Author: UkuriaOC, CryptoVizArt, Glassnode; Compiler: Baishui, Golden Finance

Summary

Since the cycle low in November 2022, Solana has outperformed Bitcoin and Ethereum in terms of price appreciation and relative capital inflows.

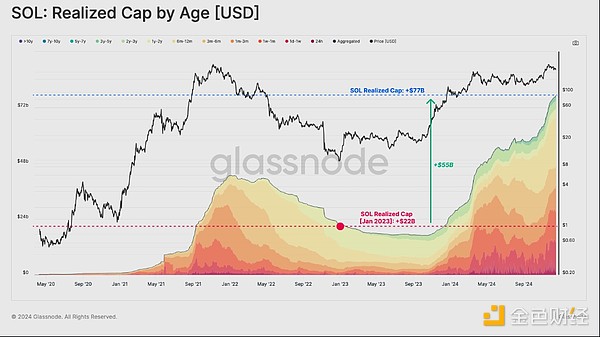

Continued positive capital inflows have led to a net liquidity increase of $55 billion, providing a huge impetus for price appreciation.

Despite a large amount of profit-taking and allocations, Solana investors have not yet reached the point of unrealized profitability (paper gains), which historically coincides with long-term macro tops, indicating that there is further room for growth throughout the cycle.

SOL, BTC, ETH Comparison

Over the past 4 years, Solana has attracted great interest and attention from investors and market speculators. Initially, the asset saw huge growth during the 2021 bull run, but then faced major challenges following the FTX debacle, which resulted in a significant oversupply.

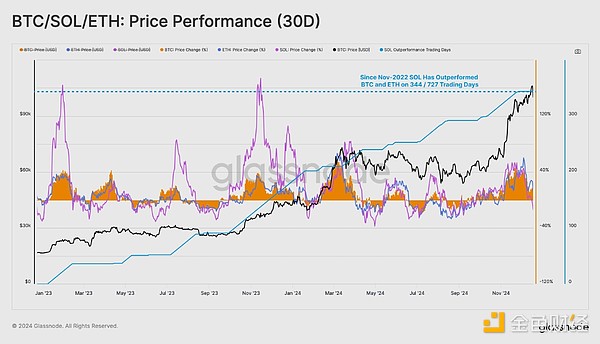

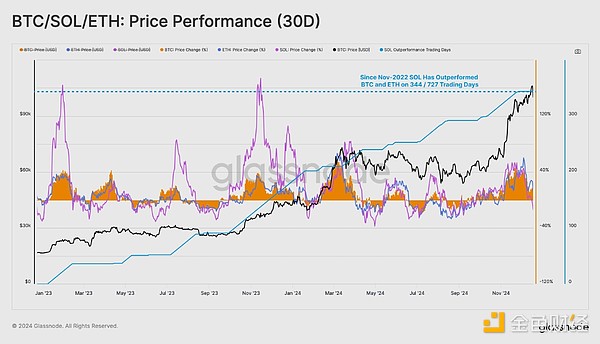

After plummeting to a shocking low of $9.64, Solana has staged a remarkable recovery, posting an astounding 2,143% growth over the past 2 years. This impressive price performance has seen Solana outperform both Bitcoin and Ethereum 344 out of 727 trading days since the FTX incident, demonstrating the massive growth and demand for the asset.

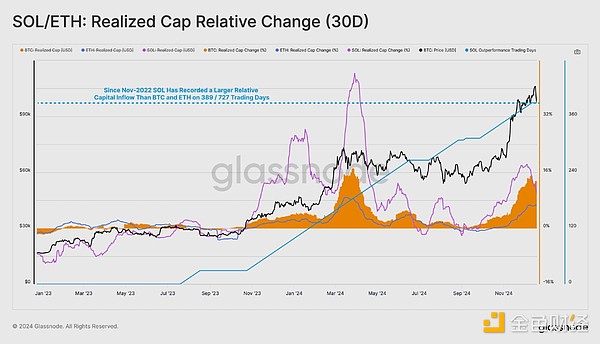

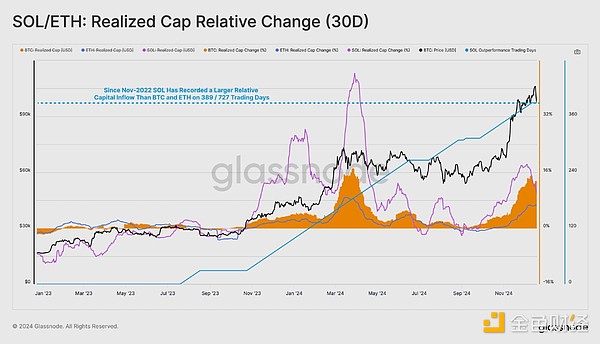

The surge in price action has also attracted a large amount of new capital into the asset. We can use the relative realized cap changes of Solana, Bitcoin, and Ethereum as an indicator to evaluate and compare the capital flow into each network.

Since the December 2022 low, Solana's capital growth percentage in 389/727 trading days is much higher than that of Bitcoin and Ethereum, highlighting its significant growth in liquidity.

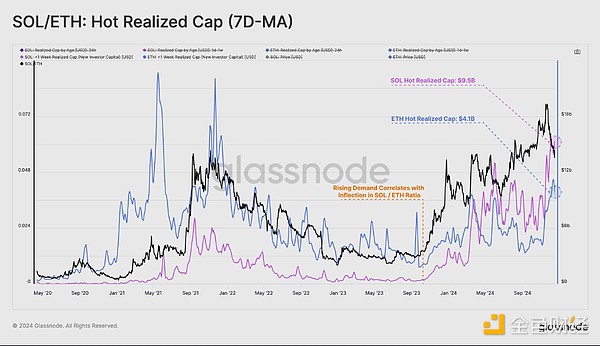

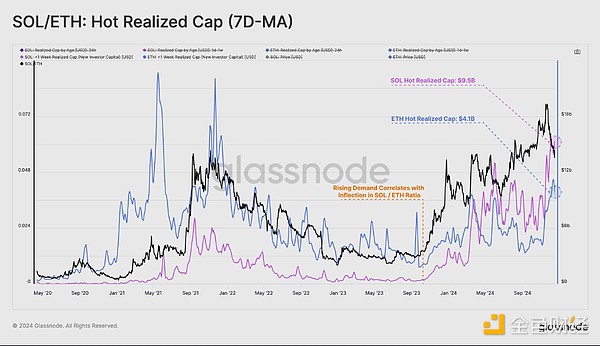

To assess the momentum on the demand side, we can track the capital inflow from new investors, which is called "Hot Realized Cap". This metric measures the capital held by active accounts over the past 7 days.

When comparing the scale of new capital entering the asset between Solana and Ethereum, we can observe that Solana's new investor demand exceeded Ethereum for the first time in history, highlighting its strong demand conditions.

Notably, Solana’s popular realized cap rises sharply before early 2024, marking an upward inflection point in the SOL/ETH ratio, with an influx of new capital driving growth.

Exploring SOL Capital Flows

Having established Solana’s outperformance relative to other major assets, we will now examine the size and composition of Solana’s capital flows.

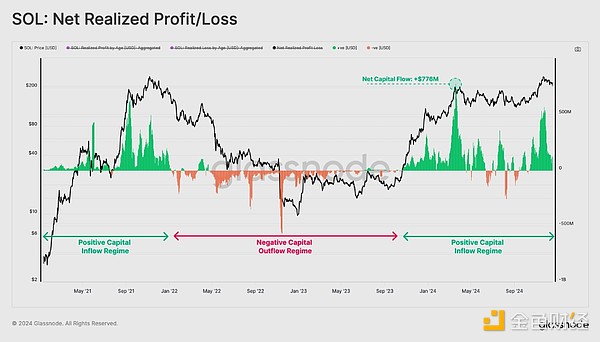

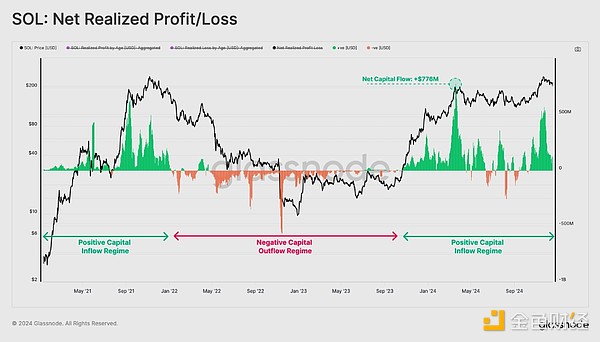

By evaluating the net realized profit/loss metric, we can visualize the daily changes in Solana’s on-chain capital flows. When this metric is positive, it represents net capital creation (money trading profits); when it is negative, it represents net capital creation (money trading losses).

We have observed that Solana has maintained positive net capital inflows since the beginning of September 2023, with only small capital outflows during this period. The continued inflow of liquidity has helped stimulate economic growth and price appreciation, reaching a staggering peak of $776 million in new capital inflows per day.

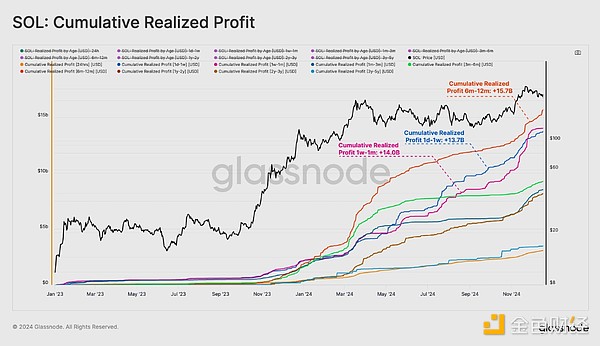

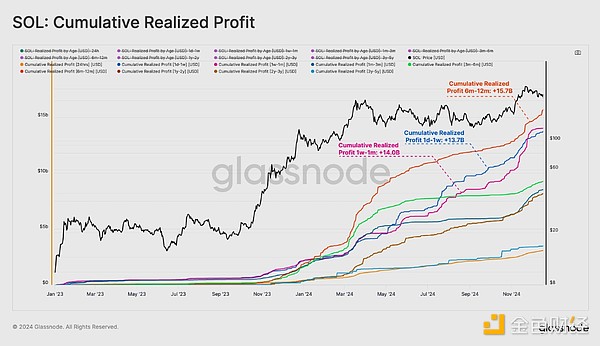

We can use the coin age breakdown of the realized profit indicator to assess which subgroups contribute the most to the selling pressure. Here, we calculate the cumulative profit-taking volume by coin age since the beginning of January 2.

24 hours: $3.1 billion

1 day-1 week: $13.7 billion

1 week-1 month: $14 billion

1 month-3 months: $8.5 billion

6 months-12 months: $15.7 billion

1 year-2 years: $8.2 billion

2 years-3 years: $8.2 billion

3 years-5 years: $3.5 billion

Notably, tokens with ages of 1 day-1 week, 1 week-1 month, and 6 months-12 months were significant contributors to sell-side pressure, with each recording sizable profits. Together, they accounted for 51.6% of realized profits, showing a balanced distribution of market influence. This underscores the idea that Solana as an asset is seen as an investment opportunity for all types of investors.

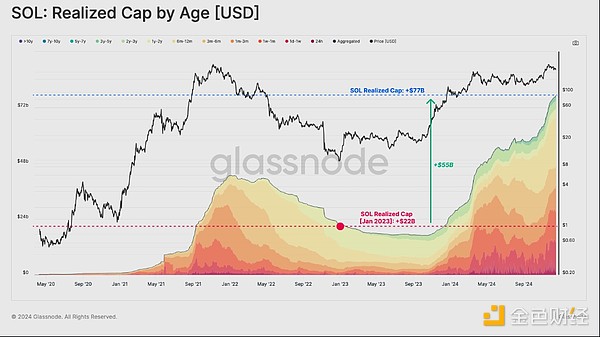

During the same period, massive capital inflows have enabled Solana to accumulate over $55 billion in USD liquidity, increasing realized cap from $22 billion to a staggering $77 billion.

Is the SOL market state overheated?

In the previous section, we evaluated a large amount of profit taking and supply allocation, so it becomes cautious to evaluate the degree of market overheating.

To this end, we can use the MVRV ratio to define pricing ranges to evaluate the extreme deviation points of investor profitability relative to the long-term average. Historically, a breakout above 1 standard deviation has coincided with the formation of a long-term macro top.

Currently, the SOL price is consolidating between the mean and the +0.5 standard deviation range. This suggests that the market is relatively hot, but also suggests that there may be further room to run before profits held by ordinary investors reach the extreme range of +1σ, triggering a series of profit-taking and distribution.

Summary

With the release of the new segmented indicators, we are able to analyze the behavior of investors during the dynamic market of the Solana asset for the first time, providing important information on the mechanism of capital creation and destruction.

Solana's rapid recovery and subsequent price increase are remarkable, and it has successfully raised a large amount of funds from both institutional and retail investors.

JinseFinance

JinseFinance