While consumer stock fund managers are still facing the age-old question of "whether young people drink liquor", gold shops have already welcomed their first batch of post-00s customers.

As one of the few businesses that has been expanding its offline stores in the past year, gold shops are indeed doing well. In Deloitte's 2023 Luxury Companies Report, Chow Tai Fook ranks among the top ten in the world with sales exceeding Hermes and Rolex. In another report, "2023 China Gold Jewelry Retail Market Insights", young people aged 18 to 34 took over from the "Chinese aunties" in the 2013 gold boom and became the main force of gold jewelry consumption.

As a "price-following" consumption, the demand for gold jewelry often keeps pace with the rise in international gold prices. However, when the international gold price hit new highs, driving the domestic gold price to jump almost every day since March, from 630 yuan per gram to 730 yuan per gram, consumers gradually turned to wait and see.

The real big gold traders are still outputting steadily.

The central bank data released on April 7 showed that despite the recent rapid rise in international gold prices, the pace of China's central bank's increase in holdings remained basically stable, with gold reserves of 72.74 million ounces at the end of March, an increase of 160,000 ounces from the end of February. This is the 17th consecutive month that the People's Bank of China has increased its gold reserves since October 2022, setting a record for the longest duration of increase.

However, with the US non-agricultural data exceeding expectations last Friday, the market has doubts and disagreements about the path of interest rate cuts this year, and the short-term game around international gold prices is heating up sharply.

So, where is this big gold cycle that started to climax in October 2022 but was foreshadowed as early as 2018?

Betrayal of interest rate anchor

Since the collapse of the Bretton Woods system and the decoupling of the US dollar from gold, we are experiencing the third round of gold bull market after 1971-1980 and 2002-2011. However, in terms of details, this gold rush has its own special features. It is actually the combination of two small cycles.

In the first stage, from the fourth quarter of 2018 to August 2020, the Fed's normal interest rate cuts and drastic monetary easing drove the start of this round of gold bull market.

Starting from the fourth quarter of 2018, the London gold price began to perform amid market speculation that the Fed's interest rate hike process was nearing its end. In March 2019, the Fed hinted at the FOMC meeting that it would not raise interest rates this year. By July, the Fed carried out its first interest rate cut in a decade, and then carried out the second and third interest rate cuts in September and October. During this period, the price of gold rose rapidly from $1,270/ounce to $1,530/ounce.

In December, the Federal Reserve said that interest rates would remain unchanged in 2020 and would remain at 1.75% for a period of time, which made gold prices lose the momentum to continue to rise. However, just two months later, the rampant spread of the new crown pandemic not only frustrated the Fed's plan to maintain interest rates, but also drew the steepest interest rate decline curve since the 21st century.

In response to the impact of the pandemic on the economy, in the first two weeks of March 2020, the Federal Reserve cut interest rates by 150 basis points from 1.75% to 0.25%. Stimulated by the Fed's interest rate cut and risk aversion demand, the price of gold in London broke through $2,000 in August 2020, surpassing the 2011 high to set a record high.

The second stage, from August 2020 to December 2022, the interest rate cuts ended, the Federal Reserve gradually turned on the "inflation warrior" mode, and the price of gold fluctuated under the shadow of war and inflation.

In the summer of 2020, people began to recover from the panic of the end of the world in the early days of the pandemic. Most economies also gradually recovered under the positive effects of fiscal policies and epidemic prevention and control. Global GDP growth gradually rebounded and came out of the trough. It has also become a consensus in the global market that the Federal Reserve will not maintain zero interest rates for a long time. As the US dollar index rebounded, the price of London gold showed a volatile downward trend throughout 2021.

The callback was interrupted by a hot war that has continued to this day. In February 2022, Russia's blitzkrieg on Kiev failed. Driven by the risk aversion of geopolitical conflicts, gold briefly returned to its previous high.

However, the actual yield of U.S. Treasury bonds still plays a more important role in the pricing of gold. The strong recovery of the U.S. economy after the epidemic has caused the inflation data in March 2022 to explode, and the figure of 8.5% has set a 40-year record. Since then, the Federal Reserve has started the main task of fighting inflation. The price of gold has retreated step by step in the rhythm of 7 interest rate hikes totaling 425 basis points this year, giving up half of the previous gains.

So far, it is still a familiar pattern, tightening liquidity, falling gold prices, U.S. Treasury bonds and gold on both sides of the scale, playing their roles competently. But at the end of this year, the trend of gold began to show subtle changes, and it was no longer satisfied with its limited role under the dollar order.

The third stage, from the beginning of 2023 to the present, is the most special stage of this round of gold bull market. The negative correlation between gold and the US dollar interest rate has shown a historically rare deviation.

Since 2023, the price of gold and the actual yield of US bonds have risen rapidly in sync - when the US dollar interest rate rose by 32 basis points, the international gold price also rose by more than 20%, breaking the gold analysis framework centered on the actual yield of US bonds.

And this deviation has been even more extreme in the market since this year.

To a certain extent, the market attributed the gradually accelerating "gold fever" since the beginning of this year to the fact that institutions were responding in advance to the previous expectation of "three interest rate cuts by the Federal Reserve this year". However, after the release of the March non-farm data, the 303,000 new non-farm jobs exceeded expectations, which reversed the expectation of interest rate cuts.

However, on the same day, after a slight drop at the opening, gold quickly rebounded and closed higher during the day. The COMEX gold price rose to $2,349.10 per ounce, setting a new record. Because the gold price rose due to the expectation of interest rate cuts, it did not fall back due to the delay in the progress of interest rate cuts, but instead climbed to a historical peak.

David Einhorn, founder of hedge fund giant Greenlight Capital, bluntly stated: This year, the Federal Reserve may not have a chance to cut interest rates even once[6]. The second half of his sentence is: "But the Fed's policy shift will not hinder the upward momentum of gold prices... Gold is one of our important investments... It is a way for us to hedge against possible adverse situations in the future." This is also a key node in the development of this round of "gold fever" to today: when a large number of analysts around the world use the negative correlation with the actual yield of US Treasury bonds as the anchor of gold, what does the occurrence of divergence and the failure of the anchor mean for gold investment? Today's investors are accustomed to the inverse relationship between gold and the actual yield of US Treasury bonds, but this simple negative correlation is not all about gold prices. Gold, as an extremely special metal whose recognition of its value has almost been engraved into human DNA, is both a commodity, an investment product and a general equivalent. Its price is determined by three factors: short-term, medium-term and long-term[2].

In the short term, gold prices are affected by risk aversion and speculative trading.

Since 2019, the world has been the opposite of calm. The COVID-19 pandemic has swept the world, the US government has been hitting its debt ceiling, the Russian-Ukrainian war and the chaos in the Middle East have made the "S3 Season" a concern for more and more people. Each risk event has driven gold prices up in a pulsed manner.

At the same time, speculative trading is also accelerating the sprint of gold prices. On March 4, the closing price of gold hit a record high, and it was at this time that speculative long positions in gold increased rapidly and short positions decreased rapidly [3]. Historically, every time the gold price breaks a new high, it will continue to rise rapidly for a period of time, which is exactly the same as this round of performance.

Of course, the big guys usually say more directly: those who are afraid of heights are miserable.

The price of gold is affected by the supply and demand of commodities and liquidity in the medium term.

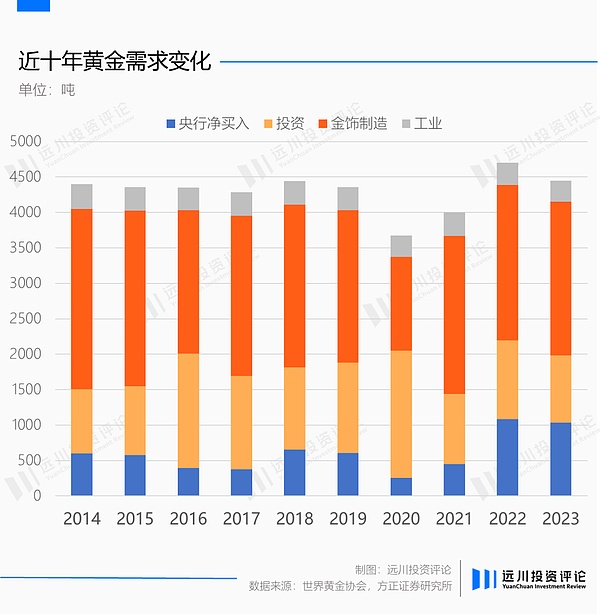

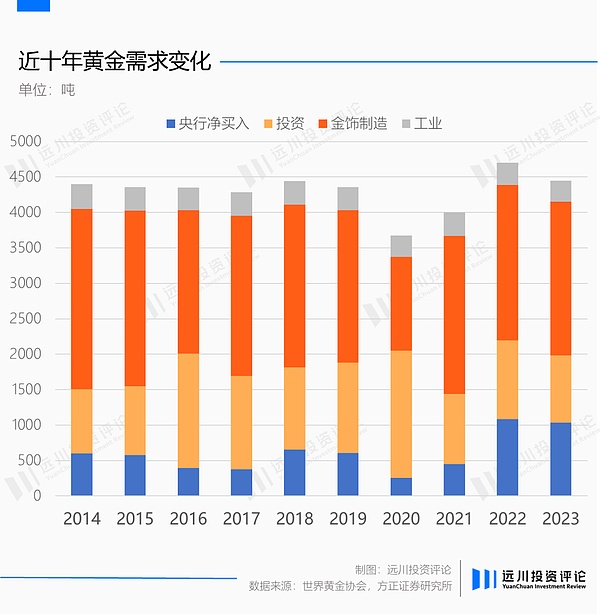

The demand for gold is mainly divided into four parts: gold jewelry manufacturing, industry, investment, and central bank net purchases. The proportion of industrial gold is low and the fluctuation is not large. Although the demand for gold jewelry is high, due to its relatively stable demand, it has only declined significantly in 2020 in the past decade. Therefore, the main factors affecting the price of gold are investment demand and the net purchase behavior of central banks of various countries.

In the past two years, the central bank's net purchases have surged, but from the overall changes in gold demand, it is obviously unable to explain this round of gold bull market, as well as the more common precious metals bull market and resource bull market in commodities.

This is the result of excessive liquidity. In 2020, the Federal Reserve and the US government used the most radical fiscal and monetary policies to prevent the US economy from falling into recession, but this was not without cost. The skyrocketing commodity prices and high inflation are not only the number one enemy of the United States, but also make the whole world anxious.

London copper futures rose more than 1 times from March 2020 to March 2022, and WTI crude oil rose an astonishing 20 times from April 2020 to May 2022. In contrast, the increase in gold prices can only be described as moderate.

In fact, medium-term factors are often an important support for driving a round of gold bull market, and are often the driving force behind breaking the negative correlation between gold and US bond real yields.

The last time gold and US bond real yields diverged was at the beginning of the last round of gold bull market. In the golden decade from 2002 to 2012, the price of gold rose more than five times. Before the outbreak of the financial crisis caused the dollar to fall, from 2005 to 2007, the US real interest rate rose in prosperity, but the price of gold also sounded the horn of a bull market at the same time - the global commodity bull market plus the continuous decline in gold production pushed the price of gold up.

The long-term factor affecting the price of gold, that is, credit hedging, is a slow variable. It is not the main determinant of short-term prices, but the subtle changes that are taking place at this moment will be reflected in the pricing of gold in a longer process of realization.

Since 2018, trade protectionism has risen again, the global value chain has shown a trend of shrinking, and geopolitics has become an important basis for companies to choose supply chain layout [4].

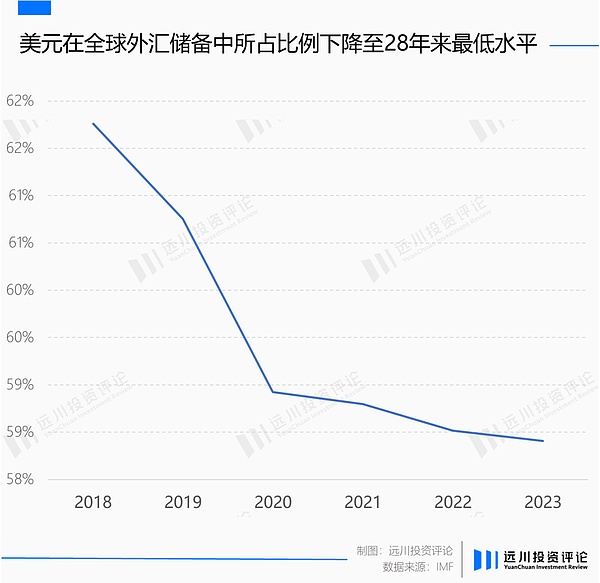

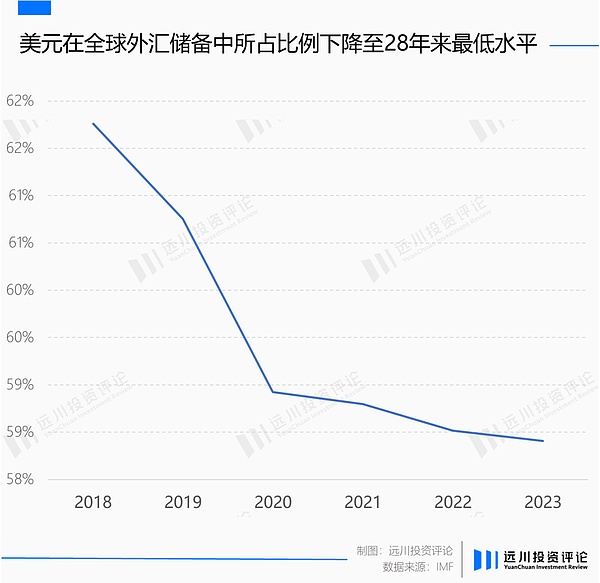

The heart of the US dollar system is also not at peace. The weaponization of the US dollar settlement system - sanctions against Iran, Russia and other countries, makes over-reliance on this legal currency no longer the best choice. According to public reports alone, countries such as Brazil, ASEAN, India, Malaysia, Saudi Arabia and others have actively developed diversified trade settlement tools. At the same time, the proportion of the US dollar in global foreign exchange reserves has also declined year by year since 2018.

According to the World Gold Council's 2023 survey, more than half of the 57 central banks surveyed will reduce the proportion of the US dollar in their total reserves in five years, and emerging economies are particularly willing to reduce their US dollar reserves. 62% of the central banks surveyed said they would increase the proportion of gold in their total reserves in the next five years, while this figure was only 42% in 2022[1].

The specter of re-inflation under the non-agricultural data makes the future purchasing power of all fiat currencies doubtful, and there are not many options left for central banks of various countries, and gold is the most obvious one among them. In 2022, the net purchase of gold by central banks of various countries more than doubled compared with 2021, and the strong net purchase has continued to this day, contributing the largest marginal change in gold demand.

When short-, medium- and long-term factors converge on the trend of gold prices, it may not be the era of gold, but it must be the gold of the era.

Hedge against fate

Cycle King Zhou Jintao summarized the investment of gold with his most classic Kondratieff perspective: the trend of gold can be seen as the opposite of economic growth. Starting from the long wave recession period, gold assets will enter a long-term bull market and obtain significant excess returns in the 5-10 years of super market in the depression period.

From this perspective of holding based on the ultra-long Kondratieff cycle, ALL IN gold is not a good idea for ordinary people. In fact, judging from the position of futures and options, the current gold long transaction has reached the most crowded level since the new crown. As long positions stop profit and short positions stop entering the market, a "long kills long" decline may occur.

Gold has never been a good variety for short-term fluctuations. The overall volatility of gold is slightly lower than that of the CSI 300, but because gold will fluctuate downward for many years due to the influence of the macro economy, the payback period for buying gold at a high point is not short. For example, investors who followed the trend and bought gold in 2013 will not be able to get out of the trap until 7 years later.

On the other hand, participants in the short-term game of gold face a powerful opponent who is almost omnipotent. In addition to professional asset management institutions, another major buyer in the gold market is the central banks of various countries. In 2023, the central bank's net purchase of gold exceeded 1,000 tons, becoming the second largest source of demand after gold jewelry manufacturing.

That is to say, central banks of various countries, which can determine the trend of gold prices denominated in their own currencies by adjusting nominal interest rates to a certain extent, are also the largest players in the gold market. This makes it unwise for small investors to try to win money from the referee.

But when we jump out of the perspective of short-term games and examine gold from the perspective of long-term asset allocation, it becomes one of the few "fate hedging tools" for most ordinary people.

On the one hand, for many families who regard outperforming inflation as a wealth management demand, although the price of gold has a certain volatility, from a 50-year time scale, the price of gold has been steadily rising. Some studies have found that the increase in the price of gold is about 3.2 times the level of inflation[2].

From a broader perspective, if we are destined to experience the end of the Kondratieff cycle, where recession turns to depression, then the excess returns of gold in this environment may offset some of the helplessness in our fate; of course, if we are lucky enough to usher in a new cycle and find a fast track to economic prosperity in the technological singularity, non-interest-bearing gold will only cause us to lose a limited holding cost in our lives.

This is the charm of gold in the foggy era: in every short term, traders are wrestling with the central banks of various countries on their own; but in the longer-term economic laws, the Kondratieff cycle has written the wealth destiny of a generation.

References

[1] Why did the gold price hit a new high: Gold analysis framework and global de-dollarization, Zeping Macro

[2] Theory of oscillation cycle, Zhou Jintao

[3] Review and outlook of this round of gold surge, Guosheng Macro

[4] Economic anti-globalization: phenomenon, dilemma and countermeasures, Zhang Guangting and Liu Tao

[5] The proportion of the US dollar in global foreign exchange reserves has dropped to a 25-year low, IMF BLOG

[6] David Einhorn thinks inflation is reaccelerating and has made gold a very large position, CNBC

WenJun

WenJun