Original article: Phantom Tokenomics, Inside the Obscure Daedalus Labyrinth

Author: 0xLouisT, L1D Investment Partner; Translator: 0xxz@Golden Finance

This article is the second part of the author's Tokenomics series

In Greek mythology, the labyrinth was built to imprison the Minotaur, a bloodthirsty monster with a human body and a bull's head. King Minos was afraid of the Minotaur, so he asked the genius Daedalus to build an intricate labyrinth so that no one could escape. But when the Athenian prince Theseus killed the Minotaur with the help of Daedalus, Minos was furious and retaliated by imprisoning Daedalus and his son Icarus in a labyrinth he had built.

While Icarus’s hubris led to his fall, Daedalus was the true architect of their fate — without him, Icarus would not have been imprisoned. This myth reflects the hidden backdoor token transactions that have become prevalent in this cryptocurrency cycle. In this article, I will reveal these transactions - labyrinthine structures carefully designed by insiders (Daedalus) that doom projects (Icarus) to failure.

What are backdoor token transactions?

High FDV tokens have become a hot topic, sparking endless debates about their sustainability and impact. However, a dark corner of this discussion is often overlooked: backdoor token transactions. These transactions are secured by a small number of market participants through off-chain contracts and side letters that are often obscure and nearly impossible to identify on-chain. If you are not an insider, you are most likely unaware of these transactions.

In Cobie's latest article, he introduced the concept of phantom pricing to highlight how real price discovery is now happening in private markets. Building on this, I would like to introduce the concept of phantom tokenomics to illustrate how on-chain tokenomics presents a distorted and inaccurate view of the actual off-chain tokenomics. What you see on-chain may appear to represent the token’s true “capital allocation table,” but it is misleading; the ghost off-chain version is an accurate representation.

While there are multiple types of token transactions, I have identified several common categories:

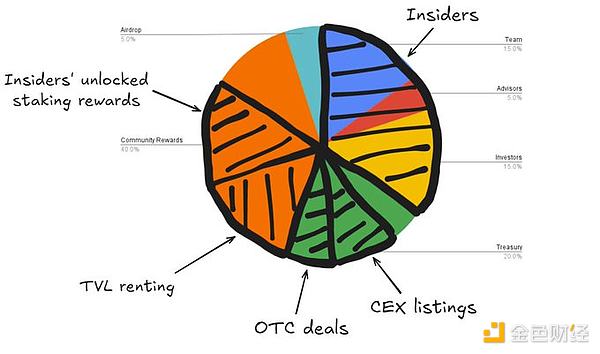

1. Advisor Allocations: Investors receive additional tokens for providing advisory services, often categorized as team or advisor allocations. This is often a means for investors to reduce their cost basis, with little to no additional advice provided. I have seen advisor allocations as high as 5x an investor’s initial investment, effectively reducing their actual cost basis by 80% compared to the official valuation.

2. Market Making Allocations: A portion of the supply is reserved for market making on CEXs, which is beneficial because it increases liquidity. However, a conflict of interest arises when market makers are also investors in the project. This allows them to use tokens allocated to market makers to hedge their locked tokens.

3. CEX listing:Pay marketing and listing fees to get listed on top CEXs such as Binance or ByBit. If investors help secure these listings, they sometimes receive additional performance fees (up to 3% of the total supply). Hayes recently published a detailed article on this topic (see Jinse's previous report: How new crypto projects should be listed), showing that these fees can be as high as 16% of the total token supply.

4. TVL leasing:Large whales or institutions that provide liquidity often receive exclusive, higher returns. While ordinary users may be satisfied with a 20% annualized return, some whales quietly earn 30% for the same contribution through private transactions with the foundation. This practice can be positive and necessary to ensure early liquidity. However, it is critical to disclose these transactions in token economics to the community.

5. OTC Rounds:While OTC rounds are common and not inherently bad, they create opacity as the terms are often unknown. The biggest culprits are so-called KOL rounds, which act as an accelerator for the token price. Certain Tier 1 L1s (names not disclosed) recently adopted this practice. Many Twitter KOLs were offered attractive token deals with large discounts (~50%) and short vesting periods (linear over six months), incentivizing them to promote the token as the next [L1] killer. If in doubt, here’s a handy KOL Translation Guide to help you cut through the noise.

6. Selling Unlocked Staking Rewards:

Since 2017, many PoS networks have allowed investors to stake vested tokens while collecting unvested rewards. If these rewards were unlocked, this would be a way for early investors to profit faster. @gtx360ti and @0xSisyphus have recently pointed to examples like Celestia and Eigen.

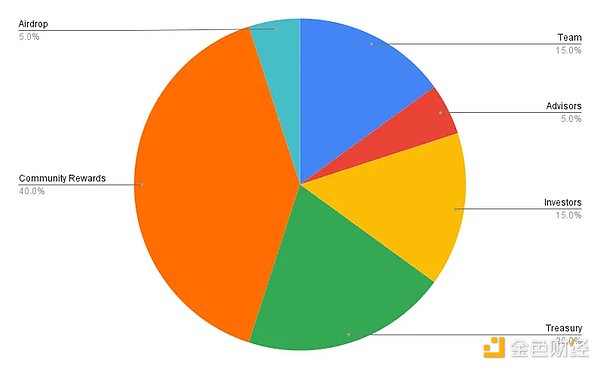

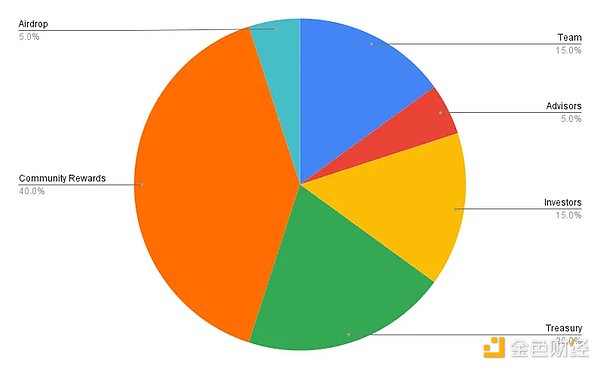

All of these backdoor token transactions create ghost token economics. As a community member, you may glance at the token economics chart below and be reassured by its apparent balance and transparency (chart and numbers are for illustrative purposes only).

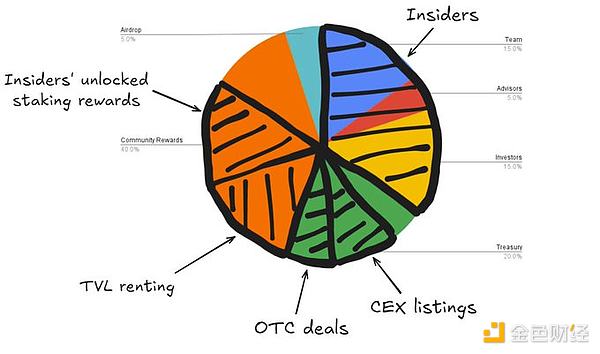

But if we peel back the layers and reveal the hidden fake transactions, the real token economics looks like this pie chart. It doesn’t leave much for the community.

Like Daedalus (who built his own prison), these arrangements seal the fate of many tokens. Insiders trap their projects in a maze of opaque transactions, causing the value of tokens to bleed from all sides.

How did we get to this point?

Like most market inefficiencies, this problem stems from a severe supply-demand imbalance.

There is an oversupply of projects on the market, which is largely a byproduct of the VC boom of 2021/2022. Many of these projects have waited 3+ years to launch a token, but now they are all entering a crowded field, competing for TVL and attention in a much quieter market. This is not 2021 anymore.

Demand does not match supply. There are not enough buyers to absorb the influx of new listings. Likewise, not all protocols can attract funds to park TVL. This makes TVL a scarce and highly sought-after resource. Instead of finding organic PMF, many projects fall into the trap of artificially increasing KPIs with token incentives to compensate for a lack of sustainable traction.

Private placements are the most active market right now. With retail investors gone, most VC firms and funds are struggling to generate meaningful returns. Their margins have shrunk, forcing them to generate alpha through token trading rather than asset selection.

One of the biggest issues remains token distribution. Regulatory hurdles make it nearly impossible to distribute tokens to retail investors, and teams have limited options — mostly airdrops or liquidity incentives.

Summary

Using tokens to incentivize stakeholders and accelerate project development is not a problem in itself; it can be a powerful tool. The real problem is the complete lack of on-chain transparency in token economics.

Here are a few key takeaways for cryptocurrency founders to increase transparency:

1. Don’t offer advisory allocations to VCs:Investors should provide full value to your company without additional advisory allocations. If investors need additional tokens to invest, they may lack real confidence in your project. Do you really want such a person to appear in your cap table?

2. Market making services have been commoditized:Market making services have been commoditized and prices should be competitive. There is no need to pay more. To help founders navigate this space, I created a guide.

3. Don’t mix fundraising with unrelated operational matters:During fundraising, the focus is on finding funds and investors that can add value to your company. Avoid discussing market makers or airdrops at this stage — save signing any documents related to these topics later.

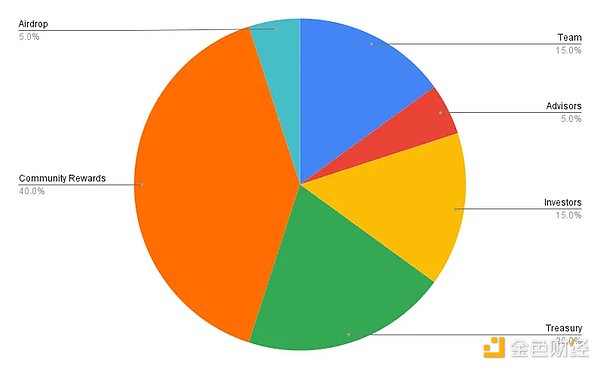

4. Maximize on-chain transparency:On-chain token economics should accurately reflect the reality of token distribution. At genesis, transparently allocate tokens to different wallets that reflect your token economics chart. For example, using the following pie chart, make sure you have six main wallets representing allocations to the team, advisors, investors, etc. Proactively reach out to the following teams:

Etherscan, ArkhamI, and nansen to tag all relevant wallets.

Tokenomist to get the vesting schedule.

Coingecko and CoinMarketCap to ensure accurate circulating supply and FDV.

- If you are L1/L2/appchain, make sure your native block explorer is intuitive and easy to navigate for all users.

5. Use on-chain vesting contracts:For teams, investors, over-the-counter transactions, or any type of vesting, make sure it is transparently and programmatically implemented on the chain through smart contracts.

6. Lock staking rewards for insiders:If you are going to allow locked tokens to be staked, at least make sure the staking rewards are also locked. You can check out my thoughts on this approach here. 7. Focus on your product, forget about CEX listing: Stop obsessing over getting a Binance listing; it won’t solve your problems or improve your fundamentals. Example of pendle: it traded on DEX for years, reached PMF, and then easily got a Binance listing. Focus on building your product and growing your community. Once your fundamentals are solid, CEXs will be begging to list you at a better price. 8. Don’t use token incentives unless necessary: If you give out tokens too easily, there is definitely something wrong with your strategy or business model. Tokens are valuable and should be used sparingly to achieve specific goals. They can be a growth hacking tool, but not a long-term solution. When planning token incentives, ask yourself:

If you think the results will drop by 50% or more after the incentive stops, then your token incentive plan is likely flawed.

If there is only one key takeaway from this post, it is this: prioritize transparency.

I am not trying to blame anyone. My goal is to spark a real debate that promotes transparency and reduces fake token trading. I sincerely believe that this will strengthen the field over time.

Stay tuned for the next part of my token economics series, where I will dive into a comprehensive guide and rating framework for token economics.

Let’s make token economics transparent again and get out of the Daedalus maze.

Catherine

Catherine