Source: insights4.vc, Translated by: Shaw Jinse Finance

Introduction

Fintech 1.0 moved existing banking products online—think of early online banking and payment apps. The user experience shifted to web and mobile devices, but fund flows still relied on traditional channels like ACH, SWIFT, and card processing networks. Value creation came from convenience and user interface optimization, not from changes in how funds flowed. The Fintech 2.0 of the 2010s spawned mobile-first new banks and specialized fintech companies. Emerging challengers like these new banks targeted specific groups (students, gig economy workers, under-banked populations) with simple and seamless applications, but their core functionality still relied on partner banks and card networks. Differentiation was in branding and features, while traditional payment systems and regulations limited innovation, keeping them always at the "top of the technology stack."

High fixed costs and licensing barriers meant that only licensed banks or their partners could handle custody and transfers, so most fintech startups were simply repackaging the same old systems. By the late 2010s, "embedded finance" and Bank as a Service (BaaS) were touted as the next stage of development—what might be called the conventional wisdom of Fintech 3.0. Any application could access the banking system via APIs to offer account, payment, or lending services. This did expand distribution channels, but actual fund flows remained confined to closed, bank-controlled networks. Over-reliance on a few originating banks led to service homogenization and risk concentration. These banks faced increasing compliance burdens, rising costs, and a slowdown in innovation experimentation. For two decades, fintech innovation remained superficial—offering better user experiences on aging infrastructure—because building new infrastructure outside the banking oligopoly was virtually impossible. Stablecoins mark a turning point, while cryptocurrencies take the opposite approach. Instead of starting with fancy interfaces, they build entirely new financial infrastructure from scratch (e.g., automated market makers, on-chain lending). In this series of experiments, fiat-backed stablecoins have emerged as groundbreaking products with practical applications. Unlike previous phases of fintech, stablecoins are not merely repackaging old systems; they are entirely new systems in themselves. They directly perform critical banking functions on open networks. In other words, we are transitioning from fintech companies that rely on others' infrastructure to fintech companies that own and build entirely new infrastructure. This research report argues that the hallmark of Fintech 3.0 is the native infrastructure of stablecoins—a programmable digital dollar based on a blockchain track—which will unlock a series of previously unattainable specialized fintech opportunities.

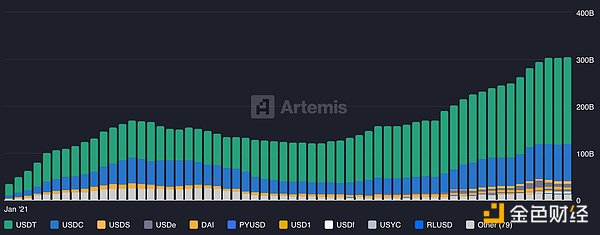

Stablecoin supply by token. Source: Artemis

What is Fintech 3.0: Stablecoin Native Infrastructure

Fintech 3.0 refers to financial products and services based primarily on stablecoins and tokenized asset payment tracks, rather than traditional banking networks. Its key characteristic is the flow of funds on open, interoperable blockchains.

This contrasts sharply with today's closed, permission-required payment systems (such as FedWire, SWIFT, and Visa/Mastercard), which are limited by bank hours, geographical barriers, and multiple intermediaries. Stablecoin payment systems operate 24/7, 365 days a year, covering the globe and enabling fast, direct transfers without the need for multiple correspondent banks. For example, anyone can send USD-pegged stablecoins, such as USDC or USDT, across borders in seconds with minimal network fees, whereas international wire transfers can take days and incur high fees. Stablecoin transactions are settled almost instantly, typically requiring only a few block confirmations, achieving near-instantaneous peer-to-peer settlement and avoiding the delays of batch processing.

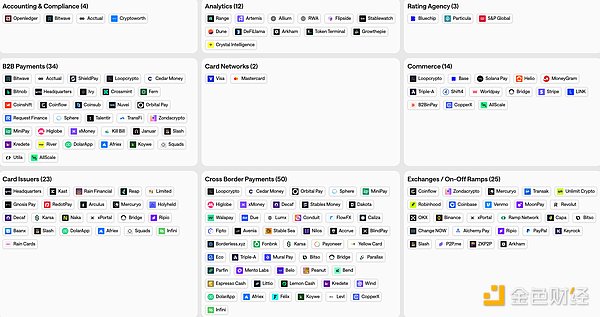

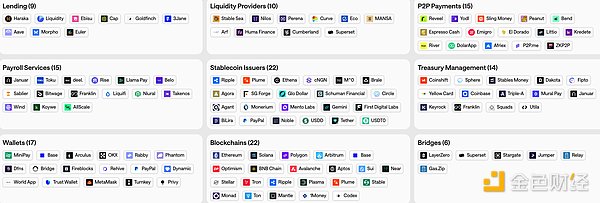

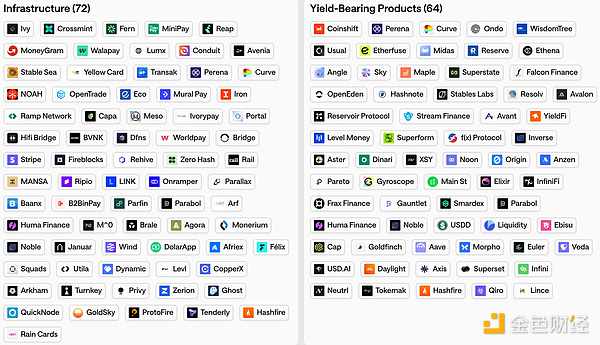

Stablecoin Ecosystem Map

Stablecoin Ecosystem Map

Programmability and composability are equally important

Stablecoins are digital bearer certificates that exist on a public blockchain ledger, meaning they can interact with smart contracts and other crypto assets. The dollar has become software.

Rotating Savings Clubs and Overseas Families

In many cultures, community savings circles (such as mutual aid societies, savings mutual funds, etc.) are very popular—members contribute funds to a pool and take turns receiving returns. Overseas families also frequently send remittances home to support their relatives. Traditional remittance methods are inefficient: remittance fees are high, and it is difficult to coordinate cross-border savings using cash or bank transfers. Stablecoins offer an opportunity to standardize and simplify community finance. For example, a fintech app allows friends from different countries to form savings circles using USD stablecoins. Each member's monthly deposit is a stablecoin transfer (almost free and instant), and the pool is transparently stored in a smart contract, which will transfer one-time returns to each member's wallet in rotation according to a schedule. This reduces losses caused by transaction fees (more funds flow to members) and increases transparency (all deposits and expenditures are publicly and transparently recorded on the blockchain). Similarly, expatriate users can pool funds to support community projects in their hometowns because they know stablecoins are better at protecting against inflation than local currencies. These apps can generate revenue by charging a small management fee or by holding the pooled funds in a yield-generating stablecoin account over a period of time. The key improvements are convenience and trustworthiness—people without formal bank accounts can participate with just a mobile wallet, and they don't need to rely on a "cash custodian" in the group to manage their funds. Furthermore, stablecoins can bypass some national restrictions: for example, if a family in country A wants to send money to relatives in sanctioned or economically unstable country B, traditional remittance channels might be blocked, but a well-designed stablecoin solution (compliant with the regulations of the country of origin) can still deliver aid directly to those in need. We have already seen NGOs use USDC to provide humanitarian aid to beneficiaries in economically devastated regions precisely because it is faster and more reliable than correspondent banks. Consumer-centric fintech companies can apply the same principles to ordinary people, providing a faster, more economical, and more transparent way to accomplish long-standing informal community affairs. What Areas Should Stablecoin Entrepreneurs and Investors Focus On? Given the above, in the stablecoin era, what types of companies and products should founders and investors focus on? This article doesn't promote any specific company, but it highlights some promising opportunities in the Fintech 3.0 era. Vertical New Banks Based on Stablecoins Essentially, these digital banks or financial applications are tailored to specific groups but operate on stablecoins. For example, it could be a wallet + bank card for remote freelancers, expatriate gig workers, or regional expatriates, with all internal transfers using stablecoins to ensure speed. This new type of bank can offer multi-currency accounts (based on stablecoins), allowing users to hold and remit US dollars without a US bank account. Compared to traditional new banks, its advantage lies in significantly reduced cross-border transaction costs, as stablecoins offer near-free foreign exchange conversion and instant transfers. This business model can generate revenue through transaction fees (via linked bank cards), subscription fees for premium services, or loans (e.g., providing small upfront payments or credit lines after trust is established). This includes building software for businesses that uses stablecoins at its core for cheaper and faster cross-border payments. Imagine an accounts payable tool for import/export companies that automatically converts invoices into stablecoin payments, handles cash management (e.g., converting portions of receivables into local currency and hedging when necessary), and even provides financing services. By combining on-chain settlement with a familiar user interface, these tools can significantly reduce payment times and foreign exchange costs for SMEs engaged in global trade. Another direction is on-chain invoice factoring or trade finance, where platforms provide liquidity by pre-paying businesses' invoices in stablecoins and then using smart contracts to collect payment from counterparties, thus ensuring transaction execution. Stablecoin payment channels make even short-term credit easier to issue across borders, as collateral can be on-chain and payments are instantaneous. These fintech solutions can profit from invoice discounts, subscription fees, or foreign exchange spreads, and they address a glaring pain point: small businesses often face cash flow shortages due to slow international payments. While Fintech 3.0 is fundamentally about building new payment pathways, the world will likely remain in a hybrid model for some time—stablecoins need to be integrated into the banking system, and vice versa. This presents opportunities for companies offering “stablecoin-as-a-service” to banks, payment service providers (PSPs), payroll processors, and marketplaces. For example, an API platform could allow any fintech company or bank to easily pay or receive stablecoin deposits, presenting all the complexities of blockchain technology under a simple interface. We’ve already seen some initial progress: some banks, such as Cross River, are launching services to unify fiat and stablecoin funding flows for their fintech clients. A startup can also become a Stripe in the stablecoin payments space, handling compliance, chain selection, and conversion. Its revenue streams could be API usage fees or a percentage of transaction volume. Such infrastructure development accelerates stablecoin adoption by making it easy for traditional institutions to use stablecoins. They effectively address interoperability challenges, ensuring stablecoin tracks can connect with existing ledgers and payment methods (ACH, SWIFT, etc.) without requiring each institution to build from scratch. As stablecoins become more widespread, we may see large corporations, brands, and even governments wanting their own stablecoins or tokenized deposits for specific purposes. Fintech companies can develop toolkits to help other institutions issue and manage stable-value digital tokens. For example, a platform could help retail brands issue dollar-backed loyalty tokens that also serve as payments at their stores (similar to a fully-reserve private stablecoin). Alternatively, commodity producers could issue tokens redeemable for a certain quantity of goods (an asset-backed stablecoin used for transaction settlement). These issuers require technical support (smart contract issuance, reserve management dashboards, compliance controls) and may also need ongoing management services. Fintech companies in this space can charge setup fees, consulting fees, and transaction fees for the continuous circulation of tokens. Essentially, this is a "stablecoin white-label" service—lowering the entry barrier for specific issuers. Not every company needs its own token, but those with large ecosystems (such as Amazon gift card balances or airline miles) may find branded stablecoins valuable in terms of improving customer engagement or financial efficiency. Helping businesses create such stablecoins securely and compliantly is a worthwhile niche market to explore, especially given the clear rules for new entrants in regulatory frameworks. One of the risks hindering institutional adoption of stablecoins is how to comply with Anti-Money Laundering (AML), Know Your Customer (KYC), tax laws, and similar regulations when using open blockchain systems. Tools need to be developed that allow businesses and regulators to "see" the flow of stablecoins while ensuring their security and avoiding excessive infringement on user privacy. Feasible solutions include on-chain identity frameworks (enabling wallets to carry authenticated identity information or risk scores), advanced analytics tools for detecting illicit activity in stablecoin transactions, and reporting tools that integrate on-chain transactions into a company's regular compliance and accounting systems. For example, a fintech company specializing in this could provide compliance officers with a dashboard displaying every stablecoin payment, counterparty (perhaps verifiable via NFT-based credentials), and flags of any risk patterns. Alternatively, a travel rules compliance solution could be considered, transmitting necessary sender/receiver information along with blockchain transactions when needed. As stablecoins become mainstream, regulators will require the development of standards; therefore, building middleware that meets regulatory requirements while retaining the attractive openness of stablecoins is crucial and potentially highly profitable. Revenue could come from a Software-as-a-Service (SaaS) model or transaction fees for compliant processing. Essentially, these are key elements ensuring Fintech 3.0 operates within the legal framework. Talent capable of tackling the challenge of merging on-chain privacy with off-chain compliance will be highly sought after. Restraints, Risks, and Why This Transformation Is Still in its Early Stages The legal status of stablecoins and digital assets varies by jurisdiction. Some countries have clear frameworks (for example, the EU's Crypto Market Structure Act (MiCA) classifies certain stablecoins as electronic money), while others (such as the US, as of mid-2025) are still discussing federal stablecoin legislation. This uncertainty may hinder the full adoption of stablecoin payment systems by institutions until the relevant rules are finalized. Furthermore, a startup operating globally must navigate a complex web of regulations: what is permitted in one country (such as offering USD stablecoin accounts) may be restricted in another. Regulatory crackdowns pose a risk; sudden bans or new requirements could disrupt business models. Fintech 3.0 builders need strong compliance strategies, and until the law is more comprehensive, they may operate using a hybrid model (using stablecoins in a lenient environment and defaulting to fiat currency when necessary). The good news is that the current trend is generally moving towards clearer regulation, not the other way around. For example, in the United States, the GENIUS Act and other legislation aim to provide regulatory and reserve standards for payments made through stablecoins. However, navigating the complex legal environment remains a significant challenge. Stablecoin Trust and Technological Risks Stablecoins inherently carry risks, which fintech companies must manage carefully. Users and businesses must trust that stablecoins are indeed backed by fiat currency and can be redeemed for it. Any crisis of trust (e.g., de-pegging events or issuer bankruptcy) can destroy its value proposition. While the largest stablecoins have consistently maintained their peg to fiat currencies, there have been historical examples of failed stablecoins. Fintech companies should perhaps diversify their support across multiple reputable stablecoins and develop contingency plans (e.g., the ability to quickly switch users to other stablecoins if one becomes problematic). From a technical perspective, building systems on blockchain infrastructure introduces smart contract and cybersecurity risks. If not properly mitigated, hacking or vulnerabilities can lead to financial losses. Furthermore, there are scalability issues: if a fintech company's user base expands to millions, can its chosen blockchain handle such massive transaction volumes without incurring high fees or slowdowns? Emerging solutions (such as L2 networks and new protocols) are working to address this, but it remains an evolving field. Essentially, stablecoin fintech companies must be both financiers and technologists, handling issues previously abstracted by banks (such as settlement finality, fraud prevention, and fund security) at the protocol level. User Experience Gap Despite technological advancements, using stablecoins and crypto wallets remains less convenient for the average user than using a banking app. Managing private keys, dealing with wallet addresses, and understanding network fees can all be daunting. The success of Fintech 3.0 hinges on integrating the complexities of blockchain into a familiar and user-friendly interface. This requires significant investment in design, education, and customer support. Furthermore, stablecoin conversions (fiat currency deposits and withdrawals) must be seamless. If target users have to figure out how to buy USDC on an exchange before they can use the app, many potential customers will be lost. Many startups are working on improving accessibility (e.g., integrating native payment methods), but this remains a pain point, especially in emerging markets. Trust is another crucial aspect of the user experience: emerging fintech companies must build trust in the security and accessibility of customer funds. Ironically, despite the transparency offered by blockchain, ordinary users may still worry about where their funds are going if they don't understand self-custody. We may see more regulated custodial wallets or insurance products to enhance user peace of mind. In short, the work of bridging crypto technology with the expectations of ordinary users is still ongoing, and until this issue is resolved, stablecoin fintech companies may face slower adoption rates outside of early tech-savvy groups. Existing Players and Hybrid Models Banks and card networks are not standing still; they are actively adapting (for example, Visa is piloting payments using USDC, and JPMorgan Chase has launched its own deposit token) and integrating the many advantages of stablecoins into their products and services. In the short term, we will see hybrid payment systems. For example, users may swipe their cards to pay, but back-end settlements between merchant acquiring institutions will be conducted through stablecoins. If traditional financial institutions can successfully modernize their payment systems (even with underlying blockchain technology), they may offset some of the cost advantages of emerging fintech companies. Furthermore, they possess brand reputation and a large user base. Fintech 3.0 startups must prepare not only for competition from other startups in the industry but also for the challenges of collaborations between large banks and large technology companies. The most likely scenario is coexistence: stablecoin payment systems will coexist with continuously improving traditional payment systems, such as Faster Payment Networks and central bank digital currencies. This is not an overnight replacement. Therefore, emerging fintech companies must integrate with existing systems as needed (to expand coverage) and focus on market segments truly overlooked by traditional institutions. The transition to a completely new payment system is a gradual process; many users may not even know or care whether stablecoins are involved if the front-end product meets their needs. We need patience and adaptability; the infrastructure revolution is underway, but it will go through a phase of hybrid innovation.

Conclusion

Fintech 1.0 and 2.0 primarily rented space from banking infrastructure, constrained by the rules and costs of banks and card networks. Stablecoin-based Fintech 3.0, however, allows fintech companies to become partial owners and rebuilders of the infrastructure. Stablecoins and open blockchains create a more level playing field, enabling smaller teams to build cross-border value transfers that previously required global banks, often faster and at lower costs.

The most compelling opportunities are not universal wallets or payment applications, but products designed to fill specific gaps in traditional systems.

Use cases such as freelance income, Islamic finance, and SME trade demonstrate that digital dollar payment channels can offer unprecedented convenience and efficiency. For investors, the key is to focus on how stablecoins can evolve from trading instruments into a broader layer of payments and banking services. For developers, the challenge lies in designing products that can only be achieved based on a programmable, always-running currency, rather than simply porting old banking products to APIs. Fintech 3.0 will coexist with traditional finance for many years, but its direction is clear. Stablecoin infrastructure is expected to become a core component of global finance. The ultimate winners will be those who can combine the efficiency of this new track with practical solutions to real-world problems and are willing to assume responsibility for operating critical financial infrastructure.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Joy

Joy Alex

Alex Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Brian

Brian Joy

Joy Alex

Alex Brian

Brian