Author: Trendverse Lab

Since 2024, the stablecoin market has been undergoing a new transformation driven by structural innovation. After years of dominance by fiat-backed stablecoins like USDT and USDC, USDe, launched by Ethena Labs, has rapidly risen to prominence thanks to its fiat-free synthetic stablecoin design. Its market capitalization briefly exceeded $8 billion, making it the "high-yield dollar" of the DeFi world.

Recently, the Liquid Leverage staking campaign launched by Ethena and Aave has sparked heated market discussion: with an annualized return of nearly 50%, while seemingly a standard incentive strategy, it may also reveal another noteworthy signal: the structural liquidity pressures faced by the USDe model during the ETH bull market. This article will focus on this incentive program, briefly explaining USDe/sUSDe and the related platforms. It will then analyze the systemic challenges underlying these initiatives from the perspectives of revenue structure, user behavior, and capital flows. By comparing them with historical cases like GHO, we will explore whether future mechanisms are resilient enough to cope with extreme market scenarios. I. Introduction to USDe and sUSDe: Synthetic Stablecoins Based on Crypto-Native Mechanisms USDe, launched by Ethena Labs in 2024, is a synthetic stablecoin designed to avoid reliance on the traditional banking system and coin issuance. To date, its circulation has exceeded $8 billion. Unlike fiat-backed stablecoins like USDT and USDC, USDe's peg relies on on-chain crypto assets, particularly ETH and its derivatives (such as stETH and WBETH). Its core mechanism is a "delta-neutral" structure: the protocol holds positions in assets such as ETH while simultaneously opening an equivalent perpetual short position in ETH on a centralized derivatives exchange. Through a hedging combination of spot and derivatives, USDe achieves near-zero net asset exposure, keeping its price stable around $1. sUSDe is a representative token obtained by users who stake USDe to the protocol, with the feature of automatically accumulating returns. Its main sources of income include: funding rate returns in ETH perpetual contracts, and derivative income from the underlying staked assets. This model aims to introduce a sustainable income model for stablecoins while maintaining their price peg.

II. Introduction to Aave and Merkl: A Collaborative System of Lending Protocols and Incentive Distribution Mechanisms

Aave is one of the oldest and most widely used decentralized lending protocols in the Ethereum ecosystem, dating back to 2017. Its "flash loan" mechanism and flexible interest rate model promoted the early adoption of DeFi lending systems. Users can deposit crypto assets into the Aave protocol to earn interest, or borrow other tokens by pledging assets, without the need for an intermediary. Currently, the Aave Protocol's total value locked (TVL) is approximately $34 billion, nearly 90% of which is deployed on the Ethereum mainnet. The platform's native token, AAVE, has a total market capitalization of approximately $4.2 billion, ranking 31st on CoinMarketCap. Data source: DeFiLlama. Merkl, an on-chain incentive distribution platform launched by the Angle Protocol team, provides programmable and conditional incentive tools specifically for DeFi protocols. By presetting parameters such as asset type, holding period, and liquidity contribution, protocols can precisely set reward strategies and efficiently complete the distribution process. To date, Merkl has served over 150 projects and on-chain protocols, distributed over $200 million in cumulative incentives, and supports multiple public blockchains, including Ethereum, Arbitrum, and Optimism. In this USDe incentive campaign jointly launched by Ethena and Aave, Aave is responsible for organizing the lending market, configuring parameters, and matching collateralized assets, while Merkl is responsible for setting the reward logic and on-chain distribution operations. In addition to the current USDe incentive collaboration, Aave and Merkl have previously established a stable collaborative relationship across multiple projects, one of the most representative cases being their joint intervention to address the depegging of the GHO stablecoin. GHO is Aave's native over-collateralized stablecoin, minted by collateralizing assets such as ETH and AAVE. In its early days, the coin's price quickly fell below its peg due to limited market acceptance and insufficient liquidity, hovering between $0.94 and $0.99 for a long time, losing its peg to the US dollar. To address this deviation, Aave, in collaboration with Merkl, established a liquidity incentive mechanism for the GHO/USDC and GHO/USDT trading pairs on Uniswap V3. This incentive mechanism targets a price close to $1, offering higher rewards to market makers who provide concentrated liquidity near $1. This incentivizes buying and selling depth within the target range, thereby creating a price stability wall on the chain. This mechanism has proven effective in practice, successfully driving the GHO price back up to near $1. This case reveals the essence of Merkl's role in the stability maintenance mechanism: through programmable incentive strategies, it maintains the liquidity density of key trading ranges on the chain, just like arranging "subsidized vendors" at the market price anchor. Only by continuously providing returns can a stable market structure be maintained. However, this also leads to a related problem: once the incentives are interrupted or the vendors withdraw, the support of the price mechanism may also fail.

III. Analysis of the Source Mechanism of the 50% Annualized Return

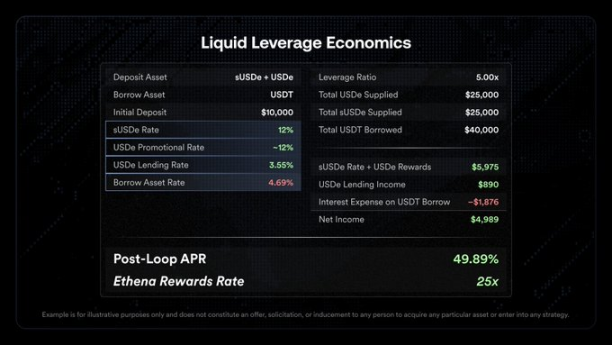

On July 29, 2025, Ethena Labs officially announced the launch of a functional module called "Liquid Leverage" on the Aave platform. This mechanism requires users to deposit sUSDe and USDe simultaneously into the Aave protocol at a 1:1 ratio, forming a composite staking structure and thereby receiving additional incentive returns.

Specifically, qualified users can obtain three sources of income:

1. Incentive USDe rewards automatically distributed by Merkl (currently approximately 12% annualized);

2. The protocol income represented by sUSDe, that is, the funding fees and staking income from the delta-neutral strategy behind USDe;

3. Aave's basic deposit interest, which depends on the current market capital utilization rate and pool demand.

The specific participation process of this event is as follows:

1. Users can obtain USDe through the Ethena official website (ethena.fi) or decentralized exchanges (such as Uniswap);

2. Pledge the USDe held on the Ethena platform and exchange it for sUSDe;

3. Transfer equal amounts of USDe and sUSDe to Aave at a 1:1 ratio;

4. Enable the "Use as Collateral" option on the Aave page;

5. After the system detects compliance operations, Merkl The platform automatically identifies the address and distributes rewards regularly;

Image source: Official Twitter

Official data, underlying calculation logic breakdown:

Assumption: US$10,000 principal, 5x leverage, a total loan of US$40,000, with US$25,000 pledged to USDe and sUSDe respectively

![]()

Catherine

Catherine

Catherine

Catherine Hui Xin

Hui Xin Clement

Clement Joy

Joy YouQuan

YouQuan Hui Xin

Hui Xin YouQuan

YouQuan Davin

Davin Joy

Joy Clement

Clement