Author: Gryphsis Academy

Abstract

The source of income for the Ethena protocol is spot staking income + short position funding rate income. The introduction of BTC collateral dilutes the staking yield, and the calm market and Ethena's large number of shorts reduce the funding rate income.

Increasing the types of collateral is the only way for Ethena to develop in the long term, but it means that there may be long-term low interest rates.

The current insurance fund of the protocol is not sufficient and there is a high risk.

Ethena has a natural advantage in the face of a run when the funding rate is negative.

The total amount of open interest in the market is an important indicator to limit the issuance of USDe.

Ethena is a stablecoin protocol built on the Ethereum blockchain, which provides a "synthetic dollar" USDe through a Delta neutral strategy.

The working principle is: users deposit stETH into the protocol and mint an equivalent USDe. Ethena uses the over-the-counter settlement (OES) solution to map the stETH balance to CEX as margin and short an equal amount of ETH perpetual contracts. This portfolio achieves Delta neutrality, that is, the value of the portfolio does not change with the price fluctuations of ETH. So in theory, USDe has achieved value stability.

Users can pledge their USDe to the protocol to mint sUSDe, and holding sUSDe can obtain income generated by the funding rate. This income was once as high as 30% or more, which is one of the main means of Ethena to attract deposits.

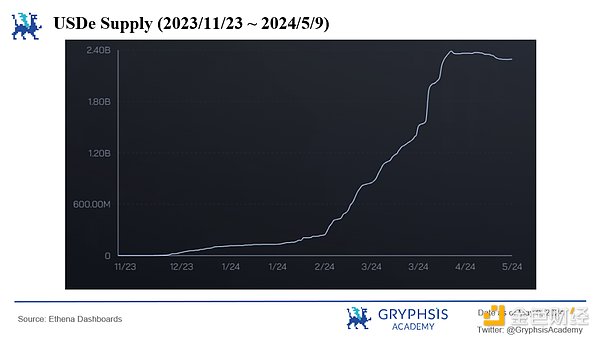

As of May 9, 2024, the yield of holding sUSDe is 15.3%, and the total issuance of USDe has reached 2.29 billion US dollars, accounting for about 1.43% of the total market value of stablecoins, ranking fifth.

In the Ethena protocol, both stETH collateral and ETH perpetual contract short positions will generate income (derived from the funding rate). If the combined yield of the two positions is negative, the insurance fund in the Ethena protocol will make up for the loss.

What is the funding rate?

In traditional commodity futures contracts, the two parties agree on a delivery date, that is, a period of physical exchange, so when the futures contract is about to reach the delivery date, the futures price will theoretically be equal to the spot price. However, in digital currency transactions, in order to reduce delivery costs, perpetual contracts are widely used: compared with traditional contracts, the delivery link is cancelled, resulting in the disappearance of the association between futures and spot.

In order to solve this problem, the funding rate is introduced, that is, when the perpetual contract price is higher than the spot price (the basis is positive), the longs pay the funding rate to the shorts (the funding rate is proportional to the absolute value of the basis); when the perpetual contract price is lower than the spot price (the basis is negative), the shorts pay the funding rate to the longs.

Therefore, the more the perpetual contract price deviates from the spot price (the larger the absolute value of the basis), the greater the funding rate, and the stronger the inhibitory force on price deviation. The funding rate becomes the connection between futures and spot prices in perpetual contracts.

Ethena holds ETH airdrop positions and stETH, and the income comes from the funding rate and pledge income. When the comprehensive yield is positive, the insurance fund will reserve a part of the income to compensate users when the comprehensive yield is negative.

In the current bull market, the sentiment of long positions is obviously higher than that of short positions. The demand for long positions in the market is greater than that for short positions, and the funding rate remains at a high level for a long time. The Delta risk of the spot collateral in the Ethena protocol is hedged by the short position, and the short position held can obtain a large amount of funding rate income, which is why the Ethena protocol generates high risk-free returns.

Before the launch of USDe, the stablecoin project UXD on the Solana chain also used the same method to stabilize the currency, but UXD used hedging on the DEX contract exchange, which also laid the groundwork for UXD's failure.

From the perspective of liquidity, centralized exchanges account for more than 95% of open contracts. In order to expand the scale of USDe to the billion level, centralized exchanges are the best choice for Ethena: when USDe issuance grows massively or when a run occurs, the price of Ethena's short position will not cause too much disturbance to the market.

Because Ethena uses centralized exchanges for hedging, it will inevitably generate new centralized risks, so Ethena introduced a new mechanism OES, which entrusts collateral to third-party custody (Copper, Fireblocks). Centralized exchanges do not hold any collateral, which is similar to depositing users' collateral in a multi-signature wallet to minimize centralized risks.

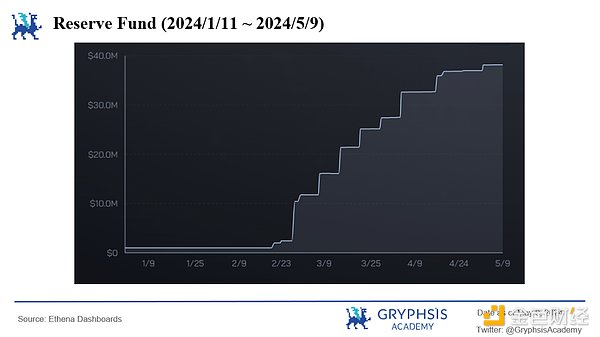

The insurance fund is an important part of the Ethena protocol. It transfers part of the income from stETH positions and ETH short positions when the combined yield is positive and releases it when the combined yield is negative to maintain currency price stability.

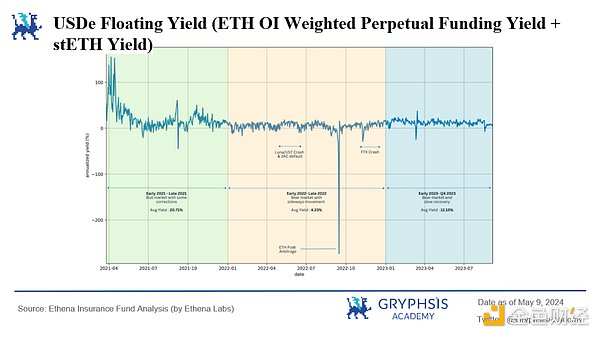

Figure 1: USDe Floating Yield Simulation

The high USDe yield in the 2021 bull market reflects the strong bullish demand, with long positions paying shorts 40% of the funding rate each year. With the start of the 2022 bear market, the funding rate often fell below zero, but it did not remain negative, and the average remained above 0.

In the second quarter of 2022, the collapse of Luna and 3AC had a surprisingly small impact on the funding rate. The short-term downturn caused the funding rate to hover around 0 for a while, but it quickly returned to a positive value.

In September 2022, Ethereum switched from POW to POS, triggering the biggest black swan event in the history of funding rates. The funding rate once fell to 300%. The reason was that in this conversion, users only needed to hold ETH spot to get short rewards, which led to a large number of users not only holding ETH spot long positions, but also holding ETH short positions to hedge a large amount of ETH spot in order to obtain stable airdrop returns.

The influx of a large number of shorts caused the ETH perpetual contract funding rate to plummet in a short period of time, but after the short release ended, the funding rate quickly returned to a positive level.

The collapse of FTX in November 2022 also caused the funding rate to fall to -30%, but it did not last, and the funding rate quickly returned to a positive value.

Through historical data, the average comprehensive income of USDe has remained above 0, demonstrating the long-term feasibility of the USDe project. However, short-term normal market fluctuations or black swan events lead to a comprehensive income less than 0, which is unsustainable. Adequate insurance funds can make the protocol transition smoothly.

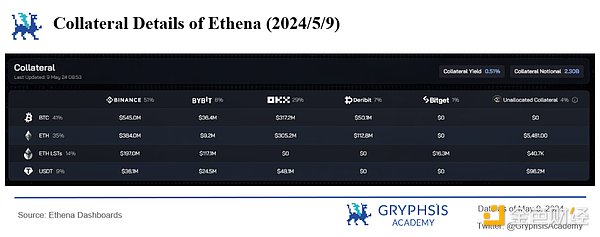

Starting from 2024/4, users can pledge BTC in the Ethena protocol to mint USDe stablecoins. As of 2024/5/9, BTC collateral currently accounts for 41% of the total collateral.

Figure 2: 2024/5/9 Ethena Collateral Details

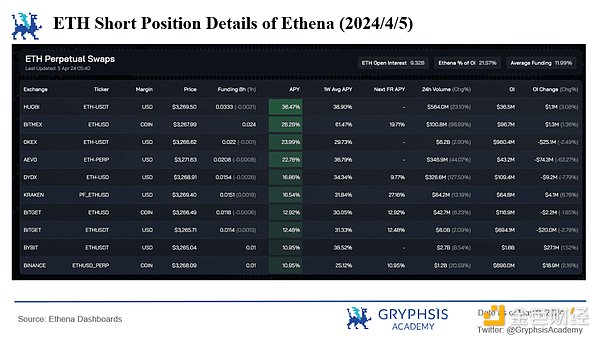

Figure 3: 2024/4/5 Ethena Protocol's ETH Short Position Details

On the eve of Ethena accepting BTC as collateral, Ethena's ETH The total amount of short positions has accounted for 21.57% of the total open interest. Although centralized exchanges have strong liquidity and Ethena holds ETH short positions in multiple exchanges, the rapid growth of USDe issuance has led to the fact that centralized exchanges may not be able to provide sufficient ETH perpetual contract liquidity. Ethena urgently needs new growth points. Compared with liquid pledge tokens, BTC does not have native pledge income. If BTC is introduced as collateral, the pledge yield contributed by stETH will be diluted. However, the open interest of BTC perpetual contracts in centralized exchanges exceeds 20 billion US dollars. After the introduction of BTC collateral, USDe's short-term expansion capacity will increase rapidly, but in the long run, the growth rate of the total amount of BTC and ETH open contracts is the main factor limiting USDe's growth.

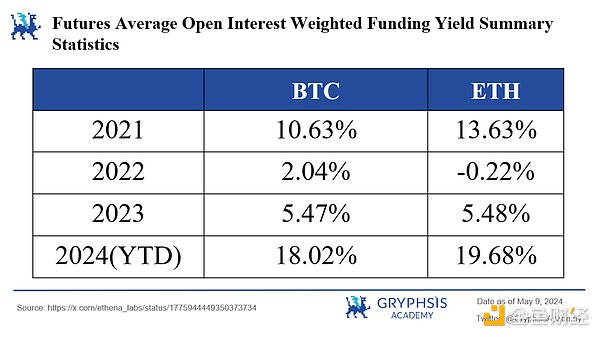

Figure 4: Average Funding Rate Yield in Each Year

Although BTC collateral dilutes the staking income of stETH, according to historical data, the average funding rate of BTC perpetual contracts is lower than ETH in a bull market and higher than ETH in a bear market. It is also a hedging measure to cope with the low funding rate in a bear market, which increases the diversification of the investment portfolio and reduces the risk of USDe decoupling in a bear market.

At present, the yield of sUSDe has rapidly fallen from 30%+ to around 10%+, which is due to the overall market sentiment and the impact of a large number of short positions brought about by the rapid expansion of USDe on the market.

It is well known that USDe's terrifying growth rate comes from the ultra-high funding rate payment in the bull market, but USDe as a stable currency is still extremely lacking in application scenarios, and the existing trading pairs are only associated with some other stable currencies. Therefore, the purpose of most USDe holders holding USDe is just to reap high APY and airdrop activities.

Although the mechanism of the insurance fund is to enter when the comprehensive interest rate is negative, users who provide stETH will redeem when the comprehensive income is lower than the stETH pledge yield; and users who provide BTC will be more cautious. As the basis gradually decreases, the funding rate income continues to be sluggish. In the absence of ultra-high APY, a large number of redemptions may occur after the second round of airdrop activities. The reason can be referred to the dilemma that Bitcoin L2 is also facing: a large number of users (especially large users) regard BTC as a target for value storage and have extremely demanding requirements for fund security.

Therefore, the author believes that if USDe's stablecoin application scenarios have not achieved breakthrough development before the end of Ethena's second season airdrop activities, coupled with the gradual reduction of funding rates, USDe is likely to be unable to recover.

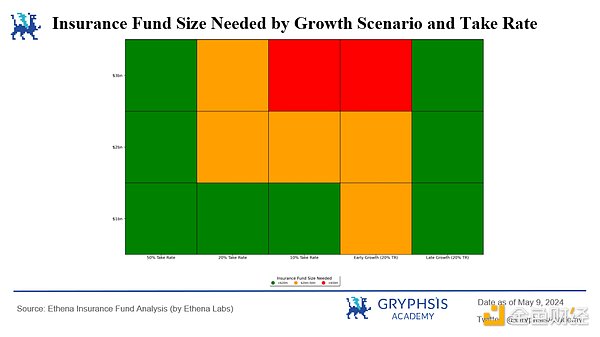

Ethena officials conducted simulation calculations and came to the following conclusions about the insurance fund:

Figure 5: Initial required insurance amount scale by growth scenario and insurance fund withdrawal rate

In Figure 5, green, yellow, and red represent that the initial insurance fund scale is less than 20 million US dollars, between 20 million and 50 million US dollars, and greater than 50 million US dollars to ensure the safety of funds.

The vertical axis indicates that the USDe issuance is expected to reach 1 billion US dollars, 2 billion US dollars, and 3 billion US dollars in two and a half years (2021/4~2023/10). The first three horizontal axes indicate that when the USDe issuance is linearly growing, the insurance fund withdrawal rate is set to 50%, 20%, and 10%, respectively. The fourth horizontal axis indicates that when the USDe issuance remains unchanged after the first year of exponential growth, the insurance fund withdrawal rate is set to 20%. The fifth horizontal axis indicates that when the USDe issuance continues to grow exponentially, the insurance fund withdrawal rate is set to 20%.

From Figure 5, it can be concluded that for a starting insurance fund of 20 million US dollars, a 50% withdrawal rate is very safe and can make the insurance fund capitalized in almost all cases and growth levels. If a black swan event occurs before the insurance fund has a chance to capitalize through positive fundraising, premature exponential growth could pose a risk to the solvency of the insurance fund. At the same time, late exponential growth is safer because it provides more time for the insurance fund to grow.

But the reality is that the starting insurance fund is only $1 million, and the supply of USDe is increasing much faster than the early exponential growth in the Early Growth case in the model. Of the current $38.2 million insurance fund (accounting for only 1.66% of USDe issuance), nearly half has been added in the past month. It can be seen that the problem caused by the rapid issuance of USDe is that the early insurance fund of the Ethena project is seriously insufficient compared to the official model calculation.

Insufficient insurance funds have two consequences:

Users lack confidence in the project. If the high yield begins to decline, the project TVL will gradually decrease.

High TVL, low insurance fund, the project party must increase the withdrawal rate of the insurance fund (at least 30% or higher) to replenish the insurance fund as quickly as possible, but with the current funding rate income gradually declining, the user's rate of return is even worse, which may aggravate the first consequence.

Figure 6: 2023/11/23~2024/5/9 USDe Total Issuance

Figure 7: 2024/1/11~2024/5/9 Insurance Fund Amount

Referring to the ETH Pow arbitrage event in the third quarter of 2022 in Figure 1, the funding rate has experienced a huge drop in a short period of time, and the annualized rate has exceeded 300% at one point. In such black swan events, a run on USDe is basically inevitable, but USDe's unique mechanism seems to have a natural advantage in dealing with runs.

In the early stages of a sharp decline in funding rates, a run may have already occurred. Due to the occurrence of a run, the Ethena protocol needs to return a large amount of spot collateral and close an equal airdrop position. Due to the reduction in airdrop positions, the expenditure of the insurance fund also decreases, and the insurance fund can be maintained for a longer period of time.

From the perspective of liquidity, when a run occurs, Ethena needs to close short positions. In a market with a negative funding rate, it means that long liquidity is abnormally sufficient, and closing short positions will hardly be troubled by liquidity issues.

At the same time, the 7-day cooling-off period for sUSDe in the Ethena protocol (collateral cannot be liquidated within a week of collateralization) can also serve as a buffer for market mutations.

But all this is based on the adequacy of the insurance fund.

The total amount of open interest (OI) in the market has always been a key factor restricting the issuance of USDe and a potential risk for USDe in the future. As of 2024/5/9, ETH OI in the Ethena protocol accounted for 13.77% of the total OI, and BTC OI accounted for 4.71% of the total OI. The huge short positions generated by the Ethena protocol have brought certain disturbances to the contract market, and the subsequent expansion of USDe will have certain liquidity problems.

The best way to solve this problem is to add as many high-quality collateral as possible (funding rate is greater than 0 for a long time), which can not only increase the upper limit of USDe supply, but also increase the diversification of the portfolio and reduce risks.

In summary, the Ethena protocol demonstrates its unique stablecoin mechanism and sensitive response to market dynamics. Despite the challenges it faces such as long-term low basis, insufficient insurance funds, and potential bank runs, Ethena has maintained its market competitiveness through innovative over-the-counter settlement mechanisms and diversified collateral products.

With the continuous changes in the market environment and technological innovations in the industry, Ethena must continue to optimize its strategies and enhance its risk management capabilities to ensure the adequacy of the insurance fund and the stability of liquidity. For investors and users, it is crucial to understand the operating mechanism of the protocol, the source of income, and its potential risks.

Others

Others

Others

Others Others

Others Others

Others Beincrypto

Beincrypto Nell

Nell Nell

Nell Coinlive

Coinlive  Coindesk

Coindesk Nell

Nell Cointelegraph

Cointelegraph