Ethereum is winning the war for real-world assets (RWAs), and no other chain comes close. RWAs operate like a flywheel: the more liquidity, the more attractive they become, and institutions will chase the money. The dominant force here is a power law, and Ethereum’s network effects play out in three tiers: good, better, and optimal:

Let’s dive into the different categories of RWAs and Ethereum’s dominance in each area

Stablecoins

Stablecoins are the largest category of RWAs — of all on-chain RWAs

Of these, 90% are stablecoins. Stablecoins are the most mature category of RWAs, and because RWAs rely on stablecoin liquidity, they typically grow in tandem. Ethereum L1 already has nearly $160 billion in stablecoins. This represents 57% of all stablecoins (an astonishing figure in itself), and if you add in stablecoins issued by all EVM-compatible chains, the market share reaches 95%. This means that 95% of stablecoins are reinforcing Ethereum's existing network effects. Even the newest and brightest stablecoin-focused networks, such as Stripe's Tempo, Circle's Arc, and Tether's Plasma, use the EVM. Prominent stablecoin issuers range from centralized players like Circle and Tether (which have issued a combined $130 billion in stablecoins on Ethereum) to decentralized protocols like Ethena and Sky (which have issued a combined $24 billion in stablecoins on Ethereum). Trump is also deploying digital dollars on Ethereum through World Liberty Financial's USD1 stablecoin, which already has a market capitalization of $275 million on Ethereum, with an additional $2.2 billion of USD1 held on other EVM chains. Stablecoins have long been considered the lifeblood of the on-chain economy, and they are increasingly driving the real-world economy. Whether it's everyday payments or multi-billion dollar transactions, everyday people and the world's largest funds are turning to stablecoins to simplify payments. In the stablecoin space, the EVM dominates and its momentum continues to grow. Winning the stablecoin race means winning the RWAs, and Ethereum's network effect in the stablecoin space is already astounding. Treasury bonds are the world's reserve asset, and Ethereum is their on-chain home. Ethereum L1 has locked up $5.2 billion in Treasury products, representing 70% of the market share. If the broader EVM ecosystem is included, industry dominance reaches 86%. Many big names in traditional financial asset management have launched their own tokenized Treasury products on Ethereum. BlackRock, the former Federal Reserve investment manager, holds the title of largest issuer with BUIDL, a $2.2 billion on-chain money market fund designed for institutions that maintains a stable $1 value and pays daily interest directly to wallets (90% on Ethereum). Traditional financial brokerage Fidelity also recently entered the tokenized Treasury bond space. Earlier this month, it minted $203 million worth of FDIT (an on-chain representation of the Fidelity Treasury Digital Fund), deploying it exclusively on Ethereum's Layer 1.

For all the other tokenized treasury issuers that followed suit, the logic was simple: Choose to deploy on Ethereum, no one gets fired. The pioneers have blazed the trail, they recognized the advantages of this chain, and they demand world-leading liquidity.

That’s why Ethereum now has 34 different treasury products (more than double the number of the next closest network). Data Source: RWA.xyz Gold Ethereum L1 is home to nearly $2 billion in tokenized gold, representing 78% of global tokenized gold. This percentage jumps to 99.96% if the EVM chain is included, signaling Ethereum’s absolute dominance. Since the end of August, the price of gold has risen by 10%. While we've seen greater daily volatility in ETH, it's clear we're in another phase of gold's 2025 rally. During this period, the total value of tokenized gold issued by industry leaders Paxos (PAXG) and Tether (XAUT) has surged. PAXG is only available on the Ethereum network, while 99.9% of XAUT is also issued on L1. Compared to the $231 billion gold ETF market or the estimated $27.4 trillion physical gold market cap, the tokenized gold market is just getting started. But when large institutional gold holders decide to tokenize (like BlackRock’s iShares Gold ETF), the tried-and-true Ethereum will be the obvious place to deploy it.

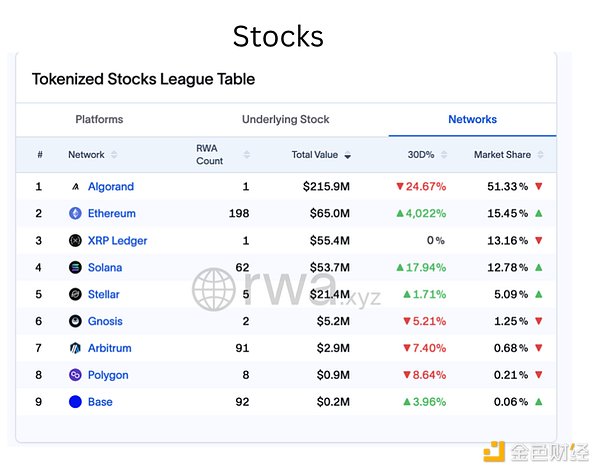

If you’re bullish on-chain gold, you’re bullish on Ethereum. Data source: RWA.xyz Tokenized shares are the youngest RWA market, and their development has been limited by the regulatory uncertainty that comes with putting shares on-chain. Today, the tokenized share market is small, valued at only $420 million. It is also the only RWA category where Ethereum does not have a clear leader. Ethereum L1 hosts only 15% of on-chain shares, a rare exception to its usual RWA dominance. However, a closer look reveals that leading competitors Algorand and XRP each have just one share, compared to Ethereum's 200. Furthermore, Exodus Movement (the only share on Algorand) recently announced it will issue equity on Ethereum (and Solana). Excluding Algorand and XRP from the competition, Ethereum L1 controls 44% of all tokenized shares, followed closely by Solana at 30%.

Data source RWA.xyz

Does Solana have a chance here? Perhaps, but consider the headwinds it faces.

Like tokenized treasuries, many of the top tokenized equity issuers have chosen Ethereum L1 as their home. A prime example is the recent deployment of Ondo Global Markets, which has issued $63 million worth of tokenized certificates backing 103 different single stocks, stock indices, and ETFs—exclusively on the Ethereum Layer 1 network. Furthermore, Robinhood, eToro, and Coinbase are all preparing to list tokenized securities. Once the SEC greenlights tokenized stocks, they are all likely to issue these securities on proprietary Ethereum Layer 2 platforms… The Ultimate Game of Network Effects Traditional finance also exhibits clear network effects. The New York Stock Exchange (NYSE), the world's largest exchange, accounts for over a quarter of global stock market value and hosts most major US companies.

Source: New York Stock Exchange

Wall Street industry organizations have begun experimenting with EVM-based technology in an effort to tokenize assets. Against this backdrop, it's hard to imagine any other chain being able to defeat Ethereum's profound network effects.

Ethereum L1 controls $160 billion of RWAs (79% of market share)

With Ethereum L2s, this number rises to $185 billion (86% of market share)

If all EVM chains are included, “Ethereum” controls $200 billion in total (93% of market share)

In other words:

93% of RWAs ... At least 86% of RWAs are optimal for Ethereum At least 79% of RWAs are optimal for Ethereum This is why people like Tom Lee say institutions are building on Ethereum. Because it is. Ethereum is winning the RWAs game, and no other chain can come close. But what if the EVM wins and Ethereum doesn't? Some still believe the EVM will win, but Ethereum won't. They'll point to permissioned enterprise chains building independent L1 EVMs and exclaim, "Look! They're building a better version of Ethereum." However, every centralized EVM chain only solidifies Ethereum's lead. All enterprise chains agree to use Ethereum for its security and neutrality, and no other chain can compete on that front. But what if Ethereum wins and ETH doesn't? Others argue that RWAs don't add value to ETH as an asset, assuming this sector doesn't directly increase Ethereum's revenue. However, if Ethereum becomes the world's ledger, it's not far-fetched to think that ETH could replace other stores of value like Bitcoin and gold. In a world lacking native collateral, Ethereum is uniquely positioned to succeed: it has a deflationary mechanism, an accretive supply dynamic, and no counterparty risk. Once the market understands this powerful trinity, the world will understand. Ethereum = The World's Ledger

ETH = The World's Reserve Asset

Alex

Alex

Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Future

Future Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph