Author: Alex Thorn, Gabe Parker; Source: Galaxy; Compiler: Songxue, Golden Finance

Foreword:

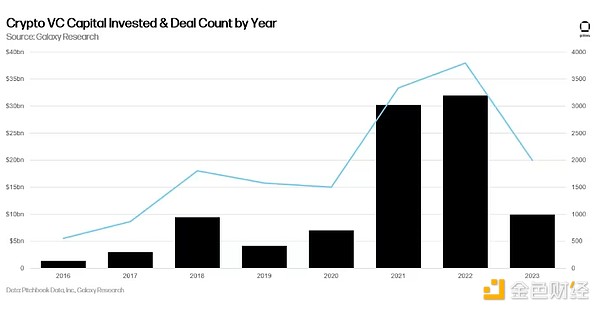

2023 is a landmark year for cryptocurrency In 2022, BTC is up more than 160% and ETH is up 90%, but cryptocurrency venture capital is still significantly lower than in the great year of 2022. Tighter monetary policy has increased capital costs and reduced venture capital allocations across the board, while several major incidents at venture capital-backed cryptocurrency industry startups have further reduced allocators’ investment interest. Ultimately, 2023 will end with only 1/3 of the investment volume in crypto venture capital and only slightly more transaction volume than the previous two years. However, the combination of the cryptocurrency industry looking set to surge in 2024 and central banks preparing to ease monetary policy could lead to renewed interest in cryptocurrency venture capital this year.

Venture Capital

The number of transactions and investment capital

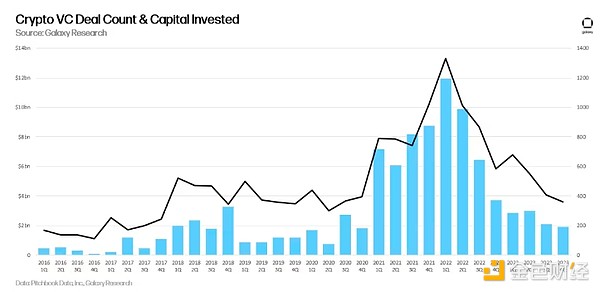

From the number of transactions and investment Capital-wise, 2023 is the third-biggest year for cryptocurrency venture capital, although both metrics are down significantly from 2022.

Quarterly , deal numbers and capital investment continue to hit new lows. Q4 2023 saw $1.98 billion invested across 359 deals, slightly lower than Q3 2023.

The number of transactions reaches 2020 The lowest level since the second quarter of 2020, and investment capital hit the lowest level since the fourth quarter of 2020.

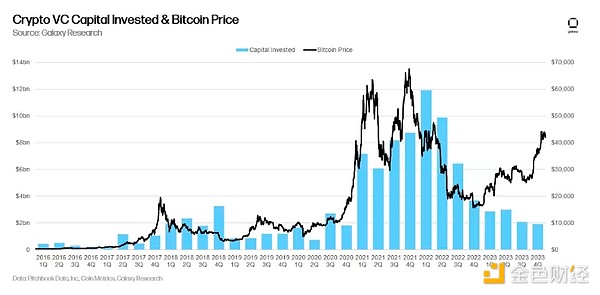

Venture Capital Investment and Bitcoin Price

While venture capital investment is often correlated with Bitcoin price, This correlation broke significantly in 2023, with Bitcoin rising 160% and cryptocurrency venture capital investments continuing to hit new lows.

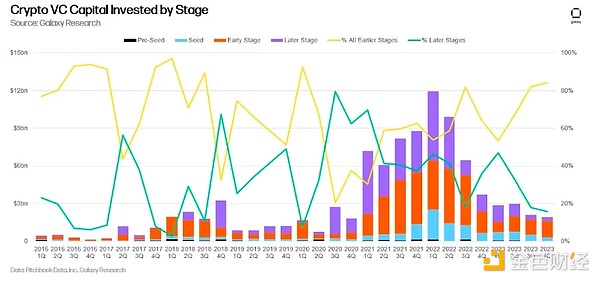

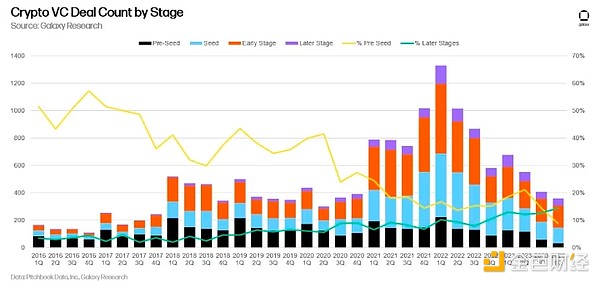

Phased venture capital

Early-stage companies accounted for the majority of venture capital deals throughout 2023, a trend that accelerated throughout the year. Less than 20% of deals completed in Q3 and Q4 2020 were by late-stage companies.

Although the seed round investment The share of deals in the earliest stages increased from mid-2022 to mid-2023, but the share of deals in the earliest stages fell sharply in the second half of 2023.

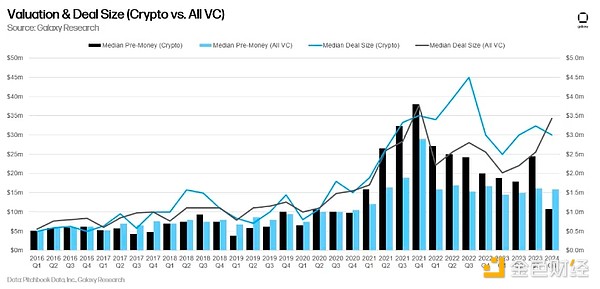

Valuation and Transaction Size

Venture-backed cryptocurrency company valuations fell sharply in 2023, reaching the lowest median pre-money valuation since Q4 2020 in Q4, while pre-money valuations for all VCs Valuations have remained relatively stable after initially declining in early 2022. The fourth quarter was down 33% from the all-time high of $4.5 million in the third quarter of 2022.

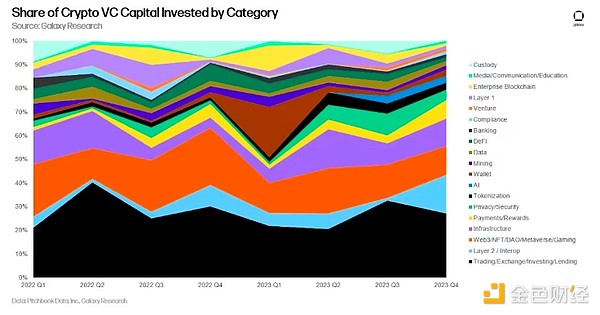

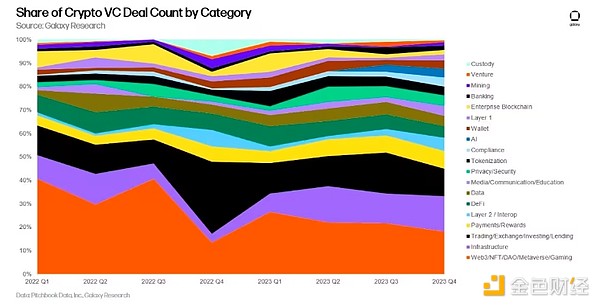

Classified by industry Investing

Startups focused on trading, exchanges, investments and lending companies raised the most venture capital funding (27% of the total) for the fourth consecutive quarter. Our Layer 2 and interoperability category had the second-highest amount of funding raised (16%), led by Wormhole’s $225 million round. Web3 ranked third with 12% of funding. Our new AI category is holding steady at around 3% of all funding raised.

From the number of transactions See, Web3 continues to lead, a category that includes gaming, NFT, DAO, and Metaverse-related companies, followed by infrastructure companies, surpassing trading, exchanges, investments, and lending companies in second place.

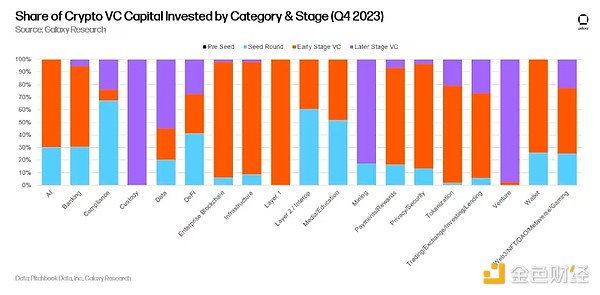

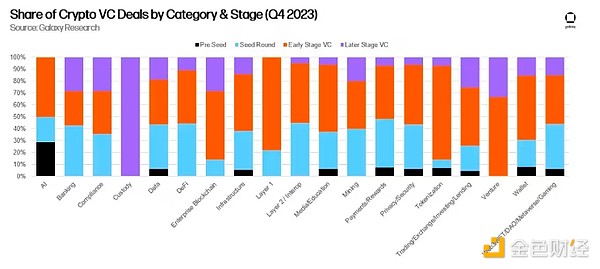

By stage and category Divided Investments

From a stage perspective, startups in the compliance category are biased towards the seed stage, while capital in the venture capital and custody categories are heavily biased towards later stages. A company is classified as a "venture capital" if it is a platform for financing or capital deployment. Note that one company raised late-stage funding in the managed category but did not disclose the deal size, so one column in this chart is based on extremely limited data.

In terms of transaction quantity , it’s worth noting that 50% of AI startup deals were seed or pre-seed, indicating strong corporate interest in this emerging category.

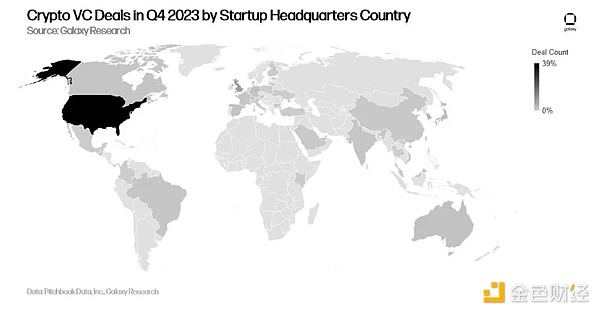

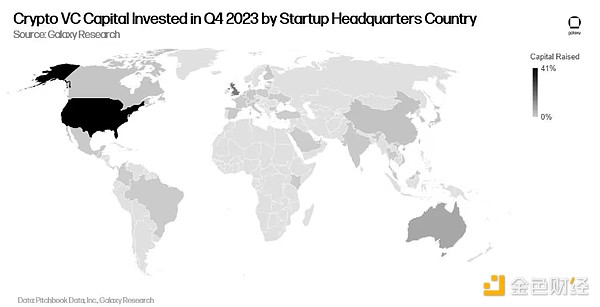

By geographical location of investments

In 2023, the United States continued to dominate in terms of deal volume and investment. Nearly 40% of deals in the fourth quarter involved U.S.-based startups.

From investment capital See, it’s a similar situation. Despite regulatory headwinds, U.S. dominance continues.

Group Investment< /h3>

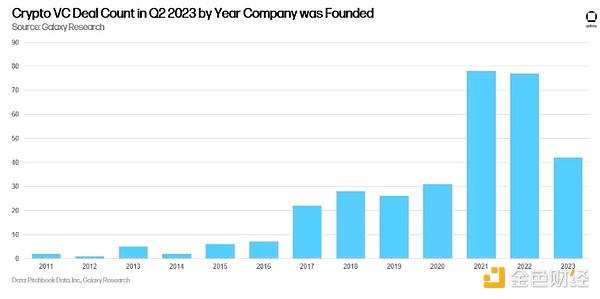

In the fourth quarter of 2023, companies established in 2021 accounted for the largest number of transactions (78), followed by companies established in 2022 (77) and companies established in 2023 (42).

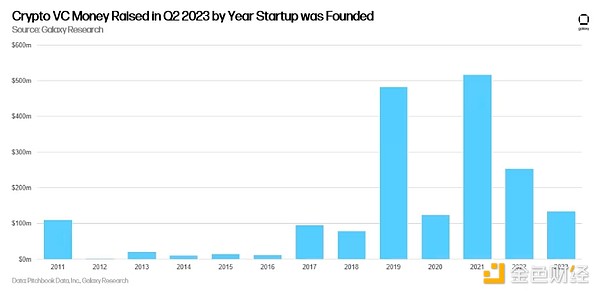

Established in 2021 Companies raised the most money ($516 million), with startups founded in 2019 coming in second ($482 million).

Cryptocurrency Venture Capital

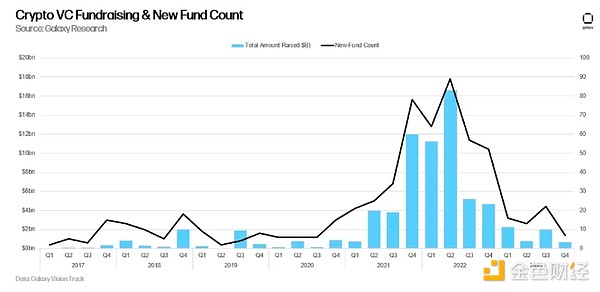

Cryptocurrency venture fund fundraising remains extremely challenging. Turmoil in the macro environment and cryptocurrency market infrastructure startups prevents allocators from making the same level of commitment to cryptocurrencies as they did in 2021 and 2022. The fourth quarter of 2023 saw the smallest number of new cryptocurrency VC funds and the smallest allocation amounts.

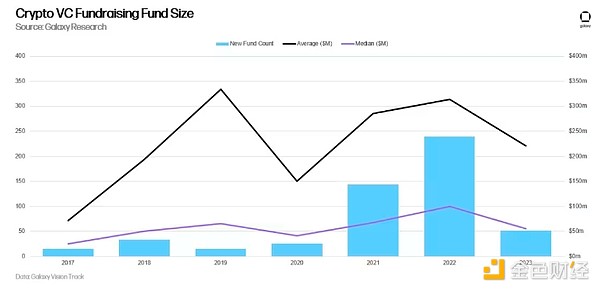

From an annual perspective , 2023 saw the smallest number of new cryptocurrency venture capital funds launched since 2020. Average fund size is down 30% year over year, while median fund size is down 45%.

Summary

2023 is going to be a tough year for crypto VCs, and the ecosystem has yet to firmly hit bottom. Despite the recovery in liquid cryptocurrency prices, venture capital activity continues to hit new lows every quarter. Founders and investors alike continue to face a difficult funding environment.

Bitcoin ETF will put pressure on cryptocurrency venture capital and hedge funds. The ability for allocators to access the cryptocurrency at low fees through a regulated spot Bitcoin ETF will create additional challenges for asset managers looking to launch new active funds. While some managers already do this, managers who do not currently benchmark against BTC will face pressure to do so overtly or implicitly.

Pre-seed deals continue to decline both in real terms and in relative terms. Only 32 pre-seed deals were completed in Q4 2023, accounting for just 8.9% of closed deals and 0.26% of invested capital, down from the high of 217 deals (43%) in Q1 2019 and Q1 2016. Capital investment in the first quarter was the highest at 19%.

Trading and Web3 companies continue to dominate, but AI is showing growth. Companies that provide investors with a way to buy and sell cryptocurrencies continue to dominate funding, but Layer 2 and interoperability investments increased in the fourth quarter, with Wormhole bridge raising significant funding. Artificial intelligence is becoming a more interesting category, with several startups entering this space.

The United States continues to dominate the cryptocurrency startup ecosystem. While the U.S. maintains a clear lead in deals and capital, regulatory challenges in the U.S. could force more companies to look overseas. If the United States is to remain a center of technological innovation, policymakers should be aware of how their actions or inactions may impact this ecosystem.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Revelointel

Revelointel Cointelegraph

Cointelegraph Ftftx

Ftftx