Author: CryptoVizArt, UkuriaOC, Glassnode; Compiler: Wuzhu, Golden Finance

Summary

Bitcoin has reclaimed short-term holders’ cost basis ($61,900) and 200DMA ($63,900) following the Fed’s 0.50% rate cut.

After a period of net capital outflows, short-term holders have seen slightly less pressure as prices have risen above their cost basis.

New investors have shown a degree of resilience, with relatively small actual losses, suggesting they are confident in the overall uptrend.

The perpetual futures market has shown a cautious recovery in sentiment, with demand gradually increasing, but still below levels seen during the strong bull run.

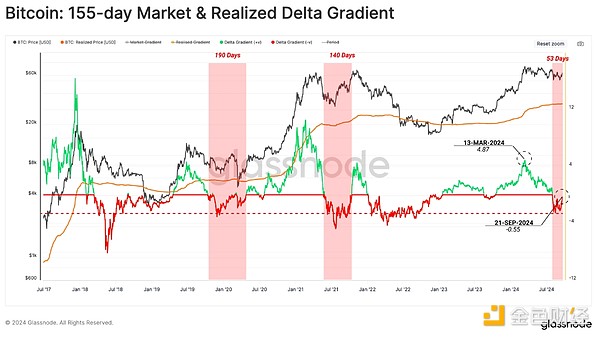

Shift in Market Gradients

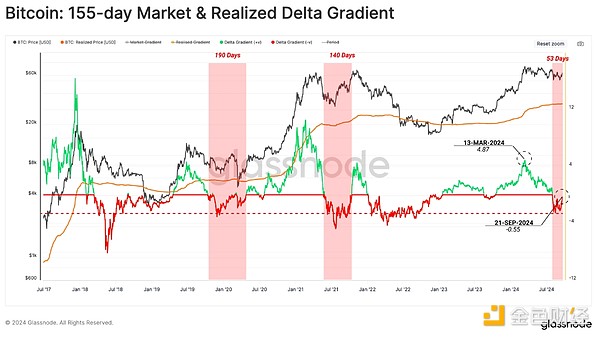

After the market reached its March ATH, capital inflows into the Bitcoin network slowed, causing price momentum to weaken. This can be confirmed by comparing the smoothed 155-day gradient of price (black) to the gradient of actual price (red).

In recent weeks, the market gradient has fallen to negative values, while the actual price gradient is positive, but trending lower. This suggests that the decline in spot prices has been more intense than the intensity of capital outflows. The chart below measures the z-scores of these two gradients. Negative values can be interpreted as periods of relatively weak demand, leading to a sustained contraction in prices. Using this indicator, we can see that the current structure is very similar to the 2019-20 period, when the market experienced a long period of consolidation after a strong rebound in the second quarter of 2019.

New Capital Flows

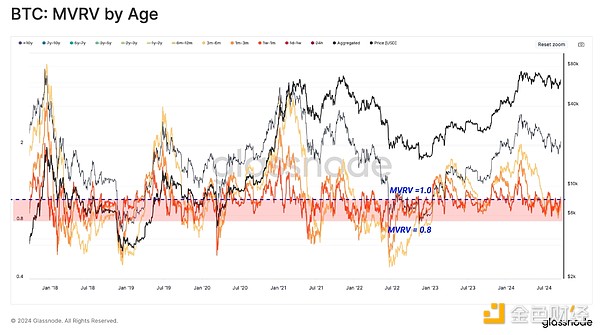

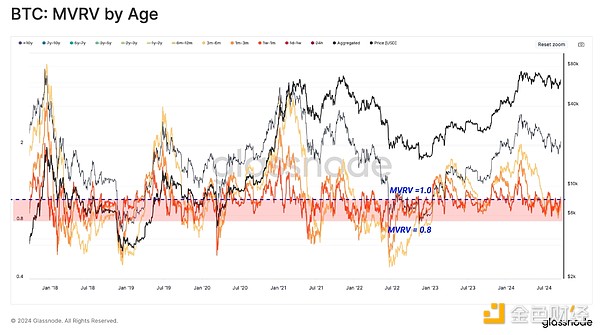

The current consolidation phase has pushed spot prices below the cost basis of several subgroups of short-term holders (MVRV ratio <1) since late June 2024. This highlights how investors have been under financial pressure in the near term, suffering increasing unrealized losses.

However, While many new investors’ holdings are in negative value, the magnitude of their unrealized losses is significantly lower than the mid-2021 sell-off and the COVID crash in March 2020.

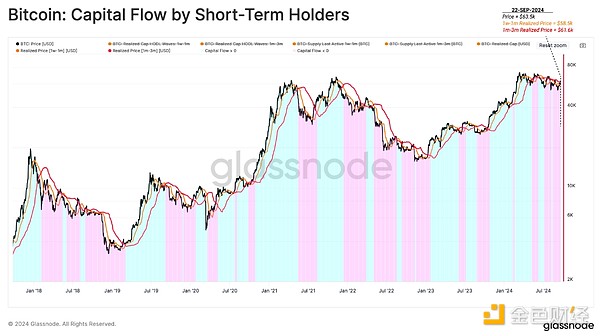

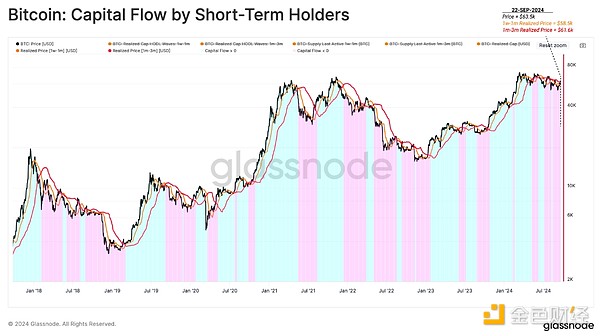

When the market enters a prolonged contraction, diminishing returns prompt investors to cash out at lower prices to reduce losses. As a result, the cost basis of relatively young supply is below the spot price. The repricing of short-term holder supply to lower prices can be described as a net capital outflow from the Bitcoin ecosystem.

To measure the direction and strength of capital flows from the perspective of new investors, we constructed an indicator comparing the cost basis of the two subgroups (1w-1m as the fast trajectory and 1m-3m as the slow trajectory).

Capital Outflows (blue) During a market downtrend, the cost basis of the youngest tokens (1w-1m in red) decreases faster than the older coin age group (1m-3m in red). This structure suggests that the overall direction of capital flows is negative, and the strength of this outflow is proportional to the deviation between these trajectories.

Capital Inflows (blue) During a market uptrend, the cost basis of younger tokens expands faster than the cost basis of older coin age groups. This suggests that the pace of capital inflows is proportional to the divergence between these trajectories.

The cost basis of newer tokens is currently lower than that of older tokens, suggesting that the market is experiencing a net outflow mechanism. Using this indicator, a sustainable market reversal may be in the early stages of building positive momentum.

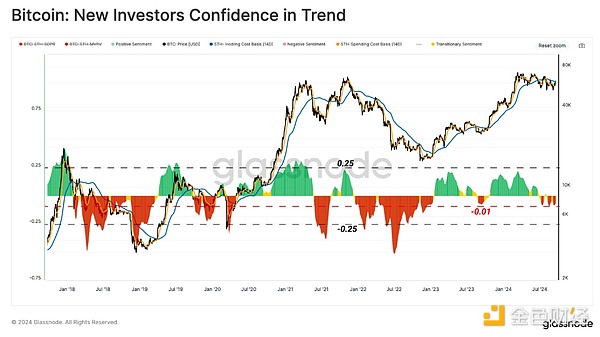

Confidence of New Investors

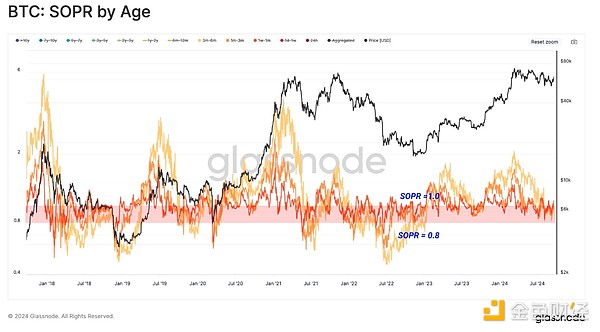

As the unrealized losses held by new investors during market corrections increase, their propensity to capitulate at losses also increases. Statistics show that short-term holders are more sensitive to volatility, making their behavior useful for tracking market turning points.

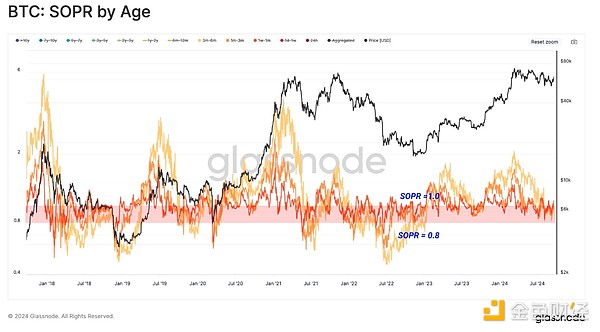

The SOPR metric by coin age shows almost identical behavior when examined alongside MVRV by coin age. This confirms that new investors are both holding assets at a loss and experiencing enough stress to materialize those losses.

We can also assess how strongly short-term holders react to changes in market sentiment.

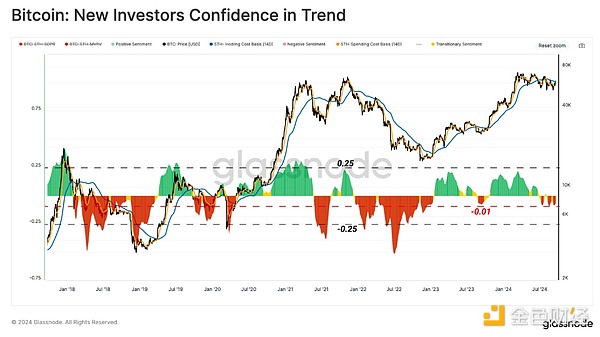

The difference between the cost basis of new investors who are spending (red) and the cost basis of all new investors (blue) reflects their aggregate confidence. When normalized by the spot price, this deviation allows us to highlight periods when new investors overreact to extremely high unrealized profits or losses.

In recent months, new investors who bought tokens in the last 155 days have shown higher market confidence than in the previous "bearish trend". The magnitude of losses locked in by this group is still relatively low compared to the cost basis they hold.

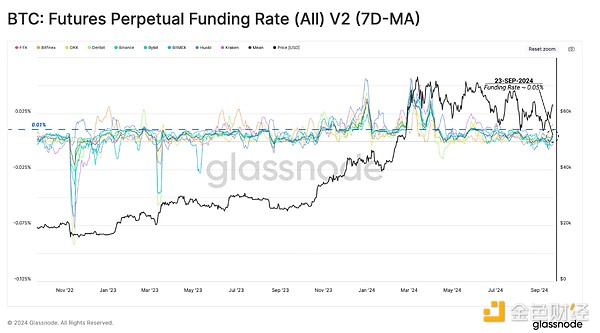

Long Perpetual Contract Premium

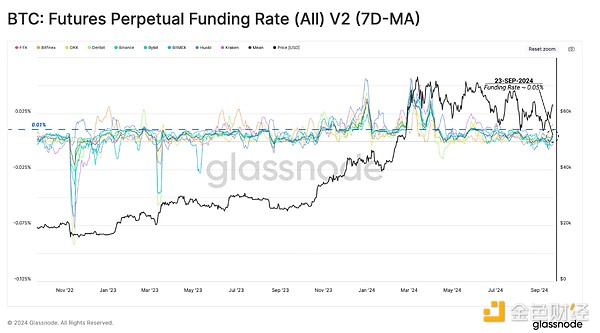

We can use the perpetual contract futures market to add another dimension to our investigation of new capital confidence in the uptrend. First, we use the futures perpetual swap funding rate (7D-MA) to show that speculators are willing to pay higher rates to take on leverage on long positions.

Considering that a funding rate value of 0.01% is an equilibrium value for many exchanges, we consider deviations above this level as a threshold for bullish sentiment. The recent price rally has been accompanied by a relative increase in long-biased leverage in the perpetual swap market. This has pushed the weekly average funding rate up to 0.05%.

While this is above equilibrium levels, it does not yet indicate a strong or excessive level of demand for long bias in the perpetual swap market.

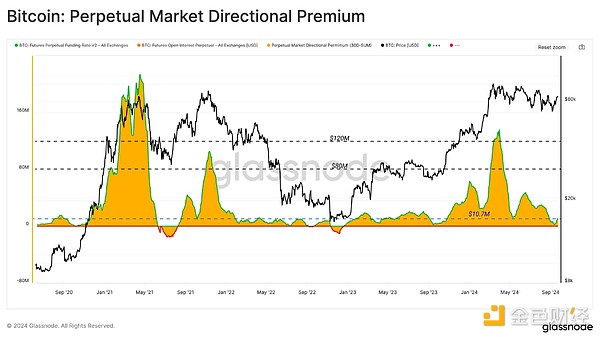

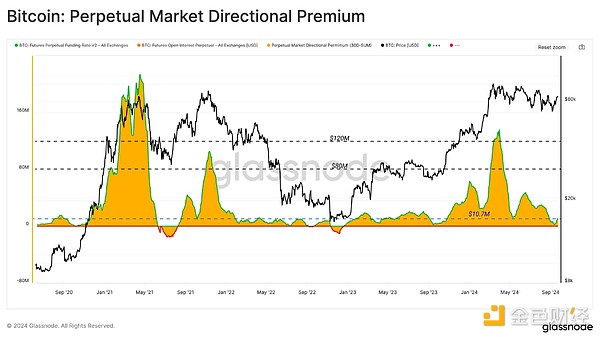

If we calculate the cumulative monthly premium paid by long contracts to shorts over the past 30 days, we can see that the total cost of leverage near the ATH in March was about $120 million per month.

As of mid-September, this indicator had plummeted to $1.7 million per month and has only risen slightly to $10.8 million per month today. Therefore, the demand for long leverage has increased in the past two weeks, but it is still far below the level in January 2023. This shows that the market has cooled down significantly during this correction.

Summary

The Bitcoin market has been in a long consolidation phase that is reminiscent of the period from late 2019 to early 2020. Since the all-time high in March, capital inflows to the Bitcoin network have slowed, challenging profitability for short-term holders.

However, despite a period of partial net capital outflows, new investor confidence in the market remains very strong. The long bias in the perpetual futures market has also seen a very modest uptick in recent weeks.

Overall, this paints a picture of a market cooling down from the excessive volatility of March, while not breaking the mood of many new Bitcoin investors.

JinseFinance

JinseFinance