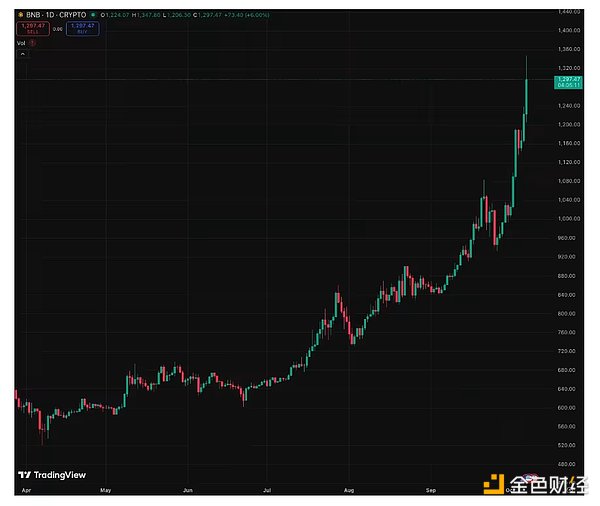

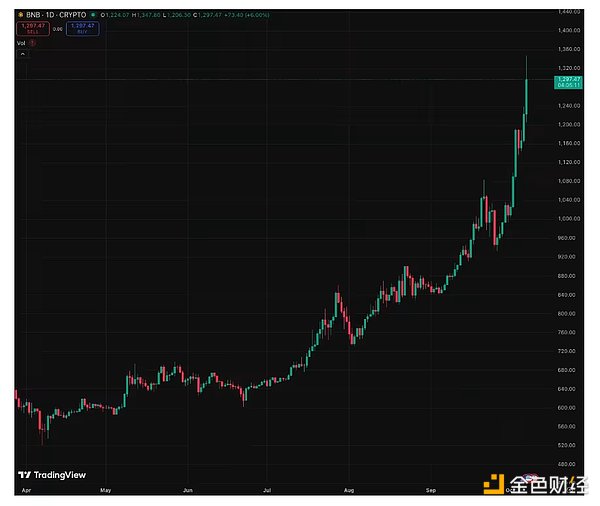

Source: Galaxy; Compiled by: Golden Finance Note: This article was written before the market crash on October 11th. Introduction: For the second time since June, Binance's BNB Smart Chain surpassed all other blockchains in transaction volume. Memecoin transactions have been the primary driver of BNB Chain DEX volume. Meanwhile, the chain's native gas token, BNB, also broke a new all-time high, and its market capitalization just surpassed XRP, making it a top-three crypto asset, behind Ethereum's Ether and, of course, Bitcoin. Binance founder Changpeng Zhao (CZ) was a key driver of this surge in activity, frequently tweeting about individual memecoins, promoting BNB's perpetual contract platform, Aster, and appearing on an X Spaces broadcast titled "BNB Super Cycle" on October 8th. It attracted thousands of live listeners and amplified the narrative that BNB's recovery represents a full-cycle ecosystem comeback. Key Takeaways: * BNB broke to a new all-time high and is currently trading around $1,250. * CAKE, the native token of the PancakeSwap protocol on BNB Chain, was also compromised.

* BNB Chain's memecoin launch platform Four.meme surpassed Solana's Pump.fun in revenue within 24 hours.

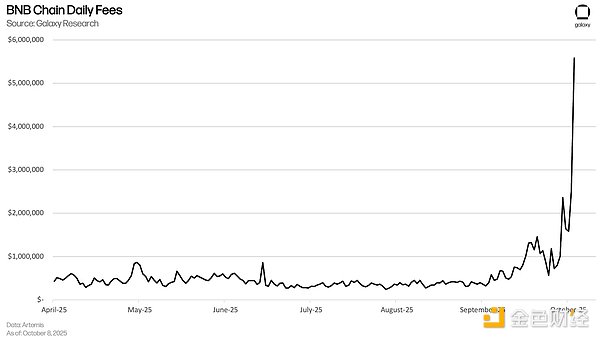

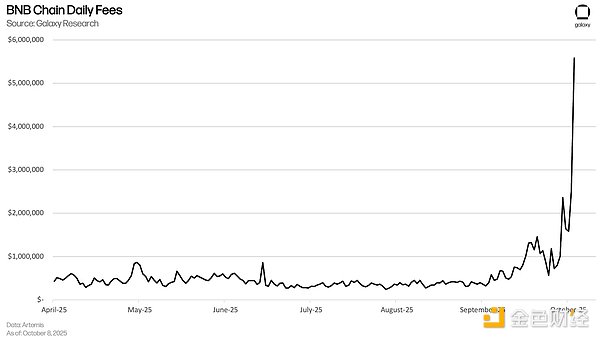

* BNB Chain's daily fees have surpassed $5 million, up from under $500,000 in August.

* This represents an increase of over 1,000%.

* BNB Chain's daily DEX trading volume has soared to over $6 billion, while Solana's volume is approximately $5.5 billion.

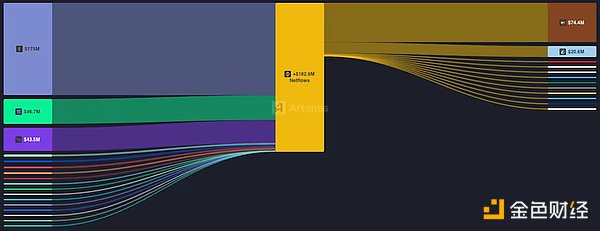

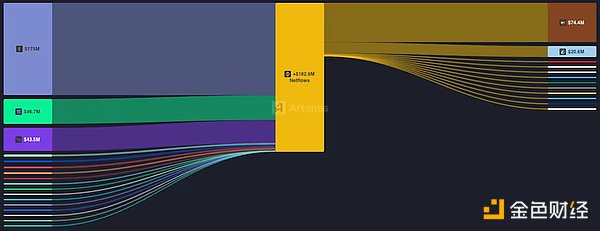

* Artemis data shows that BNB Chain has seen net inflows of over $182.6 million over the past three months.

* All of this makes BNB Chain a challenger to Solana and Hyperliquid in the memecoin and perpetual contract verticals, respectively. CZ’s tweet “BNB meme szn” on October 7th. Over the past six months, BNB has surged approximately 133%, far outperforming BTC. Meanwhile, CAKE has also risen approximately 146%, indicating that trading and on-chain activity are returning to the Binance ecosystem. This move also reflects the success of PancakeSwap's token economics, which utilizes a buy-back-and-burn model. The decentralized exchange aims to reduce net supply by approximately 4% annually, funded by platform revenue. The protocol's ultimate goal is to reduce the total CAKE supply by approximately 20% by 2030, one of the clearest deflationary frameworks among major decentralized exchange tokens. BNB Chain's surging decentralized exchange trading volume and user activity clearly helped PancakeSwap achieve its goals.

BNB price chart, October 7

With the increase in user activity, the BNB chain's daily transaction fees have also surged. Transaction fees have soared from less than $500,000 in August to over $5 million on October 8, an increase of more than 1,000%.

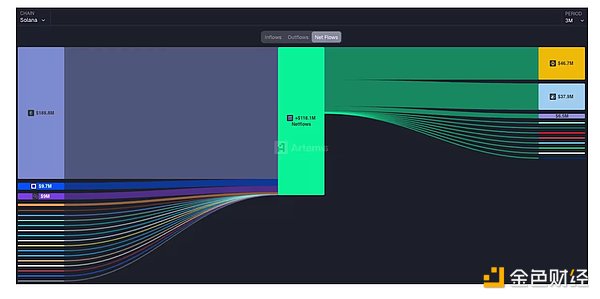

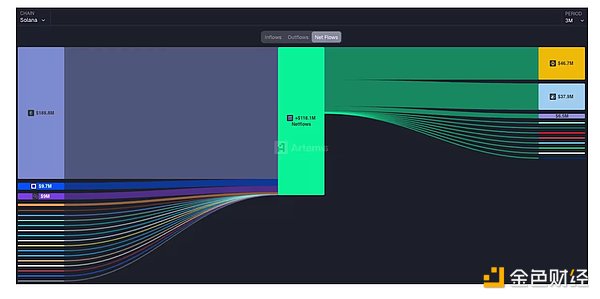

BNB chain's DEX trading volume (over $6 billion) has surpassed Solana (approximately $5.5 billion). This is noteworthy, as Solana's trading volume was less than $1 billion in April. The aggressive marketing and incentives are having their intended effect. Net Inflows Artemis data (as of October 7) shows that the BNB chain has seen a net inflow of over $182.6 million over the past three months. In comparison, Solana saw net inflows of over $118 million, and Avalanche saw net inflows of over $41 million.

BNB chain

Catherine

Catherine