While SBF is still eating vegetarian food in prison, FTX, which has lost its boss, has ushered in a new turn.

After nearly two years of wrangling, after countless rekindled hopes and shattered dreams, investors' money finally has the possibility of recovery. On January 3, according to the official announcement of FTX, the FTX debtor reorganization plan officially came into effect. Customers can file a claim through the official website to obtain compensation refunds, and the first round of distribution will be launched within 60 days after the effective date. The initial stage of compensation is about 1.2 billion US dollars. After a long bankruptcy and recovery process, FTX now has 14.7 billion to 16.5 billion US dollars to repay customers and other debtors.

As soon as the news came out, creditors cheered. Although the cash compensation made them bear potential losses, the long road to debt collection finally came to an end, and most users were still overjoyed. But for the market, the mixed feelings seem to be more obvious. FTX's compensation means that liquidity may flock in, but its sell-off fundraising has also cast a shadow on some currencies.

It has to be admitted that this black swan event two years ago is still having a profound impact on the crypto market even now.

The FTX incident is undoubtedly a heavy stroke in the negative sense in the not-so-long history of crypto. At that time, the collapse of FTX swept the entire crypto field, and the chain reaction affected hundreds of crypto companies, and hundreds of investment institutions suffered losses. Not only did the market suffer a heavy blow, but it also completely destroyed the mainstream recognition of cryptocurrencies that had just turned good. On the other hand, the abuse of funds, financial fraud, lottery decisions, and various outrageous operations of SBF and his team also made users extremely angry about being manipulated and played with.

Back to the debt, on November 12, 2022, SBF announced on social media that more than 130 affiliated companies, including the exchange FTX.com and the affiliated trading company Alameda Research, have voluntarily filed for bankruptcy in accordance with Chapter 11 of the U.S. Bankruptcy Code in order to "evaluate and liquidate assets in an orderly manner in the interests of global stakeholders." Initially, the Wall Street Journal said that FTX's funding gap was about $8 billion. But as the trial continued to deepen, the total amount of claims increased at an astonishing rate, and the final claims exceeded 36,000, with a total amount of claims of about $16 billion.

Since then, creditors and FTX have started a long tug of war, and the restructuring "wolf" has continued, and FTT has once become the core target of the narrative.

As early as January 23, FTX's newly appointed CEO John J. Ray III had expressed plans to restart the exchange. As expected, when trust collapsed, no one cared. It was not until three months later, in April 2023, that Andy Dietderich, a lawyer at Sullivan Cromwell, the law firm representing FTX, once again stated that FTX was considering reopening its exchange business at some point in the future. Since some of the debts had been recovered at that time, the market began to shift from the crazy debt collection perspective to the restructuring plan. Subsequently, the restructuring received good news again. In May, John J. Ray III confirmed the FTX 2.0 plan, and in June, court documents even showed that several companies including Nasdaq, Ripple, and BlackRock had acquisition plans for it.

Affected by the news, although the recovery was once silent, the market's confidence in the restructuring plan gradually increased. It was not until November 2023 that the market officially participated in the pricing of the restructuring narrative after SEC Chairman Gary Gensler mentioned that "it is possible to restart FTX within the legal framework." The direct target FTT was snatched up off-site, soaring 40%, reaching a high of US$5.54. However, with the disclosure of the trial documents, the court confirmed the properties of its practical tokens and declared that the intrinsic value of FTT was zero, which shattered the holders' dreams again.

Although the FTT dream was shattered, the creditors' compensation was a foregone conclusion. As the crypto market continued to rise, in February 2024, FTX said it had enough funds to pay in full all approved customer and creditor claims. On October 8, a U.S. court judge formally approved FTX's restructuring plan, which enabled FTX to repay creditors for the first time, involving an amount of more than $14 billion.

The payment plan was postponed again and again, and finally on January 3 this year, the FTX debtor restructuring plan officially came into effect. The first batch of debts will be paid within 60 days after it takes effect on January 3. According to FTX's plan, creditors need to complete tax form submission and KYC verification before January 20. The first batch of "convenience" users will be repaid first, including users with claims of $50,000 or less, accounting for about 98%. They are expected to receive a 119% repayment of their declared value of funds, including principal and interest. The first batch of compensation is expected to be $1.2 billion, and there is no specific timetable for the remaining amount. BitGo and Kraken will assist FTX in making compensation, and both have initiated customer notifications in the compensation process.

FTX also added time interest on top of the debt, which seems to be a happy ending for everyone, but for creditors, it is not a perfect ending. The reason is that in the compensation, FTX mentioned that it can only be repaid in the form of stablecoins and legal tender, and noted that the amount of compensation is based on the value of the application date of the claim submission, which is concentrated around November 22. But at that time, the crypto market was shaken, and Bitcoin once fell to $16,000. Now, Bitcoin has reached $95,000, an increase of more than 4 times, which is obviously far from the so-called "benevolent and righteous" repayment of 119%.

In this regard, some creditors are also dissatisfied, especially large creditors. For example, Sunil Kavuri, the representative of FTX's largest creditor group, once said that FTX should pay in "BTC physical form" rather than cash equivalent. But it is obvious that FTX will not agree. Even if it wants to approve it, it is willing but unable. The FTX liquidation team once said helplessly that when it took over, BTC only had 0.1% of the book value.

Overall, most creditors are satisfied with the compensation. After all, the road to debt collection is not smooth, and the key is to get the money in pocket. On the other hand, such a large compensation naturally attracted the attention of the market. $16 billion, where does FTX get it? Where will the funds go?

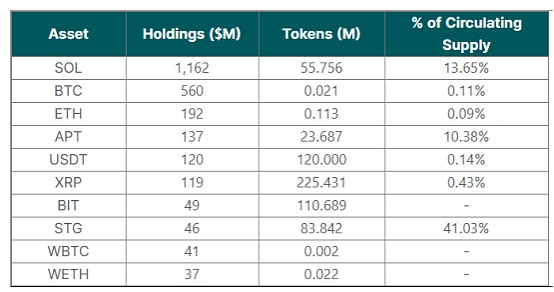

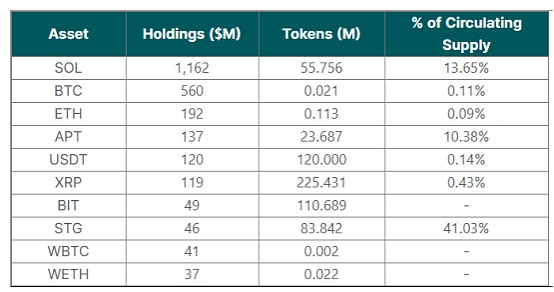

As for how it comes, FTX's wallet is enough to explain the problem. As early as the end of August 2023, the shareholder report disclosed FTX's crypto assets. The top 10 currencies accounted for 72% of FTX's total crypto asset holdings. At that time, the total value of the holdings was about US$3.2 billion, of which SOL held the most, reaching 55 million, BTC held about 21,000, and ETH held 113,000.

Since the start of the restructuring plan, FTX has been selling coins to pay back the money. At the beginning of 2024, FTX liquidated all of its 22 million GBTC shares, including about 20,000 BTC. In October, FTX sold $28 million of SOL, and in December, it released another $178,000 of SOL pledge.

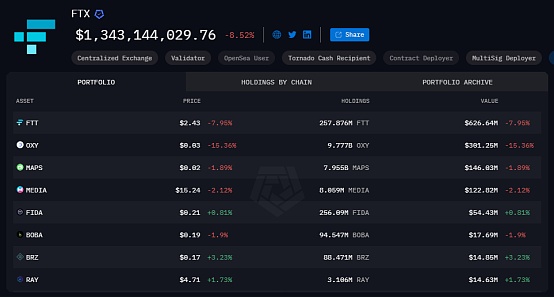

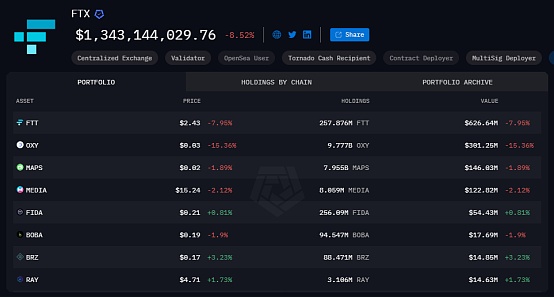

From the current holdings, FTX has completed the sale of most mainstream coins, and the total amount of crypto assets held is $13.43. There are 20 currencies with holdings of more than one million US dollars. Among them, FTT has the most concentrated value, with a total of $626 million, followed by OXY with a total of $301 million, and MAPS and Media also hold more than $100 million.

The sell-off will undoubtedly affect prices in the short term, especially for currencies with low liquidity or greater FTX concentration. The currencies at the top of the holdings are more likely to be widely affected. FTT is the first to be affected. This currency, which has already become a MEME, is likely to have no one to take it. OXY, MAPS, MEDIA, FIDA, BOBA, SRM, AMPL, etc. will be affected due to the large proportion of FTX holdings.

From the current point of view, the repayment of FTX addresses is still in preparation, and there is a lot of capital flowing to the exchange every day, but at this stage it has not caused a major impact on the currency, and the impact seems to be relatively controllable. The periodic impact is still there, but the market has already viewed the selling pressure from a longer-term perspective.

After the $16 billion is paid off, will it flow into the crypto market? Combined with the special date of Trump's inauguration on January 20, some industry insiders are optimistic that this move may catalyze the next round of rise in the cryptocurrency market cycle in 2025, allowing Bitcoin to break new highs again.

This statement is not groundless. The creditors of Mentougou are a precedent. In the disclosure on July 30, 24, Mt.Gox completed the distribution of 41.5% of Bitcoin to creditors, and the creditors received a total of 59,000 Bitcoins. However, Glassnode shows that although Mt. Gox creditors received nearly $4 billion worth of Bitcoin, most groups did not sell it, but instead returned to become firm holders.

Of course, whether the creditors who have been hit hard will choose to hold it still depends on their personal preferences and cannot be discussed uniformly. It is worth noting that due to the protracted debt collection, most of the original creditors will isolate or sell the debt to the debt settlement company early to get rid of the debt and obtain funds as soon as possible. This proportion is not small, and this part of the funds is unlikely to flow back.

But in any case, some of the funds from cryptocurrencies will inevitably flow into cryptocurrencies, which is still a good thing for the crypto field where liquidity is frequently in crisis.

Back to the current market, garbage time is still continuing. The rise in macro data, the uncertainty of the external situation, and the debt crisis of the US authorities have caused a sharp increase in the market's risk aversion, and risky assets have suffered a blow. Even the natural disasters and man-made disasters in the United States recently have increased the market's concerns about liquidity again.

On January 7, wildfires broke out in California, USA. This is a common event that occurs every year, but this year's wildfires, affected by record summer temperatures and droughts, are particularly raging. According to the latest data from the California Disaster Rescue Department on the 12th, the wildfire has caused 24 deaths and 16 missing. The total area of the four wildfires in the county has exceeded 160 square kilometers, which is larger than the urban area of San Francisco. AccuWeather analysts expect economic losses to be between $135 billion and $150 billion. At present, Biden's side has stated that the US government will pay "100% of all costs" caused by the disaster and will ask Congress for more financial assistance.

In the face of this natural and man-made disaster, the economic level has suffered a huge blow. Whether it is due to the long-term impact of insurance assessments, personal hedging needs, or longer-term concerns about US inflation and debt, the conservative trend of liquidity will only become increasingly prominent. More noteworthy is that for risk markets, the volatility of emotions is continuing to expand.

After the incident, California Governor Newsom blamed the local government, while US President-elect Trump pointed out that Democratic California Governor Newsom and current President Biden should be held responsible for the fire. The confrontation and conflict between the two major parties have not slowed down even in the face of a unified natural disaster. The buck-passing and internal struggles will only shake the world's confidence in the stability of the US financial market.

As Trump approaches the coming of age, any event is very likely to touch the sensitive nerves of the encryption and even risk markets. Even if the direct impact is limited, there are risks and concerns. Just a few days ago, Tom Lee, chief investment officer of Fundstrat Capital, a firm bull on Wall Street, came to sing a pessimistic view, suggesting that due to the reduction of global liquidity, although the long-term bullish expectation of $250,000 remains unchanged, Bitcoin may fall sharply from its recent highs and may test the support level of $70,000 or even $50,000.

Misfortunes come with blessings, but it is also when Trump comes to power that the expected support for Bitcoin is still relatively solid. Early this morning, the Washington Post reported that David Sacks and the Trump transition team are working closely with crypto industry leaders to develop legislative strategies. Trump is expected to sign an executive order on his first day in office, which may involve "de-banking" and the abolition of controversial crypto accounting policies that require banks to include their digital assets in their balance sheets.

Affected by this, Bitcoin has returned to above $95,000. As of press time, BTC is now at $95,452 and ETH is at $3,183.

Anais

Anais