Author: Prathik Desai Source: thetokendispatch Translation: Shan Ouba, Golden Finance

Three months ago, even Ethereum's most staunch supporters might not have imagined that the Ethereum exchange-traded fund (ETF) in the United States would soon celebrate its first anniversary.

However, now is the highlight moment for Ethereum ETFs. They have been trading for a full year since their first transaction on July 23, 2024.

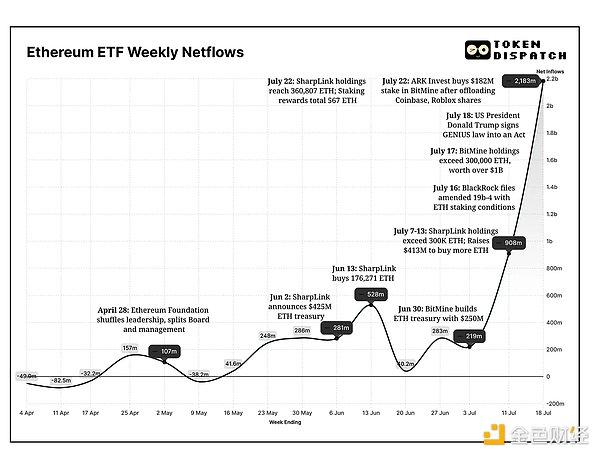

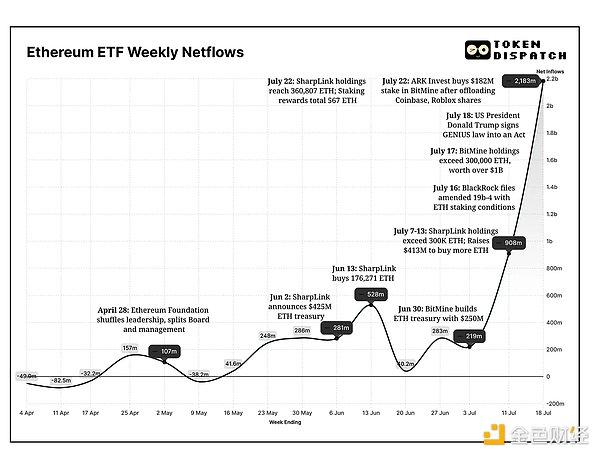

In June 2025, the Ethereum ETF had its best month to date, with net inflows of more than $3.5 billion, up 70% from the previous high of $2.08 billion in December 2024. And July's performance is expected to surpass June, with inflows of more than $3 billion so far. The past two weeks ending July 18 set a record for the best weekly net inflows in history. More notably, the Ethereum ETF has not seen any net outflows for the past 10 consecutive weeks, the first time in its 52-week history.

The "hockey stick" growth trend shown in the chart below tells the story of this extraordinary growth trajectory.

When U.S. regulators approved the Ethereum ETF in May 2024 and started trading on July 23, the market reaction was quite muted. After all, Bitcoin stole the limelight from ETFs as early as the beginning of the year. The launch of the Ethereum ETF did not spark market frenzy, with little price volatility and less attention. In the first few months, there was no massive inflow of funds. In fact, many early trading weeks even saw net outflows. In the first 39 weeks, the Ethereum ETF saw net inflows in only 15 weeks, while in the past 14 weeks, there were net inflows in 13 weeks, a significant change in market sentiment within three months. As of July 21, 2025, the total assets under management (AUM) of all Ethereum ETFs in the U.S. market exceeded $19 billion, double the approximately $9.6 billion two months ago. Moreover, the strong demand for ETH is not only reflected in ETFs. Institutional interest in Ethereum is rapidly heating up through the "Ethereum Vault".

On June 2, SharpLink Gaming became the first U.S. public company to announce the inclusion of Ethereum in its corporate treasury strategy. While the crypto world was tracking public companies adding Bitcoin to their balance sheets, Ethereum co-founder Joe Lubin brought Ethereum to the financial party.

Lubin currently serves as Chairman of SharpLink Gaming’s Board of Directors and leads the company’s $425 million Ethereum treasury strategy.

Since the launch of its treasury program, the company has become the world’s largest public Ethereum holder, holding 360,807 ETH, worth more than $1.3 billion at current prices. The company has also raised an additional $413 million and received a total of 567 ETH in rewards for staking ETH.

Furthermore, in a supplemental prospectus filed with the SEC, SharpLink applied to increase the amount of common stock that can be issued from the initial $1 billion to $5 billion.

At the same time, it also faces challenges from a new competitor - BitMine Immersion, a company that originally focused on Bitcoin mining, now also bets heavily on Ethereum, holding more than 300,000 ETH, which is valued at more than $1 billion at current prices. Tom Lee, chairman of the company and a veteran Wall Street figure, said: "We are steadily moving towards our goal: to acquire and stake 5% of the total supply of Ethereum."

SharpLink and BitMine currently hold more ETH than the Ethereum Foundation.

Taken together, the trend of capital inflows into ETH vault companies and ETFs shows that institutions are heavily investing in Ethereum as an infrastructure layer. This trend continues to strengthen.

ARK Invest, led by Cathie Wood, recently sold most of its holdings in Coinbase and Roblox to increase its stake in BitMine Immersion, investing $182 million. ARK has previously had a small allocation to ETH, but has reorganized its three flagship ETFs to adjust the BitMine allocation to 1.5% in total.

Billionaire Peter Thiel has also bought a 9.1% stake in BitMine.

In addition, a new company called Ether Machine is about to go live, a merger of multiple companies to create a public company that provides institutional exposure to Ethereum infrastructure and ETH revenue.

The company will be led by co-founders Andrew Keys (former Consensys board member) and David Merin (former Consensys executive and current Ether Machine CEO). After the merger is completed, Ether Machine plans to be listed on the Nasdaq, and will hold more than 400,000 ETH, with a total valuation of more than $1.5 billion.

What happened in the past few months? The recent "regime change" of the Ethereum Foundation may be one of the key factors.

At the end of April this year, the Ethereum Foundation carried out a major personnel reorganization, officially separating the board of directors from management for the first time. The new leadership team clearly stated that expanding the scalability of the Ethereum main layer, improving the performance of Layer 2 solutions, and optimizing the user experience are core priorities.

The practicality and profitability of Ethereum also make it a high-quality asset in the eyes of investors.

Currently, no ETF products in the United States offer staking income. The U.S. Securities and Exchange Commission (SEC) has not approved such a mechanism. If ETH ETFs can support staking in the future, Ethereum will be expected to become a "digital bond" in institutional portfolios.

Staking ETFs can provide a native yield of 3–5%. Even with the current total holdings of ETH ETFs of $19.6 billion, if the average yield is 4%, ETF issuers can earn more than $750 million in staking income each year.

BlackRock is already exploring the feasibility of incorporating staking into the ETF structure. In its recently submitted 19b-4 revised document, it explicitly mentioned "staking as a potential future feature", provided that regulatory approval is obtained. The market is waiting.

Experts expect that the staking function of the ETH ETF is expected to be approved in the last quarter of this year.

For many investors, staking may become the decisive factor between "exposure" and "commitment". Passive income from compliant products may attract long-term capital such as pensions, endowment funds and sovereign wealth funds.

Market makers and trading institutions Wintermute pointed out in a report at the beginning of the listing of ETH ETF that the lack of a staking mechanism will weaken the attractiveness of Ethereum as an ETF carrier.

Once the macro environment turns - such as interest rate cuts, inflation stabilization, or funds looking for higher yield opportunities - ETH will become a very attractive asset. It has the scarcity brought by supply contraction, the ability to generate returns through staking, and the accessibility achieved through ETFs and custodians.

The price of Ethereum has begun to move in line with institutional activities. If the price breaks further, market sentiment will be boosted and more funds will flow in. In any case, after a long period of silence, both retail investors and institutions will usher in the evolution of Ethereum.

In the past two weeks, the price of ETH has risen by more than 50%, setting a new high in 2025. In the past three months, the increase has reached 150%.

For every new share issued by the ETF, an equal amount of ETH must be purchased to lock in market supply. The reduction in the number of tradable ETH will naturally put upward pressure on prices.

It is expected that major ETH vault companies will also choose to hold for the long term and not sell easily. Registered investment advisors (RIAs), wealth management institutions and listed companies often do not pursue short-term gains, and they rarely sell in panic.

These vault builders are looking at Ethereum as “programmable collateral” – an asset that can generate income, ensure security, and exist stably.

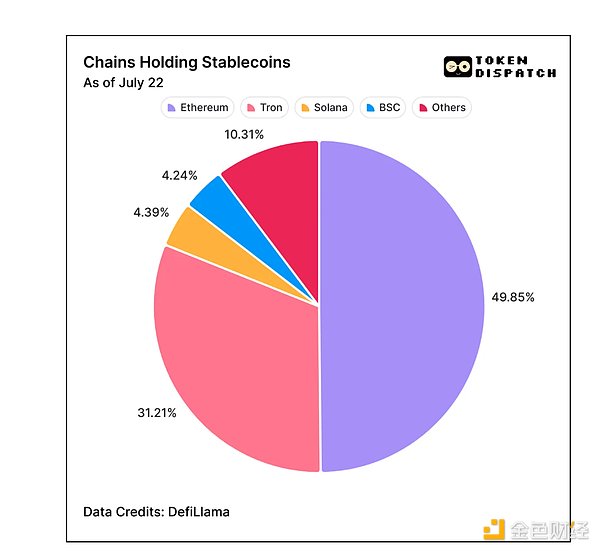

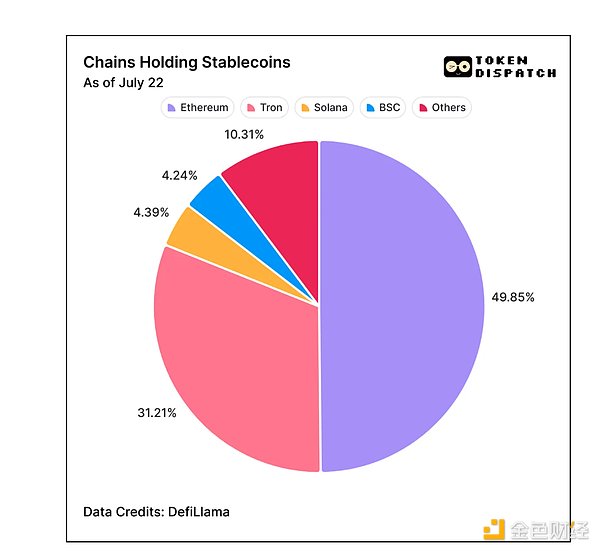

In addition, the current macro environment continues to be favorable: the GENIUS Act was recently signed into law, officially recognizing stablecoins as “digital cash”. Ethereum, as the main settlement layer of stablecoins, will be the biggest beneficiary, with a current market share of over 50%.

So, what happens next?

Once the ETF pledge function is approved by the SEC, institutional demand will continue to accelerate. More companies will also start to build ETH vaults due to the income from pledge. Asset management giants like BlackRock will also further increase the weight of ETH in their portfolios.

For traditional investors, this may be the first time they realize that ETH now has two powerful institutional-level distribution channels - ETFs and vaults. Both of these lock up supply and penetrate Ethereum into the traditional economic system.

Those who try to compare Bitcoin's ETFs and vaults with Ethereum ignore the essential differences.

BTC is a value storage tool and the "digital gold" in macro configuration; while ETH is being actually put into use. Fund issuers and vault builders buy ETH for what it can do: staking rewards, infrastructure operations, and the programmable layer needed for financial applications.

Bitcoin is an asset you hold in your hand; Ethereum is a system you can build a network on top of.

Anais

Anais