Author: Ciaran Lyons, CoinTelegraph; Compiler: Wuzhu, Golden Finance

The amount of Ethereum withdrawn from crypto derivatives exchanges has reached its highest level since August 2023 - analysts interpreted this as a positive sign for Ethereum prices.

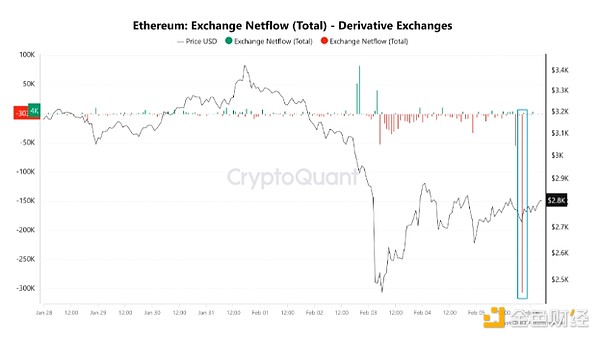

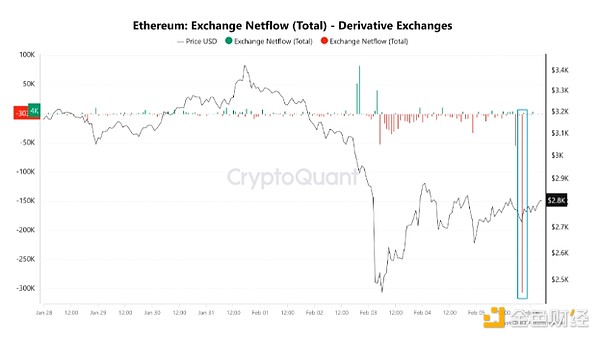

On February 6, the net flow of Ethereum on crypto derivatives exchanges was negative 300,000 ETH, equivalent to an outflow of approximately US$817.2 million. As of the time of publication, ETH was trading at US$2,724.

The Ethereum net flow of crypto derivatives is -300,000 ETH. Source: CryptoQuant

CryptoQuant contributor Amr Taha said in a Feb. 6 analyst note that this is a bullish sign because traders pulling their ETH off derivatives exchanges (which involve contracts between buyers and sellers to trade an asset at a pre-agreed price on a specific date) means reduced selling pressure, while closing leveraged positions and potentially moving ETH to cold wallets.

Taha said the increase in ETH being pulled off derivatives exchanges reduces the “immediate supply available for sale,” making it harder for ETH prices to fall.

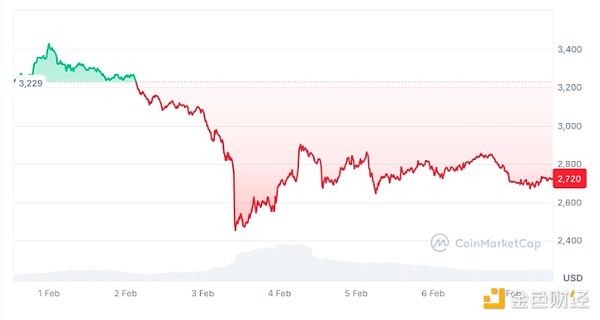

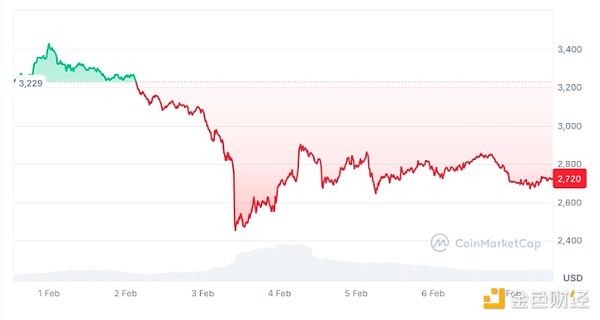

ETH is down 19.42% over the past 30 days and has been trading below the psychologically important $3,000 price level since February 3.

As of the time of publishing, Ethereum is trading at $2,720. Source: CoinMarketCap

Taha added: “If demand remains stable or increases, prices will rise due to reduced supply.”

Crypto commentator Kyle Doops said in a Feb. 6 X post that “Big moves like this usually mean less selling pressure and major position unwinding — usually a bullish sign.”

Just days ago, Eric Trump, son of U.S. President Donald Trump, posted on X that “now is a good time to accumulate ETH.”

The move comes after a growing list of bullish catalysts for Ethereum, including the potential launch of a collateralized Ethereum exchange-traded fund and Donald Trump’s World Liberty Financial cryptocurrency project continuing to increase its Ethereum holdings.

Consensys founder Joe Lubin recently said ETF issuers are hoping that funds offering collateralization will soon receive regulatory approval.

“We have been in discussions with ETF providers and they have been working very hard on this, so they expect approval very soon,” Rubin said.

Joy

Joy