In recent weeks, the discussion about increasing blob throughput in Pectra has intensified, and two camps have emerged. One side supports increasing throughput, while the other is more cautious and prefers to wait for more clear data to support this change.

In my opinion, the sentiment in the community has become very clear: independent stakers are core to Ethereum.

While there is no consensus on the minimum requirements for validators (see sassal.eth's tweet #12), the Ethereum community has made it clear that we are not willing to sacrifice independent/family stakers for linear scaling.

In my opinion, this reflects the healthy direction of Ethereum and emphasizes the importance the community attaches to the viability of independent staking.

However, this also raises an important question: “Where is the line?”

Specifically, at what point does the role of low-bandwidth, weaker contributing stakers in decentralization no longer offset their limitations on Ethereum’s ability to scale?

In this article, I hope to provide more data points to help the community make a more informed decision about whether to pursue increased blob throughput in Pectra.

As Prysm core developer Potuz1 said, the real question is not “if we want to scale, how to scale”, but “are we ready to scale now?”

1. Who is experiencing the reorganization? (October 2023 - October 2024)

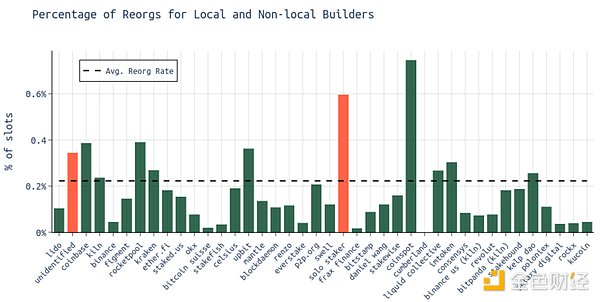

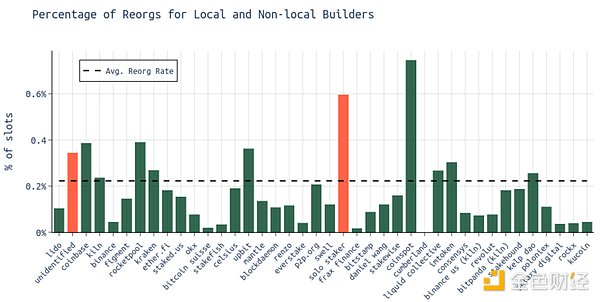

On average, about 0.2% of blocks are reorganized (reorganized blocks are part of the leaked blocks). Professional node operators (NO) like Lido, Kiln, Figment, and EtherFi are reorganized less frequently than average.

Less professional node operators, such as independent stakers, Rocketpool operators, and the unidentified category (which may contain a large number of unidentified independent stakers), experience reorganizations more frequently.

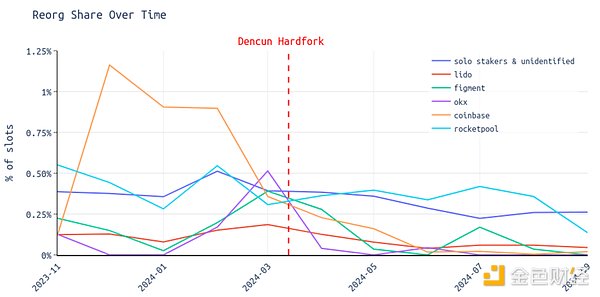

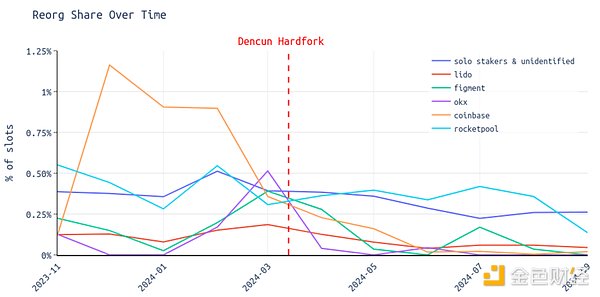

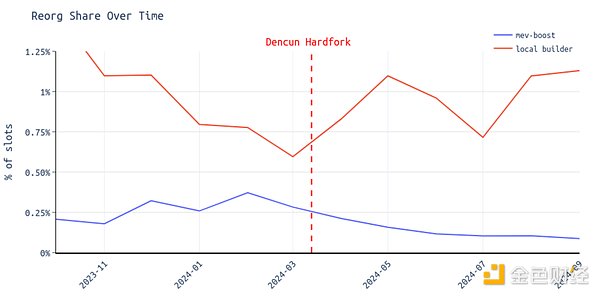

As shown in the previous analysis1, the reorganization rate has been decreasing since the Dencun hard fork.

In the figure below, we can see that this effect varies between different entities:

Since Dencun, the reorganization rate of independent stakers and unidentified nodes has decreased.

Rocketpool operators and large operators like Lido, Coinbase, Figment, and OKX have also seen a decrease in reorganization rates.

2. What is the situation of local block construction? (Oct 2023 - Oct 2024)

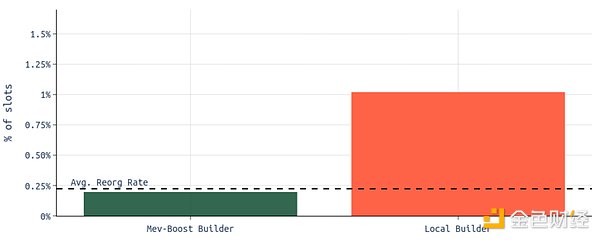

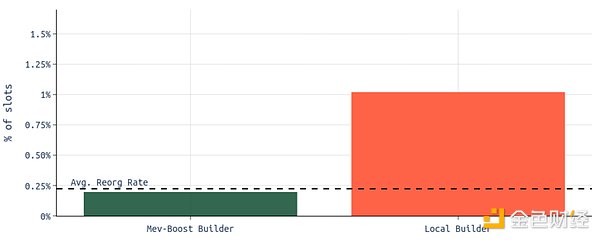

The reorg rate for local builders is about 1.02%.

The reorg rate for MEV-Boost builders is about 0.20%.

Local builders are about 5 times more likely to experience a reorg than MEV-Boost builders.

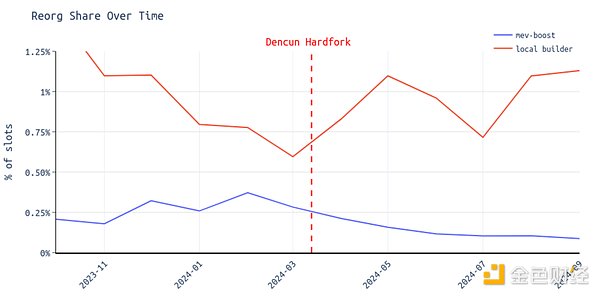

The reorg rate for local block builders appears to have remained the same or even increased after the Dencun hard fork.

For MEV-Boost users, the reorg rate has been trending down since Dencun.

It is worth noting that previous analysis showed that local builders included more blobs in their blocks on average. In addition, we also observed that after the Dencun hard fork, blocks containing 6 blobs faced some challenges for a while, but eventually stabilized. This may explain why the reorg rate for local builders has not decreased.

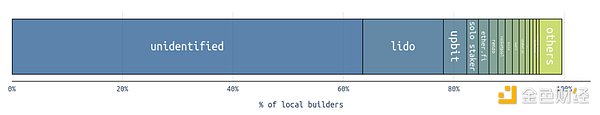

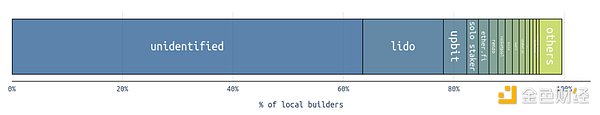

3. Who are the local builders? (October 2023 - October 2024)

Independent stakers (labeled here as “independent stakers”, but many of them belong to unidentified categories) are the largest entities in the “local builders” category.

In addition, there are some Lido node operators who do not use MEV-Boost at all, or use the lowest bid flag.

Key Insights

Independent stakers are more likely to miss slots than professional validators.

Independent stakers often choose to build blocks locally instead of using MEV-Boost.

Local block builders do not benefit from the fast propagation provided by MEV-Boost relays.

Relays employ timing strategies (e.g., relay delays to allow time for more profitable blocks).

Epoch boundaries lead to increased reorganizations.

Multiple factors can cause reorganizations, making it difficult to determine exactly why some validators (such as independent stakers) experience reorganizations more frequently than others.

Anais

Anais