What is Ethereum Classic (ETC)?

Ethereum Classic (ETC) is a cryptocurrency, a blockchain, and a world computer.

JinseFinance

JinseFinance

TL;DR

Just yesterday, GCR, a famous "big short" in the cryptocurrency circle, tweeted after a year, encouraging everyone not to "give up" in the recent market crash. The tweet has received more than 50,000 likes. I believe many people are curious about the deeds of this legendary trader in the cryptocurrency field.

This article takes this opportunity to introduce GCR's background, trading philosophy, and the content of market analysis and predictions he shared in his past tweets. GCR is known for his outstanding performance on the FTX exchange and his accurate predictions of market trends. GCR's preference for shorting, investment in meme coins and NFTs, and his bet on the 2024 US presidential election are all reflected in the article.

Although GCR reduced his social media activities in early 2023, his market insights and trading strategies are still of interest to the cryptocurrency community. GCR's last public speech emphasized his positive views on the future of cryptocurrencies, especially his long-term optimism about the price of Ethereum. I believe that this article will help everyone regain confidence in the future development of the cryptocurrency market in the digital age and provide valuable experience and inspiration to the public.

Introduction

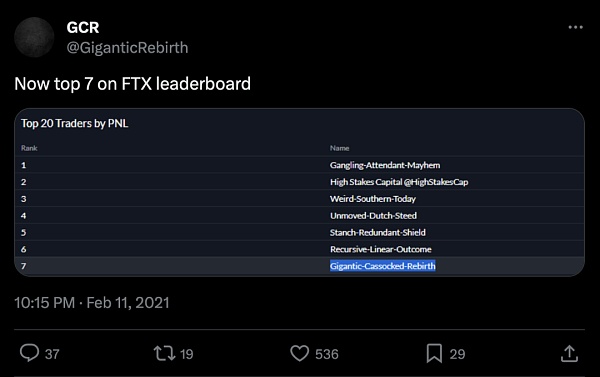

GCR is one of the most famous traders in the Crypto space. He was known on the defunct FTX exchange under the alias "Gigantic-Cassocked-Rebirth" and is well known on Twitter for his frequent and proven investment tips related to Crypto, multiple successful predictions, and smart writing.

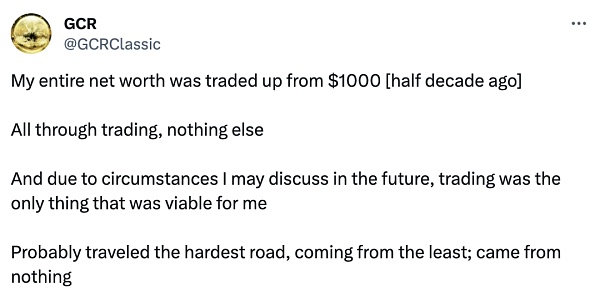

From 2021 to 2022, he frequently appeared on FTX's top trader rankings and beat many other market participants to become one of the top overall profit and loss figures on the exchange. Although his identity remains a mystery, he claims to have started from almost nothing and amassed his wealth simply through trading.

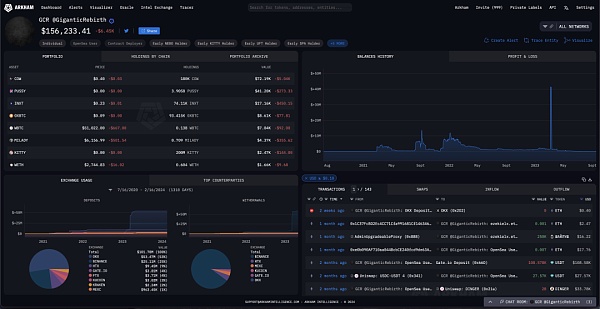

GCR Arkham User Portrait

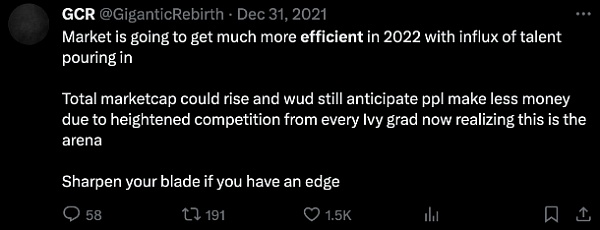

One of the first posts after GCR appeared on the FTX leaderboard - posted using the account @GiganticRebirth

1. Background and history of GCR

GCR's tweets about his early history

He calls himself a hard worker. When the market is good, he encourages other traders on Twitter to devote more than 120 hours a week to perfecting their craft. Although he encouraged his audience to take a break at the end of 2022, he personally said that he has not taken a day off in nearly 3 and a half years.

GCR's Advice to Traders

GCR is essentially a contrarian - he often mentioned a "Tree of Life" in his tweets in 2021, which is the key to exploiting the market. After a lot of speculation about GCR's secrets from many different traders, he finally suggested that this "Tree of Life" is actually just a willingness to bet against the consensus view. He is a big fan of George Soros and often mentions Soros's talking points to discuss reflexivity and the concept of contrarian thinking

GCR's contrarian thinking strategy reflects his deep understanding of market behavior and accurate grasp of group psychology. He recognizes that in the market, most people's views are often wrong, and real opportunities are often hidden in the opposite direction of consensus. This way of thinking enables him to find profit margins in market fluctuations and achieve success through distinctive trading decisions.

George Soros's reflexivity theory holds that the biases of market participants affect market prices, and these price changes in turn affect the expectations and behaviors of participants, forming an interactive cycle. GCR is obviously deeply influenced by this theory and applies it to his trading strategy, looking for imbalances and opportunities in the market through reverse thinking.

Some of GCR's reverse predictions

He is best known for publicly and successfully trading Crypto in the markets of 2021 and 2022, accumulating a large number of loyal fans, who are distributed on his multiple backup accounts. However, in early 2023, he became silent and left after posting "This may be my last tweet about Crypto" on the X platform. Since then, his social accounts have gone silent.

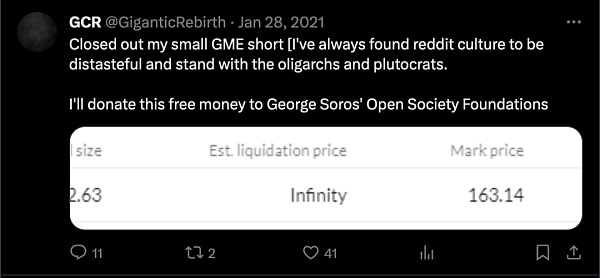

2. Crypto Bull Market - Early 2021

In early 2021, GCR was not well-known and had only a small number of followers on Twitter, where he would post details of his recent market sentiment and trading activities. From the beginning, he liked to take a contrarian view, and one of his earliest posts detailed his shorting of the retail-driven GME stock price rally in January 2021. "I have always found Reddit culture offensive, and I am on the side of the oligarchs and the rich," he wrote.

GCR discusses meme stock trading

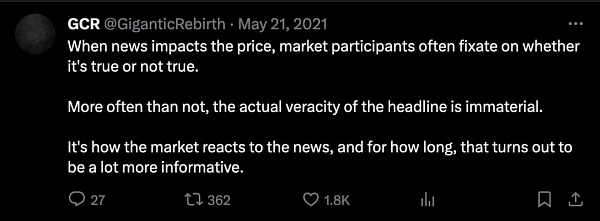

His posts in 2021 mainly consist of trading principles that have since been widely circulated on Crypto Twitter, namely that he will repeatedly emphasize the importance of patience and finding areas where you can play a unique advantage.

GCR's advice on news trading

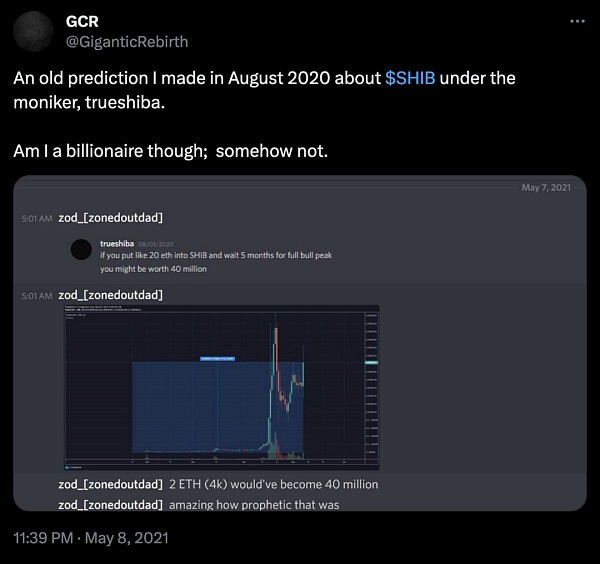

Interestingly, he also announced one of his previous predictions, that "if you put 20 ether into SHIB and wait 5 months to the full bull market peak, it may be worth 40 million." By May 2021, it turned out that traders actually only needed to invest 2 ETH in Shiba Inu Coin (SHIB) to make a profit of $40 million. This was GCR’s first post, highlighting his love for memecoins (an asset class that was particularly skeptical of traditional traders in early 2021).

GCR’s trading discussion on SHIB Coin

During April and May, he posted many bearish warnings, strongly opposing popular bullish narratives such as the “super cycle” promoted by other popular 2021 traders like 3AC’s Su Zhu. His reasons for supporting his positions were sometimes very simple, just contrary to the “mainstream market view” in the 2021 mass retail trader-driven boom.

GCR's Tweet Warns of Market Pullback

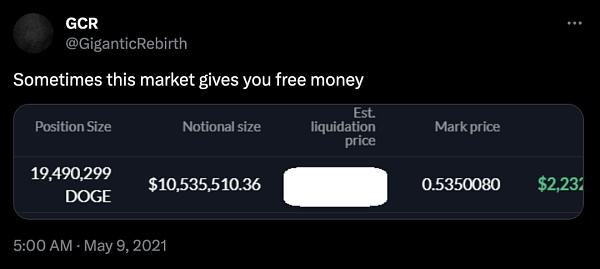

During the Crypto craze in early 2021, the popular meme coin Dogecoin (DOGE) began to surge in price. By its peak in May 2021, DOGE's price had risen by 69,136%, significantly higher than its 2020 lows. Dogecoin is a "meme coin," a coin with no utility or fundamentals to back it up. It unexpectedly reached a market cap of $98 billion after tech mogul Elon Musk took an interest in it and began talking about it on Twitter. Much of its gains were driven by the liquidation of short positions held by traders who did not believe a joke coin could have such a significant market cap.

One of GCR’s most notable trades in early 2021 was a public short on the top of DOGE on May 9, 2021 – the day Elon Musk appeared on Saturday Night Live (SNL). More than a year later, he explained: “Coins heavily invested by retailers are often hyped for months due to some ‘future catalyst’… Just as mass retail traders imagine that meme catalysts will make them millionaires, market makers use the last waterfall of liquidity to distribute (chips)

GCR shorted Dogecoin at the highest point

3. Upstream - Second half of 2021

Pecresse ultimately did not win — but GCR later said his goal was to capitalize on the upside of a fringe candidate being accepted by the mainstream — as he explained, the difference between 5% and 50% is a 10x return, while betting on the winner in a to-die race would only give a 2x return.

GCR’s Political Predictions

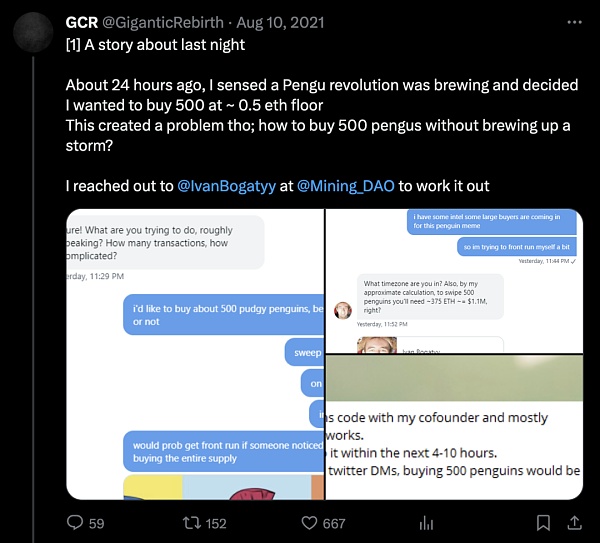

In August, GCR began speculating on NFTs (non-fungible tokens), favoring their lower market cap over meme coins, which he calls “altcoin 2.0.” In addition to attempting to purchase hundreds of “Pudgy Penguins” NFTs, his address also won a “Sad Doge” NFT at an auction, which he sold a month later for $2 million in USDC (US dollar stablecoin). However, he commented that NFTs are an asset class that is very difficult to gain exposure to, saying, “My NFT investment is seven figures, but it only accounts for less than 1% of my net worth and is part of my broader barbell investment strategy.”

GCR NFT Purchase

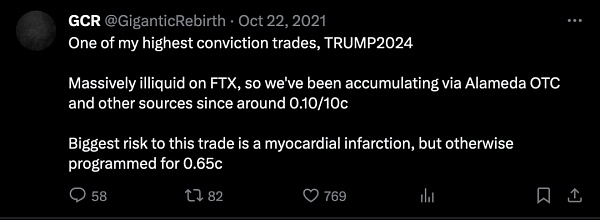

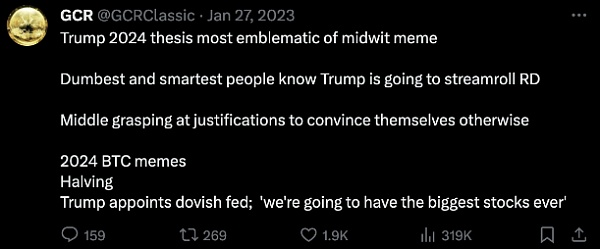

By October 2021, he began betting on Trump to win the 2024 election. Due to the sheer size of the transaction, it was almost impossible to get enough liquidity on the exchange, and he eventually had to resort to direct over-the-counter (OTC) transactions with Alameda Research. Just over a year later, Alameda Research’s balance sheet was leaked, showing that they still held $7.3 million worth of unhedged TRUMPLOSE tokens — likely the remnants of the GCR trade.

GCR’s prediction for Trump’s reelection in 2024

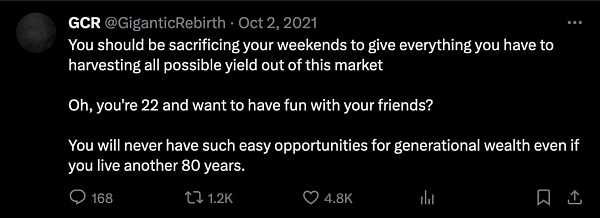

In October, GCR released his advice to young traders to take their time looking for every possible edge in the market. “Even if you live another 80 years, there will never be such an easy opportunity to gain generational wealth.” This state of extreme exuberance lasted for about two months — until the end of November 2021, when the Crypto market reached its all-time high.

GCR's Advice for Young Traders

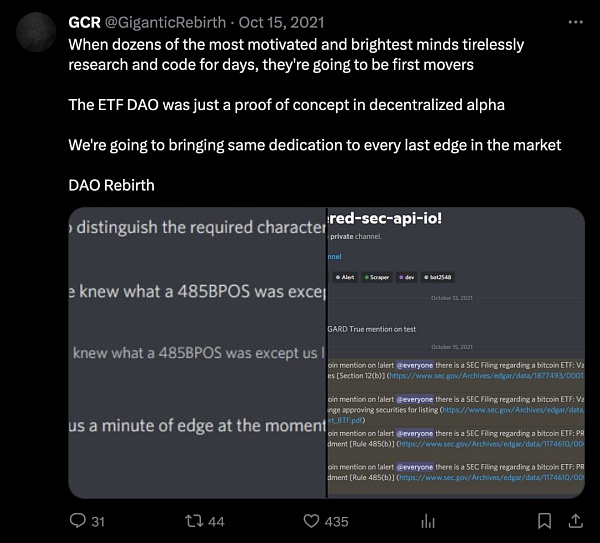

Soon after, he began recruiting members for a new team - named RebirthDAO. Its stated goal was to form a "decentralized hedge fund" by combining the power of many extremely successful traders in the Crypto market. The team's first trade was an ETF news trade in October 2021: designed to identify and take advantage of the approval of the Proshares BTC futures ETF. According to GCR, the trade was very successful - RebirthDAO was one of the first public traders to receive news alerts that pushed the price of BTC from $57.1K to $59K, giving them a precious few seconds advantage over other news traders.

GCR discusses RebirthDAO on Twitter

4. “The Big Short” - GCR in 2022

GCR discusses shorting the market in November 2021

The research team used various means to collect this information, not only reviewing documents, but also analyzing on-chain wallets and even directly contacting project team members to understand the scale of their token issuance in 2022.

GCR later mentioned that many of the currencies that DAO believes are particularly suitable for shorting are either projects in the Solana ecosystem, which have received financial support from FTX and have a large number of tokens locked to investors; or Metaverse-related currencies, which were overly sought after by the market at the end of 2021.

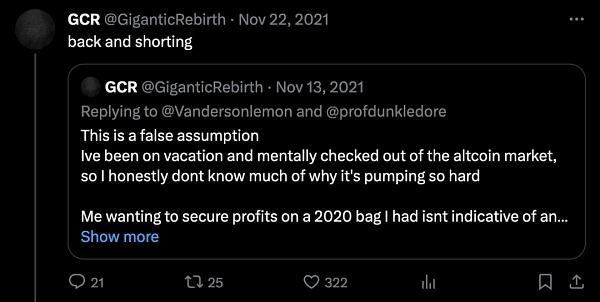

However, GCR’s most famous operation was a public bet with LUNA’s founder Do Kwon. On March 14, 2022, GCR proposed a $10 million bet to Do that the price of Terra Luna would be lower a year later than it was then. GCR successfully convinced Do Kwon to bet $10 million with his own Crypto, with a well-known account called @cobie managing the escrow for the bet.

GCR bets on a fall in the price of LUNA

While GCR successfully convinced Do to bet $10 million directly with him, he wanted the bet to be larger, so he used derivatives on FTX to cover his balance and shorted $10 million worth of LUNA perpetual futures. Just two months later, on May 7, GCR revealed that the position had made a profit of $2.3 million.

GCR discusses his views on LUNA

LUNA is highly susceptible to selling pressure due to its unique nature - it is used as an asset to support "algorithmic stablecoins" such as UST, and the value of UST depends on the price people in the market are willing to pay for LUNA. During most of the bull market, buyers willing to buy LUNA were able to absorb all the funds that flowed out of the UST system - it even withstood a "decoupling" event during the crypto market crash in May 2021. But by May 2022, there were more than $10 billion of UST in the LUNA system, compared to just $1 billion in 2021.

When UST was sold in large quantities on the market, people holding UST rushed to exchange it for LUNA, and then sell it for real US dollars. The long queue of people waiting to exchange UST, claim and sell LUNA discouraged other traders, and no one was willing to buy LUNA on the market - which caused the price of LUNA to start falling sharply.

Finally, the price of LUNA fell to almost zero. GCR only spent $0.72 to completely offset his risk on LUNA, and he actually hedged his $20 million LUNA short position for less than a dollar.

GCR closed its short position in LUNA

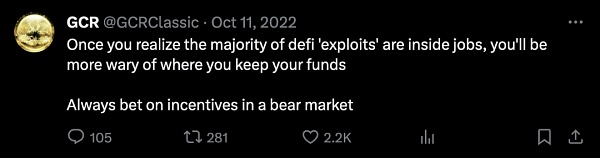

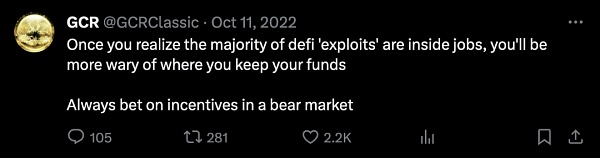

As the bear market continues in 2022, GCR foresees more and more cyber attacks, scams and frauds, which may come from criminals or from some project teams. As more and more decentralized finance (DeFi) projects are damaged by code defects, exploits and reentry attacks, GCR warns traders to pay special attention to incentive mechanisms in the bear market and use them as an important basis for investment decisions.

GCR's Comments on Scams and Fraud in the Bear Market

By the end of 2022, GCR had shorted the remaining rally of Dogecoin (DOGE) several times and advised his followers to take a break and vacation when the market situation was not optimistic. As the global price bottom of BTC came at the end of the year, GCR reminded traders that "macroeconomics will never give you an advantage; it is never possible to... stick to what you understand."

On November 8, 2022, the FTX exchange collapsed due to a large loss of customer deposits. After discovering that its sister company Alameda Research had been using the exchange's user funds, a large amount of capital outflow quickly led to the bankruptcy of the exchange.

GCR has repeatedly reminded traders to pay attention to the security of fund custody - during the bull market, a large number of hacks, scams and wallet fund loss made him call on more traders to choose top exchanges for fund custody. Unfortunately, he did not foresee the collapse of the second largest exchange in the Crypto field.

When FTX stopped withdrawals, GCR wrote: "I hope that for the benefit of the entire industry, the last part of my prophecy will not come true." But unfortunately, in the next 3 months, it was discovered that FTX itself had about $9 billion in debt and had allowed Alameda to use customer funds to bear losses for many years. What is an item on their balance sheet? It is $7.3 million worth of "TRUMPLOSE" tokens. "I always thought they were hedging on Betfair," GCR posted online.

5. 2023 and Beyond: GCR's Predictions for the Future

Following the FTX debacle, GCR permanently stopped tweeting on the @GiganticRebirth account. His alternate account @GCRClassic provides fewer individual transaction updates and gives more general predictions for the future.

GCR's advice to Crypto participants

During the 2022 crypto market trough, GCR's most important advice may be a reminder about the value of time: "No matter how much money you have left now, the depth and breadth of understanding the market are invaluable." Even though he lost a lot of money on FTX, GCR remains optimistic about the prospects of Crypto. He said: "In an increasingly digital world, digital assets are indispensable." This tweet was posted on November 23, just two days after the price of BTC fell to approximately $15,476.

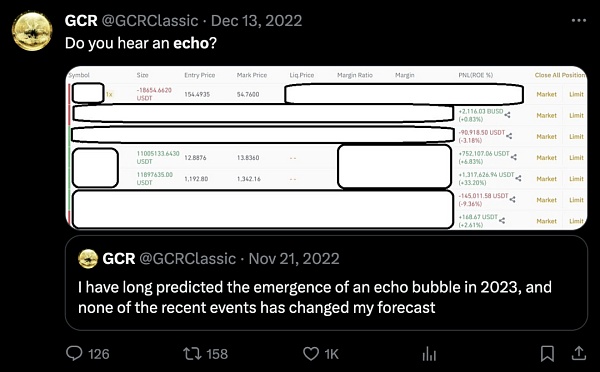

As the market becomes uncertain about the prospects of Crypto and some startups begin to shift their attention away from the industry, GCR has proposed a view that there may be an "echo bubble" in 2023, which will appear after the last optimists in the market have been completely eliminated. Interestingly, the full recovery of the market in January 2023 actually laid the foundation for the cyclical bottom of BTC.

GCR's "Echo Bubble" Theory

In early 2023, as the market gradually recovered, GCR took the opportunity to discuss some of his long-term beliefs and predictions for the future of Crypto. In one of his earliest tweets in 2023, he pointed out that the next rally will be led by China: "Many future rallies will appear in coins that no one in your circle knows about." Within months, the first BRC20 coin, ORDI, had been deployed on the BTC network. By November, ORDI would reach a market cap of $1 billion — largely due to its popularity among Asian exchanges and speculators.

GCR’s Belief in an Asia-Driven Bull Cycle

GCR remains optimistic about the future of Crypto, albeit with a dose of pessimism and skepticism. In a May 2022 tweet, he predicted that humanity would become more “desperate, greedy, depraved, lonely, and trapped in the metaverse.” He has continued to stick with this view throughout 2023, as the Crypto market slowly went through various phases, including casino coins, meme coins, and even a bizarre project involving hamster racing. In 2023, the valuation of RLB, the token of Crypto's top online casino, soared to a peak of $777 million, but has since fallen by more than half.

GCR's Casino Theory

Since the end of 2021, GCR has predicted that the efficiency of the Crypto market will increase significantly. He believes that there are many reasons for this increase, such as graduates from top universities joining the field, more mature regulatory structures, and strict control of privacy-preserving protocols and private Crypto. Although it is generally believed in the field of Crypto that transactions can remain anonymous to a certain extent, GCR reminds everyone not to mistakenly believe that any action on the blockchain is private.

GCR's views on the future talent development of Crypto

He has shown a keen interest in the 2024 US presidential election - starting in late 2021, he placed a heavy bet on Donald Trump, believing that he would be the ultimate winner. "The dumbest and the smartest know that Trump will win easily," he said. The former US president has continued to be in the spotlight throughout 2023 with a series of eye-catching feats, including turning himself in to Fulton County Jail in Georgia on August 23.

GCR's View on Trump's 2024 Campaign

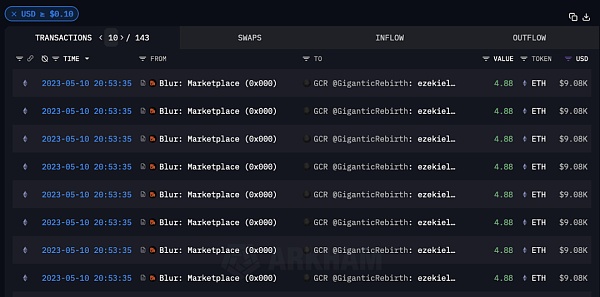

In the first three months of 2023, GCR invested money to buy more than 300 tokens of the NFT project "Milady", even though some people in the Crypto circle thought the project was a bit weird. About three months later, when Elon Musk posted a meme about the NFT project on Twitter, GCR sold about half of the tokens on hand. Even so, he still holds more than $890,000 worth of Milady tokens in his public wallet address ezekielx.eth.

GCR buys Milady on BLUR

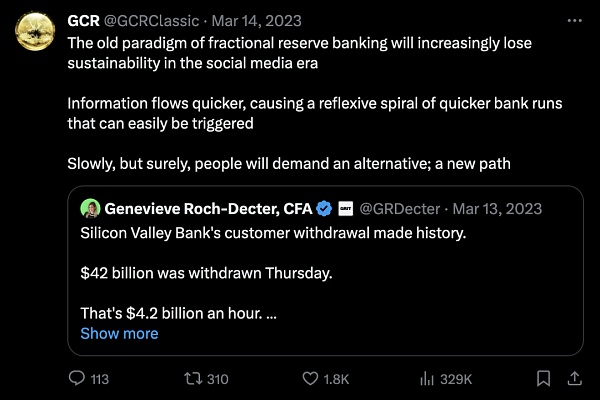

A month before GCR left Twitter, Silicon Valley Bank collapsed. This caused USDC, one of the largest stablecoins in Crypto, to temporarily decouple, and its value fell to $0.88 at one point. This incident did not affect GCR - he exchanged a total of $4 million in USDT for USDC on the chain.

GCR's stablecoin transactions

On Twitter, GCR expressed his view that Crypto is bound to be widely adopted in the digital age. He said: "People will seek another option, a new way."

GCR's comments on the future of finance

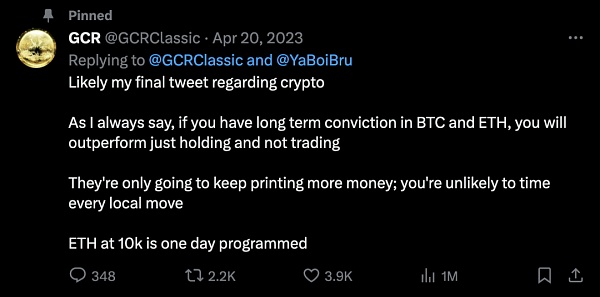

His last tweet on the GCRClassic account was positive. He said: "They will continue to print more money." He also said: "The price of Ethereum will rise to $10,000 one day."

GCR's last tweet and his prediction for the price of Ethereum

A week later, he liked a tweet from someone else that said "See you when ETH reaches $10,000." He has not appeared since.

Ethereum Classic (ETC) is a cryptocurrency, a blockchain, and a world computer.

JinseFinance

JinseFinanceOn May 31, 2024, the Ethereum Classic (ETC) network has successfully completed a production reduction (“Fifthening”), with the block reward reduced from 2.56ETC to 2.048ETC.

JinseFinance

JinseFinanceSOLANA, Dialogue with Magic Trader: Sneaking into the GCR Community to Buy Sol at the Bottom of $9 Golden Finance, How is Solana Trending?

JinseFinance

JinseFinanceLUNC community approves Proposal 12033 for mandatory KYC, enhancing Terra Luna Classic's security and fostering confidence.

Edmund

EdmundLUNA and LUNC have completed an A-B-C corrective structure.

Beincrypto

BeincryptoA Terra Labs spokesperson accused the case of being 'highly politicized.'

Beincrypto

BeincryptoEthereum Classic (ETC) is arguably one of the tokens that have benefitted the most in the recent rally. Given its ...

Bitcoinist

Bitcoinist Nulltx

Nulltx Nulltx

Nulltx Nulltx

Nulltx