Author: Christopher Rosa, Research Analyst at Galaxy Digital; Translation: Golden Finance xiaozou

Michael Saylor's innovative move at Strategy (MSTR) to use financial engineering to allocate Bitcoin (BTC) on a large scale has triggered a wave of corporate imitations. To date, more than 50 companies have adopted his Bitcoin-centric reserve strategy, and the number is still growing. However, a group of companies are currently opening up a new path - they are not only seeking exposure to crypto assets, but are also committed to integrating into Ethereum's own economic ecosystem.

This article will deeply analyze the first four US public companies to establish Ethereum reserves, track their financing paths in detail, evaluate "Ethereum concentration" (the number of ETH held per share), and analyze the premium level given to their Ethereum reserves by the market. In addition to quantitative indicators, we will also explore the profound impact of these strategies on the health of the Ethereum network, the staking ecosystem, and DeFi infrastructure, revealing how these financial strategies can both reshape corporate balance sheets and inject core capital into the Ethereum decentralized economic system.

1、SharpLink Gaming(SBET)

(1)Company Background

Founded in 2019, SharpLink Gaming (NASDAQ: SBET) is an online technology company that provides real-time betting and interactive gaming services to sports fans through a proprietary platform. The company also develops free games, mobile applications, and provides marketing services to sports media, leagues, teams, and betting platforms to enhance user stickiness. The real money fantasy sports and simulation games it operates cover more than 2 million users, with an annual consumption of nearly 40 million US dollars, and it has obtained operating licenses in all states in the United States that allow fantasy sports and online gambling.

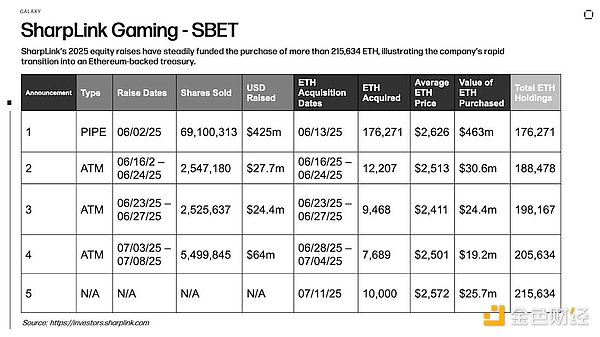

Last month, SharpLink began to include ETH in its balance sheet through a combination of private equity investments (PIPEs) and on-site issuance (ATM) financing. Management explained that the move stems from a firm belief in the prospects of ETH as an interest-bearing programmable digital asset, enabling the company to profit from staking and related income opportunities. It is worth noting that this innovative financial strategy does not replace its core gaming and interactive gaming business, but serves as a strategic supplement to its main business.

(2) Financing and ETH Acquisition

(3) ETH Configuration and Staking

SharpLink has pledged all of its ETH reserves and obtained 100 million between June 28 and July 4. ETH staking rewards bring the cumulative staking income to 322 ETH since the launch of the program on June 2.

(4)Core Insights

SharpLink Gaming's strategic deployment of Ethereum has made it the largest holder of ETH reserves among publicly listed companies. Through multiple equity financings, including a large-scale PIPE financing of US$425 million and subsequent ATM issuance, the company quickly established the largest Ethereum position in the industry. Although this financial strategy has risks such as ETH price fluctuations, it also creates considerable staking income potential, highlighting the attractiveness of proof-of-stake digital assets as reserve assets. By staking 100% of its ETH reserves, SharpLink not only earns income, but also directly enhances the security and stability of the Ethereum network - enriching the diversity of validator participation and deeply binding corporate capital to the healthy development of the protocol.

2、BitMine Immersion Technologies(BMNR)

(1)Company Background

BitMine Immersion Technologies (NASDAQ: BMNR) is a Las Vegas-based blockchain infrastructure company that operates industrial-grade Bitcoin mining farms, sells immersion cooling hardware, and hosts third-party mining machines in low-cost energy regions such as Texas and Trinidad.

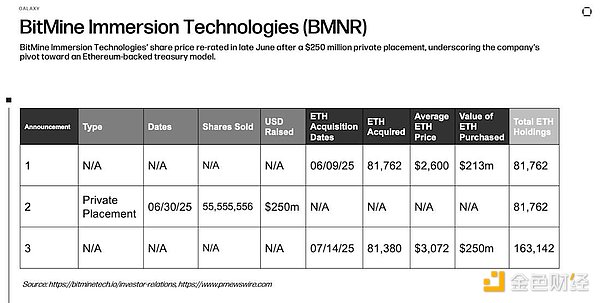

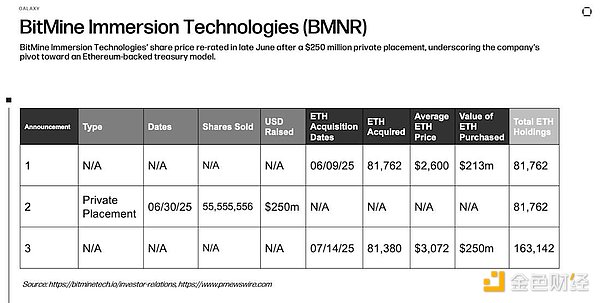

On June 30, the company raised approximately $250 million through a private placement of 55.6 million shares (US$4.50 per share) to expand its Ethereum reserves. As part of the deal, Fundstrat co-founder Tom Lee was appointed chairman of BitMine’s board of directors, with the addition of the well-known crypto strategist to guide its plans to expand its ETH allocation.

(2) Financing and ETH Acquisition

(3) ETH Configuration and Staking

BMNR holds a large amount of ETH reserves, but as of the time of writing, there is no public information confirming whether it has used part of the ETH for active staking or on-chain deployment.

(4)Core Insights

BitMine added approximately 81,380 ETH to its balance sheet through a $250 million financing, bringing its total holdings to over 163,000 ETH. To support this accumulation, the company expanded its diluted total share capital to over 56 million shares, an increase of approximately 13 times. This level of equity dilution highlights the huge equity issuance required to support a large-scale Ethereum reserve strategy, as well as the capital-intensive nature of accumulating ETH in the public market.

3、Bit Digital(BTBT)

(1)Company Background

Bit Digital (NASDAQ: BTBT) is a New York-based digital asset platform founded in 2015, initially operating industrial-grade Bitcoin mines in the United States, Canada, and Iceland.

In June 2025, the company raised approximately $172 million through a fully underwritten public follow-on offering, and combined with the proceeds from the sale of 280 BTC, it reallocated capital to Ethereum, cumulatively purchasing approximately 100,603 ETH, and completed a strategic transformation to an Ethereum staking and reserve model under the leadership of CEO and crypto industry veteran Sam Tabar.

(2) Financing and ETH Acquisition

(3) ETH Configuration and Pledge

As of March 31, Bit Digital held approximately 24,434 ETH, of which 21,568 ETH was actively pledged. The company reported an average annualized return of 3.2% on its ETH staking activities in 2024.

After completing its strategic transformation, Bit Digital significantly expanded its ETH reserves through public offerings and sales of BTC, with total holdings increasing to 100,603 ETH. Although the company has not yet disclosed the specific amount of ETH staked and the expected rate of return after the transformation, its past operations indicate that it will continue to earn income through Ethereum staking.

(4)Core Insight

Bit Digital's financial transformation is particularly noteworthy because it combines a traditional public offering with an unconventional BTC liquidation and ETH purchase operation. This strategy makes it a maverick among listed crypto companies, demonstrating the company's strong confidence in ETH's ability to generate income compared to BTC's passive balance sheet function.

4、GameSquare (GAME)

(1)Company Background

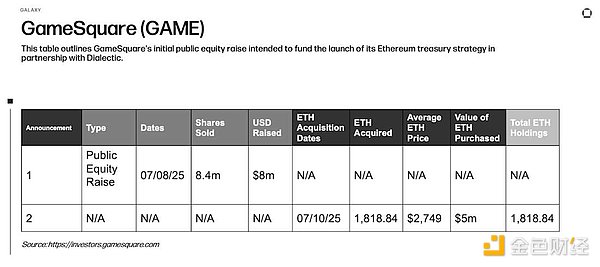

GameSquare Holdings (NASDAQ: GAME) is a Texas-based gaming media group that owns brands such as FaZe Clan, Stream Hatchet and GCN, and provides creator-driven marketing and content services to global advertisers targeting Generation Z players. In July, the company raised approximately $8 million through a subsequent equity offering, and launched the Ethereum Reserve Program in cooperation with the crypto agency Dialectic, intending to allocate up to $100 million in ETH, with the goal of obtaining a yield of 8% to 14%.

(2) Financing and ETH acquisition

(3) ETH configuration and pledge situation

GameSquare has completed its first Ethereum acquisition. As an important part of its digital asset reserve strategy, the company purchased US$5 million worth of ETH. The move marks the company's official entry into the field of crypto asset reserves, aiming to diversify its assets and support long-term innovation.

(4)Core Insight

GameSquare's shift to an Ethereum reserve strategy means that it is ambitiously breaking through the boundaries of its core business in gaming media. By partnering with Dialectic and leveraging its Medici platform, the company plans to invest funds in the decentralized finance (DeFi) sector to obtain a significant return of 8% to 14% - far exceeding the standard Ethereum staking yield (usually 3% to 4%). If executed properly, this strategy will directly promote the stability and development of the entire Ethereum ecosystem by enhancing the liquidity of key DeFi protocols and enriching validator participation, and consolidate the foundation of DeFi infrastructure with the active participation of corporate capital.

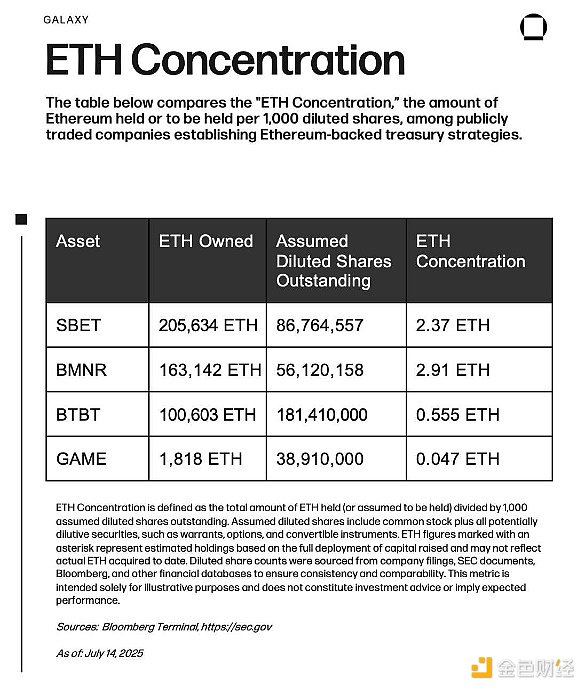

5、ETHConcentration

The ETH concentration index, pioneered by SharpLink Gaming, provides investors with clear and comparable parameters for evaluating the size of listed companies' ETH reserves. The index is calculated based on the ETH holdings corresponding to every 1,000 fully diluted outstanding shares, and fully incorporates potential equity dilution factors such as warrants, stock options and convertible instruments. The ETH holdings data shown are all directly disclosed by the company or estimated based on the full allocation of ETH based on its announced fundraising. The fully diluted number of shares is derived from company filings, Bloomberg, SEC documents and financial databases to ensure consistency and accuracy of cross-company data. This indicator provides investors with an intuitive comparison tool based on single-share ETH exposure.

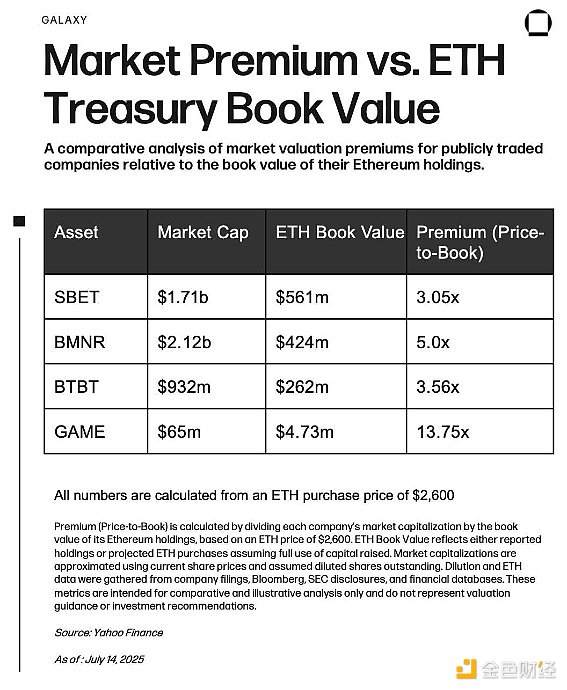

(1) Market value relative to ETH reserve book value premium

(2)Core Insights

ETHand Bitcoin Reserve Theory

The rise of ETH reserves marks an important evolution in the strategy of listed crypto companies. The core of Bitcoin theory is a passive, digital gold-like value storage, while Ethereum also has the unique advantage of creating active returns through staking and DeFi strategies. The four companies analyzed in this article have all explicitly used ETH as an interest-bearing reserve asset: SharpLink and BitMine have committed (or plan to) stake 100% of their holdings to obtain protocol-layer staking rewards; GameSquare has gone a step further and adopted complex DeFi strategies in cooperation with Dialectic to pursue risk-adjusted enhanced returns. This embrace of income-generating Ethereum is in stark contrast to the non-interest-bearing, passive model of Bitcoin reserves, and marks a paradigm shift in corporate financial management to active balance sheet growth.

Unlike many Bitcoin reserve companies that rely on convertible bonds and leverage (as described in a recent research report by Galaxy Securities), the four leading ETH reserve companies, SharpLink, BitMine, Bit Digital and GameSquare, all build their reserves entirely through equity financing. This means that they have no debt maturity pressure, coupon payment obligations, and default risk when the crypto market goes down. The zero-leverage feature significantly reduces system vulnerability and avoids the refinancing and equity dilution risks brought by deep in-the-money convertible bonds.

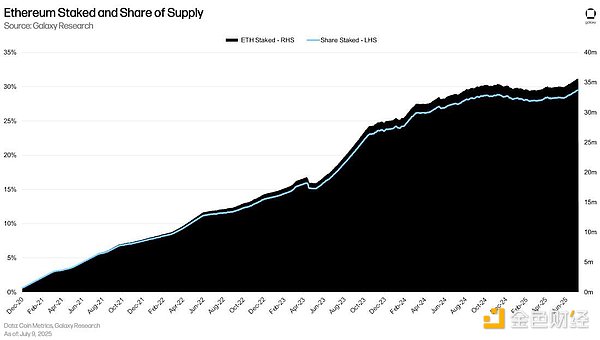

The key is that these Ethereum reserve strategies introduce structural innovation: productive capital. By staking ETH, companies can not only obtain 3%-5% of the protocol's native returns, but also directly enhance the security and stability of the Ethereum network. The more ETH a company reserves and actively stakes, the stronger the certainty and risk resistance of the Ethereum validator set, thus forming a long-term positive cycle of corporate capital and protocol health.

In fact, the rise of ETH reserve companies is likely to be one of the important reasons for pushing the scale of Ethereum staking to a record high on July 9 (over 35 million ETH pledged, accounting for more than 30% of the total).

For GameSquare, the company plans to implement enhanced yield strategies with partners such as Dialectic, and its ETH reserves may also be allocated to DeFi native basic protocols such as lending, liquidity provision (LPing) or re-staking. This move will not only increase potential returns, but also strengthen the Ethereum core protocol ecosystem by deepening the liquidity and institutional participation of the decentralized market.

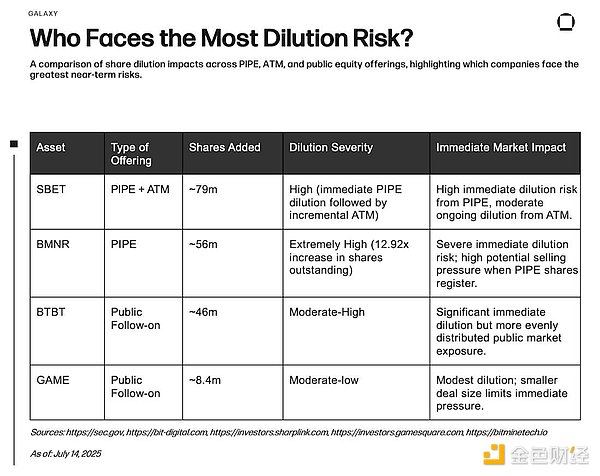

Who is most at risk of equity dilution?

Investors must carefully evaluate how equity financings, especially PIPE transactions, dilute existing shareholders and suppress stock prices by issuing new shares to the market. BitMine's large-scale PIPE financing makes it particularly vulnerable to significant short-term dilution effects and stock price volatility. SharpLink's combination of PIPE and ATM will cause immediate dilution and continue to generate gradual pressure. In contrast, Bit Digital and GameSquare adopted a more transparent and conventional IPO method, with clearer dilution effects and potentially lower market risks. Ultimately, companies that choose PIPE structures face higher initial market shock risk than ATMs and traditional IPOs (especially during periods of volatility), but all of these equity-focused strategies avoid the highly leveraged convertible bonds characteristic of the Michael Saylor model adopted by Strategy.

6Conclusion

On the surface, the sharp fluctuations in the Ethereum Reserve stock price may be similar to the speculative ups and downs common in meme coins. But there is a fundamental difference in the strategies adopted by the first batch of ETH reserve companies: rather than relying on market hype or passive asset exposure, these companies deliberately position Ethereum as a productive reserve asset - obtaining native returns through staking, or in some cases allocating it to more complex DeFi strategies. This distinguishes them from the pioneering Bitcoin reserve companies that follow the passive "digital gold" model and often finance through highly leveraged convertible bonds. In contrast, the current four ETH reserve companies (SharpLink, BitMine, Bit Digital and GameSquare) all adopt equity financing strategies, avoiding the structural vulnerability risks associated with debt repayment pressure and maturity cliffs.

The key is that this capital is not idle capital. By staking ETH, these companies directly enhance the network's validator security and protocol layer stability. Taking GameSquare as an example, when it adopts a DeFi native yield strategy, reserve capital may also support liquidity supply, lending markets and other Ethereum infrastructure. Although risks such as dilution effects, smart contract risks and price volatility still exist, investors can use tools such as dilution impact analysis and market-to-book premium valuation to assess downside risks and yield-driven upside potential. Ultimately, this wave of ETH reserves provides a new model that is more participatory and capital-productive - while introducing a new market-based on-chain enterprise reserve asset class, it is likely to simultaneously enhance the Ethereum ecosystem.

Alex

Alex

Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Hui Xin

Hui Xin