Author: Christopher Roark, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Former US President Donald Trump's token launch was a failure in some ways.

On October 16, former US President Donald Trump launched his World Liberty Financial (WLFI) token. The token's website claims that it will allow investors to gain voting rights on future decentralized finance (DeFi) protocols.

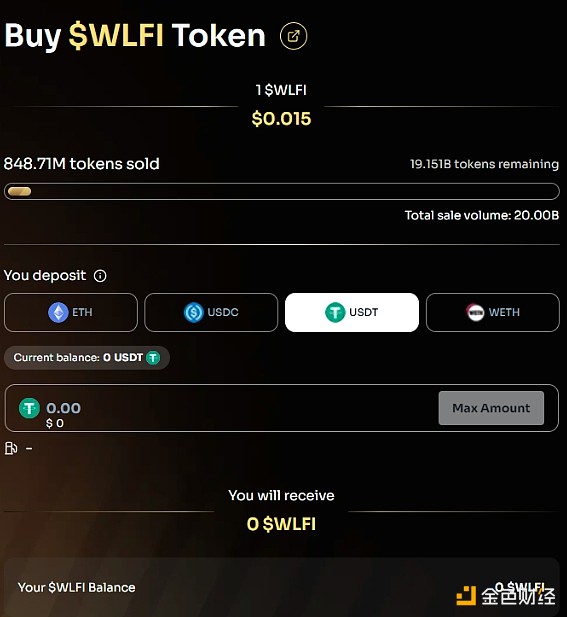

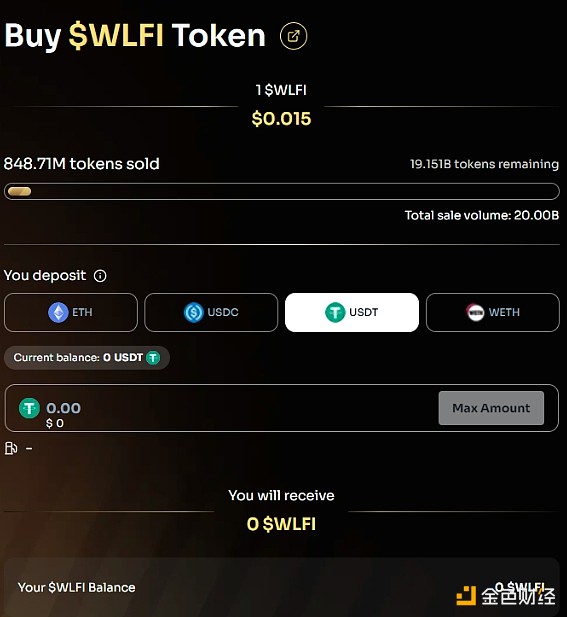

However, after nearly a full day of trading, sales of the token have been tepid. As of 10:00 a.m. UTC on October 17, the token's website showed that only 848.63 million WLFI (based on the pre-sale price, worth $12.7 million) had been sold, leaving 19.1 billion tokens ($287 million) unsold. First-day sales accounted for only 4.24% of total sales.

Number of WLFI tokens sold. Source: World Liberty Financial.

Here are five reasons to explain the token’s surprisingly poor performance.

Restrictions on who can buy

Unlike most token presales, which are open to anyone and can be purchased anonymously, only accredited U.S. investors or non-residents can purchase Trump DeFi tokens.

When users first visit the site, they are asked whether they reside in the United States and "meet the requirements to be deemed an 'accredited investor' as defined in Regulation D under the U.S. Securities Act of 1933," or reside outside the United States.

Users who do not fall into either category are not allowed further access to the site.

Buyers are not allowed to obtain tokens unless they first pass a Know Your Customer (KYC) check to verify their identity. Presumably, people who claim to be U.S. residents must provide a sworn statement that they are an accredited investor to pass this check.

According to Investopedia, a U.S. resident investor can only be considered "accredited" if they have an annual income of more than $200,000, a net worth of more than $1 million, or are a general partner, executive officer, or director of a company issuing unregistered securities.

These criteria effectively exclude the vast majority of Americans.

Users can bypass this requirement by clicking “I live outside the United States,” but they must then provide proof of residency outside the United States to proceed.

The fact that many Trump supporters live in the United States and are not accredited investors is likely the main reason for the token’s weak sales.

In general, such requirements are easily circumvented. Cryptocurrency users outside the United States can purchase tokens from the site and then sell them to U.S. residents through decentralized exchanges.

U.S. residents who purchase the tokens will identify themselves using a cryptographic address, making it nearly impossible for the government to determine whether they are U.S. residents and giving sellers plausible deniability.

However, this did not happen with Trump’s WLFI tokens, which are non-transferable.

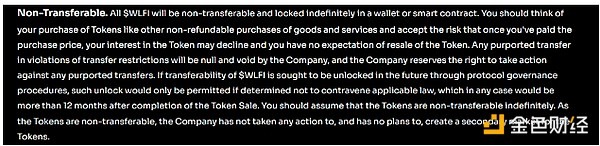

WLFI is not transferable or tradeable

Unlike most cryptocurrencies, WLFI cannot be transferred from one wallet to another. This means that accredited investors cannot sell tokens to non-accredited investors, and anyone outside the United States cannot sell them to US residents.

In fact, holders cannot sell tokens at all. The only thing they can do with the tokens is wait for the DeFi protocol to be released, when its developers claim that holders will be able to vote on proposals affecting the protocol.

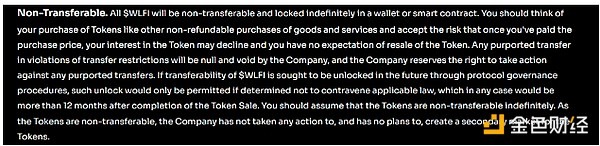

The terms and conditions of the token sale clearly state that tokens cannot be transferred to other users.

WLFI Sale Terms and Conditions. Source: World Liberty Financial.

The inability to sell tokens means that investors cannot profit by selling tokens at a higher price, and token holders cannot profit from the upcoming DeFi protocol.

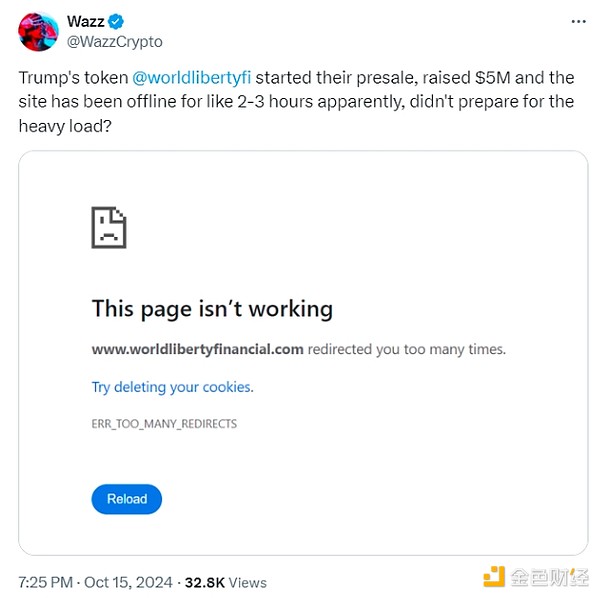

Website crashed

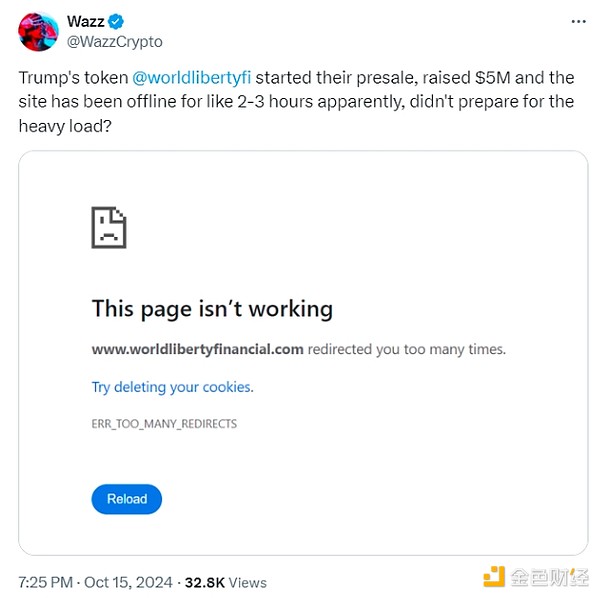

Despite only a few hundred million tokens being sold, the website was unable to handle even such a small amount of traffic. Some users reported that they were met with the message “This page isn’t working” when they tried to buy the token.

Source: Wazz

Since the site is down, some users may not be able to purchase WLFI, and after considering their plans, they may have changed their minds and decided to keep their money. This may have further reduced the sale of tokens.

The WLFI team has not explained why the site went down, but they probably expected sales to be worse than they turned out to be. Therefore, they may not have prepared enough servers to handle the traffic to the site, causing the site to go down and making the situation worse.

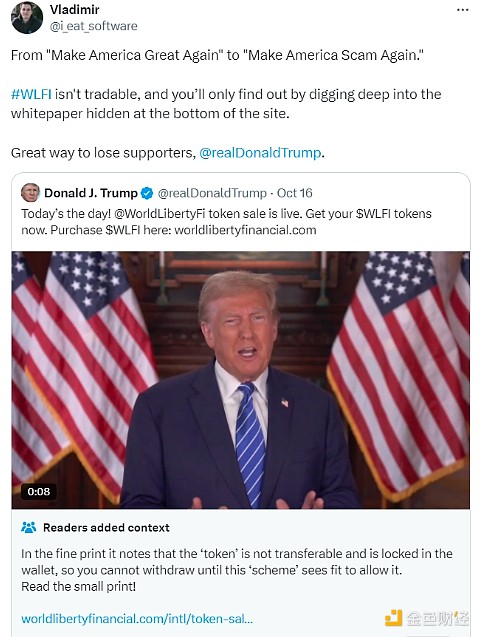

People Think It’s a Scam

Another reason for the weak token sales could be the general perception that the project is a scam or a small scam.

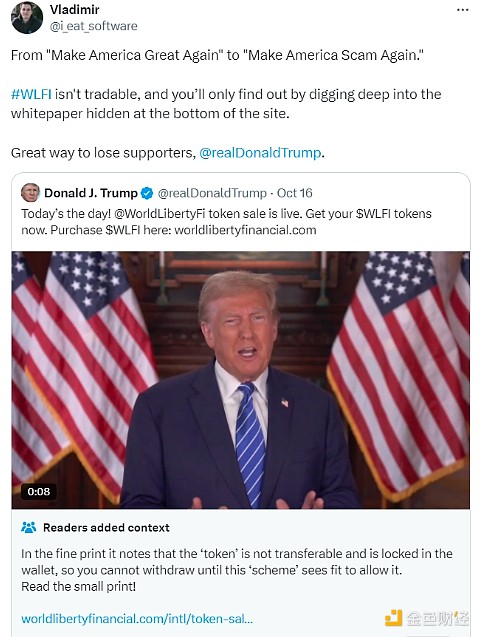

Some observers have expressed their belief that the lack of transferability was intentionally hidden from buyers in order to sell more tokens.

Although the lack of transferability is clearly stated on the token’s website, some believe that the project does not expect buyers to read the fine print.

Trump’s announcement of the token was so controversial on X that it caught the community’s attention. The note states, “In the fine print, it states that the ‘tokens’ are non-transferable and locked in a wallet, so you cannot withdraw your tokens until a time this ‘program’ sees fit. Please read the fine print!”

Reflecto Passive Income Token founder Vladimir Djukic shared the news:

Source: Vladimir

The purchasing process is cumbersome

Another reason for the token sale’s weakness could be that the buying process is too frustrating for many potential investors.

Some people may not know if they are accredited investors, as they may not even know what the term means.

Others may not be sure what it means to “live” in the U.S. For example, if a person visits the U.S. a few months out of the year but spends the rest of the time in another country, they may not be sure which button to push.

Even if they make it to the token sale page, they must first pass a KYC check before they can proceed to the final step of the purchase. Some users may not trust the Sumsub company that performs the KYC check and may not be willing to upload their passport or driver’s license.

Even if they are willing to trust a company that performs the KYC check, they may simply not be willing to upload their documents.

The overall tediousness of the buying process could be another reason many backers decide to skip the token sale, even if they believe the tokens will somehow pay off in the long run.

Despite the poor token sale, Trump still has the support of many in the U.S. cryptocurrency community. According to data from the U.S. Federal Election Commission, political action committees of Trump allies raised more than $7.5 million in cryptocurrency between July and September.

Trump's opponent, Vice President Kamala Harris, is also considered a better fit for cryptocurrency than incumbent President Joe Biden, according to research by Galaxy Digital.

She recently tried to attract cryptocurrency voters by promising to provide reasonable asset regulation as part of her "opportunity economy promise."

Alex

Alex