator platforms, music, art, loyalty, finance, identity, etc. Protocols that allow lending, borrowing, and derivatives on NFT assets have become an entirely new category covering 49 projects.

Scaling and interoperability projects are maturing. In 2019, there were 17 Layer 2 projects. There were 8 cross-chain and interoperability projects. Today, scalability and interoperability exist as separate “technology layers” in the crypto market map, covering many categories and subcategories. There are now 73 significant Layer 2 projects. Layer 3 projects have emerged. Modular blockchains are a new category within scalability, with more than 60 significant projects, more than all Layer 2 and cross-chain projects combined in 2019. Intent and account abstraction is a new category within the interoperability layer, with 11 projects.

Consumer-facing applications and protocols are growing. Gaming, social, and other consumer-facing applications are expanding rapidly. In 2019, there were only 30 major gaming projects; today, there are 121 projects in the games, gaming platforms, and metaverse space. Social applications and protocols now have 110 projects.

Innovative technologies have moved from the theoretical stage to the practical stage. Innovations that were still theoretical in 2019 now have active projects. For example, zero-knowledge technology has grown from a handful of pioneer projects like Zcash to being used by 159 projects in the Crypto Market Map.

As categories mature, some categories experience consolidation. In 2019, smart contract platforms and exchanges were the two largest categories of crypto projects. The number of projects in these two categories has not grown significantly as users and developers have consolidated onto fewer platforms. As categories mature, we expect the same consolidation effect to impact other categories.

Specialization has become critical in the cryptocurrency space in order to keep up with the progress of different categories. Each field requires unique expertise. As crypto expands, it becomes increasingly challenging to fully understand all verticals. The Crypto Market Map aims to address this by providing an overview of the entire industry.

The Crypto Market Map intends to include only major projects and underestimates the number of all projects in the cryptocurrency space. The Crypto Market Map aims to include projects with significant industry or cultural impact and longevity.

The projects in this market map are drawn from a pool of thousands of crypto projects. To be included in the Market Map, projects must have at least one of the following characteristics:

Raised over $2M since 2019 and active updates since March 2024

Raised over $50M since 2019 and active updates since March 2024

Has 50+ developers involved in 2024

Ranked in the top 100 by market cap on Coingecko

Major DeFi project on its chain on DefiLlama

Individual projects with significant community support with over 10k Twitter followers

Individual projects with leadership or significant roles in a chain’s ecosystem

Even if the above criteria are met, projects participating in hackathons and projects that do not show intent to ship their initially announced products or whose shipping timeline may be too far away are excluded.

The Crypto Market Map is not yet complete and is in beta. Please help us improve it! This map is still in beta and is far from complete.

We have reviewed thousands of crypto projects for inclusion in the Market Map, but we expect there will still be gaps. Some projects may be absent due to missing data sources. Classification can be subjective, so projects may be missing from certain categories.

In addition, as new projects become more relevant over time, keeping the map up to date will be a community effort.

By building the Crypto Market Map in the open, we aim to provide a valuable and community-driven tool for everyone in the crypto industry.

Missing project? Misclassified? General feedback? Please contribute here to improve and expand the Crypto Market Map.

Weatherly

Weatherly