A quick look at Blast's fifth "Gold Points" plan

Blast’s fifth distribution will give away 10 million gold points to Dapps. This is the last gold point distribution before the Blast airdrop on June 26th.

JinseFinance

JinseFinance

Author: Zack Pokorny, Galaxy; Translator: Tao Zhu, Golden Finance

This report is the second in a three-part series that dives into the risks and rewards of staking, re-staking, and liquidity re-staking. The first report provided a comprehensive overview of how staking and pledge work on Ethereum and the important considerations for stakeholders when engaging in this activity. This report provides an overview of how re-staking and pledge work on Ethereum and Cosmos and the important risks associated with them.

The industry's experiments in scaling blockchains through modularity have led to the creation of many new protocols and supporting middleware. However, each of these networks needs to build its own security moat, usually through a variation of Proof of Stake (PoS) consensus, a resource- and time-intensive process that has led to many isolated security pools.

Re-staking is the use of the economic and computational resources of one blockchain to protect multiple blockchains. In the case of PoS blockchains, restaking allows the stake weight and validator set of one chain to be used on any number of other chains. The result is a more unified, efficient security system that can be shared by multiple blockchain ecosystems.

While it’s not always called “restaking,” the concept has a long history. The Polkadot ecosystem experimented with the idea as early as 2020. Cosmos launched a version of restaking called Replication-Secure in May 2023; Ethereum will enable staking via EigenLayer in June 2023. The majority of the value of restaking protocols comes from staking on Ethereum. Ethereum is the most economically secure PoS blockchain, with over $100 billion in total staked value and over a million validators staking ETH (don’t confuse the term “validator” with validating nodes, as they are not the same in the Ethereum ecosystem). “Economically” is italicized to emphasize the distinction between the economic security of a chain and its overall immunity to attack or manipulation. The level of economic security of a chain does not always indicate the overall security of that chain.

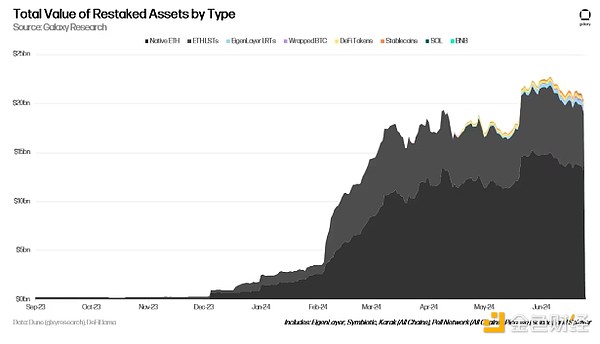

As of June 25, 2024, $20.14 billion worth of assets were re-staked. Ethereum is by far the largest protocol supporting re-staking, with $19.4 billion in re-staked deposits for ETH and its derivatives, of which $18.3 billion was deposited by users in 2024. Notably, $58.5 million was re-staked on Solana via Picasso and Solayer, and $223.3 million in BTC was re-staked on various chains including Bitlayer, Merlin, BSC, etc. via Pell Network and Karak. Below is a chart of the total value of re-staked assets by type for the leading re-staking solutions (EigenLayer, Karak, Symbiotic, Solayer, Picasso, and Pell Network) by total value locked.

An estimated $1.7 billion is also re-staked via Cosmos Hub validators and their re-stacking model known as Replicated Security.

While the benefits of re-stacking for advancing the modular and unified economic security thesis are clear, there are risks associated with implementation that cannot be ignored. This report provides an overview of the major re-stacking solutions built on top of the Ethereum and Cosmos ecosystems. It does not delve into the risks posed by products built on top of re-stacking protocols such as Liquid Re-stacking. This will be the primary focus of the next report in this series.

Here is a list of terms and their definitions that will be used repeatedly throughout this report:

Slashing – A penalty given to validators who fail to complete their work correctly or accurately. In addition to losing a portion of their stake, validators may also be jailed (temporarily removed from the set of active validators) or expelled (permanently removed from the set of active validators) as a supplementary non-financial penalty.

Slashing Conditions – The basis on which a validator is penalized (slashed). This may include double signing, downtime, or other misconduct unique to a particular network.

Liquidity Staking Tokens (LST) – Liquid, fungible tokens that represent illiquid assets deposited by chain validators.

Liquidity Re-collateralization Tokens (LRT) – Liquid fungible tokens representing illiquid ETH, LST, and other assets used as re-collateral.

Node Operators – Entities that run nodes and provide other services for active validation services. This term covers EigenLayer node operators and Cosmos Hub validators for the purposes of this report.

Active Validation Services (AVS) – Any platform that relies on re-collateralized resources for security. Active Validation Services are abbreviated as AVS in this report. This term covers EigenLayer AVS and Cosmos consumer chains for the purposes of this report.

Economic Security – The USD-denominated value of assets staked by validators on the network.

Computational Security – The hardware and software required to validate the network.

Base Network – The network whose staked assets or validator set are used to economically and computationally secure AVS, also known as the “base protocol” or “base chain”. This term can be applied in the context of the Cosmos Hub and Ethereum.

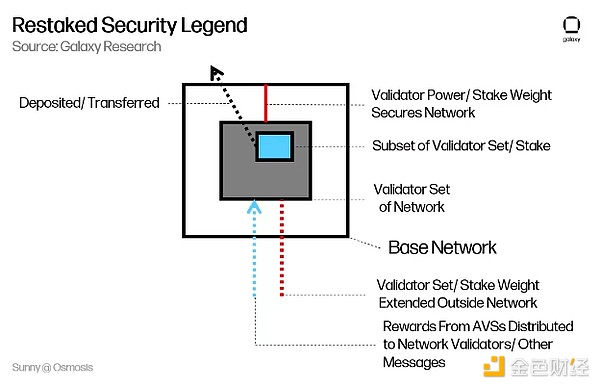

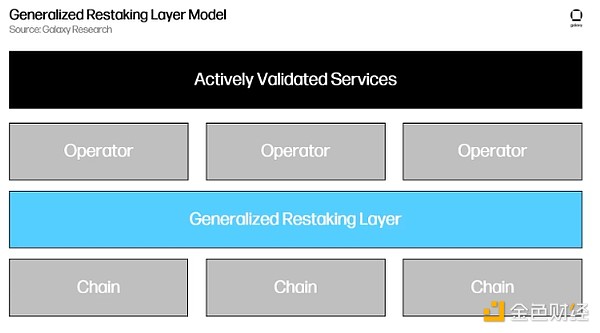

The following illustration is key to understanding the overview of some of the re-staking models covered in the report. It is based on Sunny Aggarwal’s keynote at the 2023 Shared Security Summit.

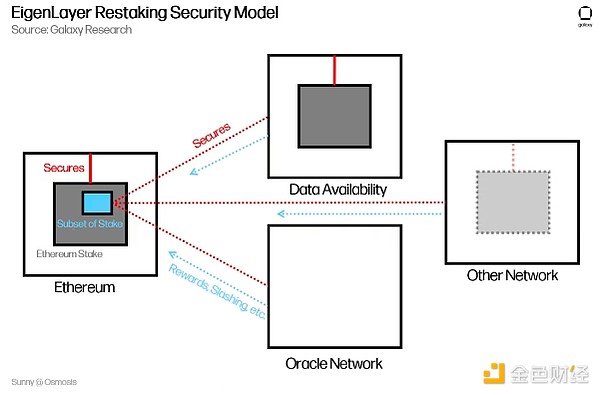

EigenLayer is a set of smart contracts on Ethereum that can be used to restake assets to secure an external service called AVS (Active Validation Service). The smart contract specifies the details of the relationship between node operators and EigenLayer AVS. These details include components such as slashing penalties, reward payments, AVS registration, and validator exit. AVS does not inherit security from EigenLayer itself. EigenLayer smart contracts act as a middleware technology that connects AVS with Ethereum validators and node operators and their underlying staked assets.

The following diagram outlines how EigenLayer re-staking works. Note that EigenLayer is an opt-in system. Not all Ethereum validators (also known as Beacon Chain validators) are required to be EigenLayer node operators, and vice versa; Beacon Chain validators who choose to join EigenLayer can point their withdrawal vouchers to EigenLayer, allowing AVS to cut their stake and pay them rewards, while also assuming the responsibilities of being a Beacon Chain validator.

EigenLayer allows AVS to lease a subset of Ethereum stake, which can be ETH staked natively in a beacon chain validator or LST. AVS may or may not have its own validator set and staked assets. In return, the leased subset of Ethereum stake receives rewards from each AVS for complying with additional slashing conditions. They are in addition to the beacon chain rewards that the beacon chain validator receives directly or accumulates through LST. A single ETH or LST unit can be leased by any number of AVS. However, each AVS adds additional slashing conditions for that unit of value.

At the time of writing, EigenLayer is in the early stages of development and does not enforce any slashing conditions or re-staking rewards. In theory, EigenLayer acts as an open market where AVS can freely purchase economic security from a subset of Ethereum validators, and Ethereum users and node operators can choose the AVS they are willing to secure with their staked assets. This is a feature of EigenLayer that other similar cross-chain staking solutions (i.e. replicated security) do not have. This is a market-driven approach to finding the balance of supply and demand for re-staked ETH with less friction, although today's airdrop may affect it.

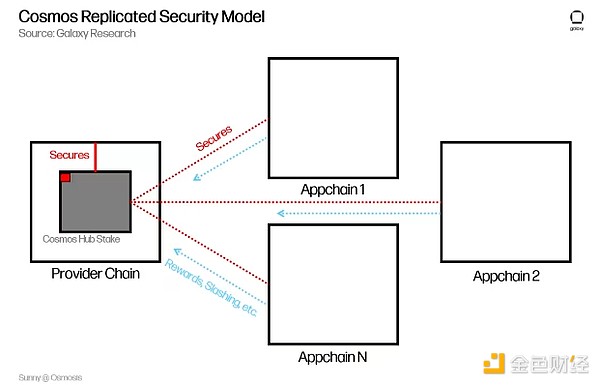

Cosmos's replicated security is implemented by the Cross-Chain Validation (CCV) module, which is located in the application layer of the Cosmos protocol technology stack. Replication safety is implemented by the in-protocol infrastructure of the Cosmos Hub and consumer chains, not by applications on top of the chains themselves. Replication safety relies on light clients, lightweight versions of client software that can run on resource-constrained devices, for the Cosmos Hub and consumer chains. It also relies on the Inter-Blockchain Communication (IBC) protocol to transmit messages about Cosmos Hub validators, their shares, and the rewards they receive from securing consumer chains.

Under replication safety, nearly all Cosmos Hub validators and their stakes (the top 95% of voting power) must secure a consumer chain that passes governance, even if they do not vote to join a consumer chain in the process (hence the term “replication safety”). The Cosmos Hub’s validator set and stake weight are actually replicated across all consumer chains. This is different from EigenLayer’s approach, where re-stakers, node operators, and beacon chain validators voluntarily decide to re-stake to an AVS of their choice. If ATOM stakers do not want their stake to be affected by consumer chain slashing, they can re-delegate their stake to validators outside the top 95%, who may not secure the consumer chain. However, doing so comes with trade-offs and may result in lower ATOM staking rewards for delegators, among other risks. As of June 25, 2024, 113 of the 180 validators in the Cosmos Hub active set are below the 95% threshold.

The following diagram outlines how replication security works; note that it looks similar to EigenLayer, except that the entire ATOM stake (minus the 5% red blocks) secures the consumer chain, and that consumer chains do not have their own sovereign validator set in any case (the Cosmos Hub validators take their place). The Cosmos consumer chain, Stride, uses "governors", validators who accept STRD stakes to vote on governance. However, these governors do not build blocks or validate transactions on the network.

It is worth noting that Cosmos Hub validators run separate software, and in some cases separate hardware, to secure consumer chains with their ATOM stake. Although nearly every Cosmos Hub validator secures every consumer chain, consumer chain transactions are not executed on the Cosmos Hub and do not take up Cosmos Hub blockspace; the blockspace of the base chain and each consumer chain are mutually exclusive.

Partial set security (more information and proposal voting) was introduced as part of the Gaia upgrade, allowing a subset of the ATOM stake to secure a consumer chain. Partial set security is more similar to the EigenLayer model in that Hub validators can choose to secure consumer chains; consumer chains can outline the minimum stake amount required to secure their chain. Partial set security will rely on governance in the first iteration before adding permissionless consumer chain launches. As of June 25, 2024, no Cosmos chain has launched under partial set security.

In addition, a proposal was published in early May 2024 to bring security aggregation to the Hub, starting with BTC. If passed, this would allow Hub validators to receive BTC delegations through Babylon to secure the Hub and its consumer chains, and pave the way for any on-chain asset to be used as economic security through Hub validators.

Generalized Restaking, also known as universal restaking, is a restaking system that pools native assets from many chains in the restaking process. This approach is asset and base chain agnostic as it allows for the pooling of many staked assets across multiple chains. The model is “generalized” because assets can be pooled from many chains. At a high level, generalized re-staking relies on an additional layer or series of contracts that sits between the economic security source chain and AVS, across multiple blockchains. Below is a simplified diagram of how generalized re-staking works.

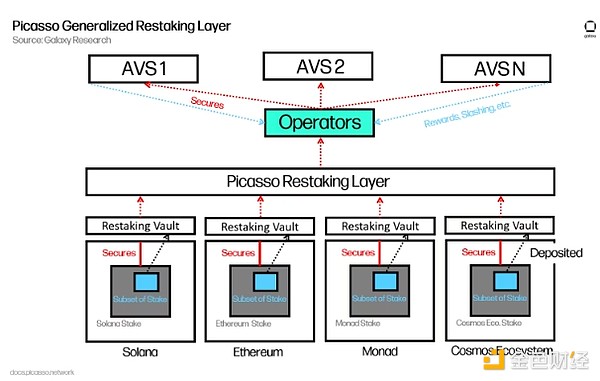

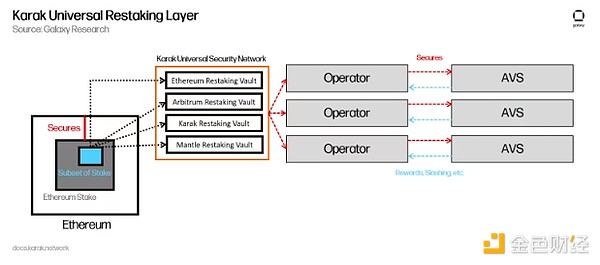

Picasso and Karak are examples of general or universal re-staking platforms.

Picasso is a general-purpose re-staking blockchain built using the Cosmos SDK. It connects base chains to Picasso via IBC. The Picasso chain receives details about deposited assets on the base chain via IBC and then allocates user funds to AVS accordingly. The “Orchestrator” smart contract on the Picasso chain is responsible for allocating user funds to Picasso node operators, registering and deregistering AVS, and a number of other duties. At a high level, Picasso’s re-collateralization solution is very similar to that of EigenLayer, which allows a subset of the network’s staking weight to opt-in to secure AVS. This architecture is replicated on multiple base chains and ultimately pooled on Picasso. Node operators under Picasso are selected through governance. At the time of writing, the re-collateralization layer only accepts deposits from Solana via SOL LST and native SOL as re-collateralization collateral. Picasso’s roadmap includes expansion to Cosmos chains and assets once AVS begin rolling out on Solana. The first AVS was launched in April 2024, which supports IBC connections between Solana and external blockchains.

Karak is a universal re-staking layer that accepts deposits from Ethereum, Arbitrum, Mantle, BSC, and the Karak network, which is built on top of Karak as a universal layer 2 for AVS. It relies on ETH LST as the main collateral asset and is supplemented by stablecoins, Pendle tokens, EigenLayer Liquid Re-staking Tokens (LRT), Liquid Staking BNB, and Wrapped Bitcoin. The LST accepted are either wrapped and bridged from Ethereum, or are native assets of the chains they can be deposited on. It functions similarly to Picasso in that it allows for the pooling and re-staking of multiple assets across multiple networks. Unlike Picasso, which exists as a standalone layer 1 and propagates assets through IBC, Karak is strictly a collection of smart contracts built across multiple chains, including Ethereum layer 2. Karak also accepts a wider range of assets than Picasso, such as stablecoins.

Under any re-staking solution, the benefits of a unified security model also come with risks. The risks of the re-staking model can be categorized by the three main stakeholders involved in the re-staking supply chain. This includes the base layer network, node operators, and AVS. The next section of this report will delve deeper into the risks these entities take on in the context of EigenLayer and Cosmos restaking. End users who delegate assets through restaking solutions are downstream of these entities and therefore inherit all of the risks, the symptoms of which are detailed below.

The security of a base network is derived from the pre-existing staked assets in its chain, which are the same assets used at the time of restaking. Therefore, the main risks of restaking to the base network are slashing events that affect the security of the base chain and the centralization of the base chain’s stake distribution.

Slashing conditions enforced at the restaking layer may negatively impact the security of the base chain and applications on top of it, primarily if the restaking layer’s stake is concentrated in the hands of a small number of node operators. This is particularly concerning for EigenLayer and Ethereum, as Ethereum has a diverse set of applications with a total value locked (TVL) of $41.2 billion as of June 25, 2024 (TVL excluding EigenLayer is $59.3 billion including it). AVS-triggered penalties could significantly reduce the amount of staked assets available to secure the base chain, depending on the relative size of the re-staked assets versus the staked assets on the base chain.

As of June 25, 2024, only about 17% of the total ETH staked on the Beacon Chain has been re-staked, and 98.26% of all re-staked ETH is captured by EigenLayer. The percentage of Beacon Chain deposits re-staked via EigenLayer is 11.93%. Slashing re-staked ETH has the most direct impact on the security of the Ethereum protocol, as these deposits represent collateral directly staked to the Ethereum protocol. This is different from re-collateralized LST, where tokens with the value of the Beacon Chain deposit can be slashed before the underlying deposit itself. Therefore, there is a potential path to slashing LST without changing the security of the underlying chain. More information on this idea will be presented in a future report, focusing on the dynamics of LRT. EigenLayer does not currently enforce any slashing conditions on node operators, so there is little risk of negatively impacting Ethereum's security through re-collateralization. However, this will change when slashing is implemented. Cosmos Replicated Security took a similar approach to limiting slashing penalties when it first launched. The steps taken by EigenLayer in this regard are not unique to the re-collateralization solution.

Under Replicated Security, 95% of the Cosmos Hub stake is used to secure AVS. Therefore, slashing penalties enforced on the AVS layer have a near 1:1 impact on the Hub's economic security. This idea also applies to centralized power on Hub staking, which will be examined later. Unlike Ethereum, the Cosmos Hub does not support smart contracts or the applications they support. However, economic security still plays an important role in protecting the network.

In addition to the basechain security share that is at risk of slashing through restaking, it is also necessary to consider the types of violations that an AVS can perform that could result in slashing.

Not all slashing violations on AVS may be objectively and cryptographically verifiable. The Eigen Foundation proposed this idea in a white paper explaining the $EIGEN token. In the paper, the team explained that intersubjectivity failures (i.e., failures that are not easily verifiable on-chain) in certain AVS (such as oracles) could cause the basechain to split. Enforcing on-chain actions on EigenLayer AVS may require off-chain agreement or social consensus among network observers — a cumbersome process that could result in a basechain fork if node operators widely disagree on the correct state of the AVS.

To address the burden on Ethereum consensus due to inter-subjective faults, validators can use EIGEN tokens to perform inter-subjective slashing via a token fork rather than a base chain fork. This idea was first proposed by Paul Sztorc in 2014 via the Truthcoin whitepaper and has recently been popularized by EigenLayer. It essentially alleviates the need for social agreement between base layer validators by allowing node operators to express their preferences for inter-subjective faults and assertions on the restaking layer via EIGEN tokens.

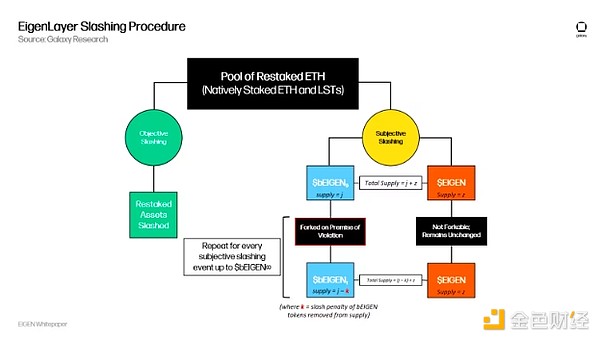

The image below highlights the slashing procedure for EIGEN tokens:

The objective slashing procedure is shown on the left side of the image above. Objective slashing penalties are mathematically and cryptographically provable violations, such as double signing and downtime, that can be verified through the on-chain protocol. For these violations, the re-staked assets can be slashed without general agreement among chain observers. The right side of the figure shows the inter-subjective slashing procedure. Penalties in these cases may require social agreement among chain observers. Through the EIGEN token, node operators can rely on the protocol to slash the staked EIGEN supply instead of the staked ETH. Therefore, there are two "classes" of EIGEN:

1) Raw EIGEN, which can be held in externally owned accounts (EOAs) or used to interact with decentralized finance (DeFi) applications.

2) bEIGEN or staked EIGEN, which can be forked and may be subject to slashing penalties.

Each new fork of bEIGEN results in a reduction in supply, as the slashing penalty manifests as the removal of the slashing violator's bEIGEN from the circulating supply. By slashing tokens and reaching social consensus on the next fork, EigenLayer can more effectively extend Ethereum PoS security beyond its boundaries by limiting the inputs required to Ethereum's base layer. AVS can also replace EIGEN with its own token as the inter-subject token if it wishes. This is a basic explanation of how the EIGEN token and inter-subject slashing work; the precise details can be found in the EIGEN whitepaper.

Under replicated security, AVS is limited to slashing in the same way as the Cosmos Hub. This includes downtime and double signing, objectively verifiable failures leading to jail time, and up to 5% of stake being slashed. This is in part because replicated security requires a supermajority (95%+) of the base layer economic security and validators to secure AVS. Therefore, a collusion by validators to attack the consumer chain would cause the price of ATOM (the Cosmos Hub staked asset) to plummet. This idea does not work with partial set security or EigenLayer's re-staking method, as only a small fraction of the total stake can be used to secure AVS.

Cosmos Hub validators vote on governance proposals to review which AVS can be protected with replicated security. This process vets consumer chains before they can participate in shared security. Once accepted as a consumer chain and launched on mainnet, additional measures are taken to protect the Hub from consumer chain slashing. They include:

1) A governance proposal to review the integrity of AVS's double-signed claims to Hub node operators. This protects the Hub from accepting slash packets sent by malicious AVS, permanently removing honest validators from the network. In the future, Cosmos Hub developers are working to enable AVS to submit slash packets that can be automatically verified by the Hub, rather than through governance. Proposal #818 is an example of this process. In this case, two Hub validators accidentally double-signed on Neutron (the Cosmos consumer chain).

2) Limit or tier downtime slashing penalties so that at a single point in time, at most only 1% of the Hub validator set can be slashed and jailed. This allows the Hub to maintain liveness even in the event of true misconduct at the AVS layer. However, proving downtime cryptographically can be difficult.

3) Limit consumer chains’ influence over slashing parameters. Only Hub validators can outline penalties that consumer chains can impose on their stake and validator set. Doing so ensures that the liveness and overall security of the Hub cannot be threatened by AVS.

Fraudulent voting will be introduced in the next iteration of Cosmos shared security. These governance proposals allow for slashing of validators that perform non-objectively verifiable attacks that stem from properties unique to partial set security (i.e., the subset problem).

Restaking introduces the possibility of slashing based on additional parameters enforced by AVS (rather than strictly enforced by the base chain). This introduces a higher degree of rewards and penalties. However, on the Cosmos Hub, the ability of consumer chains to enforce additional slashing penalties is strictly limited and controlled by Hub validators through governance. On Ethereum, due to the nascent and diverse nature of its restaking solutions and AVS, it is unclear what impact slashing will have on base chain security. Similarly, no penalties are currently implemented on EigenLayer AVS, the largest restaking solution on Ethereum. In the future, it is possible that functionality will be introduced in EigenLayer to support automatic slashing initiated by AVS, resulting in the underlying stake protecting Ethereum being compromised.

The same reasons that drive centralization of stake in base network environments can impose additional centralization pressures through the validation of AVS. This is primarily driven by the revenue and overall profitability earned by node operators (which is tied to the opportunities provided by AVS), their timing of listing, and their ability to scale. Therefore, measures taken to prevent the centralization of stake on the base protocol, whether algorithmically enforceable rules or self-regulatory measures taken by base layer validators, may be circumvented by the introduction of re-staking rewards.

Replicated security is unique in that the Cosmos Hub validator set and native stake are effectively replicated in AVS, and every node operator participating in replicated security runs the same additional services. However, the rewards node operators receive from staking are not equal. Node operators with larger managed stake balances receive higher rewards than those with smaller managed stake balances. While the cost of protecting an AVS is the same for all Hub node operators, the reward is variable and depends on the amount of stake managed. Therefore, Hub node operators with larger managed stake balances have a greater opportunity to offset the cost of protecting new AVS. Smaller node operators face a greater risk of operating at a loss or shutting down operations entirely.

Under the implementation of partial set security and security aggregation, the cost/reward dynamics of running an AVS will change for node operators, as they will be able to choose to protect different sets of AVS. However, this could still result in unequal access to staking rewards for large node operators, as users may choose to delegate additional stake to operators that receive higher re-staking returns than other operators. In these cases, the base layer’s staking distribution could experience stronger centralization pressures than it does today.

Restaking can also put centralization pressures on Ethereum. Some restaking protocols, such as Karak and Symbiotic, do not offer permissionless onboarding of Beacon Chain node operators. In these cases, users who want to re-stake native ETH must do so through a set of permissioned node operators, or users can stake other assets, such as LST, which are already a source of base layer centralization. A restaking protocol that supports permissionless native restaking is better for base layer staking centralization, as it allows anyone to earn restaking rewards at any time without requiring a set of permissioned node operators. EigenLayer supports permissionless onboarding of native staked ETH through EigenPods. Any user can launch an EigenPod to run as a Beacon Chain validator node operator and earn restaking rewards. To do this, node operators must enable the EigenLayer smart contract to enforce additional slashing conditions on their staked ETH. As of June 27, 2024, there are 3.9 million native ETH locked in EigenPods.

Liquid re-staking on Ethereum can also create centralization pressures. LRT applications that accept native ETH deposits as re-staking collateral may centralize Beacon Chain staking in a similar way to LST applications. LST applications incentivize users through higher staking returns and liquidity on native ETH deposits, just like LRT applications. The advantage of LRT over LST is that LRT passes the additional returns of re-staking to users, while LST does not. If LRT applications do not accept native ETH as re-staking collateral, users must stake other assets, most commonly LST, thereby increasing demand for LST and exacerbating the centralization of these liquid staked assets in the base layer.

Risks for node operators are primarily operational and relate to their ability to scale and establish streamlined processes for adding and removing AVSs. Failures in any of these areas could result in reduced staking or an uncompetitive product. Each AVS added by an individual node operator creates additional complexity, cost, and liability for them.

The different types of AVSs also mean that node operators may need unique costs and procedures to support each AVS, making processes and infrastructure difficult to replicate across services. This can result in node operators running dozens or even hundreds of services, requiring unique infrastructure and processes to operate across hundreds to thousands of validators. Ultimately, the diversity of AVSs can make it difficult for node operators to scale and manage operations.

The procedures for removing AVS support are just as important as adding support. This is especially important in the context of re-staking, where AVS churn rates can be high. Ensuring a smooth delisting process is important to avoid being slashed or causing disruption to AVS operations. This is particularly true in cases where node operators use the same servers to run both AVS and Ethereum validator software.

Node operators also face social risks. The addition and removal of AVS directly impacts the returns and risks to end users who re-stake their assets through the re-staking node operator. Communicating details about opting in/out of AVS and notifying end users of actions that may impact their delegated funds is an extremely important responsibility of node operators. Failure to do so could result in a loss of trust from end users, which could harm business and create reputational risk for node operators.

Economic security is shared or centralized under re-staking, meaning that many AVS and base chains have the power to slash the same value that collectively secures them. The risk is that entities outside the protocol could directly impact the security of AVS (AVS to AVS and base chain to AVS), such as the impact of AVS slashing on base chain security. Other AVS and basechain slashing risks include volatility in the USD value of the assets securing the AVS, and their ability to adequately incentivize node operators.

Economic security is measured in USD, and is provided in native units of digital assets (e.g., AVS is backed by $100 million worth of ETH). Fluctuations in the value of the assets securing the AVS affect its economic security. Using higher quality, more liquid assets to secure the AVS is key to mitigating volatility in its economic security. Some AVS may still choose to use more volatile assets for a variety of reasons, such as new user acquisition or ecosystem coordination. The risk of USD volatility is not unique to AVS, and basechains face the same headwinds of volatility in the USD value of the native collateral assets, especially in the early months and years after mainnet launch.

Second, node operators and end users put pressure on AVS to see if they will generate enough “real” value (whether from transaction fees or revenue generated by AVS functionality) to make it profitable enough for node operators to provide services to them. As a result, AVS may choose to launch with an inflationary token to adequately repay the debt owed to node operators. Even so, over time, node operators may decide that they are not receiving enough incentive to continue running certain AVS. This could result in certain AVS not having enough validators and staked assets to protect them, which would negatively impact the security of those AVS.

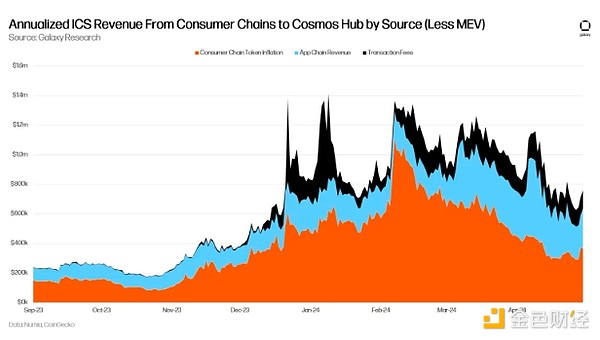

While we don’t know what the incentive landscape will look like through EigenLayer restaking, we have an idea of what Cosmos replicated security (excluding MEV) will look like by April 2024 (at a price of ~$8.75 per ATOM). Galaxy Research estimates that the consumption chain adds approximately 0.04% to Hub validators’ earnings, or $0.003 per ATOM earned by the top 95% of validators by voting power.

Under replicated security, the re-staking dynamics on Cosmos differ from Ethereum in that the market-driven nature of EigenLayer allows the supply and demand of re-staking services to naturally find equilibrium when they are too scarce or too abundant.

Similarly, base chains face the same headwinds in incentivizing participation in security in the early months and years after mainnet launch. However, both of these risks are particularly important for AVS to rely on re-staking solutions because they do not directly own the security they rely on. Depending on the re-staking yield and EigenLayer smart contract functionality, competition between AVS for shared security could be intense and cause validators to frequently re-adjust the set of AVS they support at any given time. This in turn could promote faster turnover of AVS and increased volatility in the economic security of AVS.

There are a few other risks and considerations worth highlighting. These include re-staking and leverage, the impact of airdrops on the re-staking protocol, and the impact of re-staking on asset liquidity.

Re-staking itself is not financial leverage. Rather, it is a more abstract type of leverage that depends on the responsibility and ability of node operators. This is because node operators are penalized based on their behavior and ability to operate under the AVS rules they choose to join, rather than being penalized based on asset prices (e.g. margin calls). This is similar to taking on more and more responsibility at work. The more projects you take on, the more likely you are to make mistakes, get fired, or take a pay cut. However, if you misallocated your company-sponsored 401k and lost all your savings, you would not lose your job.

The basis for penalties for restaking is within the control of node operators, as they voluntarily opted into the slashing conditions and control the hardware/software they run. This is not the case with financial leverage, as individuals cannot control the market that ultimately penalizes them. This is a critical distinction, as the basis for penalties is entirely dependent on the capabilities and behavior of the node operators, and penalties against one node operator do not have an impact on the stake of another node operator (i.e., one validator cannot be slashed for the misbehavior of another validator), as there is a negative feedback loop/daisy chain effect with financial leverage unwinding.

That said, as explained earlier in this report, penalties against node operators can have knock-on effects on the security of AVS and the underlying chain. For example, if 1 ETH protecting three AVS is slashed by one of them, then all three AVS protected by that 1 ETH will have their security negatively impacted. This can make malicious attacks and collusion against AVS and its underlying chain easier to conduct.

Airdrop mining can distort the supply of re-pledged tokens. Points incentivize users to deposit assets into re-pledge protocols independent of the demand for AVS re-pledged securities, increasing the supply of re-pledged assets. Airdrop mining can also negatively impact the design of applications. The fast-paced nature of points and the momentum of the ecosystem may drive developers to launch applications before they are ready to deploy or fully flesh out their intended use. The result may be phantom applications that are not used for a long time, or applications that lack key functionality, such as the ability to withdraw or transfer assets. Eventually, all of these forces driving the inorganic supply of re-pledge will have to be unwound, which could negatively impact asset prices and cause other problems for DeFi products related to re-pledge. Over time, the industry will have a clearer understanding of what the true supply of re-pledge looks like (which is a function of demand), especially as re-pledge protocols deployed on Ethereum and Cosmos become more fully functional.

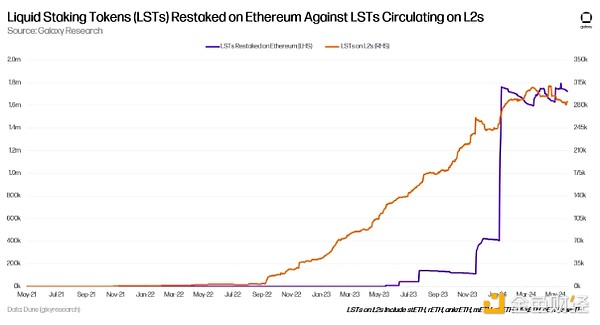

Another consideration in the context of Ethereum restaking is attracting liquidity to Ethereum L1. Ethereum’s rollup-centric roadmap aims to drive L1 activity and liquidity off-chain, but restaking incentivizes activity to stay on or return to L1. This dynamic is emphasized by the restaking protocol and the points program at the LRT protocol level.

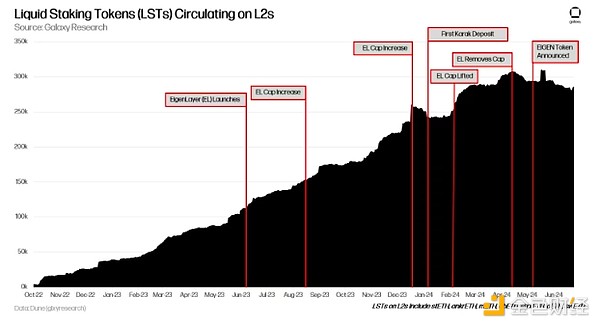

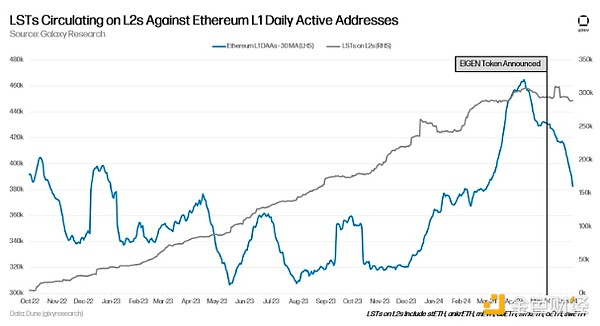

The chart below shows this trend through the lens of LST restaking on Ethereum L1 and LST circulating on L2. The amount of LST on L2 peaked in April 2024 and has been range-bound since February 2024 after 21 months of continuous growth. At the same time, the amount of LST staked on Ethereum L1 has been growing parabolicly.

The figure below tracks the trend of the observed LST over L2 over the entire process, and superimposes the key re-entry events.

With LST liquidity flat on L2 and increasing hype around re-staking applications, daily active addresses (DAA) on Ethereum L1 also reached a 35-month high on a 30-day moving average; indicating that re-staking is attracting users back to L1. The 30-day moving average of DAAs on Ethereum last reached 460,000 addresses in May 2021.

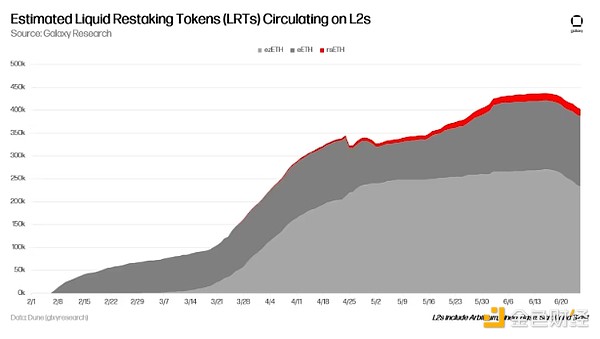

While LST liquidity on L2 has remained flat, LRT has become increasingly prominent. LRT can be found on Arbitrum, Base, Blast, Linea, Mode, OP Mainnet, and Scroll, with 69% of the native unit supply on Arbitrum and Blast. Not shown in the chart are 24,744 ezETH and 7,396 eETH on Mode.

Despite the growing importance of LRT on L2, LST has much higher liquidity and adoption than LRT. However, as discussed in the analysis above, the importance of LST began to wane as they were locked in the re-staking protocol launched on the Ethereum base chain. It is important to consider the potential impact of the stagnation of LST expansion on the overall liquidity of decentralized financial applications on L2, especially when LRT liquidity is comparable.

Re-staking is an important primitive in the evolution of public chains; it aims to create a more unified and efficient security model for blockchain applications that can be derived and shared by multiple protocols at the same time. The idea and its implementation in the Ethereum and Cosmos ecosystems are still in the early stages of experimentation and research. Many details about how re-staking protocols work in practice remain unknown. Furthermore, their exact impact on stakeholders such as the underlying network, node operators, and AVS remains unclear. However, in this report, we detail the important risks and considerations of re-staking in the early stages of its evolution for the major entities involved in the activity. Areas for further research include liquid re-staking protocols and other types of products and services that can be built on re-staking protocols.

Blast’s fifth distribution will give away 10 million gold points to Dapps. This is the last gold point distribution before the Blast airdrop on June 26th.

JinseFinance

JinseFinanceXPLA, the Web3 gaming ecosystem in which Com2uS Group participates, has officially launched its own Layer 2 blockchain. XPLA Verse acts as L2 on the Oasys gaming-specific blockchain.

JinseFinance

JinseFinanceObviously, we are still in the first half of the bull market, and the stories of the mid- and second-half of the bull market are still in the making.

JinseFinance

JinseFinanceFalse advertising programs are rampant, promoting black boxes in a world where transparency is paramount. Solend founder Rooter said the problem isn't rewarding users per se, but how these "loyalty programs" obfuscate opportunity costs.

JinseFinance

JinseFinanceThis article gives a brief introduction to the technology of Lightning Network, hoping to play a role in popularizing science.

JinseFinance

JinseFinanceI tend to look at its development from a more practical point of view, and participate in this ecology appropriately within the risk range I can bear.

JinseFinance

JinseFinanceSolana-based DeFi protocol Drift launches Drift Points, a rewards program to incentivize user engagement and loyalty, recognizing both current and historical contributions.

Huang Bo

Huang BoINTERNET CITY, DUBAI, Jul. 22, 2022 – LBank Exchange, a global digital asset trading platform, has listed Template Value Sharing ...

Bitcoinist

Bitcoinist Cointelegraph

CointelegraphThe decentralized finance (DeFi) market has taken a massive hit with the recent crypto market downtrend. The space which had ...

Bitcoinist

Bitcoinist