Author: Mask

Web3

technology, with blockchain at its core, is reshaping the global financial, social and business ecosystems through innovative models such as decentralization, smart contracts and encrypted assets. With the rapid development of this field, the financial risks, data security challenges and legal gaps it brings have prompted regulators in various countries to actively intervene. The United States, the European Union, Singapore and Hong Kong, as key hubs for the development of globalThis article will conduct an in-depth analysis of the Web3 regulatory policies of these four major jurisdictions from the dimensions of regulatory agencies, policy frameworks, core rules and market impact, revealing their commonalities and differences, and exploring the future direction of global regulatory coordination.

United States

Law enforcement first

"

Model under the Securities Law1. Multiple regulatory systems and policy trends

United States

(CFTC)(FinCEN)and other federal agencies, as well as state regulators.

After Trump took office on January 20, 2025, he appointed Mark T. Uyeda as Acting Chairman of the SEC and Caroline Pham as Acting Chairman of the CFTC, aiming to provide a more stable and predictable policy environment for the cryptocurrency industry and achieve the transition from "regulation through law enforcement" to "clear regulatory framework".

. On January 23, 2025, Trump signed the executive order "Strengthening America's Leadership in Digital Financial Technology", which aims to promote the United States' leadership in digital assets and financial technology and support the responsible development of the cryptocurrency industry.

The executive order proposes the establishment of a "Presidential Digital Asset Market Working Group" to explore federal regulatory measures for stablecoins and related plans for national digital asset reserves, and explicitly prohibits the "establishment, issuance, circulation or use" of central bank digital currencies (CBDCs).

2. Establishing a Strategic Bitcoin Reserve

On March 6, 2025, Trump signed the Executive Order on Establishing a Strategic Bitcoin Reserve and U.S. Digital Asset Inventory, and held the first cryptocurrency summit at the White House on March 7, indicating his commitment to making the United States the "global cryptocurrency capital." However, on March 7, the price of cryptocurrency continued its recent decline, and the price of Bitcoin fell rapidly, failing to meet market expectations.

On January 23, the Senate Banking Committee established a Digital Assets Committee, chaired by Senator Cynthia Lummis, which reflects the importance attached to the regulation and development of the cryptocurrency field.

In May 2025, there were reports that the stablecoin bill was advancing and the process of US dollar digitization was approaching a turning point. The Trump team may support the inclusion of legal stablecoins (such as USDC) in the national economic strategy. If realized, stablecoins will become the "commercial hub" of the federal government's digital financial system, rather than a competitor to Bitcoin.

3. State-level regulatory characteristics

In addition to the federal regulatory framework, each state has also developed its own unique regulatory model:

• New York’sBitLicenseis the most influential cryptocurrency license, requiring companies to comply with strict consumer protection and anti-money laundering compliance requirements.

• Wyoming has adopted a relatively friendly regulatory attitude, passing a series of laws to recognize cryptocurrencies as currencies and allowing banks to provide digital asset custody services.

Europe

Unified regulatory attempts under the MiCAframework

1. MiCA: Unified rules for the European crypto-asset market

EU passes the Crypto-Asset Market Regulation Act (MiCA)

text="">Becoming GlobalWeb3Regulated"Forerunner". This regulation, which will come into effect in 2024, establishes comprehensive rules for the issuance and market trading of crypto assets: • Classification regulation: Crypto assets are divided into electronic money tokens (EMT), asset reference tokens (ART) and utility tokens. Non-fungible tokens (NFT) and central bank digital currencies (CBDC) are not within the scope of MiCA regulation.

• Licensing requirements: Companies providing crypto-asset services need to register as a crypto-asset service provider(VASP)and meet capital, reserve and disclosure requirements.

• Special provisions for stablecoins: Set reserve assets, capital requirements and daily liquidity limits for stablecoin issuers, especially limit the scale of use of non-euro stablecoins in the euro area.

II. Implementation by Member States and Market Response

1. The implementation of MiCA adopts a dual-track system

"

" leaf="">Transition period:• Encryption service providers already operating in the EU havea transition period of 12-18months to adapt to the new rules.

• New market entrants need to comply withMiCAimmediately.

2. Market reactions are polarized:

• Compliant companies welcome the legal certainty brought about by unified standards, which facilitates free operation in the markets of

27member states. • Innovative companies are concerned that strict compliance requirements may inhibit flexibility, especially for DeFiprojects.

1. Regulatory agencies and legal framework

Singapore'sWeb3regulation is led by the Monetary Authority of Singapore(MAS)

, which adoptsrisk gradingand the Securities and Futures Act (SFA)classify and regulate digital payment tokens(DPT)and security tokens. • Regulatory agencies: MASis responsible for licensing and overall supervision, while the Accounting and Corporate Regulatory Authority(ACRA)is responsible for corporate registration compliance.

II. Licensing system and compliance requirements

Singapore implements classified licensing management for encryption business:

•DPT Service License: Applicable to wallet services, exchanges and custodians, and are required to meet anti-money laundering (AML), fund security and minimum capital requirements. • Capital Market Services License: For the issuance and trading of security tokens, the strict supervision of the SFA applies.

MAShas set up a moderately lenient exemption period for start-ups, allowing them to conduct limited business before fully meeting the requirements. This gradual regulatory approach has attracted well-known companies such as

Circleand Paxosto settle in. III. Regulatory dynamics and market impact

1. In 2024-2025, Singapore's regulation will tighten:

• Stablecoin regulation:

In 2023, the "Stablecoin Regulatory Framework" requires issuers to meet reserve requirements text="">1:1Anchoring, independent auditing and daily liquidity requirements. • DTSPNew regulations:MASHong Kong

From"Grey Area"To Transformation into a Compliance Test Field

Hong Kong

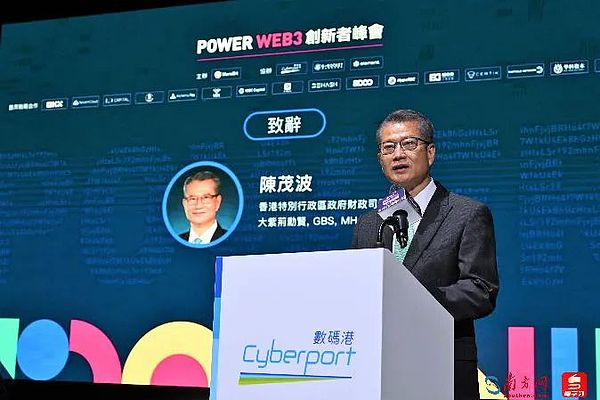

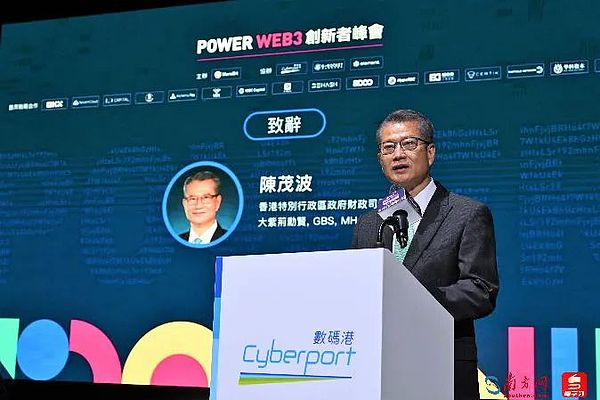

FromGrey Area"To ="">Web3delivered an important speech, reflecting Hong Kong's positive attitude and regulatory ideas in promoting the development ofWeb3Web3

2025

Year On April 7, at the "2025 Hong Kong Web3 Carnival" event, Chan Mo-po said Hong Kong is committed to promoting the third generation of the Internet ( He pointed out that blockchain technology is showing great potential, which can significantly improve transaction efficiency, reduce costs and enhance market transparency, and the development of Web3.0 based on blockchain technology is also accelerating. Hong Kong has always adhered to the principle of “same business, same risk, same supervision” and is committed to establishing a suitable framework for the development of Web3.0. Chan Mo-po mentioned that Hong Kong is one of the first regions in the world to establish a clear licensing system for virtual asset trading platforms (VATP). The Hong Kong Securities and Futures Commission has so far issued 10 VATP

licenses; In 2024, Hong Kong will be the first to approve virtual asset spot ETFs (Exchange Traded Funds), making Hong Kong the largest virtual asset ETF market in the Asia-Pacific region, building a bridge between traditional finance and cryptocurrency innovation. 1. Evolution of the regulatory framework

Hong Kong'sWeb3regulation has undergone significant changes:

•Before 2022: Relatively loose

regulatory vacuum, attracting a large number of crypto companies to register. • 2022-2023: Adopt the Virtual Asset Policy Declaration and the VASP

licensing system, and move tosame business, same risks, same supervisionsame business, same risks, same supervision Principles. • 2024 2024-present: Fully implement the licensing system and establish global compliance standards. II. Core Regulatory Measures

1. Hong Kong adopts a multi-institutional collaborative regulatory model:

•SFC

: Responsible for the licensing of virtual asset trading platforms(VATP)and the supervision of security tokens. • HKMA: Participate in the supervision of stablecoins and payment-related services.

2. Key regulatory requirements include:

• Licensing system: All VATPmust obtain SFCNo. 1

12. Key regulatory requirements include: • Licensing system: All VATPmust obtain

SFC lang="EN-US" lang="EN-US" lang="EN-US">)• Asset custody: It is required to custody customer assets through a wholly-owned subsidiary and obtain a TCSPlicense.

• Investor protection: Currently, only professional investors are allowed to participate in security token transactions, and retail investor protection is achieved through restricted access.

III. Market Development and Policy Support

1、Hong Kong has taken a number of measures to enhance its competitiveness:

• 2024ETF

, becoming the largest virtual assetETFin the Asia-Pacific region ETF market. • 2025Policy Statement: Plans to expand the regulatory framework, possibly including clearer rules on stablecoins.

2. Hong Kong’s advantages are:

• Capital and talent advantages brought by its status as an international financial center

• Potential connection opportunities with the Mainland market

• Clear regulatory expectations and legal certainty

I. Differences in regulatory philosophy

II. Comparison of regulation in specific areas

1. Stablecoin regulation:

• United States: May relax regulation and focus on payment functions

• EU: Strict capital and reserve requirements, restrictions on non-euro stablecoins

• Singapore:1:1

• Hong Kong: Reserve funds100%Bank custody, licensing system to be implemented within the year

2. Security tokens:

• United States: Strictly apply securities laws, registration or exemption required

• EU:ARTtokens applyMiCA, other security tokens follow the securities law

• Singapore: ApplicableSFA

, but there is an exemption for small issuance• Hong Kong: Disclosure of asset ownership and smart contract risks is required

3. Decentralized Applications:

• United States: High-pressure supervision and strict law enforcement

• EU: MiCAReserve some exemption space

• Singapore: Sandbox mechanism supports experiments

• Hong Kong: The regulatory framework has not yet been clarified and may be included

VASPScopeIn the future, with the development of emerging issues such as real asset tokenization (RWA) and on-chain privacy, global regulatory coordination will become more important. Regulators in various countries need to find a dynamic balance between protecting the financial system and maintaining technological vitality, while industry participants need to develop adaptive strategies in a complex and changing regulatory environment. The future of Web3 depends not only on technological innovation, but also on regulatory wisdom. Only by exploring feasible models within the regulatory framework can this revolutionary technology realize its transformative potential.

Weatherly

Weatherly