Author: Evanss6, Source: Author Twitter @Evan_ss6; Compiled by: Songxue, Golden Finance

This article will discuss the supply dynamics of Ethereum, including ETH pledge, Gas usage, exchange balance, ETH, re-pledge and liquidity re-pledge and Eigenlayer in smart contracts.

(1) ETH Staking

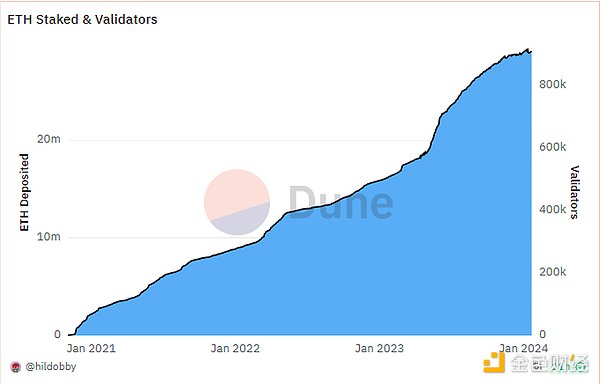

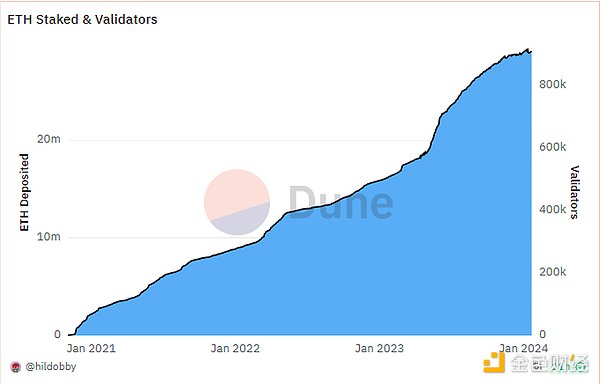

Starting from the total ETH staking, this is a huge uptrend and is right at the ATH level.

This is the largest ever pledge from Celsius/Figment, approximately 573,000 ETH.

On the other hand, There is a lot of new ETH being staked, and a large portion of it is driven by Eigenlayer (more on that later).

(2) Gas Usage

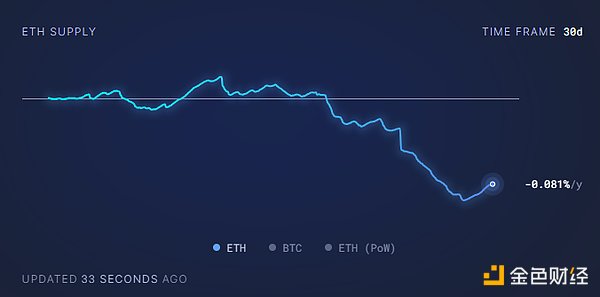

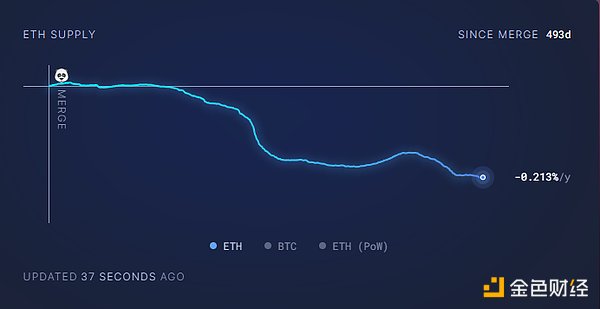

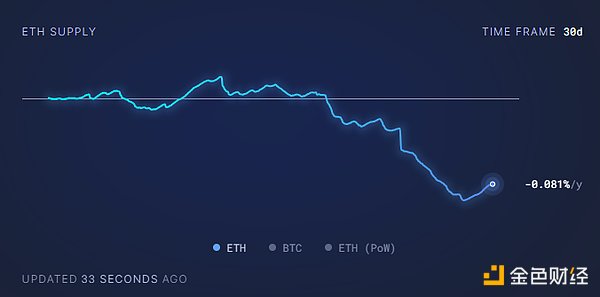

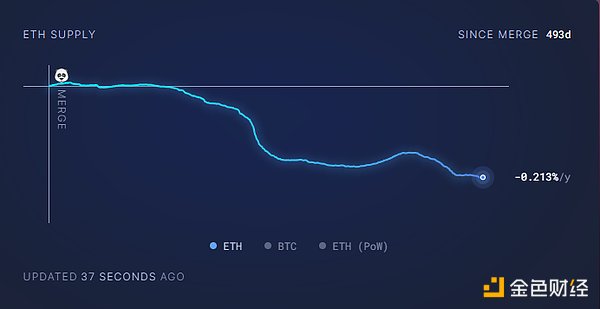

ETH has been deflationary for the past 30 days and for the past 493 days (since the merger).

Gas consumption is primarily driven by Uniswap, ETH transfers, Tether/USDC, L2s, Metam4sk and OpenSea/Blur.

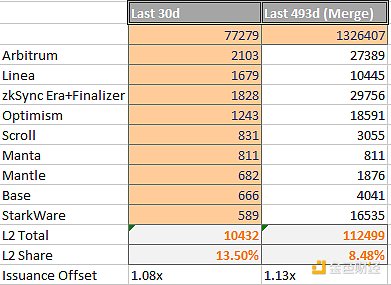

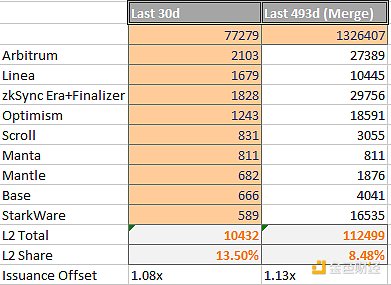

Learn more about L2:

Their proportion of total Gas consumption is on the rise. Dencun's EIP-4844 will change things a bit, but here are the numbers for the timeframes mentioned above:

Offset of 1.08x/1.13x on 30-day and 493-day timeframes, mostly bearish/ recovery stage.

(3) Transaction Exchange balance

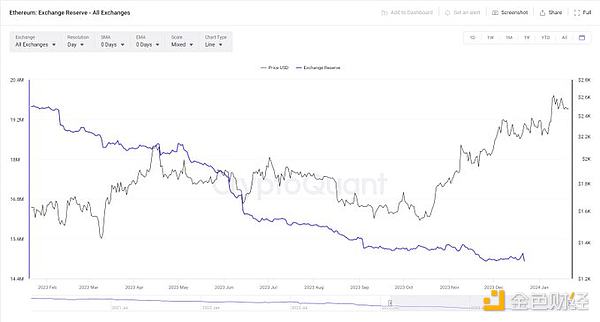

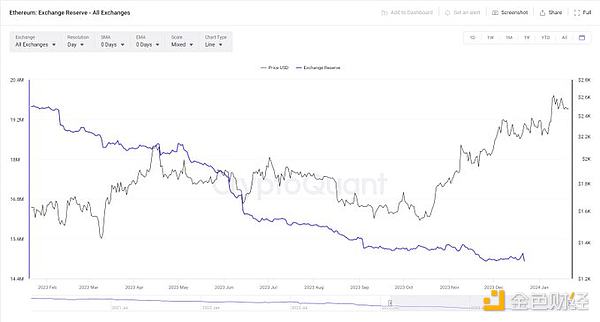

Next let’s look at the exchange balance. We can see that over the past year, the number of Ethereum on exchanges has dropped from 19.6 million to a low of 14.9 million.

(4) Intelligence ETH in Contracts

The trend continues to rise and is now almost at all-time highs (sorry, no chart).

(5) Re-staking

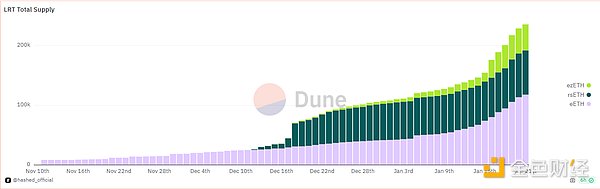

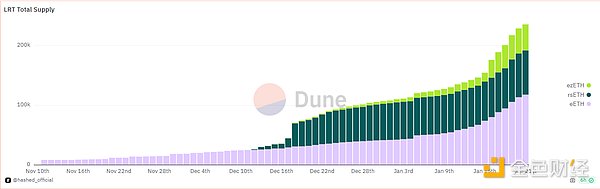

@eigenlayer holds ~745,000 ETH (note the Llama graph is a bit old). This number has been growing steadily, although major LSTs have hit their caps, driven by protocols EtherFi, Kelp, and Renzo.

Since the beginning of December, these protocols have increased their stake by approximately 220,000 coins of Ethereum and continues to grow steadily ahead of the launch of @eigen_da, a Celestia competitor.

The regular LST cap is scheduled to be increased on January 29 for 5 days.

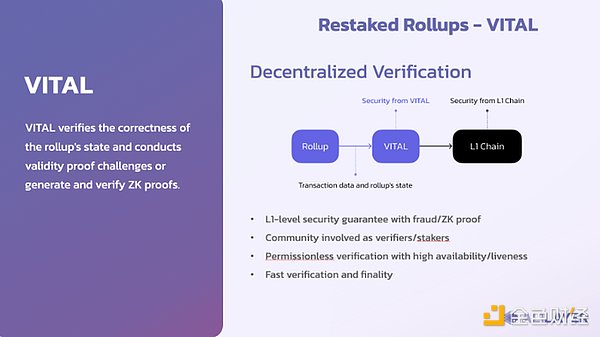

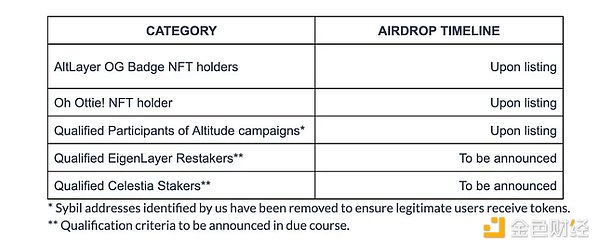

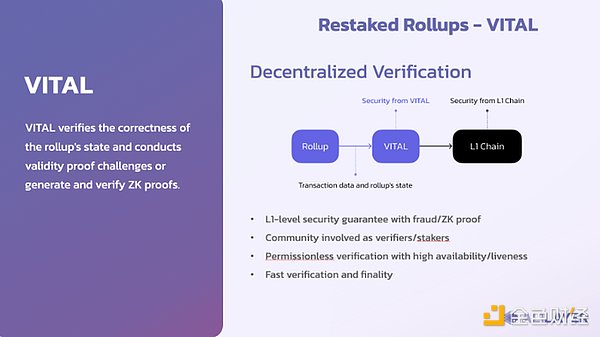

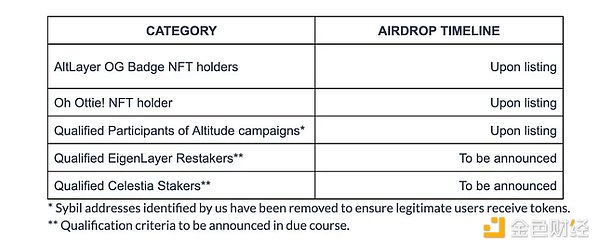

In addition to the general excitement about Eigenlayer, even more enthusiasm was ignited when @alt_layer, the restaked rollup Binance Launchpool project powered by Polychain, announced that it would be undergoing an airdrop. This airdrop is open to stakers of @CelestiaOrg and re-stakers of @eigenlayer.

Altlayer is scheduled to launch the token on the 25th of this week.

This airdrop announcement has certainly fueled speculation about future airdrops to Eigenlayer retriers from other AVS and adjacent projects.

In general, both supply and demand are showing positive trends. Factors such as DeFi, L2, and Eigenlayer continue to absorb more Ethereum, while there is a net tightening on the supply side, while Celsius has finally stopped selling and the Ethereum spot ETF hype is brewing.

In addition to these, I expect there will be several other important Ethereum projects launching their tokens in the first half of 2024, of which @LayerZero_Labs has been confirmed and Starkware/zkSync is also widely anticipated.

JinseFinance

JinseFinance