Author: Jiawei @IOSG

Foreword

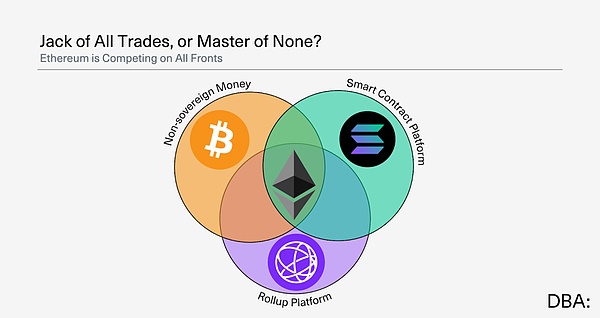

▲ Source: Jon Charbonneau

DBA co-founder Jon Charbonneau published an article titled "Etherum's North Star" at the end of last year, pointing out that Ethereum lacks a clear "North Star" goal. Jon also pointed out in an earlier tweet that even Ethereum could not reach a consensus on its core products.

Since this cycle, the community has been discussing the poor performance of ETH prices. In general, ETH prices are not only a reflection of market sentiment, but also a key factor in whether Ethereum can unify the community vision, balance decentralization and performance, and consolidate its leading position as a smart contract platform.

Inspired by the above article, this article will discuss some of the problems that the author believes have occurred in Ethereum.

ETH price - It does mean something

In this cycle, we have seen that the ETH/BTC exchange rate has hit a multi-year low, and SOL/ETH has continued to hit new highs, which has become the main factor that Ethereum has been criticized by the community.

EF's technical geeks are disgusted with the community's dissatisfaction with the ETH price, and think that they are a group of short-term speculators. It is true that protocol design should not be price-oriented, but excessive avoidance of price discussions is also a bad performance. This section discusses the importance of ETH prices.

#ETH prices are directly related to EF's runway

From EF's 2024 report, as of October 2024, EF's total assets are approximately US$970.2 million, including US$788.7 million in cryptocurrency assets (99.45% of which are ETH); US$181.5 million in non-crypto assets.

If the annual burn rate of US$130 million is maintained and the ETH price is stable, the current treasury can be maintained for about 7.5 years. A fall in ETH prices will shorten the actual runway, and vice versa.

The $130 million burn rate is an exaggerated figure. Previously, the community also criticized EF for its redundant staff (about 200 people), with only 35% of them being technical personnel. Aave founder Stani Kulechov proposed cutting the burn rate to $30 million and laying off 80 people.

#Protocol Security

The ETH price directly affects the cost of attacks under the PoS consensus. Of course, actual attacks also need to consider geographically dispersed verification nodes and Slashing mechanisms, but price is still a key factor.

After Ethereum adopts the PoS mechanism, the ETH price directly affects the returns of stakers. If the ETH price falls, the actual returns will also shrink, which may lead to the withdrawal of staked nodes and a decrease in network security. Currently, Lido's TVL is about 20 billion US dollars, down nearly 50% from the high of 40 billion US dollars in December last year. Last year, the SOL/ETH trading pair reached a maximum increase of more than 3 times, and the SOL staking income was still about 2 times that of ETH, which may drive many stakers to switch from Ethereum to Solana in the next cycle.

#Confidence of Ecosystem Participants

Needless to say, the price is the result of the ecosystem participants (developers, users, investors and other roles) voting with their feet. In this cycle, when mainstream public opinion is generally not optimistic about Ethereum, poor price performance may trigger a negative feedback loop.

Eric.eth, an early developer of the Ethereum ecosystem and co-author of EIP-1559, also published a statement: As Vitalik fades out, EF gradually loses touch with the community and becomes more opaque. Faced with the expansion of rivals such as Solana and EF's "anti-competition" attitude, he received a large number of questions from early Ethereum developers about "why they insist on staying in this ecosystem."

The price of ETH is a mirror and should be paid attention to and valued by EF.

Decentralization is a spectrum, and so is competition

Different people, from different standpoints, must have different understandings of decentralization. The memecoin trader on Solana does not need a blockchain that can resist state-level attacks. The distribution of memecoin chips, dev run, and the address of the rat warehouse can be seen on the chain, which is enough for them.

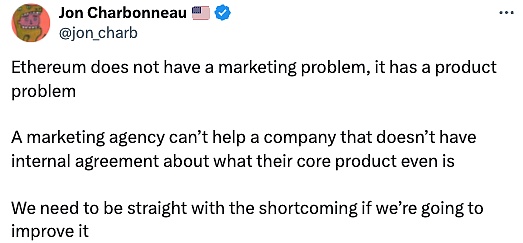

▲ Source: dba

Similarly, competition and non-competition are relative. The author believes that the competition faced by Ethereum is mainly the following two points.

As a value storage asset

As a smart contract platform

In the previous Ethereum pledge report, the author mentioned that ETH is the reserve asset of the DAO vaults of various protocols, the collateral of CeFi and DeFi, and NFT transactions, MEV pricing, token trading pairs, etc. as accounting units and exchange media, and the value persists in time and space, and should be used as a value storage asset.

But this is only within the Ethereum ecosystem. In a broad sense, looking beyond the ecosystem, ETH's value storage attribute is still significantly weaker than Bitcoin.

For example, from the perspective of positioning, since the birth of Bitcoin, people have begun to build its narrative around "digital gold" and "scarce assets that resist inflation". The core function of Bitcoin is clearly defined as value storage, which is easier to be understood by the mainstream market and the public.

As a smart contract platform, Ethereum's value sources include Gas, staking income, and ecological applications built on the chain. This complexity has led to the dilution of its value storage attribute, and the public is more inclined to regard it as a "technical token" or "utility token" rather than a pure value storage tool.

From the perspective of supply, the total amount of Bitcoin is fixed at 21 million, and the inflation rate is gradually reduced to zero through the halving mechanism. The actual inflation rate of ETH's supply may be lower than that of Bitcoin after the implementation of EIP-1559 and PoS. However, due to the recent sluggish network activity, it has gradually returned to inflation and is constantly changing with network fluctuations.

Compared to Bitcoin, Ethereum's complex functions and mechanisms require a higher threshold of cognition. In addition, institutional investors (such as MicroStrategy and Tesla) publicly hold Bitcoin as a reserve asset, which also strengthens its legitimacy of value storage.

Therefore, at present, ETH's value storage attribute is difficult to compete with Bitcoin. Ethereum's core positioning is a smart contract platform.

As a value storage asset

As a smart contract platform

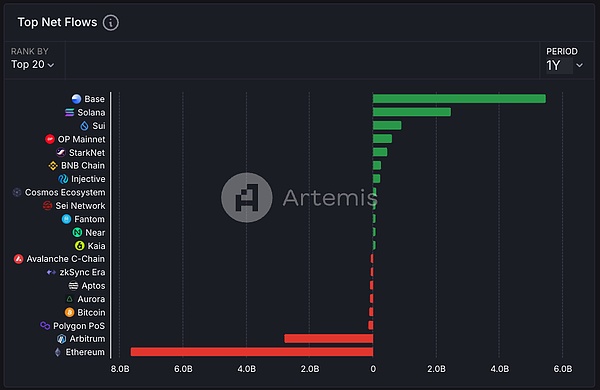

As a smart contract platform, Ethereum is facing fierce competition from Layer1 such as Solana and Sui. From the data point of view, although Ethereum has an absolute advantage in stablecoin issuance and TVL, key data such as daily transaction volume, daily average number of active addresses, and number of transactions have shown a downward trend.

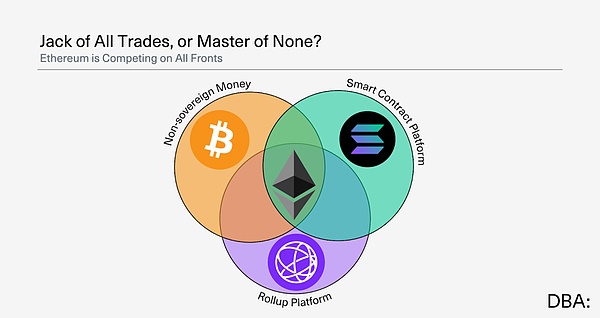

▲ Source: Artemis

From the perspective of capital flows over the past year, protocols such as Base, Solana, and Sui have captured large inflows, while Ethereum has seen an outflow of nearly $8 billion. Transactions in the Ethereum ecosystem are mostly concentrated on Base and Arbitrum. Although this is in line with the expectations of the Rollup-centric roadmap, the sluggish activity of L1 will more or less affect the market's pricing of ETH.

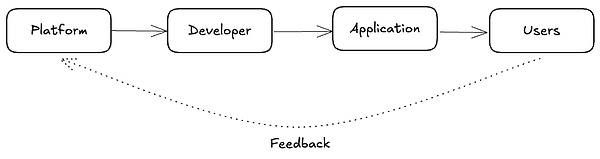

▲ Source: IOSG

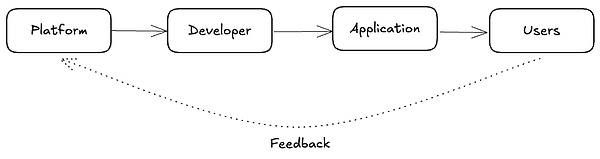

The above feedback loop mechanism is basically formed between platforms, developers, applications and users. Good platforms attract high-quality developers, developers create good applications, applications attract users, and users promote the prosperity and growth of platforms.

Due to the different technical development routes of Ethereum and Solana, developers often need to choose one of the two platforms. Therefore, at the level of "smart contract platform", the two must be in a competitive relationship.

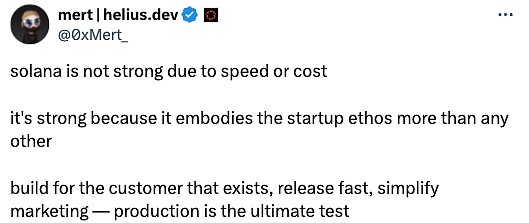

▲ Source: Solana

The solanaroadmap.com webpage is so concise that it only has four words, abbreviated as IBRL. But the current Solana is not limited to high performance. In addition to the technical IBRL, Solana's culture and attention capture also have differentiated competitive points.

▲ Source: mert

The author once asked in X "Why not launch memecoin on Ethereum L2", because L2 also has the characteristics of low cost and high throughput. The answer is "culture". Looking at the user portrait in general, it is generally believed that users on Ethereum seem to be more "old money" mining in DeFi, while Solana represents fresh blood and the rapid flow and redistribution of capital.

New things tend to capture attention better than old things. Many founders I talked to in this cycle chose to build consumer applications on Solana. In addition to technical reasons, most of them mentioned the word "attention" - more users in this cycle are focusing on Solana.

In this cycle where there are so many projects on the market and attention is extremely scarce, founders will try their best to increase the exposure of their projects and let the market discover their products. Solana also has more hot money and a smoother user experience, because when you want others to use your product, every additional step will be friction and obstacles.

The authorities are confused - the choice of the Ethereum Foundation

Is the policy of non-intervention suitable for Ethereum in a highly competitive environment?

The community is divided on Aya's transfer to the chairman of the Ethereum Foundation: critics point out that the slow progress of Ethereum development, insufficient developer support, and weak token prices during Aya's seven years in office are directly related to his management; his advocacy of "subtraction philosophy" and decentralized governance are criticized as "laissez-faire", which has led to EF's failure to actively coordinate ecological resources, in sharp contrast to the efficient operation of the Solana Foundation.

These comments are difficult to sort out in a short period of time, and are not within the scope of this article, but they reflect the dissatisfaction of the community to a certain extent, as an outlet for venting pent-up emotions.

EF’s role has never been to control or own all domains in Ethereum. Instead, our responsibility—our accountability—lies in upholding Ethereum’s values. Through both our actions and our non-actions, we are accountable for ensuring that Ethereum remains resilient, not just as a network, but as a broader ecosystem of people, ideas, and values—never reduced to a single organization’s product. ——Aya Miyaguchi

On the day of her inauguration, Aya published an article titled "A new chapter in the infinite garden", stating that the role of the Foundation is "gardener" rather than "controller", supporting the ecosystem by cultivating client diversity, R&D coordination, and community activities; advocating adaptive growth and decentralized leadership, and opposing corporate expansion; and believing that Ethereum needs to maintain its original vision as a "world computer".

The author believes that it is beneficial to talk about values and ideals when things are in a growth cycle; but if the system is in a recession and cannot generate incremental growth, then this "high-sounding talk" will appear pale and powerless, and will not convince the public.

The premise of becoming a "world computer" and the fundamental basis for practicing and developing values is that someone builds on the ecology and is willing to follow and promote such values. The prosperity and growth of the ecology is a necessary condition.

Han Feizi pointed out in "Five Vermin" that the essence of Confucianism's "using literature to disrupt the law" lies in empty talk about benevolence and righteousness, ignoring real contradictions. When resources are limited, empty talk about benevolence and righteousness will lead to a separation from actual needs, and must rely on practical means such as "law, tactics, and power". When Confucius traveled around the countries, only Wei State (with a more developed economy) briefly accepted his idealism; in Song, Chen, Cai and other countries where wars were frequent, Confucius' idealism was neglected due to the lack of material foundation.

Some time ago, when the community questioned EF's continued selling of ETH and its failure to maintain runway through financial management methods such as staking, EF sold a small amount of ETH on the same day. With the spread of community dissatisfaction, this move seems to be a bad one. Vitalik said that if the foundation pledged ETH, it might be forced to make an "official choice" in a controversial hard fork event, violating the principle of Ethereum's decentralization. This overly vague reason also seems untenable and cannot respond to the core concerns of the community.

Based on the above discussion, whether it is the weakness of various data from the perspective of "smart contract platform" or the sluggish price of ETH as a currency with "store of value" attributes, Ethereum seems to be somewhat powerless. At this time, choosing to insist on inaction is not necessarily a wise move.

「Ethereum is an ecosystem, not a company」

Vitalik emphasized in the Chinese AMA on February 27 that Ethereum is not a company, but an ecosystem.

I think Ethereum is a decentralized ecosystem, not a company. If Ethereum becomes a company, we will lose most of the meaning of Ethereum's existence. Being a company is the role of a company. ——Vitalik Buterin

The author agrees with the view that Ethereum should not be a company, because corporate operation means that it is for profit to a certain extent, which conflicts with the positioning of Ethereum. However, the result of the non-corporate operation orientation is that it is difficult to set up some indicators to measure the efficiency of the system, and the goal of the system is divergent, rather than optimizing for a certain point or direction.

The embarrassing thing is that although EF does not consider Ethereum to be a company, the public still tends to price and value Ethereum in a company-like manner, referring to indicators such as the number of active addresses, transaction volume, and protocol revenue, which is difficult to achieve the simplicity of Bitcoin's "totem".

From a series of fundamental data such as protocol revenue, Ethereum no longer has strong momentum. For example, due to the sluggish L1 activity, ETH destruction has been greatly reduced. ETH has ended the deflation cycle of nearly two years and returned to inflation, with an annual inflation rate of 0.72%.

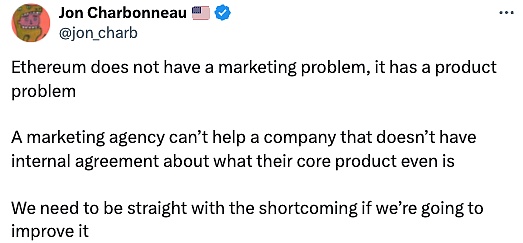

▲ Source: Dankrad

At the technical development level, Aya wrote in the article: Instead of controlling, we steward All Core Dev calls to create space for technical decisions to emerge through community wisdom. Coordination rather than dominance is a good starting point, but it is too idealistic. The coordination-based approach will encounter many problems in practice, such as inefficiency and high friction. Everyone has their own opinions, and without global decisions, it will eventually lead to difficulties in implementation.

Of course, this article does not clarify who is right or wrong, nor does it criticize EF's approach, but attempts to state the author's views and logic and point out the pros and cons. In summary, the author believes that EF needs to avoid falsehoods and seek truth from facts, discover problems, listen to the opinions of the community, and take action.

Conclusion

Crypto has different main lines in different cycles. In this cycle dominated by the mainstream narrative of Bitcoin ETF and the Solana memecoin craze, Ethereum is obviously not favored by the market. Ethereum has good values and idealism, but these superstructures need to be supported by real use cases and communities.

Keeping this value unchanged, what can Ethereum do at this stage?

Speed up development progress, focus on capacity expansion, solve cross-L2 interoperability problems, and make Ethereum sufficiently usable at the technical level. Attract long-term developers, etc.

Education. ethereum.org has always done a good job in multi-language support. Ethereum is unlikely to do some political lobbying, but education on a global scale is quite necessary.

EF needs to reform, achieve transparent governance and community supervision, and balance idealism with market demand.

As an Ethereum enthusiast for many years, I feel sorry for the current situation, but I am also happy to see challengers such as Solana impacting Ethereum's position - after all, the story of latecomers challenging the established "winners" in Crypto is constantly repeating, which is equally exciting.

Hope we can make Ethereum great again.

Milady

Weatherly

Weatherly