Source: Youbi Capital

TL;DR

The FIT21 Act established a complete and clear encryption bill for the encryption industry for the first time. It was passed by the House of Representatives on May 22. If the bill is officially signed into law, it will have a far-reaching impact on the entire encryption industry.

The United States has adopted a joint regulatory model for a long time. Each federal regulatory agency has its own regulatory model for the encryption industry, resulting in a "separate" situation. Due to the lack of a perfect legal path, the various federal agencies cannot be coordinated in their claims of jurisdiction, so the encryption industry regulation in the United States has been in a chaotic and difficult to regulate environment.

The FIT21 Act regulates various core regulatory issues. The Act first clarifies that the SEC and CFTC will be the main regulators of the crypto industry, and for the first time clarifies the classification of cryptocurrencies as securities and commodities, which solves the core regulatory conflict issues that have long existed in the crypto industry.

The Act specifies in detail the registration standards for crypto practitioners at the SEC and CFTC, providing practitioners with clearer regulatory guidance. At the same time, the Act also provides sound consumer protection measures, such as a 12-month token lockup for token issuers to prevent short-term speculators from endangering the health of the industry.

In the Act, Congress is very optimistic about the crypto industry and actively encourages American companies to combine blockchain technology in innovative ways, while urging the SEC and CFTC to conduct research on DeFi to help with subsequent supervision.

If FIT21 can be formally passed into law, industry practitioners will have clearer legal guidance to prevent wrong practices, and consumers will also be better protected under this regulatory framework. In the future, the entire market is very likely to usher in rapid growth on both the consumer and innovation sides, helping the entire industry to accelerate its departure from the regulatory Wild West that has lasted for more than a decade, and making cryptocurrency truly enter the mainstream vision.

The passage of the FIT21 bill is mainly the result of the active promotion of the Republican Party and the continued support of both parties. The bill was originally initiated by a Republican-led committee, and almost all Republican members of the House of Representatives voted in favor of the bill, and some moderate Democratic members also agreed to the bill. In this process, leading companies in the crypto industry also called on legislators to pass FIT21, which shows the importance of the bill.

With the election approaching, the continued expansion of the influence of the crypto industry has made the entire crypto industry an important voting base for inter-party games. Candidates who are optimistic about the crypto industry will be favored by more voters, which will also have a very positive impact on the passage of FIT21.

FIT21 has not yet been signed into law. The next step will be to transfer it to the Senate for a vote, and finally the integrated text will be signed by the president. Patrick McHenry said at the CoinDesk Consensus conference a few weeks ago that the bill is expected to be officially signed into law within the next year.

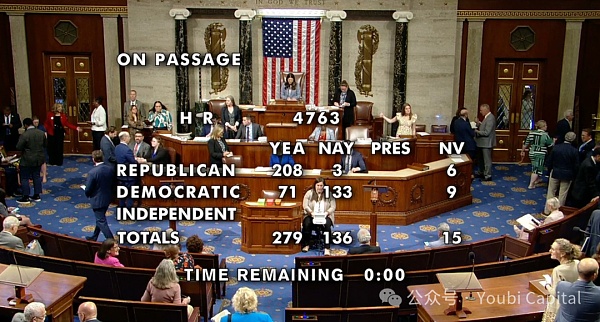

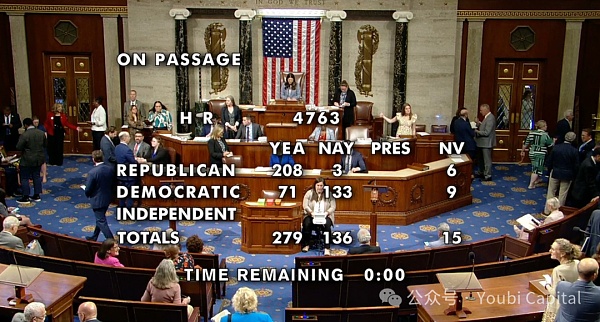

On May 22, local time in the United States, the Republican-led FIT21 bill was passed in the U.S. House of Representatives with 279 votes in favor and 136 votes against. The passage of this bill is an extremely important moment for the crypto industry, symbolizing that the crypto industry has made important legislative achievements in the U.S. Congress, and its influence has already reached the highest power center in the United States. As the first bill in the crypto industry to establish a complete regulatory system, FIT21 is also the first step in helping the crypto industry move out of the Western world.

1 Current Status of Crypto Industry Regulation in the United States

The crypto industry has spawned many businesses, such as centralized exchanges, mining, staking services and other crypto businesses supported by smart contracts. Currently, the United States adopts a joint regulatory model for cryptocurrencies. Different federal agencies can regulate businesses within their jurisdiction. Important federal agencies such as SEC (U.S. Securities and Exchange Commission), CFTC (U.S. Commodity Futures Trading Commission), FinCEN (U.S. Financial Crimes Enforcement Bureau) and OFAC (Office of Foreign Assets Control) are all involved in the supervision and crackdown on illegal activities in the crypto industry. These different federal agencies have had varying degrees of impact on the industry.

1.1 Regulatory agencies “act independently”

Figure 1: Current regulatory landscape of the crypto industry

Since the crypto industry has no systematic regulatory framework and adopts a joint regulatory model, it is very easy for each law enforcement agency to advocate its own views and a “hundred schools of thought” regulatory pattern.

SEC plays an extremely important role in the regulation of the crypto industry. Its main responsibility is to define whether different crypto asset entities are securities. It mainly uses the Howey test to determine whether they fall under its regulatory framework. In order to better help practitioners determine whether the digital assets they issue belong to "investment contracts" and should be included in "securities", the SEC issued a guidance document in 2019 entitled "Analysis Framework for Whether Virtual Assets Belong to Investment Contracts". Although the document has no formal legal effect, it provides guidance for practitioners.

CFTC's attitude towards digital assets is clearly stated on its official website, saying that virtual assets, including all virtual currencies, are commodities, so the CFTC has the power to regulate manipulation and fraud in the digital asset futures market. The revised "Digital Commodity Consumer Protection Act" in 2022 gives the CFTC exclusive jurisdiction over "digital commodity" transactions and platforms, and authorizes it to register and regulate spot exchanges, which means that spot exchanges follow the same rules as other commodity exchanges.

FinCEN Financial Crimes Enforcement Bureau is mainly engaged in anti-money laundering, combating terrorist finance and KYC. FinCEN's main power is granted by the Bank Secrecy Act (BSA), which clearly stipulates that if the encryption business involves the production, transfer and transaction of virtual currency, it must be regulated by BSA. In 2013, FinCEN issued a management framework for virtual currency and identified crypto asset trading service providers as money service businesses (Money Service Business, MSB), which indirectly recognized virtual assets as currency. Cryptocurrency trading platforms must obtain FinCEN's license and implement anti-money laundering mechanisms.

OFAC's Office of Foreign Assets Control is mainly responsible for supervising all financial transactions in the United States and sanctioning any individuals, organizations or countries that pose a threat. With the rise of digital assets, due to its technical characteristics, some transaction participants have been provided with new means of evading detection, which has increased the difficulty of OFAC's law enforcement. Unlike the SEC and CFTC, OFAC's main law enforcement scope is mainly focused on processing transactions for users in sanctioned regions and providing money laundering assistance for illegal activities outside the United States.

It can be seen that each law enforcement agency has its own regulatory model and attitude towards the crypto industry. The supervision of the crypto industry is too fragmented and unsystematic, which will inevitably cause some regulatory conflicts that make it impossible for crypto practitioners to follow legal practices, and it is easy to face unreasonable lawsuits that affect the development of the industry.

The historical law enforcement actions of each regulatory agency can be found in the appendix.

1.2 SEC "intimidation" law enforcement

In addition to the jurisdiction granted by the U.S. Congress, the SEC can use the "Regulation by Enforcement" approach to define whether cryptocurrencies are "securities." Since U.S. court precedents can serve as an important basis for jurisdiction, the SEC will use administrative enforcement to bring civil lawsuits or administrative penalties against founders, executives, etc. for violations of U.S. securities laws, and determine its jurisdiction over the crypto assets based on the court's decision. For example, in December 2020, the SEC filed a civil lawsuit against Ripple, claiming that Ripple failed to register the issuance and sale of XRP with the SEC, thereby violating the relevant provisions of the Securities Law regarding securities sales. At the same time, the SEC's lawsuit is not only aimed at the characterization of cryptocurrencies, but also deals with the business issues of some crypto companies. For example, in June 2023, the SEC filed a lawsuit against Coinbase, accusing it of illegally operating a crypto asset securities business without registration, and the court ultimately supported the SEC's allegations. This shows that the SEC is constantly expanding its regulatory scope through administrative means, and due to the ambiguity of the regulatory framework for the crypto industry, such lawsuits by the SEC are very likely to lead to "intimidation"-style law enforcement, and it is difficult for practitioners to protect themselves based on reliable laws, which has a serious impact on the development and innovation of crypto companies.

1.3 Regulatory Conflict

The current fragmented regulatory situation makes it difficult to avoid enforcement conflicts between regulatory agencies due to unclear jurisdiction. The most intense conflict is between the SEC and the CTFC, because these two regulatory agencies are targeting the most core asset classification issues in the crypto industry. The SEC tends to believe that most digital assets can be identified as securities because these assets can easily pass the Howey test, while the CFTC regards most cryptocurrencies as commodities. This will cause the SEC and the CFTC to have overlapping jurisdiction when regulating some tokens, and it is difficult to clarify the division of regulatory powers without a unified regulatory framework. In addition, the two have also had overlapping supervision of crypto companies. For example, in the 2023 Binance prosecution, both the SEC and the CFTC filed a lawsuit against Binance, and the accusations against Binance by the two parties had a lot of similarities. Overlapping enforcement may lead to unnecessary fines. In the case of unclear supervision, regulatory overlap will also have a great impact on the industry.

Therefore, for a long time, the encryption industry in the United States has been in a chaotic and difficult-to-control regulatory environment. Due to the lack of a perfect legal path, various federal agencies have been unable to coordinate their claims of jurisdiction. The resulting regulatory conflicts have had an extremely unstable impact on the development of the industry. At the same time, in the absence of a regulatory framework, encryption companies find it difficult to protect their rights and interests in the face of unreasonable accusations from some law enforcement agencies, which to a certain extent hinders the encryption industry's flexible innovation and development in the United States. The FIT21 Act is the beginning of changing the current chaotic regulatory landscape.

2 Detailed explanation of the FIT21 Act

FIT21 is the full name of the Financial Innovation and Technology for 21st Century Act (H.R. 4763). The bill redefines the different jurisdictions of the SEC and CFTC over crypto assets, establishing a clearer and more comprehensive legal regulatory framework for the crypto industry. It also includes consumer protection measures in the crypto market and a series of regulations aimed at addressing the unique structural problems of virtual assets. The clarity and comprehensiveness of the bill make it the most important bill in the crypto industry to date.

FIT21 was first initiated on July 20, 2023 by Glenn Thompson, Chairman of the House Agriculture Committee, Patrick McHenry, Chairman of the House Financial Services Committee, Tom Emmer, Party Discipline Committee Member, and three other House members. During the committee review stage, the bill passed the House Agriculture Committee with unanimous bipartisan approval. At the same time, the House Financial Services Committee also passed the FIT21 bill, which was supported by all Republicans and six Democratic members on the committee. It can be seen that the introduction of the FIT21 bill is not only the result of the joint efforts of the two House committees, but also the joint support of the Republican and Democratic parties. It is worth mentioning that the CFTC and SEC are regulated by the Agriculture Committee and the Financial Services Committee respectively. Based on the influence of the CFTC and SEC on the crypto industry, these two committees should naturally become important participants in promoting the FIT21 bill.

Figure 2: FIT21 initiator

2.1 Contents of the bill

The FIT21 bill is 253 pages long. The bill has formulated preliminary regulatory regulations in six aspects, including the definition and registration of digital assets, the division of powers between the SEC and the CFTC, and guidance on innovation in the encryption industry. The core content of each part will be summarized and analyzed below.

PART 1: Definition of assets and division of responsibilities of regulatory agencies

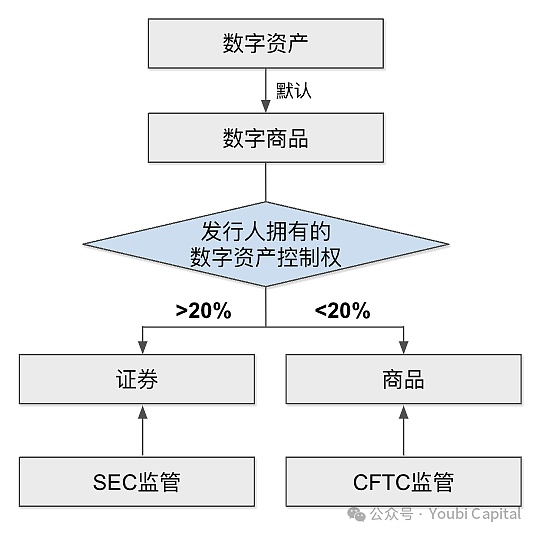

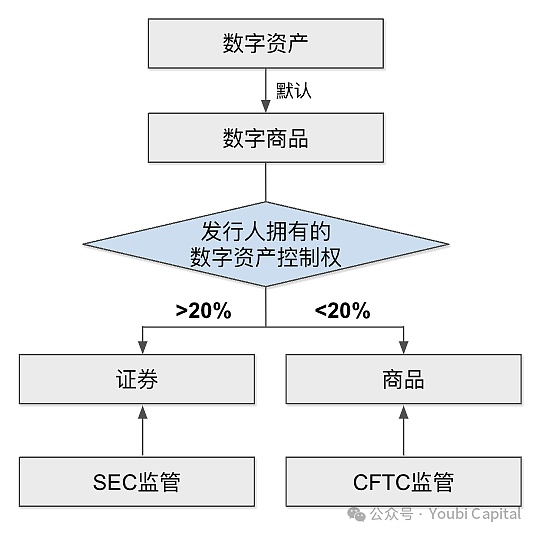

More importantly, the classification of digital currencies is clarified in this section. The bill stipulates that if a blockchain running digital assets is a functional system and a decentralized system, then the digital asset will be deemed a commodity and regulated by the CFTC. If the digital asset does not meet the definition of decentralization, it will be deemed a security and regulated by the SEC. The bill defines a decentralized system as no individual has unilateral power to control the blockchain, and no issuer has 20% or more of the control of digital assets or voting rights in digital assets. This clarification of the classification standard is of great significance to crypto assets. This standard clarifies the regulatory scope of the SEC and CFTC, which can greatly avoid regulatory confusion and conflicts.

Figure 3: Asset definition and regulation

PART 2: Clarity of investment contract assets

Due to the different structure and nature of crypto assets, FIT21 has revised the federal securities-related laws, mainly targeting the definition and regulations of "investment contract assets" (investment contract asset), aiming to provide sufficient clarity and clarity for some assets in the market.

The bill mainly made two amendments to the Securities Act of 1933. The first amendment explicitly excluded "investment contract assets" from the definition of "securities", making "investment contract assets" an independent definition, giving crypto assets an intermediate definition. If an asset is identified as an investment contract, it will not be defaulted to a security in the traditional sense. The subsequent second amendment supplements the definition of "investment contract assets":

The asset must be a transferable digital value subject that can be recorded on a public distributed ledger protected by an encryption system without an intermediary.

The asset must be sold or otherwise transferred, or intended to be sold or otherwise transferred, as part of an investment contract.

Assets are not considered securities under the Securities Act of 1933

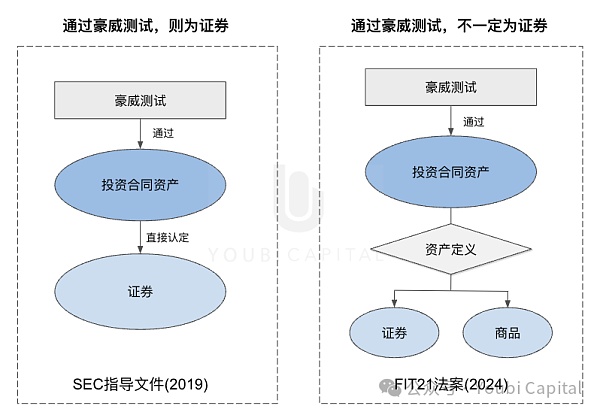

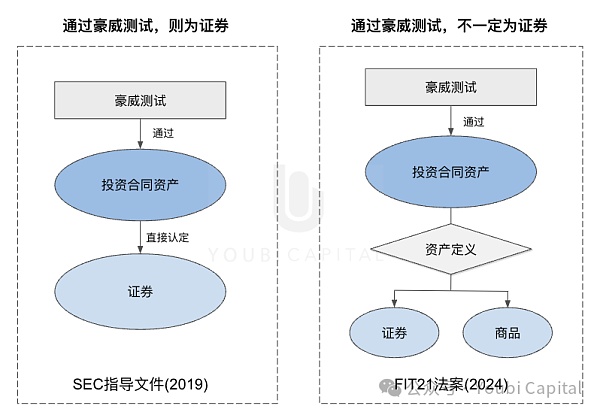

In the guidance documents previously issued by the SEC, if an asset is identified as an "investment contract" through the Howey test and is then classified as a security, it will also be considered a security and regulated by the SEC. However, due to the unique structural nature of crypto assets, digital assets may be considered commodities and can also be sold as part of an investment contract. As investment contracts and securities are not mapped, traditional asset categories are not fully applicable to crypto regulation. Therefore, the FIT21 Act explicitly excludes "investment contract assets" from the definition of "securities", providing greater regulatory flexibility for cryptocurrencies, and no longer using a single "Howey test" standard to determine whether an asset is a security, which helps to qualitatively standardize crypto assets, and improves the classification tolerance to fit the unique structure of cryptocurrencies, so as to prevent crypto assets from being directly identified as securities and causing unreasonable regulation.

Secondly, the separation of "investment contract assets" from securities also solves the current problem of regulatory division for the same digital asset. For example, in the Ripple case mentioned above, the court determined that the financing of XRP private placement for institutional professional investors met the three criteria of the Howey test and constituted a "securities" offering, while the offering of XRP through other channels did not constitute a "securities" offering. As a result, XRP sold through different channels has been subject to multiple supervision and unclear supervision. If the FIT21 Act is passed, the regulatory agencies corresponding to "investment contract assets" under different conditions will be further clarified in the future, the regulatory responsibilities of institutions will be clarified, the regulatory efficiency of each department will be improved, and the problem of confusion in regulatory responsibilities for the same digital asset at different issuance or sale stages will be reduced, bringing greater regulatory flexibility to market participants.

Figure 4: Howe test judgment logic

PART 3: Registration exemption and lock-up requirements for digital asset issuance

For the issuance of digital assets, the FIT21 Act also explains the issuance exemption standards, issuance information disclosure requirements and asset certification. In the exemption standards, the Act mainly stipulates that if the total value of the digital asset issuance does not exceed $75,000,000, and any purchaser does not own 10% of the asset issuance during the issuance stage, then the transaction of this digital asset issuance will be exempted from registration. The subsequent bill also formulated a series of basic requirements for the issuance of digital assets and strengthened the provisions on information disclosure, such as the need for issuers to provide source code, token transaction history and token economy, etc. The overall situation of asset issuance in the industry currently meets the requirements of information disclosure, and the information disclosure requirements will further protect the rights and interests of consumers.

In addition, more importantly, the bill also puts forward requirements for the lock-up period of tokens held by issuers. The bill stipulates that any relevant entity of the token issuer needs to lock up the tokens for 12 months before selling them. This rigid regulation can curb the short-term speculation of some practitioners, prevent the market from overheating and protect consumers, while promoting the long-term innovation of blockchain products and helping the industry retain innovators and long-termists.

PART 4 and PART 5: SEC and CFTC's regulatory scope for crypto companies

The fourth and fifth parts of the bill mainly stipulate the regulatory authority of the SEC and CFTC over digital assets and the registration requirements of relevant business entities. The bill clearly stipulates that cryptocurrency trading platforms, brokers and market makers will be regulated by law enforcement agencies. If the business of the business entity involves securities or commodity crypto assets, it is necessary to submit registration applications to the SEC and CFTC respectively. The bill allows the same business entity to register with the SEC and CFTC at the same time. In addition, the focus of supervision by the SEC and CFTC is slightly different. The bill clearly stipulates that the cryptocurrency trading platform needs to provide the SEC with relevant transaction information and records in the system and needs to review the security and integrity of the trading system, while the CFTC focuses on the review of customer funds custody. At the same time, the CFTC will also supervise the Commodity Pool Operator (commodity fund manager) and Commodity Trading Advisor (commodity trading advisor).

The current regulations indicate that DeFi activities are not subject to the bill, and the SEC and CFTC will jointly study and formulate detailed regulatory rules in the future.

PART 6: Congressional Attitude and Technology Innovation Supervision

In the last part of the bill, the views and opinions of Congress on encryption technology are first summarized. Congress first affirmed that entrepreneurs and innovators in the encryption industry are building and deploying the next generation of the Internet, and believed that the digital asset ecosystem has the potential to enhance the efficiency of social activity management, resource allocation and decision-making. At the same time, it emphasized that the United States should try to explore the potential of the encryption industry and the potential opportunities it brings. American companies should try to combine blockchain technology in innovative ways to explore new user participation structures. While affirming that encryption assets will bring innovation, Congress also indicated the need to cooperate with encryption industry practitioners to establish a basic framework for blockchain technology risks and investor protection. Overall, Congress is generally optimistic about digital assets and the encryption industry. While supporting the development of the industry, it also hopes that there will be a systematic framework for supervision to maximize the unique innovations that blockchain technology can bring.

In order to further respond to the development of blockchain technology and the impact of digital assets, the bill proposes to expand the research responsibilities of the SEC's Innovation and Financial Technology Strategic Center (FinHub) and the CFTC Laboratory (LabCFTC) for the crypto industry, and help the committee formulate policies and establish a supervisory system for financial technology. In addition, the bill also proposes to establish a joint CFTC and SEC Digital Asset Advisory Committee, which will specifically study issues related to digital assets. The committee will mainly strengthen the cooperation between the CFTC and the SEC to better regulate digital assets, and the committee will also appoint at least 20 practitioners to assist and strengthen close ties with the industry.

This part of the bill also proposes research on DeFi and NFTs. The bill requires the SEC and CFTC to jointly conduct in-depth research on the use, scale, advantages and disadvantages of DeFi protocols and potential risks or improvements to financial market stability. The research on NFTs is the responsibility of the US Comptroller General, mainly exploring the actual use of NFTs and how to integrate them with traditional markets.

2.2 Industry Significance

The passage of the FIT21 Act in the House of Representatives is an extremely important moment for the crypto industry, marking a major victory and legislative achievement for the crypto industry in the U.S. Congress, and its increasing influence has already reached the highest power center in the United States.

In the above, we mentioned the fragmentation of the regulatory system of the U.S. crypto industry. Different law enforcement agencies have advocated the establishment of bills or proposed guiding documents for crypto assets. Fragmented supervision not only leads to conflicts in jurisdiction and unhealthy law enforcement efforts, but also a steady stream of law enforcement lawsuits are great challenges to the sustainability and innovation of the industry. At the same time, practitioners cannot rely on the applicable legal framework for advance regulation or resistance. It can be said that the crypto industry has suffered from regulation for a long time! The promotion of the FIT21 Act is changing all this!

First of all, FIT21 is the first bill in the history of the crypto industry that provides a complete regulatory framework for the industry. The regulations specified in the bill are the core issues facing the crypto industry. For example, the bill also clearly states for the first time that the SEC and CFTC are the primary regulatory agencies in the crypto industry, and for the first time makes provisions on the classification of whether cryptocurrencies are securities or commodities, so the qualitative classification of different tokens will no longer be held by the SEC and CTFC.

At the same time, the bill also provides sound consumer protection measures, as well as clear registration regulations for crypto companies, token lock-ups by issuers, and enhanced information disclosure to further protect consumers, promote the health of the entire market, and prevent bad practitioners from continuing to release products and tokens that harm consumer rights through regulatory gaps.

In addition, the Chinese Congress is also very optimistic about cryptocurrencies in the bill. While encouraging innovation, it also prompts the SEC and CFTC to jointly study DeFi for further better regulation, which is of great significance for the industry's continued innovation and more detailed bills.

If FIT21 can officially become law, industry practitioners will have clearer legal guidance to prevent wrong practices, which will have a positive effect on the development and innovation of crypto companies, and consumers will also be better protected under this regulatory framework. Coupled with the continued expansion of the influence of cryptocurrencies, the entire market is very likely to usher in rapid growth on both the consumer and innovation sides in the future, making cryptocurrencies truly enter the mainstream vision.

A tall tree has deep roots. FIT21 is precisely this first step, which can serve as a cornerstone for subsequent more comprehensive legislation, continue to pave the way for innovation in the crypto industry in the regulatory side, help the entire industry accelerate its departure from the regulatory Wild West for more than a decade, and truly affect the future of the entire industry.

3 FIT21 important promoters

3.1 Republican-led, bipartisan continued support

From a political perspective, the Republican Party played a crucial role as the main promoter. The bill was initially passed and supported by the House Agriculture Committee and the Financial Services Committee. At the same time, the party structure of these two committees is dominated by the Republican Party, with 28 and 29 Republican members respectively. Therefore, in the early stage of the bill, during the committee review stage, the Republican Party can use its numerical advantage to pass the bill and submit it to the House of Representatives for voting. Although the Republican Party is the main promoter, it is worth mentioning that during the voting stage of the Agriculture Committee, all Democratic members also voted in favor, which means that the bill was supported by both parties in the early stage. The FIT21 bill finally received 208 votes from the Republicans and 71 votes from the Democrats in the House of Representatives. The result also shows the Republicans' support for the bill and the change in attitude of some Democratic members. Combined with Trump's recent positive attitude towards cryptocurrencies, the entire Republican Party has played a great role in promoting the crypto industry.

Figure 5: FIT21 bill voting

3.2 High attention from crypto industry practitioners

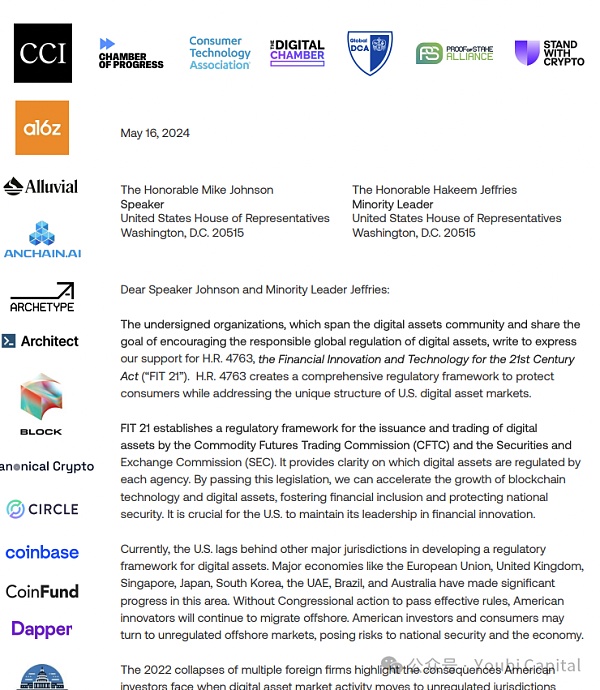

For this important bill that affects the blockchain industry, crypto industry practitioners and companies also attach great importance to it. On May 16, the Crypto Council for Innovation (CCI) and 60 other companies issued a letter of support calling for the passage of the FIT21 bill. The letter united a16z, Coinbase, Circle, Block and other important industry participants. The letter expressed the importance of FIT21 to the crypto industry and the backward regulation faced by the United States, and urged legislators to support H.R. 4763 to help the crypto industry establish a clear regulatory environment.

Figure 6: Joint appeal letter

3.3 The influence of the encryption industry continues to expand

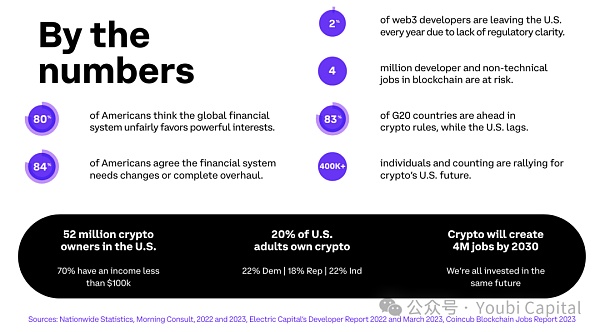

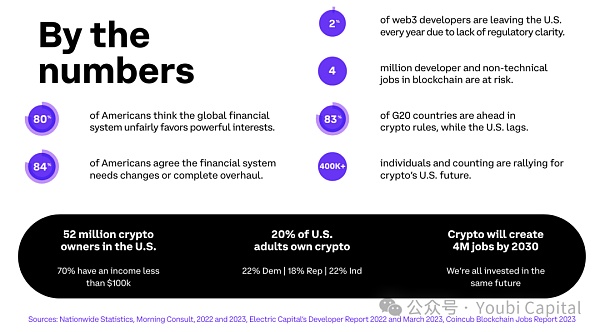

In addition to the support of political parties and practitioners, the influence of the encryption industry and the political situation in the United States have also become important driving factors that cannot be ignored. According to a research report by the non-profit organization Stand With Crypto, 52 million people in the United States currently hold virtual currencies, and another survey shows that about 20% of American citizens hold them. Although the data is biased, it can be seen that those who hold digital currencies are no longer a niche group, and their influence is gradually expanding. In addition, the encryption industry is expected to create another 4 million jobs by 2030, and its growth potential will have a positive impact on the US job market. However, the current US encryption regulatory system is not optimistic, lagging behind 83% of G20 countries, and millions of jobs in the blockchain industry are at risk. At the same time, every year a large number of practitioners leave the United States due to unclear supervision. Driven by various factors, the legislature has to pay attention to the supervision of the encryption industry, so the FIT21 bill is particularly important.

Figure 7: Stand With Crypto Poll

3.4 With the election approaching, cryptocurrency has become an important political bargaining chip

A Harris poll funded by Bitcoin ETF issuer Grayscale shows that American voters' interest in cryptocurrency is rising, and 33% say they will consider political candidates' stance on cryptocurrency before making a voting decision

A poll released by blockchain venture capital firm Digital Currency Group (DCG) shows that more than 20% of voters in several key swing states believe that cryptocurrency is a key issue in the upcoming US election.

Grayscale Poll Report: Nearly half of American voters expect that part of their investment portfolio will include cryptocurrencies

4 Next Step

Committee Review → Two Houses Vote → President Signature

FIT21 has been voted through the House of Representatives and will be voted on in the Senate next. The US legislative process can be simply divided into three stages: the committee review stage, the two houses of Congress voting stage, and the final unified bill signed by the president. In detail, the draft legislation is first proposed and reviewed by the members of the committee. After the committee reviews and passes it, it is submitted to the parliament to which it belongs for voting. Then the bill needs to be submitted to another parliament for review. The current FIT21 bill has been voted through in the House of Representatives. Next, FIT21 will be transferred to the Senate, but the transfer procedure will be a long and complicated process. Currently, FIT21 will face two situations in the Senate. First, the Senate may decide to re-draft the relevant bill, which means that it needs to be re-submitted to the Senate through the review stage of the Senate Committee. Even if it goes directly to the Senate for voting, FIT21 is also very likely to face the amendment and addition of the bill, and then return to the House of Representatives to make a decision and unify the text. According to previous reports by CoinDesk, the Senate is likely to redraft the corresponding bill of FIT21, which means that it may take some time for FIT21 to be officially passed. In the last presidential signing stage, even if the bill is rejected, the two houses can overturn the resolution with at least two-thirds of the votes in favor, so there will be a lot of room for error when the FIT21 bill is passed. At present, the White House has not threatened to veto FIT21, which means that FIT21 has received the attention of the White House and hopes to participate in the formulation of policies.

FIT21 co-sponsor Patrick McHenry said at the CoinDesk Consensus conference a few weeks ago that the bill is expected to be officially signed into law within the next year. Although the influence of the crypto industry continues to expand and it is the main battlefield of the recent US election, the possibility of FIT21 passing is very high, but the current US government's attitude towards cryptocurrencies is still relatively vague. For example, Biden recently vetoed the resolution to overturn the SEC's crypto asset accounting standard SAB 121, but he is relatively neutral about FIT21. At the same time, due to the US election, FIT21 bill matters will be transferred to the next Congress. If Trump wins the election, whether he will continue to support the implementation of the crypto bill is also an unknown, but in general, cryptocurrencies are currently important political bargaining chips, and the prospects of FIT21 are still relatively optimistic.

Appendix

SEC (Securities and Exchange Commission)

In December 2020, the SEC filed a civil lawsuit against Ripple, claiming that Ripple failed to register the issuance and sale of XRP with the SEC, thereby violating the relevant provisions of the Securities Act regarding the sale of securities. The court subsequently determined that the XRP private placement round of financing for institutional professional investors met the three criteria of the Howey test and constituted a "securities" offering, while the sale of XRP through other channels did not constitute a "securities" offering. The SEC has now appealed the case.

In June 2023, the SEC filed a lawsuit against Coinbase, accusing it of illegally operating a crypto asset securities business without registration, and the court's final ruling supported most of the SEC's allegations.

In November 2023, the SEC filed a lawsuit against Kraken, accusing it of illegally facilitating the purchase and sale of crypto-asset securities, failing to register its various businesses with the commission, and selling 11 types of unregistered securities. In response to this lawsuit, state officials accused the SEC of overstepping its authority, believing that the SEC was expanding the definition of "investment contracts" and automatically classifying crypto assets as securities. Kraken was subsequently fined $30 million.

The jurisdiction of the SEC is not even limited to the United States. For the Gram tokens issued by Telegram, since it issued tokens to U.S. citizens, the SEC took law enforcement measures against Telegram on the grounds of protecting the interests of U.S. investors, even though Telegram was registered in the UK. In the end, Telegram returned the raised funds and was fined $18.5 million.

CFTC (U.S. Commodity Futures Trading Commission)

On September 14, 2021, the CFTC filed a lawsuit against Tether and Bitfinex exchanges, accusing the two companies of fabricating trading volume and misappropriating customer funds and suspected of violating anti-money laundering laws. The two parties finally reached a settlement in October 2022, with Tether fined $41 million and Bitfinex fined $1.5 million.

In October 2020, the CFTC, FBI and the U.S. Department of Justice (DOJ) jointly sued BitMEX and its founders and executives. The CFTC claimed that BitMEX did not register with the CFTC as a commodity futures trader. In the end, the two parties reached a settlement agreement and BitMEX paid a fine of $100 million.

FinCEN (Financial Crimes Enforcement Bureau)

In 2015, FinCEN imposed an administrative penalty of $700,000 on Ripple Lbas Inc. because it did not apply for an MSB license and failed to establish a corresponding anti-money laundering mechanism.

In 2020, FinCEN imposed a civil fine of $60 million on the developers and managers of Helix and Coin Cinja mixers, and FinCEN accused Coin Ninja of violating BSA-related anti-money laundering.

In 2023, FinCEN, OFAC and other agencies sued Binance, accusing it of violating BAS and failing to comply with AML obligations.

OFAC (Office of Foreign Assets Control)

In December 2020, OFAC and Bitcoin trading platform BitGo reached a settlement over allegations that it violated sanctions requirements against the Crimea region, Iran, Syria and Cuba from 2015 to 2019. BitGo agreed to pay a fine of US$98,830.

Subsequently, OFAC also sued platforms such as Kraken, CoinList and Binance with similar allegations of "processing transactions for users in sanctioned regions", and the cases were ultimately resolved through fines and settlements.

FTC (Federal Trade Commission)

FTC is mainly responsible for consumer privacy protection and information security. In July 2023, the FTC filed a lawsuit against Celsius Network and other affiliated companies and executives, claiming that Celsius deceived consumers into transferring assets to the platform and lied that deposits were safe, but in fact user assets had been misappropriated and Celsius could not provide sufficient liquidity. In the end, the FTC reached a settlement with Celsius and permanently banned the platform from handling consumer assets.

https://www.congress.gov/bill/118th-congress/house-bill/4763/text

https://cryptoforinnovation.org/fit21-coalition-support-letter/

https://www.coindesk.com/opinion/2024/06/05/whats-next-for-fit21-a-consensus-2024-recap/

https://www.deheheng.com/content/31030.html

JinseFinance

JinseFinance