Chainalysis' Latest Report Has Implications For The Future Of Crypto

Only one region has seen an increase in crypto adoption- but how sustainable is it?

Clement

Clement

Author: Simrit Dhinsa, Anthony Scheercousse, Samuel Kiernan, Gabe Parker, Zack Pokorny, Galaxy; Translator: Baishui, Golden Finance

The first half of 2024 is a critical period for the Bitcoin mining industry, with major economic changes and evolving market dynamics. Miners have faced a roller coaster of economic changes, performing strongly at the beginning of the year until Bitcoin's fourth halving event, when hash prices subsequently fell to an all-time low. Despite these fluctuations, large miners have remained steadfast in their growth trajectory, and the post-halving economic downturn has spurred a wave of M&A activity in the field as miners seek to consolidate and benefit from scale.

In addition, the convergence of artificial intelligence (“AI”) and high performance computing (“HPC”) trends with Bitcoin mining presents an opportunity for miners to allocate capacity to meet the emerging and ongoing exponential demand curve in AI/HPC. As the report title suggests, the value of a gigawatt has grown significantly as competition for land and access to power has intensified among Bitcoin miners, hyperscalers, and others. Those with a near-term path to energyization will be uniquely positioned to capitalize on trends in both industries.

In this report, we take a deep dive into the changing landscape of Bitcoin mining, beginning with an overview of the current state of mining economics, and then expanding on key post-halving themes such as the changing capital markets landscape, the massive demand for power capacity, increased M&A activity, and projected hash rate growth in the second half of the year.

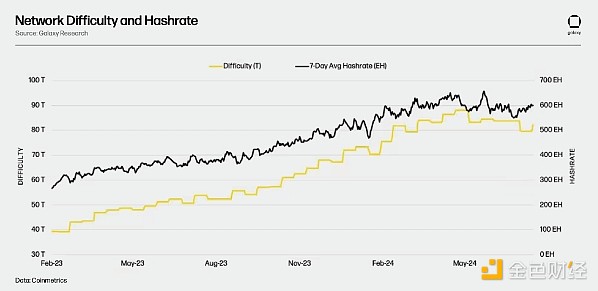

From a peak level of 88.1 T (630 EH implied hashrate), difficulty fell 10% in early July to a post-halving low of 79.5 T (569 EH implied hashrate) as hashrate hit a new all-time low. As of this writing, difficulty is 82.0 T (587 EH implied hashrate).

In Q1 2024, public miner peers raised a total of $1.8 billion in equity, the highest amount raised in a quarter in the past 3 years.

While miners have been raising capital through equity offerings in recent months, we expect debt capital markets to re-emerge in the second half of 2024 and into 2025 as the value of available power capacity soars.

Miners that have large-scale power capacity approved, have procured long-lead infrastructure, and have access to water and fiber are best positioned to take advantage of the AI revolution.

In our annual report, we estimated a hash rate target range of 675 EH to 725 EH for the end of 2024. We are now revising growth upwards to between 725 EH and 775 EH, combining public miner information, seasonal trends, and profitability analysis.

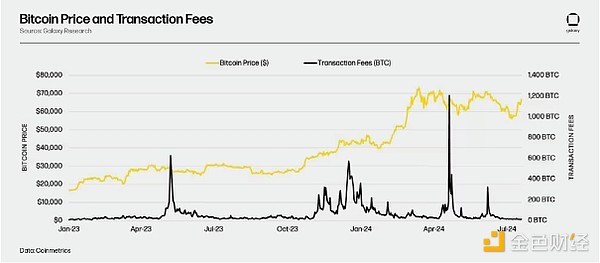

From January 1, 2024 to July 23, 2024, Bitcoin miners generated 12.97k BTC ($863M as of July 23, 2024) in transaction fees. Miners earned approximately 55% of the total fees in 2023 (23.4k BTC).

Year-to-date, over $460M has been transacted in various transactions, primarily split between site sales, reverse mergers, and company acquisitions. We expect M&A activity in the sector to continue in the future.

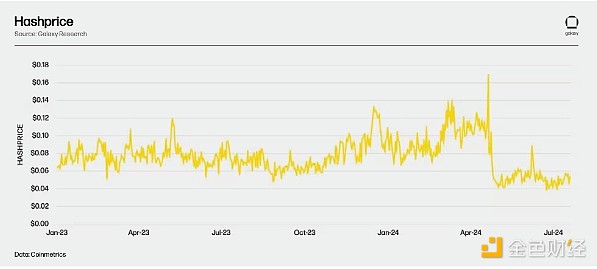

The first half of 2024 can be described as a tale of two quarters. In Q1 2024, miners enjoyed their best economics in the past two years. Driven by the rise in Bitcoin prices, the hash price averaged $0.094/TH during the quarter. The hash rate continued to climb steadily during the quarter to offset some of the gains in Bitcoin prices. Strong profitability in Q1 2024 is necessary to build cash balances before Bitcoin’s fourth halving in Q2 2024.

The mining economy remained strong in the second quarter until Bitcoin’s fourth halving. At the time of the halving, the much-anticipated launch of Runes triggered a storm of transaction fees for several days. In the week following the halving, miners generated significant transaction fee revenue, which we will explore further in the next section.

The transaction fee surge pushed the hash price up to $0.17/TH in a very short period of time, reversing the impact of the block subsidy reduction. Recall that hash price is the metric preferred by miners to extract total revenue per terahertz of computing power per day. However, the surge was short-lived and was followed by a record low in hash price after transaction fees stabilized. Since the halving, the hash price has averaged $0.054/TH.

Difficulty fell 10% from a peak of 88.1 T (implied hash rate 630 EH) to a post-halving low of 79.5 T (implied hash rate 569 EH) in early July as hash rate hit a record low. As of this writing, the difficulty is 82.0 T (implied hashrate 587 EH).

At current hash price levels, a significant portion of miners in the network remain profitable, but only marginally. Some miners who are on the sidelines may continue to operate as they can generate positive gross profits. However, when considering operating expenses and additional cash costs, many miners find themselves unprofitable and slowly running out of cash. Strong economic conditions in the first quarter of 2024 helped build cash balances, which extended the survival of inefficient miners. Without a significant increase in Bitcoin price or transaction fees, we expect that miners that are close to profitability will exit the network if the hash price falls further.

Even if this happens, downward pressure on the network hash rate due to unprofitable miners shutting down machines will be offset by the activation of a new generation of application-specific integrated circuits (ASICs). The new generation of machines has more than double the nameplate hash rate of previous generations. Seven of the top ten public miners by market capitalization collectively expect to add 109 EH of new mining machines in the second half of 2024.

As we analyze at the end of the report, we believe that the hash rate will rise significantly in the second half of 2024 despite the recent halving. If Bitcoin price does not rise, this will create headwinds for miners.

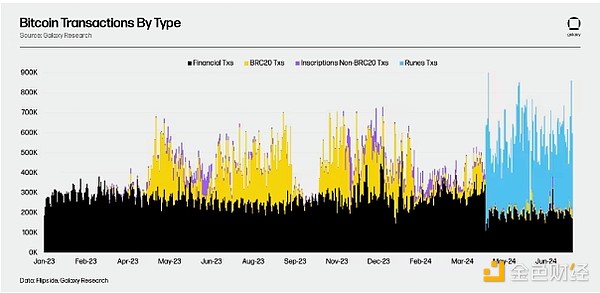

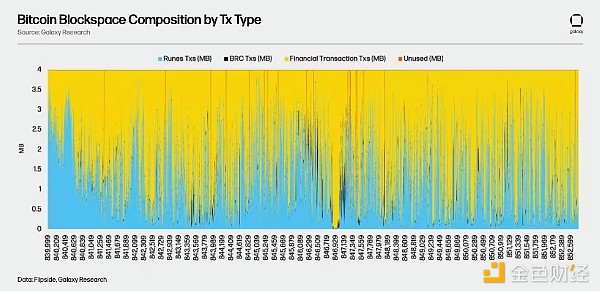

Since January 1, 2024, Bitcoin has facilitated over 99 million on-chain transactions. Of these 99 million transactions, 50% are standard transactions, which we define as financial transactions. Runes, BRC-20, and Ordinal transactions account for 35%, 11%, and 4% of the volume, respectively. The 35% market share of Rune-related transactions in total volume is significant considering the launch of the fungible token protocol on April 19, 2024. Since its launch, Runes have accounted for an average of 63% of all Bitcoin transactions.

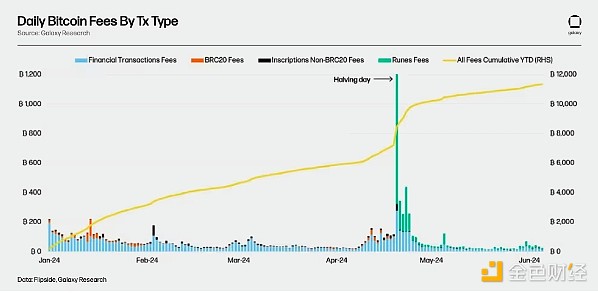

From January 1, 2024 to July 23, 2024, Bitcoin miners generated 12.97k BTC ($863 million as of July 23, 2024) in transaction fees. Miners earned about 55% of the total fees in 2023 (23.4k BTC). Bitcoin's fourth halving occurs on April 19, 2024, making 2024 a milestone year. On the day of the halving, daily fees paid to miners surged to an all-time high of over 1,200 BTC. This surge was largely due to the launch of Runes, a new UTXO-based fungible token protocol that debuted on the halving block. On this block, the Rune token XXXXFHUXXXXXX paid $23 million in fees, becoming the first Rune set included in the halving block (block 840,000). Notably, 2,411 BTC (19%) of fees generated year-to-date came from the halving day and the three days that followed.

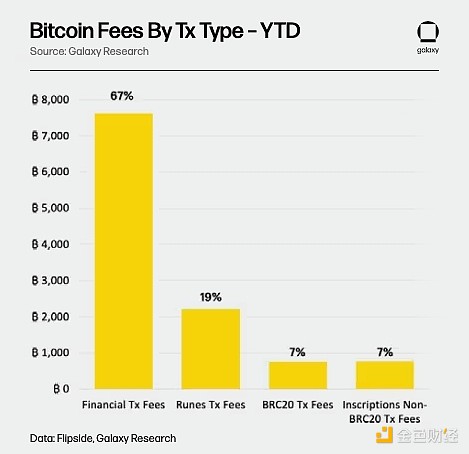

Since January 1, 2024, 67% of miner fee revenue has come from standard financial transactions, while 19% has come from Runes. BRC-20 and Ordinals transactions together account for 14% of Bitcoin fees year-to-date.

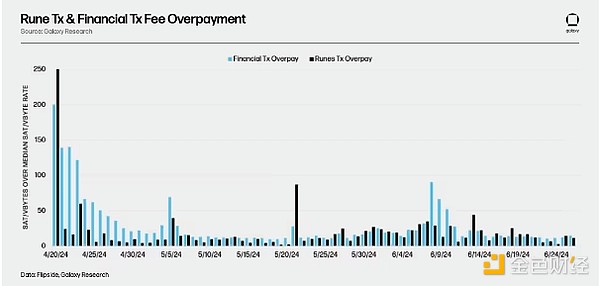

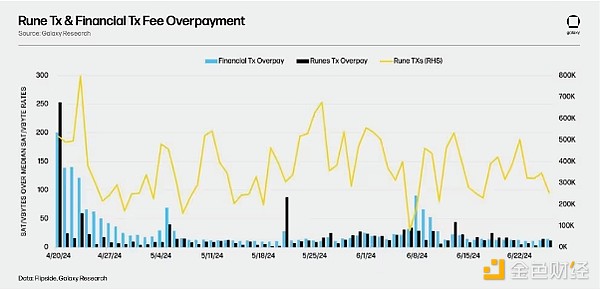

"Overpayment" refers to the fee amount (in sats/vByte) of a transaction in a block that is higher than the median sats/vByte in the same block. We choose the median sats/vByte level because we believe that if you are a high time preference user, bidding around this level will give you a reasonable chance of being included in the next block. Transactions that intentionally set higher sat/vByte rates are usually time sensitive. Transaction fees spiked significantly during the fourth Bitcoin halving on April 20, 2024 (UTC). The daily median fee rate reached 590 sats/vByte, and within an hour of the halving block, the average median block fee rate surged to 1,840 sats/vByte. Rune-related transactions paid 250 sats/vByte above the median sats/vByte level for the day (42% above the median sats/vByte) to be included in the halving block and several blocks after. During the same period, Standard Finance transactions paid 200 sats/vByte above the median sat/vByte (34% above the median sat/vByte). Since the halving, Standard Finance transactions have paid 51 more days than Rune transactions in fees, while Rune transactions have paid 18 more days than Standard Finance transactions in fees.

Overlaying the daily number of Rune transactions with the above graph, we find that surges in Rune transactions are positively correlated with surges in financial transaction overpayments. Time-sensitive financial transactions are forced to compete with Rune transactions for block inclusion. While there are days when Rune transactions surge and Rune transactions overpay for block inclusion, these are considered outliers associated with specific Rune token mints.

Analyzing the block-by-block data shows that the frequency of standard financial transactions and Runes transactions differs within a 10-minute interval. Since the halving block (block 840,000), financial transactions have averaged 2.4 MB per block, while Runes transactions have consistently occupied about 1.5 MB of block space. Although Runes is a more efficient alternative token standard than BRC-20 (average 0.06 MB per block), the dominance of Runes over BRC-20 in block space highlights the market preference for the Rune token standard. In the halving block, Runes transactions consumed 2.7 MB, accounting for about 68% of the total space in the 840,000th block.

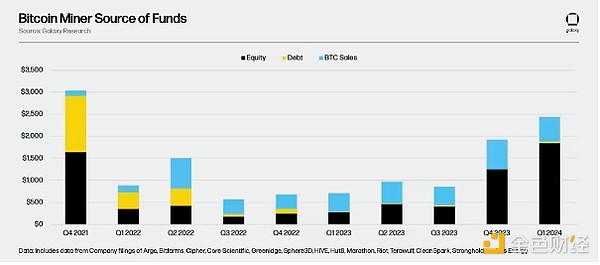

In the first half of 2024, miners raised unprecedented funds. Since Q4 2023, when valuations began to surge in anticipation of spot Bitcoin ETF approvals, miners have continued to raise capital (mostly equity) to rapidly scale up ahead of the halving. In Q1 2024, miners raised a total of $1.8 billion in equity, the highest amount raised in a single quarter in the past 3 years.

Before the halving, miners have actively raised funds to fund rapid growth, hold Bitcoin, improve mining machine efficiency, and build cash buffers to take advantage of opportunities in difficult times. Of the $1.8 billion raised, 75% came from the top three miners by market cap: Marathon, CleanSpark, and Riot. The launch of new generation machines at attractive prices by Bitmain and MicroBT has further heightened the sense of urgency to build out capacity and plug in machines as quickly as possible to generate a strong return on investment (“ROI”).

As shown in the above chart, debt capital has largely disappeared from the market since mid-2022. Previously, the debt financing options available to miners were primarily centered around staking ASICs. The challenges with ASIC-backed financing are the volatility of ASIC pricing, the rapid depreciation of collateral, and the absence of margin calls in many contracts. When mining conditions deteriorate, not only do machines generate less cash flow, but their value also declines, putting lenders in a precarious position as LTV rises and miners are unable to repay outstanding debts.

However, as the value of available power capacity surges, we expect lenders to re-enter the market in the second half of 2024 and into 2025. The insatiable demand for power capacity from Bitcoin miners and hyperscalers (i.e., large data centers with scalable cloud infrastructure) has driven up the value of available energy capacity. From a lender’s perspective, underwriting debt for miners with access to large-scale power capacity in a favorable position can provide insurance in the event that mining economics deteriorate. Additionally, during 2022 and 2023, miners are focused on strengthening their balance sheets by reducing outstanding debt and creating leaner cost structures. As a result, we believe the industry is now in a better position to take on some debt rather than relying solely on issuing equity for growth.

Power assets are still in a price discovery period. Recent asset sales have occurred across a wide range of prices per MW, but have generally trended upward. From a miner’s perspective, leveraging the rising value of their sites may be attractive at the project level as a non-dilutive alternative and a differentiation from peers that continue to dilute shareholders as their primary source of capital. Focusing on generating free cash flow and creating a lean structure, while potentially combining debt with cash flow sweeps, can allow miners to grow in a capital-efficient manner. Expansion into AI and HPC can also open the door to new sources of debt capital not available to pure miners. Even as debt opportunities grow, the “arms race” for expansion continues, and we expect large-scale equity financing activity to continue through the second half of 2024. Valuations of publicly traded miners have risen, driven by ambitious growth targets, the prospect of future Bitcoin price increases, and the AI/HPC narrative. These higher valuations help miners reduce dilution to shareholders from equity issuances. With large public miners announcing ambitious goals, expansion and funding activity doesn’t look like slowing down, even as hash prices remain near historic lows.

Miners are riding the crest of a growing trend at the convergence of Bitcoin and AI/HPC. Given the non-linear correlation of operating costs to BTC price, miners remain thinly profitable and remain well-positioned to benefit from a continued bull run in Bitcoin price. Meanwhile, generative AI is one of the fastest growing technologies in history. ChatGPT, for example, had 100 million users in its first two months after launch, making it the fastest growing application in history. Combined with the fact that AI model training and inference require an order of magnitude more power than traditional data centers use (a single query of ChatGPT requires 10 times the power of a Google search), the AI arms race has created a staggering need for reliable access to power at short notice.

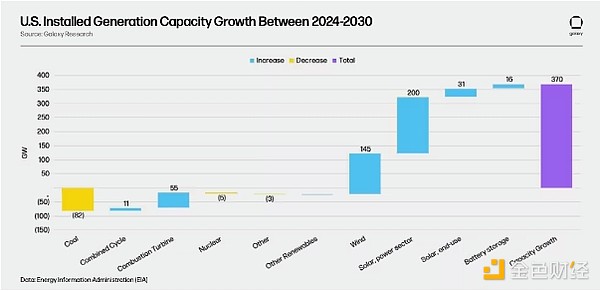

Global data center demand is expected to grow 160% by 2030. In the United States, data center demand is currently estimated at 21 gigawatts ("GW") and is expected to grow to 35 GW by 2030. Installed power generation capacity in the United States is expected to increase by approximately 370 GW over the same period. However, as shown in the above chart, the U.S. Energy Information Administration (“EIA”) projects a net decrease in dispatchable generation sources (coal, natural gas, nuclear, etc.), which means that non-dispatchable, intermittent generation sources (wind, solar, etc.) will largely fill the expected supply-demand gap. Therefore, if converted to terawatt hours (TWh), the expected increase in generation is 240 TWh, while new data center load (assuming 99.995% uptime) is expected to increase by 123 TWh (14 GW/1000 * 8,760 hours/year * 99.995%). The increase in intermittent generation sources, combined with the growing demand from inflexible data center load, could lead to grid congestion, transmission constraints, and supply shortages as load growth from other industries such as electric vehicles and domestic industrial manufacturing is expected. This could lead to further delays in load interconnection studies, approved go-live schedules, and facility agreements as grid operators evaluate the relationship between the rapidly growing electricity demand in the United States and the growth in generation. In a recent interview with the Dwarkesh Podcast, Mark Zuckerberg noted that gigawatt data centers do not exist yet and that “it’s all about securing energy,” which is the biggest bottleneck in the race for AI supercomputers. The race for power capacity is on, and Bitcoin miners with large-scale power, contiguous land, water, and fiber connections are best positioned to take advantage of this megatrend. While there are many differences between Bitcoin mining and AI data centers, miners are best positioned to enter the AI/HPC data center market from a time-to-market perspective. Most of the core electrical infrastructure, from high-voltage substation components to downstream medium- and low-voltage distribution systems, is similar to that used in traditional data centers. Some electrical components, including main power transformers and gas circuit breakers, have very long lead times, giving miners who procure these assets a competitive advantage over new entrants who face 3-4 year procurement times.

Miners own the land and electrical infrastructure needed to build the next generation of the world’s largest data centers. Data center developers and hyperscalers will likely begin bidding on these campuses to secure large-scale power quickly. This trend is just beginning, with CoreWeave’s $1 billion acquisition of Core Scientific an obvious first mover. As the traditional data center market and colocation providers become increasingly saturated, hyperscalers will be forced to push boundaries and move further into secondary and tertiary markets.

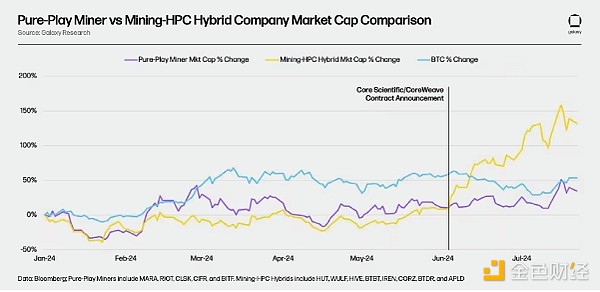

Miners began to dabble in AI/HPC in 2023, but the June 2024 CoreWeave and Core Scientific 200 MW colocation deal caught the industry off guard. Prior to the AI boom, the value of these “mega sites” owned by large miners lay purely in their Bitcoin mining potential. However, the impact of the CoreWeave deal on Core Scientific’s share price proves that miners can benefit from AI upside. The chart below shows that miners who have taken steps to adopt a hybrid mining/AI approach have benefited significantly compared to those who remain focused on a pure mining strategy.

This advantage exists because the economics of AI/HPC contracts are strong as of now. If you boil it down to a dollar/MWh ("$/MWh") figure, the latest generation of Bitcoin mining machines produces about $125/MWh (at a hash price of $0.053/day for an S21), and fluctuates with the movement of the hash price. Assuming electricity costs of $40/MWh, the gross profit per MWh is $85/MWh. In contrast, as part of the Core Scientific/CoreWeave deal, CoreWeave is willing to pay a fixed $118/MWh, plus pass-through electricity costs of 280 MW (graphics processing units (“GPUs”) + IT and mechanical cooling infrastructure) for Core Scientific to provide hosting services, even after paying for the majority of the CapEx investment.

If the market continues to reward miners that pursue AI/HPC opportunities, we believe there will be fewer pure Bitcoin miners with large farms in the future, especially if hash prices remain low.

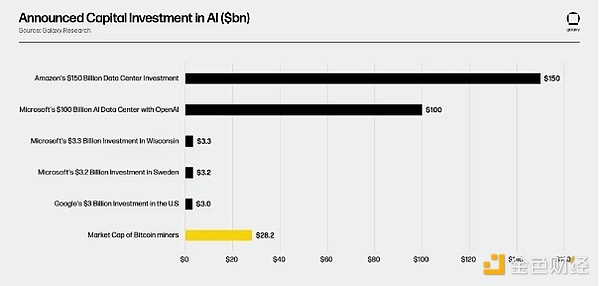

As of July 22, the total market capitalization of the companies in the above chart (pure miners + hybrid miners) is $28.2 billion. When you compare this number to the capital pouring into AI, as shown in the chart below, it is hard to imagine that well-positioned miners will not turn to hybrid approaches in the future. As computing demand grows, hyperscalers including Amazon, Microsoft (Stargate, Wisconsin, Sweden), Google, and others have announced plans for massive growth in AI in the coming years.

Some Bitcoin miners are already benefiting from AI. However, until miners prove they can build and operate these data centers at scale, they will continue to undercut pure data center providers.

Throughout 2024, Bitcoin miners have been involved in a large number of M&A transactions. As predicted in our previous report, the M&A trend has remained consistent. Miners are increasingly vertically integrating by acquiring sites to increase input control. To date, over $460 million has been transacted across various transactions, primarily split between site sales, reverse mergers, and company acquisitions. Record low hash prices and steep ASIC efficiency curves are forcing miners to adopt a more strategic approach to achieve higher operational excellence. Some of the motivations for large-scale M&A observed in 2024 include:

Vertical Integration:The asset-light era is fading. Previously, miners would host their entire fleet of mining machines at a fixed power price, sacrificing the flexibility to optimize operations for cost-efficiency. With post-halving hash prices hitting record lows, this has forced miners to vertically integrate more than ever before, enabling them to manage the dismal hash price conditions and declining mining economics through economic cuts or reduced operating overhead. In 2024, over 1.1 GW of power access has changed hands, indicating increased control of miners over their operations. Public miners invest approximately $404,000 per MW for power access, covering both current and future needs.

Business Consolidation:The public mining sector has seen notable transaction types, highlighting reverse mergers, as many mining operations were previously sustained by traditional fixed-rate agreements that are no longer economically viable, sparking widespread consolidation.

Diversification:2024 is the year to seek synergies through diversification, whether it is geographic expansion into emerging markets with lower energy costs or diversifying revenue streams outside of mining. For example, Bitdeer’s acquisition of ASIC design company Desiweminer embodies this strategy, acquiring in-house expertise to drive the launch of their proprietary ASICs, enabling them to gain another revenue stream outside of Bitcoin mining.

For miners that do not upgrade their mining machine efficiency or are unable to adjust costs after the halving, we may see an erosion of liquidity, depleting their capital reserves as they seek an exit or wait for acquirers to take advantage of their plight. If hash prices remain below $0.06/TH for an extended period, we could see an increase in the number of distressed products, as was the case in late 2022. At this hash price level, there is little room for profit beyond the price of electricity, let alone taking into account associated operating expenses, depreciation, and any outstanding interest. For example, at current hash price levels, some of the most popular previous generation machines, notably the Antminer S19j Pro, generate USD/MWh revenue of around $70/MWh. At an average electricity price of $60/MWh, there is little room to factor in all the other associated costs when addressing a miner's bottom line.

Despite the shaky financial position of some miners, miners with power assets could become attractive acquisition targets. The demand for power in the high-performance computing sector continues to grow. For example, hyperscalers face a shortage of power capacity relative to the demand for their services and are willing to pay a significant premium to do so. Earlier this year, Amazon Web Services purchased capacity for $677,000 per MW, well above the average mining transaction cost per MW in 2024. Asset-intensive miners act as a proxy for power access, as grid interconnection schedules within the U.S. remain tight and demand for AI remains strong. It will be interesting to see how many power connections the hyperscalers are prepared to bid for.

Access to affordable capital remains a challenge for smaller private miners. Even as debt markets reopen, debt coverage rates may remain inadequate. These miners may consider a reverse merger with a public company to take advantage of the market offering.

The factors that influence a company’s market value are constantly changing, and choices can be made when narrowing down the attractiveness of targets. This choice is primarily driven by changes in the power market, the premium given to public companies based on their strategies, and access to capital. Evaluating desirable targets can sometimes look like a cat-and-mouse game, trying to understand market value and anticipate waves of demand. Here is a list of some of the characteristics that make a target attractive:

Readily Available Capacity:Miners that not only have existing power capacity, but also a healthy pipeline of approved power and a clear path to power on may be attractive; “lip service” won’t work. The same is true for smaller miners that can’t reach scale, can’t upgrade their fleet, or are operating barely profitably, but have valuable power assets that could realize higher profits by deploying more efficient machines or moving to AI/HPC.

Contracted Predictable Revenue:Letters of Intent (“LOIs”) and term sheets don’t boast of stability. Miners that have contracted revenue for a certain period of time receive ongoing cash. Given the speculative nature of mining economics, miners are inherently subject to the volatility of hash prices, so diversifying revenue sources is a smart move.

Previous Generation Fleets:When considering ASIC price speculation, many miners with less efficient fleets can sell their ASICs at a discount relative to some of their peers with more efficient fleets. This can make the $/TH price attractive, providing a good price entry point for ROI on these secondary machines. Whether you want to mine (at a low cost) or speculate on resale, some machines from previous generations (30 j/TH) are selling at very attractive prices. While this may not be accretive in the context of achieving high multiples, it can provide a quick payback while keeping optionality for future fleet upgrades.

Essentially, some miners can become valuable targets for companies with high computational needs to quickly acquire scalable power. This is especially true for miners that have large interconnect agreements, a pipeline of power infrastructure growth, and ample headroom. Having this trifecta can increase the $/MW premium that miners can earn from selling such capacity. As demand for computational power continues to grow, we will be excited to see how this will impact the valuations of miners and their attractiveness as investment prospects.

In our annual report, we estimated a range of hash rate targets for the end of 2024 of 675 EH to 725 EH. We are now revising growth upwards to between 725 EH and 775 EH. To arrive at our revised estimate, we looked at a subset of public miners and their hash rate targets to see what we know is plausible likelihood of coming online this year and extrapolated that to the rest of the network. We also analyzed historical hash rate seasonality as an additional benchmark. To complete the analysis, we analyzed network breakeven points to validate the range.

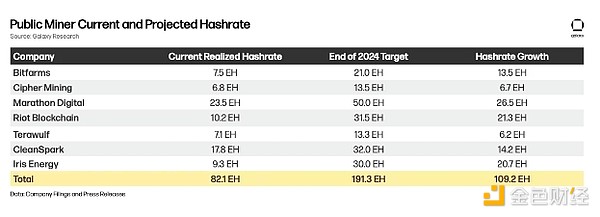

First, we will look at public miner hash rate growth in the second half of 2024. In the first half of 2024, public miners enter large-scale purchase orders for new generation machines, aided by soaring valuations and huge capital raised in the stock market. The table below summarizes the achieved hashrate numbers for a subset of public miners in June, their year-end 2024 targets, and the implied hashrate growth for the second half of 2024. In aggregate, assuming each public miner hits their stated targets, these public miners are expected to generate 109 EH of incremental hashrate, which translates to ~18% of the network hashrate growth from just 7 miners.

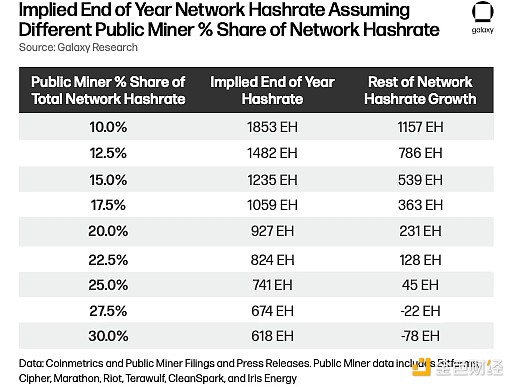

Next, to estimate the growth of the rest of the network, we analyzed the trend of this subset of public miners’ hashrate relative to the rest of the network. As shown below, historically, this subset of public miners has accounted for 11%-13% of the network. An oversimplified way to do this is to divide 109 EH by 13% to arrive at a remarkable 838 EH growth for the rest of the network. However, this assumes that public miners will continue to hold 11-13% of the network. The scenario table below shows what the year end hashrate would be if we changed the public miners’ share of the year end hashrate and assumed a current network hashrate of 587 EH, a public miner hashrate growth of 109 EH, and a current public miner share of 13% of the network hashrate.

We estimate that public miners' share of the network will be closer to 15%-30%, with a benchmark of 25%. This is because public miners have access to US capital markets and are able to raise significant funds in the first quarter of 2024, a huge advantage over private miners. At a 25% share of hashrate at the end of the year, this would mean a total network hashrate of 741 EH, and would also mean that the rest of the network would add 45 EH of growth in the second half of 2024.

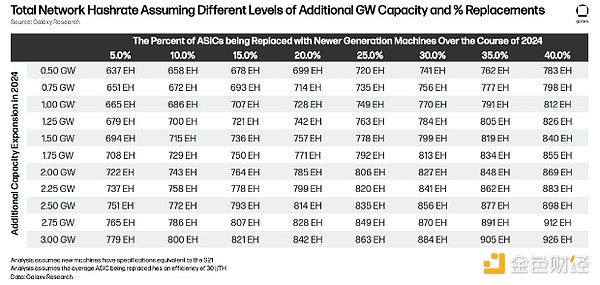

So strictly from a public miner perspective, this puts our baseline for hashrate growth at 741 EH. We expect a significant amount of additional hashrate to come online in the second half of this year, which we believe is feasible through both machine replacements and net new capacity coming online. Recalling the analysis we performed in our last annual report, the sensitivity table below shows what the network hashrate would be under different combinations of network replacement percentages and additional GW of capacity expansion. We start with a network hashrate of 587 EH, assuming new machines inserted have an efficiency of 17.5 J/TH and machines replaced have an efficiency of 30 J/TH.

We assume S21 deployment in the table above, but looking beyond 2024, the table highlights the impact on network hashrate of simply replacing older generation machines with newer generation machines. Coupled with announcements from new ASIC manufacturers suggesting Bitcoin mining ASICs could achieve efficiencies of 5 J/TH next year, this would provide another meaningful boost to network hashrate in 2025.

The next section of our analysis looks at historical hashrate trends through the summer and into the end of the year. As shown in the chart below, hash rate typically stabilizes during the summer months of July to September. This is likely due to the increasing proportion of the network located in Texas and the Middle East, where miners have had to throttle due to high temperatures. Additionally, miners in Texas are constrained due to price volatility, avoiding four coincident peaks (“4CP”), and participating in demand response programs.

After the summer, the network hash rate begins to surge as uptime increases, the need to throttle decreases, and miners plug in new machines. Public miners are expected to increase hash rate significantly in the second half of the year, and we expect a similar dynamic this year, with a slight increase in network hash rate during the summer, followed by a rapid acceleration towards the end of the year.

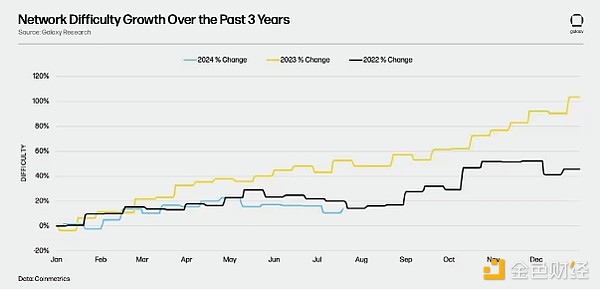

Network difficulty in 2024 follows a similar growth trajectory as 2022 and 2023. The difficulty in 2024 follows the trend in difficulty in 2022. In 2022, the difficulty increased 14% from September to the end of the year from October. In 2023, the difficulty increased 29% from September to the end of the year. If we apply these growth rates to the current network hash rate of 587 EH, it implies a range of 670 EH to 760 EH. While the targets we previously received from public miners are at the higher end of this range, it gives us confidence in the feasibility from an infrastructure build perspective.

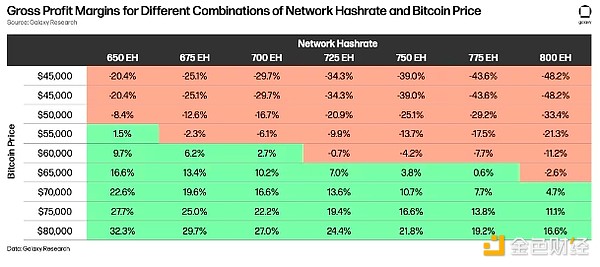

The final analysis is to understand the implied hash price based on our target hash rate to understand how economically sustainable the network is. Several variables affect this sensitivity analysis, including Bitcoin price, transaction fees, average network electricity prices, and network efficiency levels. Given the volatility of transaction fees, we assume they remain constant at 10% of the block subsidy (0.3125 BTC) per block.

For the average network electricity price, we analyzed the recent downward trend in hash rate to understand where the marginal unit of electricity price is. After the halving, the network adjusted downward by 5.62%, and the hash price fell to $0.052. Using Coinmetrics’ MINE-WATCH, the estimated average network efficiency is 33.3 J/TH, which translates to an average network electricity price of $65/MWh.

As the network hash rate grows, the mix of machines will become increasingly efficient. Therefore, we assume a 20% improvement in network efficiency (lower J/TH), which brings the efficiency to 26.6 J/TH. At these efficiency levels, the breakeven hash cost for the network would be $0.041/TH if the electricity price remained constant at $65/MWh. Hash price quantifies the revenue per terahertz of computing power, while hash cost shows the total energy cost per terahertz. If we consider Bitcoin price and network hash rate, and assume transaction fees are fixed at 10% of the block subsidy, the chart below shows the average gross profit margin for the network. Assuming Bitcoin price remains in the $65,000-70,000 range, the network can still support a hash rate of 741 EH, further confirming that these levels are economically sustainable.

In summary, based on the growth target information we received from public miners, seasonal comparisons to previous years, and economic analysis, our preliminary hash rate target is 741 EH. Due to the uncertainty of machine deployment, we created a range of 725 EH to 775 EH around this number. We recognize that there are many factors that could cause deviations from this range. On the upside, improving mining economics and faster-than-expected machine releases and deployments are two factors that could take us past 775 EH. On the downside, further deterioration in hashrate or a significant capital shift from Bitcoin mining to AI/HPC could slow growth.

The first half of 2024 marks a defining period for the Bitcoin mining industry, one that has seen significant economic challenges and groundbreaking developments. Despite record low mining economics, the industry has shown remarkable resilience and adaptability in the face of historically low hash prices and high electricity demand.

The convergence of AI/HPC with Bitcoin mining means that many companies are looking to capitalize on the industry’s strong, uncorrelated economics in a transformative new endeavor.

With the growing demand from AI/HPC data centers and miners, power supply is now a clear bottleneck. Miners with large amounts of power are therefore well-positioned to come out on top, and it will be critical for these miners to remain flexible in the future and allocate megawatts of capacity in a direction that maximizes shareholder returns.

Only one region has seen an increase in crypto adoption- but how sustainable is it?

Clement

ClementAccording to DTCC’s spokesperson, appearing on the list is not indicative of an outcome for any outstanding regulatory or other approval processes.

Catherine

CatherineBlackRock has agreed to pay the $2.5 million fine in a bid to resolve the charges brought forth by the SEC.

Kikyo

KikyoRecent transfers of substantial digital assets from #FTX and #Alameda wallets to #Binance and #Coinbase have sparked speculation about potential asset sales, amid concerns over the upcoming Bitcoin ETF.

Brian

BrianBlockFi has made an announcement of significant importance, allowing the submission of withdrawal requests from both US and international users.

Catherine

CatherineThe transferred assets underwent a two-step process, initially being moved to a holding wallet before eventually reaching the centralised exchanges.

Davin

DavinPEPE memecoin has outperformed SHIB and DOGE, surging with a record-breaking token burn and newfound investor confidence

Jasper

JasperTelegram bot Maestro, known for providing crypto trading tools for traders directly on Telegram has been compromised with more than $500k stolen

Aaron

AaronThe World Bank has issued a €100 million digital bond on Euroclear's blockchain platform, marking the debut of Euroclear's Digital Securities Issuance service.

Jasper

JasperRicardo Salinas advocates for Bitcoin as an inflation-resistant alternative to conventional banks.

Hui Xin

Hui Xin