Author: Mario @IOSG

Background

Prediction markets are a type of speculative market that trades on the basis of future event outcomes. Their core function is to aggregate scattered information through contract prices. Under certain conditions, the price of a contract can be interpreted as a probability prediction of the event. Since the 1980s, a large number of studies have shown that prediction markets are very accurate, often outperforming traditional prediction methods such as polls or expert opinions. This predictive ability comes from the "wisdom of crowds": anyone can participate in the market, and traders with better information have an economic incentive to participate in transactions, thereby driving prices closer to the true probability. In short, a well-designed prediction market can efficiently integrate a large number of individual beliefs into a consensus estimate of future outcomes.

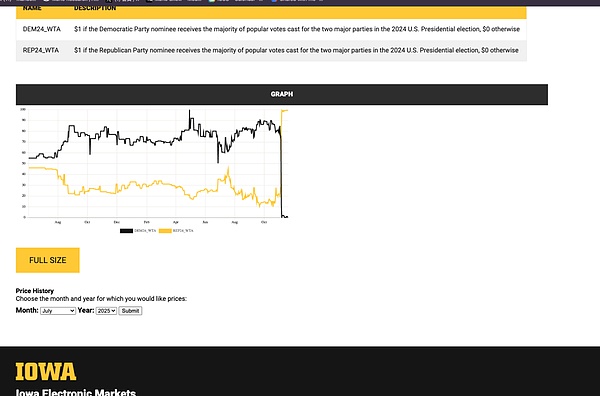

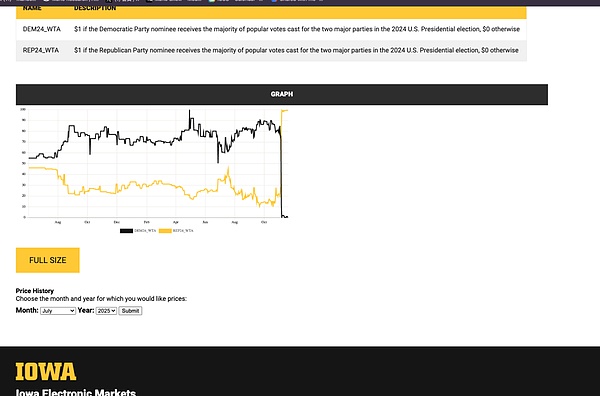

The origins of modern prediction markets can be traced back to some pioneering experiments in the late 1980s. The first academic prediction market was the Iowa Electronic Markets (IEM) founded at the University of Iowa in 1988.

IEM was a small-scale real money market (regulators limited the amount of bets per person to about $500) that focused primarily on the results of the US election. Despite its limited size, IEM has long demonstrated impressive prediction accuracy. In the week before the election, the market predicted the Democratic and Republican candidates' vote share with an average absolute error of 1.5 percentage points, compared with 2.1 percentage points in the last Gallup poll during the same period. The chart below also shows that as election day approaches and more information is absorbed by the market, the prediction accuracy continues to improve. At the same time, some forward-looking ideas about using markets to predict uncertain events are gradually taking shape. Economist Robin Hanson proposed the concept of "Idea Futures" in 1990, which is to establish an institution for people to bet on scientific or social propositions. He believed that this would form a "visible consensus of experts" and incentivize honest contributions by rewarding accurate predictions and punishing wrong judgments. In essence, he viewed the prediction market as a mechanism to resist bias and promote the revelation of the truth, applicable to scientific research, public policy and other fields. This concept (i.e., the "idea futures market") was very advanced at the time and laid the foundation for the theoretical expansion of the prediction market.

In the 1990s, some online prediction markets began to appear, covering real money markets and "virtual currency" markets. The academic market at the University of Iowa is still operating, while the "virtual currency" market has gained more attention among the public. For example,

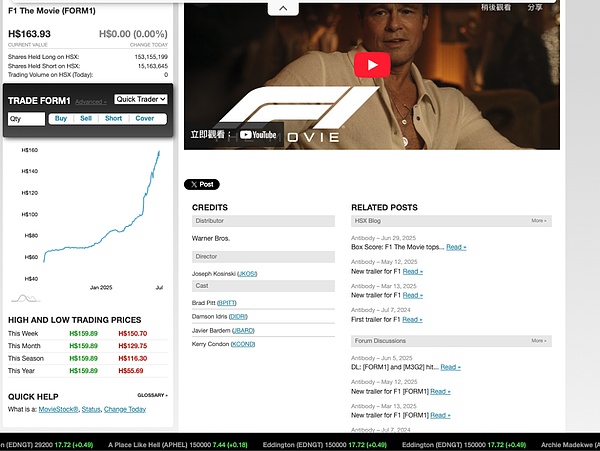

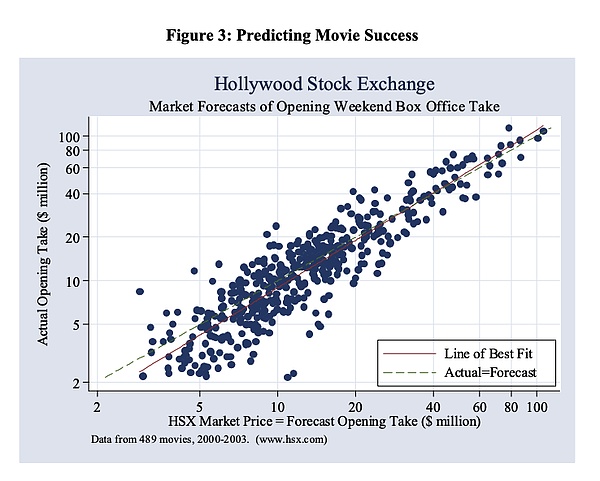

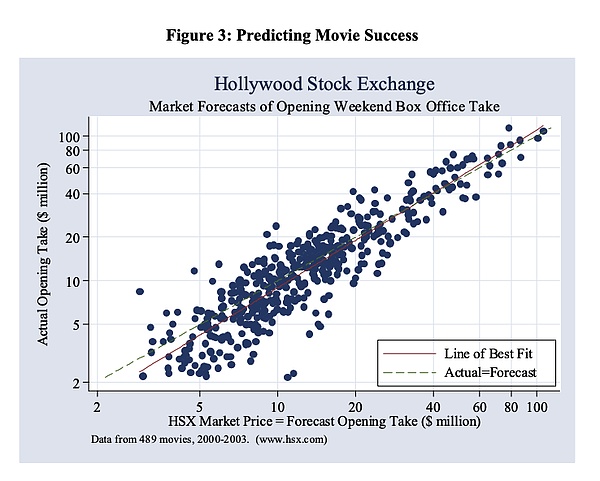

Hollywood Stock Exchange (HSX) was established in 1996 as an entertainment prediction market that trades "shares" of movies and actors with virtual currency.

HSX has proven to be very good at predicting movie opening weekend box office and even Oscars, sometimes even more accurate than professional film critics. In 2007, HSX players accurately predicted 32 Oscar nominations in 39 major awards and hit 7 winners in 8 major awards. HSX is regarded as a classic case of prediction market.

Theoretical Basis and Market Mechanism Design

The basic mechanism of the prediction market is to create an incentive-compatible structure so that market participants are motivated to reveal their true information. Since traders bet with real money (or virtual currency), they tend to trade according to their true beliefs and private information.

From an economic perspective, a well-designed market should allow traders to maximize their expected returns by quoting prices that match their subjective probabilities.

In terms of preventing manipulation, academic research has found that prediction markets are highly resilient to price manipulation. Attempts to deviate prices from fundamentals often create arbitrage opportunities for other more rational traders, who choose to trade on the opposite side, thereby pulling prices back to a more reasonable position. Empirical data shows that manipulation is often quickly corrected and even helps improve market liquidity. In other words, those who try to manipulate the market usually end up becoming "leeks" who "subsidize" smart traders, and market prices will ultimately reflect the true state of information.

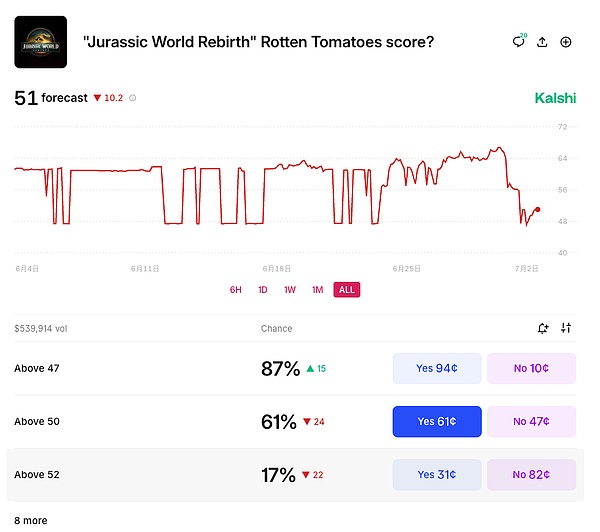

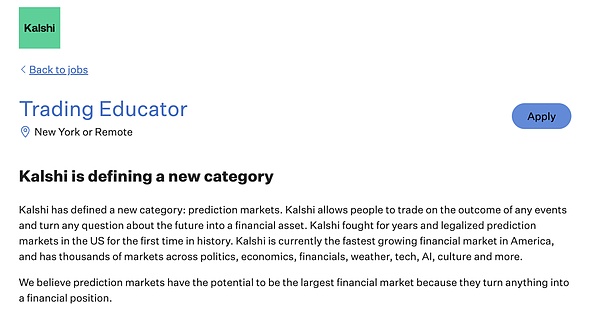

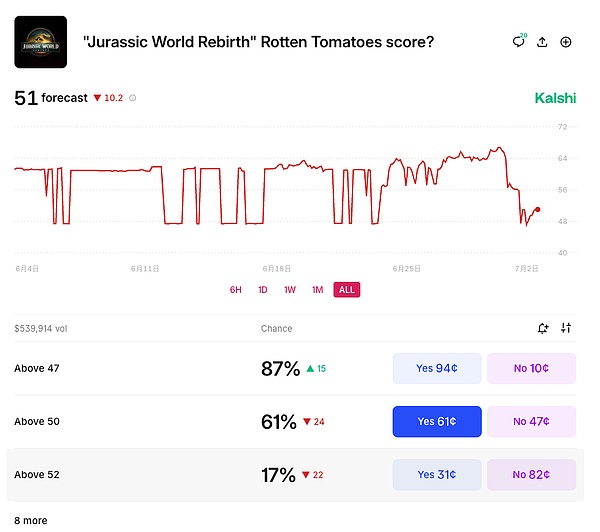

Kalshi

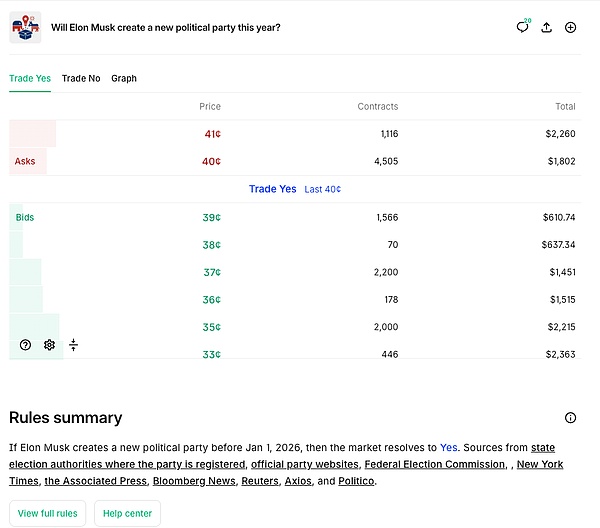

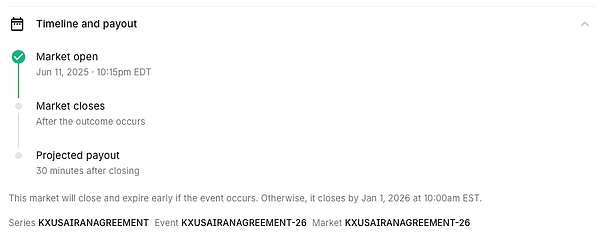

Kalshi is afederally regulated prediction market exchangewhere users can trade on the outcomes of real-world events. It is the first exchange approved by the Commodity Futures Trading Commission (CFTC) to offer Event Contracts. Event Contracts are binary futures (yes/no) with a contract value of $1 if the event occurs and $0 if it does not. Users can buy or sell “Yes” / “No” contracts at prices between $0.01 and $0.99, with the price representing the market’s implied expectation of the probability of the event occurring. If the prediction is correct, the contract is settled at $1 and the trader makes a profit. Kalshi itself does not hold positions (unlike gambling sites, it does not act as a banker). It only acts as a matching platform to match long and short parties and makes profits through transaction fees.

Market Creation Process

Proposal and Approval

New event markets (yes/no binary contracts) can be proposed by the Kalshi team or users through "Kalshi Ideas". Each proposal must pass internal review and must meet

CFTC's regulatory standards, including clear event definitions, objective settlement conditions, and permitted event categories.

Contract certification

After approval, the event was officially launched under Kalshi's Designated Contract Market (DCM) framework, and the document will list the contract specifications, trading rules and settlement standards.

Online Trading

After the event market is launched, US users can trade through Kalshi's app, official website, or integrated platforms with brokers such as Robinhood and Webull.

Initial Liquidity and Pricing

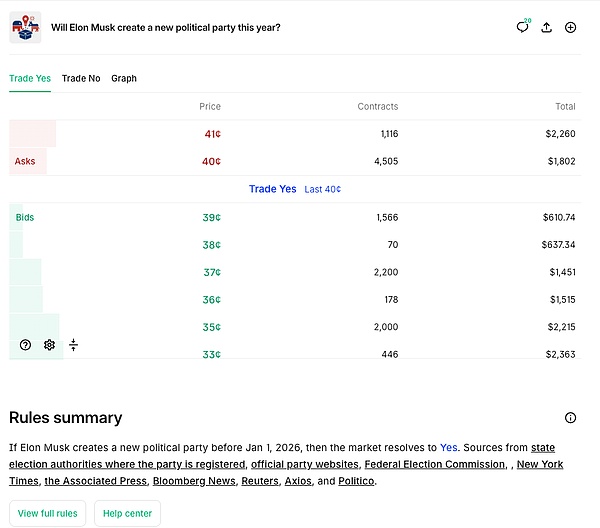

Order Book Mechanism

When a new market is launched, the order book is empty, and any user (market maker or ordinary trader) can placelimit orders (for example: buy "yes" at $0.39, or sell "no" at $0.61).

Market-making incentives

To encourage liquidity,makersusually do not charge fees, but some special markets charge extremely low fees.

Price discovery

Prices change dynamically with supply and demand, reflecting the market's consensus on the probability of events. For example, if someone buys "yes" at $0.60 and another person sells "no" at $0.40, the system will match them and create a contract. Both parties will invest $0.60 and $0.40, with a total of $1.

Market Settlement Mechanism

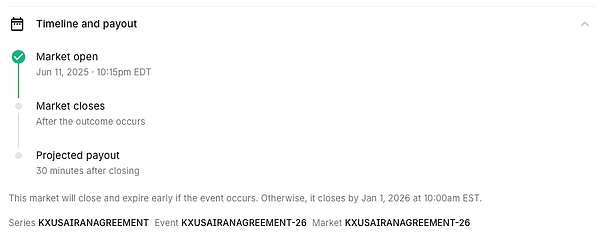

Result Confirmation

The event result is determined based on a pre-specified authoritative data source (such as government reports, official sports results).

Automatic settlement

If an event occurs, users holding the "Yes" contract will automatically receive $1 in profit per contract; on the contrary, the "No" party wins, and the losing party's contract will be reset to zero.

No additional settlement fees.

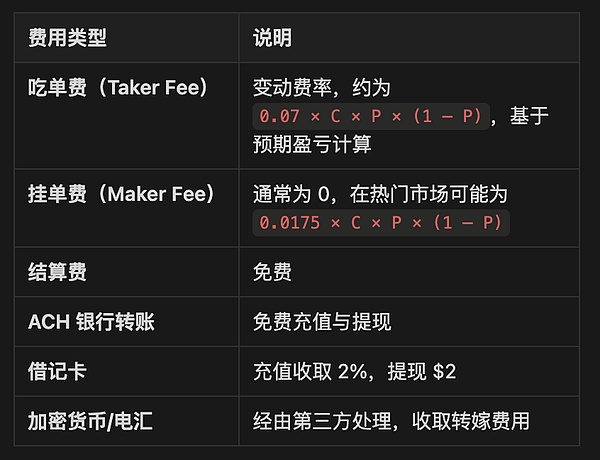

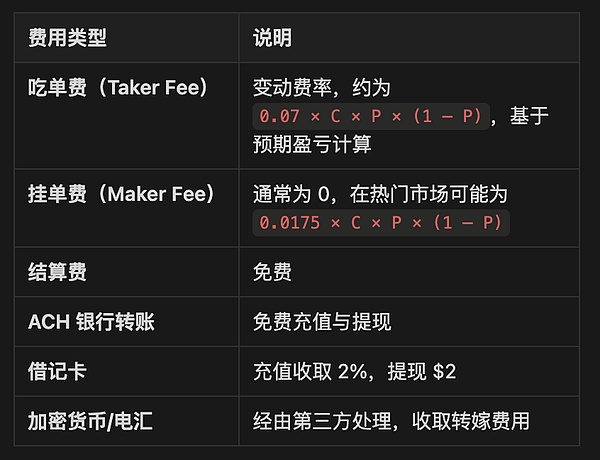

Fee Structure (Fee Structure)

Setting: P = Contract price, C = contract quantity

Polymarket

Polymarket Overview: Polymarket is a distributed prediction market platform built on Polygon, where users can trade binary outcome tokens (Yes/No Tokens) corresponding to event outcomes. It uses the Conditional Token Framework (CTF) to make each pair of outcome tokens fully collateralized by stablecoin (USDC), and the trading mechanism uses a hybrid central limit order book (CLOB) for efficient compliance. Market settlement is completed through UMA's Optimistic Oracle, a controversial distributed resolution system.

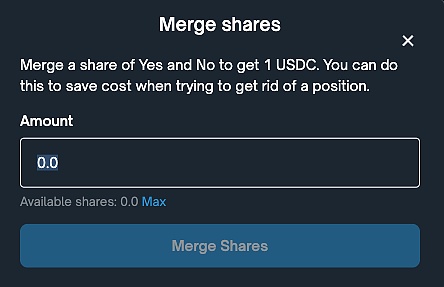

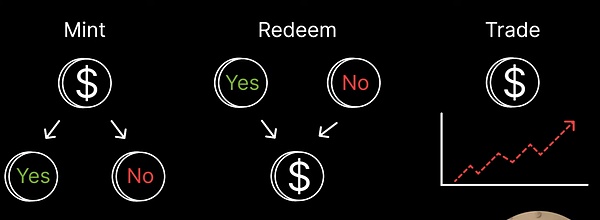

Conditional Token Framework (CTF) and Result Tokens

Polymarket uses Gnosis's Conditional Token Framework to represent each market outcome as a conditional token, deployed on the Polygon chain. For a binary market, two ERC-1155 tokens will be generated, such as Yes Token and No Token, with the same amount of USDC as collateral.

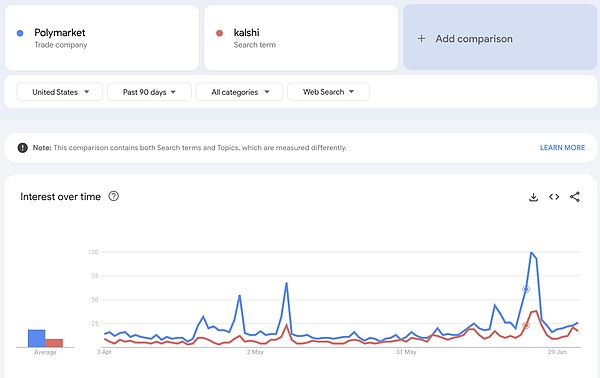

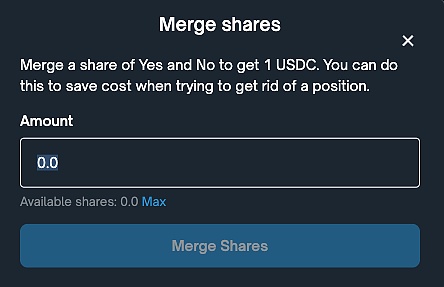

Splitting 1 USDC will generate 1 Yes + 1 No Token. Merging Yes/No Tokens can unlock and return 1 USDC, ensuring that each pair of tokens is fully collateralized. When the event ends, only the tokens corresponding to the correct results are worth $1, and the tokens corresponding to the wrong results are worth nothing.

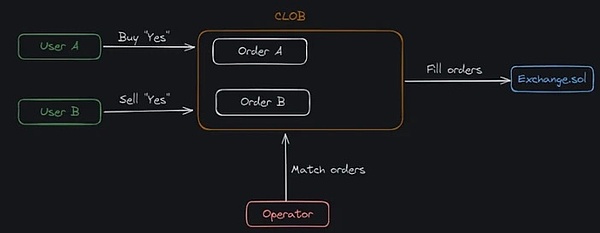

Hybrid Order Book Architecture (CLOB/BLOB)

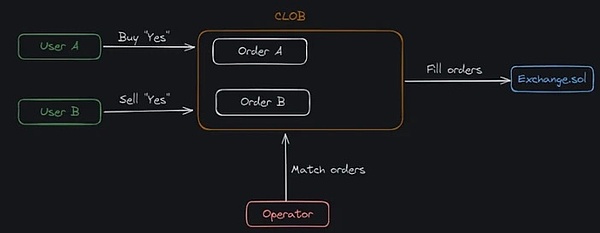

Polymarket uses a hybrid architecture called Binary Limit Order Book (BLOB) to maintain offline order management and on-chain transaction structure together. Users sign orders offline, and the operating node searches for matching orders. If there are matching orders, the on-chain economic exchange is completed through the smart contract.

Order life cycle

Users sign EIP-712 orders outside the chain (such as Buy YES @$0.62)

Operation nodes maintain offline order books

When there is a matching order, the operation node submits the matching result to the Exchange.sol contract

Atomic execution on the chain swap, complete settlement

Atomic Swap Example

Buy vs Sell: One person buys Yes at $0.40, and the other sells Yes at $0.40. The contract implements the exchange of USDC and Yes tokens

Buy vs Buy: Two people buy Yes/No from each other. The contract extracts a total of $1 from the two people and splits it into Yes/No tokens for the two users

Sell vs Sell: Two people sell Yes/No at the same time, and merge the tokens to return the collateral

Supports partial transactions, multi-order matching, price deductions, integrated transactions, and atomic execution

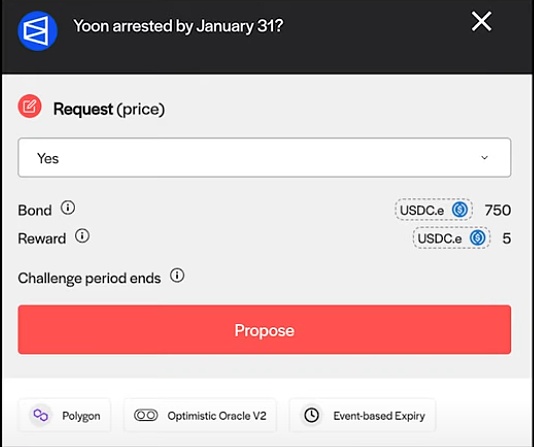

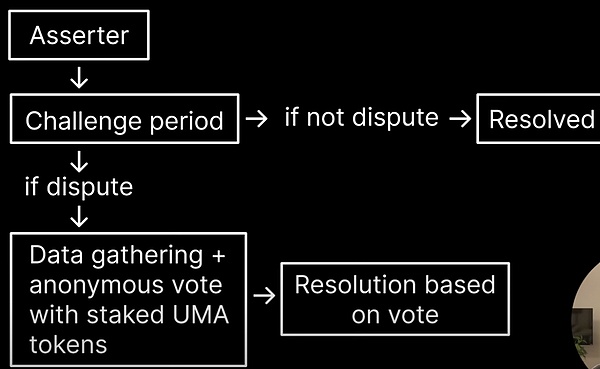

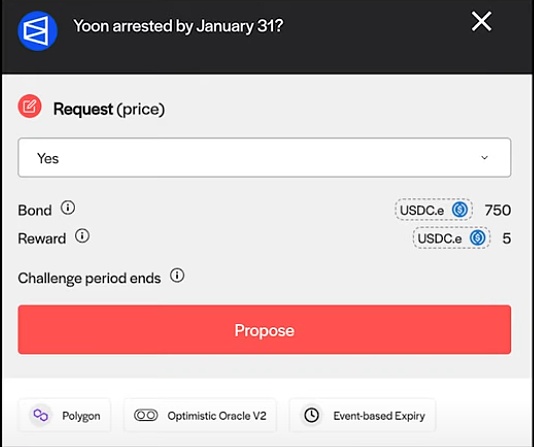

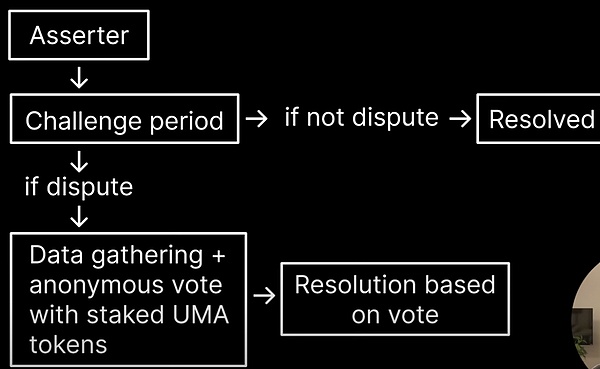

UMA Optimistic Oracle

Unlike traditional exchanges that use internal rulings or data sources, Polymarket forms consensus through the community through UMA's Optimistic Oracle.

Kalshi vs Polymarket: Comparison of structure and technology

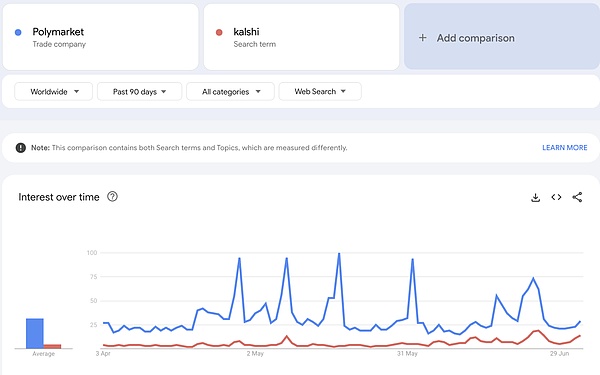

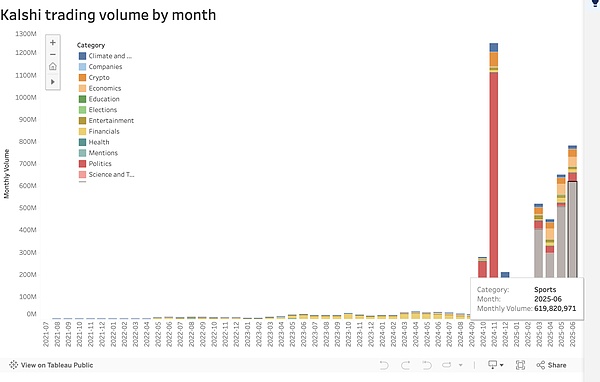

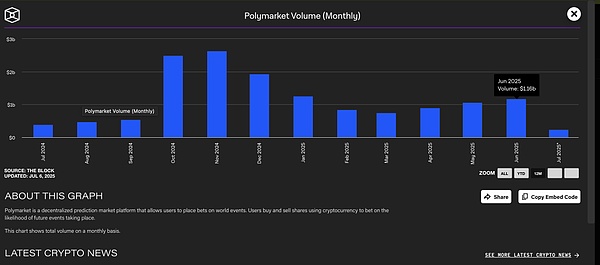

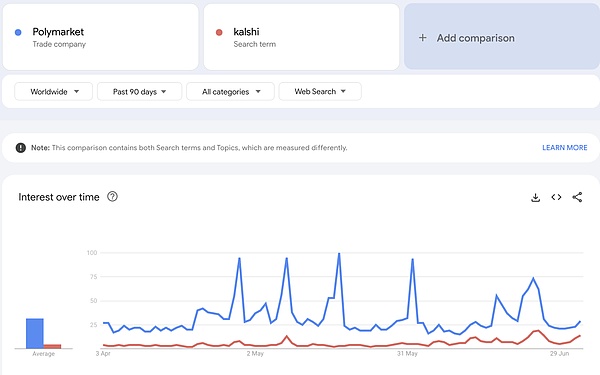

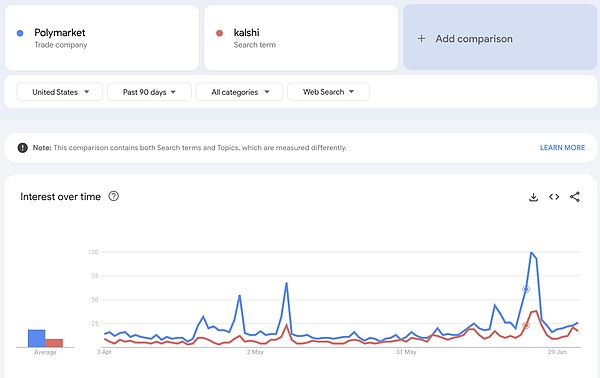

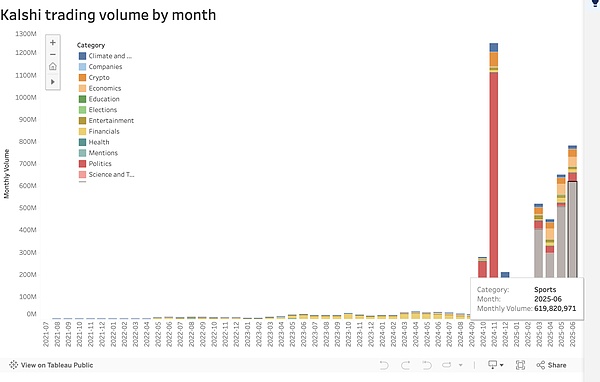

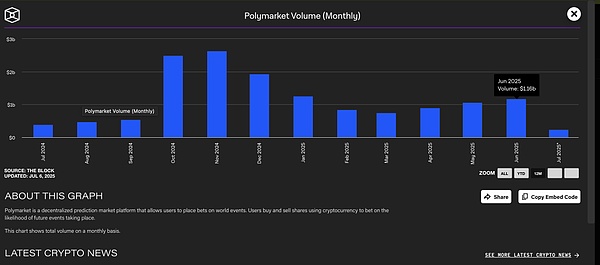

Polymarket's trading volume for the entire platform (including politics, technology, entertainment and other markets) in June was US$1.16 billion, slightly higher than Kalshi's approximately US$800 million.

Market Expansion Strategy / Growth Momentum

Academic Insight: "The Gambling Tendency of Crypto Tokens"

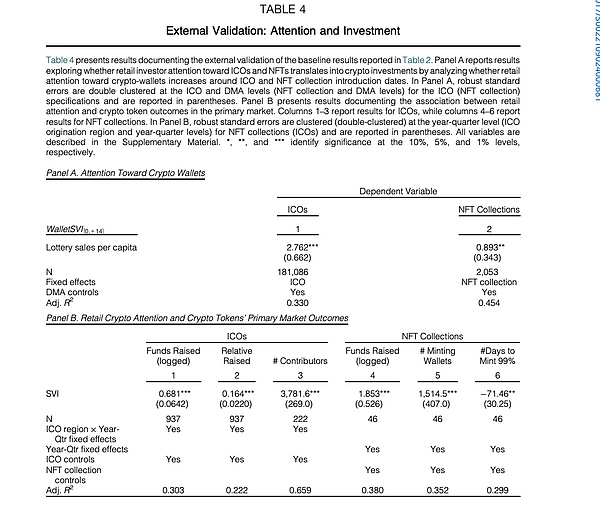

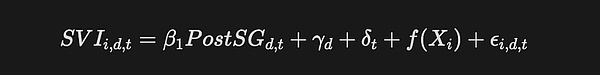

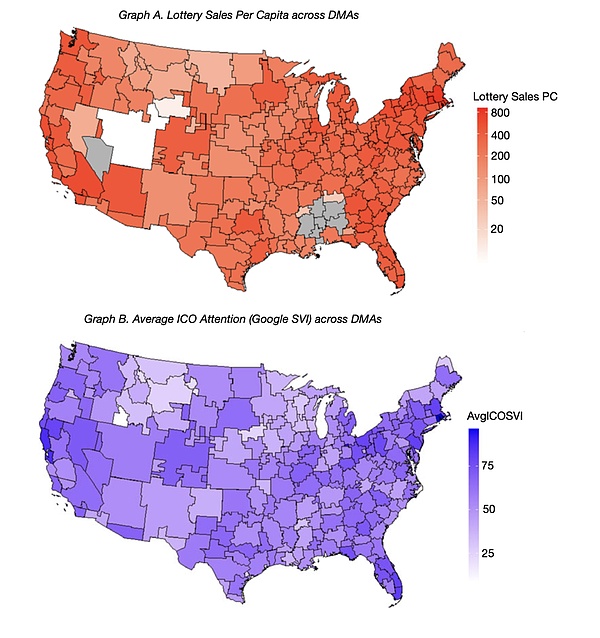

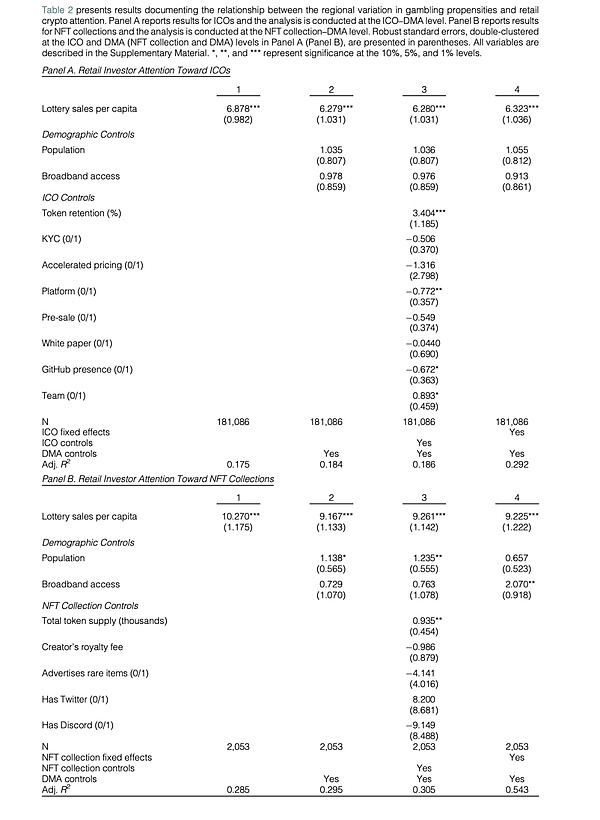

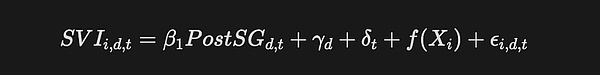

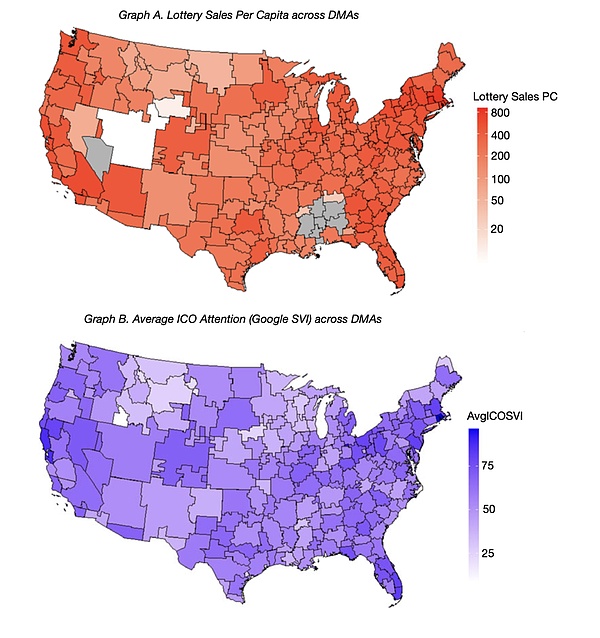

The main explanatory variables of X_d in the model are: Lottery sales per capita , and include interaction terms with token characteristics.

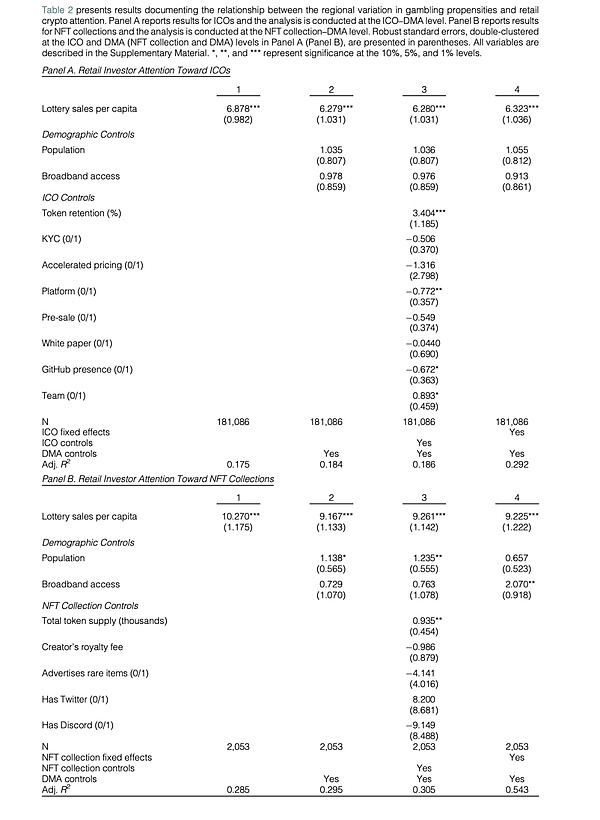

The regression results show that areas (DMAs) in the United States with higher per capita lottery sales show significantly higher Google search activity in the following aspects:

This shows that there is a high degree of overlap in the behavior of gamblers and retail crypto investors.

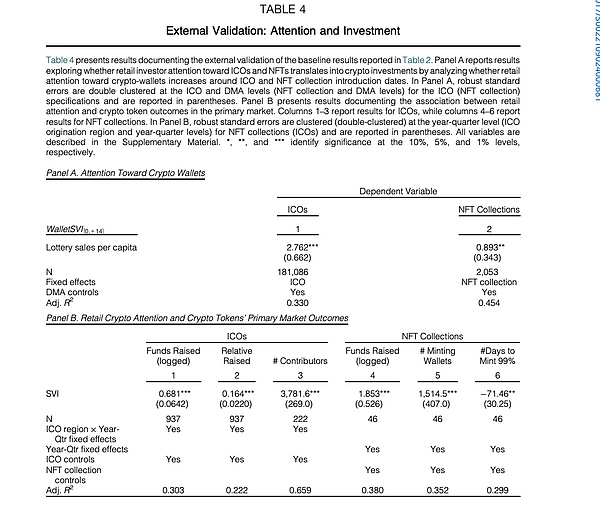

Wallet Attention and Investment Results

During the ICO/NFT release period, wallet-related searches (Wallet SVI) (such as MetaMask, Coinbase Wallet, etc.) surged more significantly in regions with high lottery sales.

These regions also showed higher financing amounts, more participants, and faster NFT minting speeds.

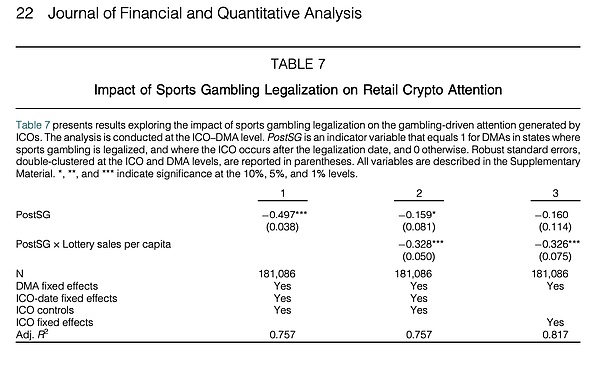

Gambling Legalization as a Natural Experiment

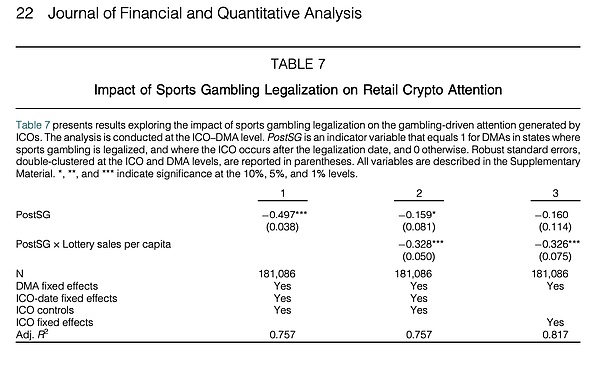

Table 7 of this paper exploits the timing differences in the legalization of sports betting across US states as a natural experiment. The results show that when gambling becomes legal in a state, crypto-related attention decreases significantly in areas with high lottery sales:

This means thatthere is a "substitution effect" between crypto tokens and gambling behavior-once legal gambling channels appear, speculative interest in crypto assets will decline.

The conclusion of the entire paper is very clear:"Gambling preferences can strongly predict retail investors' interest in the crypto market."

Crypto trading is not only "like gambling",for some users, it is gambling.

These findings further validate the contrast and highlight the existence of a class of users who have a

high risk appetite

and pursue speculative excitement in casinos or platforms like Coinbase.

Crypto Gambling Market: Stake.com as a Representative Sample

To gauge the size of the market, one can refer to the rise of crypto-native gambling platforms (which only support cryptocurrency deposits) such as Stake.com.

In just a few years, Stake has seized the huge demand of global users for high-risk and high-return entertainment, and achieved explosive growth:

Amazing revenue scale: Stake achieved approximately US$2.6 billion in gross gaming revenue in 2022 (and only US$5.2 billion in 2020). 105 million), making it one of the world's largest bookmakers. Growth continues - Stake's revenue in 2024 has reached approximately $4.7 billion, an increase of approximately 80% from 2022. In comparison, traditional giants Entain's revenue in 2024 was approximately $5 billion, and Flutter reached approximately $14 billion, and Stake has entered the same level.

User scale and coverage: As of 2023, the platform has more than 600,000 active users, despite being blocked in markets such as the United States and the United Kingdom. Its users are mainly concentrated in Southeast Asia, Japan, Brazil and other regions with loose online gambling regulations. Hundreds of thousands of people around the world have broken through geographical restrictions and are still flocking to a crypto gambling platform, reflecting the huge suppressed demand in the market.

Global Head Players: Stake's explosive growth has made it the world's seventh largest bookmaker (by revenue), even surpassing many traditional sports betting companies. It is worth noting that the revenue of DraftKings, a well-known American gambling platform, has fallen behind Stake, indicating that the cryptocurrency-driven gambling model is opening up a new market (TAM)that is difficult for traditional bookmakers to reach.

Why prediction markets have advantages over traditional bookmakers:

Tradable during events (early payout/stop profit)

Prediction markets like Kalshi allow users to buy or sell positions before the event ends, locking in profits and losses in advance (similar to the "fast payout" function of the Hong Kong Jockey Club), bringing the following advantages:

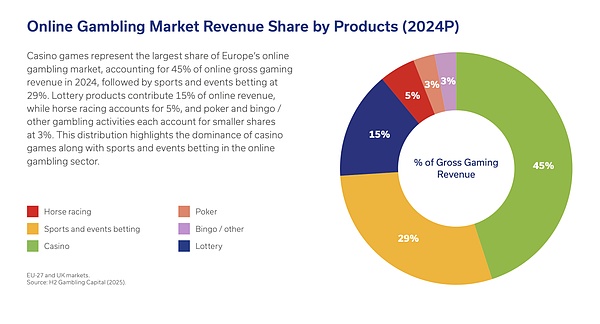

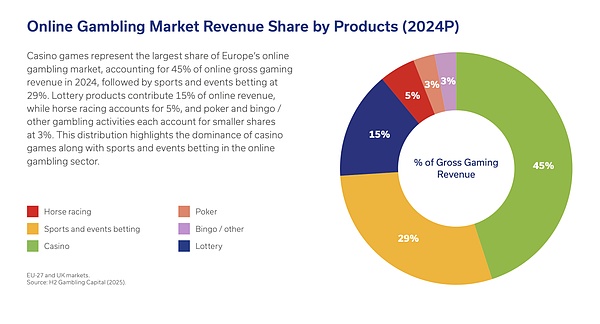

Overall size of the industry

Stake is just a representative of the crypto gambling market. According to industry reports,the total gambling revenue of crypto casinos in 2024 has exceeded US$81 billion, and even with stricter regulations in many countries, it has not been able to stop its growth.

This figure represents the gross income generated by cryptocurrency betting, indicating that the intersection of "crypto × gambling" has formed an extremely large user and capital pool, which currently mainly flows to offshore or unregulated platforms.

The success of Stake.com clearly proves that:

there is a huge market group who:

are accustomed to using cryptocurrencies for trading;

like speculation and high-volatility events;

are eager to participate in "betting" outside of traditional channels.

These people are essentially the core user base of prediction markets, but they are currently concentrated on non-custodial platforms such as Stake.

A regulated exchange such as Kalshi, with its sound market structure and compliant supervision, is expected to attract a portion of this user base while providing a compliant and exciting experience. The scale of Stake's growth suggests that if these users migrate to legal platforms, the annual total addressable market (TAM) of "crypto-flavored" gambling activities in the US market can reach

billions of dollars.

User overlap: demographic characteristics and behavioral consistency

This is not just a theoretical overlap.Many studies and questionnaires have confirmed that cryptocurrency speculators and gamblers have a high degree of overlap in key demographic and behavioral characteristics.

In many cases,they are the same type of people, or even the same person. Several prominent overlaps are as follows:

Young, Male, Risk Seeking: Crypto asset trading and sports/casino betting are more skewed towards young adult males, who generally have a high risk tolerance. They pursue high-volatility assets and large returns. A Rutgers University study showed that among monthly gamblers, more than50%have traded cryptocurrencies in the past year;More than 75% of high-risk stock traders are also trading cryptocurrencies. The researchers note that “crypto trading is highly attractive to people who have difficulty controlling their gambling behaviors.” In other words, a typical Robinhood crypto day trader (young, thrill-seeking, buying stud poker meme coins on a hunch) is very similar to a sports bettor or poker player chasing a win.

Online 24/7: Crypto markets are open 24/7 and the world is constantly moving; online gambling is also available at any time, providing a constant dopamine rush. Many people who switch from gambling to crypto trading say they are attracted to the “anytime trading” feature, especially on weekends or late at night. For people who are online frequently and have impulsive personalities, both crypto and gambling provide non-stop excitement—there is always a game to bet on, a coin to rise or fall.

Therefore, the target group that Kalshi can target is precisely those retail users who are keen on speculation, and they span the crypto trading community and the gambling community. These users are already engaged in similar behaviors. The key is to provide a product that can still provide a similar stimulating experience under a compliant and safe framework. The overlap of behaviors also shows that Kalshi's marketing should emphasize both the pleasure of predicting the market (to impress gambling users) and its financial and rational trading attributes (to impress investors' self-cognition) .

Evolution of the Crypto Narrative: Towards Compliance

In the past few years, the overall narrative of the crypto industry has undergone a huge change, from "unregulated" free innovation toinstitution-led, regulatory compliancethe right track. This shift has brought a favorable competitive environment to regulated platforms such as Kalshi, and also highlighted the strategic value of its regulatory moat (CFTC approval).

Moving closer to traditional institutions:The current trend is that large traditional financial institutions and governments have begunto actively participate in the crypto industry, bringing it credibility and regulation. For example, in 2023, BlackRock, the world's largest asset management company, applied for a Bitcoin ETF, sparking optimism in the market that the SEC may approve a spot ETF. In June 2025, the U.S. Senate also passed the GENIUS Act, which established federal crypto regulations. At the geopolitical level, former U.S. President Trump's team also proposed crypto-friendly policies such as the "National Bitcoin Reserve." All these signs indicate that crypto is no longer a fringe area, but is being incorporated into the compliance and mainstream financial system.

Compliance is a moat:In this new environment,compliance is competitiveness. The industry has shifted from "rapid trial and error" to "compliant and stable construction". Kalshi spent six years obtaining CFTC approval to become a national compliant exchange (Designated Contract Market, DCM) in the United States, which can legally provide event contract transactions in 50 states, even in states such as California or Texas that prohibit sports betting.This qualificationis extremely difficult to replicate. In contrast, Kalshi's crypto-native competitor, Polymarket, is still in a regulatory gray area and cannot legally operate in the United States, making it vulnerable to policy crackdowns. In the current trend of "institutionalized crypto", Kalshi's federal compliance status itself is a selling point, which brings trust, legal clarity and nationwide access, which is exactly the direction of industry development. In short, Kalshi is already ahead in the compliance track, while other platforms are still struggling to catch up.

Kalshi's strategy: positioning as "trading" rather than "gambling" + Robinhood distribution channel

Kalshi is very cautious in its brand positioning and deliberately avoids the "gambling" label. Instead, it shapes itself into a new type of trading platform: it provides "event contracts" investment tools and has regulated exchange qualifications. This strategy is very forward-looking: "We are not a bookmaker" - the difference in language and model: Kalshi's founders and executives repeatedly emphasized that the platform is a matching exchange, not a dealer. Unlike bookmakers who make money and bet on users to lose money, Kalshi is only responsible for matching orders and charging a fee (similar to a stock trading commission). A Kalshi representative said: "We are just an exchange... We don't make money from other people winning or losing."

CEO Tarek Mansour questioned: "If we count it as gambling, then the entire financial market should be considered gambling."

This sentence summarizes Kalshi's positioning logic: treating event contracts as financial derivatives, such as buying a contract on "whether July will set a record high temperature", is the same as buying crude oil futures or earnings options, rather than rolling the dice. This language conversion strategy is very effective, not only optimizing regulatory cognition,but also making users more willing to regard it as "investment" rather than "betting".

Integration with Robinhood: Kalshi announced a partnership with Robinhood in early 2025. Robinhood has over 15 million active users and is a gathering place for young retail traders. This collaboration has enabled Robinhood to launch the "Prediction Markets" functional block internally, allowing users to trade event contracts provided by Kalshi (such as economic data predictions and even sports results) directly in the app. This has greatly improved Kalshi's reach. Robinhood's stock price even rose by about 8% due to this integration, and investors are also optimistic about its value-added potential. By embedding into Robinhood's ecosystem, Kalshi avoids high user acquisition costs and naturally embeds prediction markets into users' existing asset categories (stocks, options, cryptocurrencies), achieving product normalization.

Avoiding "Gambling": Kalshi deliberately avoids the word "gambling" in its marketing and media materials. For example, it calls its contracts “Yes/No Event Contracts,” and its blogs and educational materials emphasize its predictive capabilities and information value rather than the thrill of gambling.

Even in its partnership with Robinhood, the language focuses on “bringing event trading to the masses” rather than using any gambling terms. This kind of slick branding is both a response to regulation and an effort to dispel the stigma of gambling among users. By packaging prediction markets as a “trading experience,” Kalshi attracts a wider user base—including those who like to speculate but want to think they are “investing rationally.”

The line between gambling and trading has always been blurred. As a student of quantitative finance, we are often taught that market fluctuations are random walks and Brownian motion. But this also raises a question: If trading is driven by volatility, speculative psychology and emotions, is it really different from gambling? If you bet on a high-risk event with a positive expected value, is it still gambling? According to the "Gambler's Ruin Theory", a gambler who continues to increase his bets but does not reduce his bets when he loses will eventually go bankrupt even if the expectation of each bet is positive. So, are we all "high-level gamblers"? The data is clear: Crypto retail investors and gamblers are not only similar, they are often the same people. Kalshi does not need to choose between these two types of users, it can serve both at the same time. Whether it is a "smart trader" executing an arbitrage strategy or a "recreational player" predicting sports results, Kalshi provides a regulated, legal market environment for these behaviors to coexist.

By abstracting the label of "gambling" and embracing the language of "market", Kalshi is connecting two large user groups: people who want to play and those who want to trade. In this process, it does not sacrifice either party, but strengthens the identity and behavioral value of both.

Catherine

Catherine