Authors: Viee, Amelia, Denise, Biteye Content Team

Recently, seven major financial associations in mainland China issued new risk warnings, specifically naming stablecoins, RWA, and various virtual assets such as "air coins" (cryptocurrencies with no real value). While Bitcoin hasn't shown significant fluctuations yet, the recent cooling market sentiment, shrinking accounts, and USDT's off-exchange discount have brought to mind past rounds of policy tightening.

From 2013 to the present, mainland China has been regulating the crypto sector for twelve years. Policies have been implemented time and again, and the market has responded time and again. This article aims to review the market reactions at these key junctures, and also to clarify one question: After the implementation of regulations, will the crypto market fall into silence, or will it gather strength for a renewed surge?

I. 2013: Bitcoin was defined as a "virtual commodity"

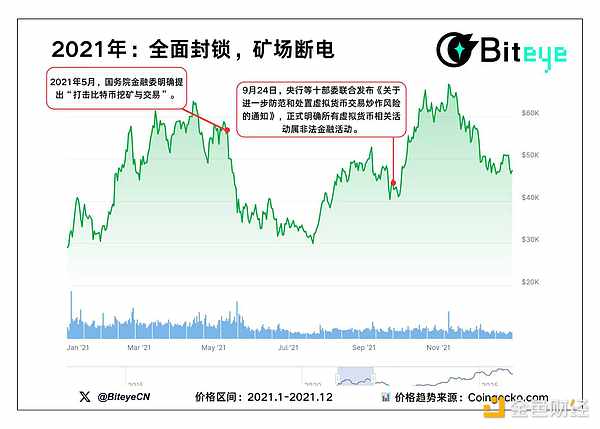

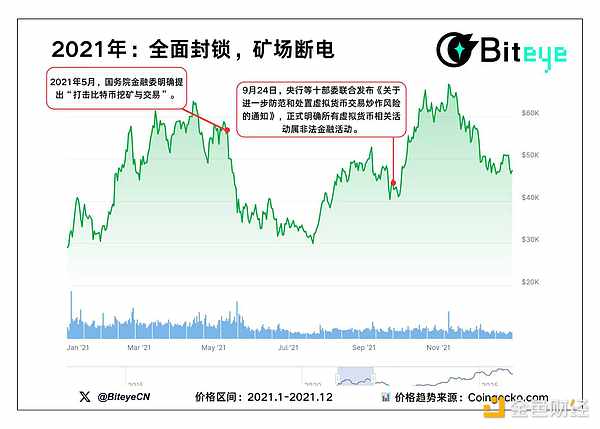

In 2021, regulatory intensity reached its peak. Two landmark events occurred that year, completely reshaping the global cryptocurrency market. In mid-May, the State Council Financial Stability and Development Committee explicitly proposed "cracking down on Bitcoin mining and trading." Subsequently, major mining provinces such as Inner Mongolia, Xinjiang, and Sichuan successively introduced policies to shut down mining operations, resulting in a nationwide "power outage wave for mining machines."

Weatherly

Weatherly