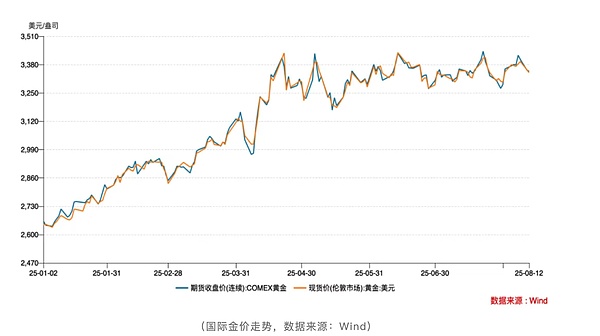

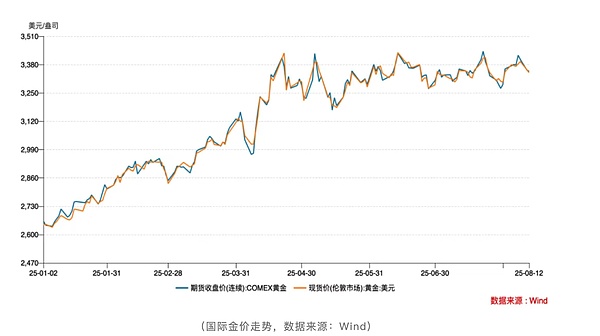

Against the backdrop of a strong stock market, gold, once a hot commodity this year, is gradually losing favor. As of the close of trading on August 12th (US time), the main COMEX gold contract on the New York Mercantile Exchange (COMEX) fell below the $3,400 mark, trading at $3,399 per ounce. The previous day, on August 11th, the front-month COMEX gold futures contract plummeted nearly 2.5%, its largest drop since May. Prior to this, the settlement price of COMEX gold futures on the COMEX had remained above $3,400 per ounce throughout August. As of 4:30 PM (Beijing time) on August 13th, the price had slightly retreated back above $3,400 per ounce. Furthermore, the price of spot gold in London also continued to decline, closing at $3,348.02 per ounce on August 12th (US time), down 1.4% from its August high. As of 4:30 PM Beijing time on August 13th, its price was $3,356.91 per ounce. The scale of gold ETFs in the Chinese market has also continued to shrink. Wind data shows that as of August 12th, the scale of seven gold ETFs based on the China Gold Spot Price Yield (SGE Gold 9999) had shrunk by approximately 6.9 billion yuan in one month. Wind data also shows that over the past month, the scale of the Huaan Gold ETF has decreased by 3.1 billion yuan, while the scale of the E Fund Gold ETF and the Guotai Gold ETF has decreased by 1.5 billion yuan and 1.2 billion yuan, respectively. Market participants believe that as global trade conflicts ease and risk aversion cools, investor enthusiasm for gold has declined. Furthermore, US President Trump's statement that he would not impose tariffs on imported gold bars also caused a sharp drop in gold prices. Meanwhile, China's onshore and offshore stock markets continued to rise, prompting investors to take profits from the gold market and shift to higher-yielding risk assets such as stocks. Some are taking profits, while others are secretly increasing their holdings. Looking at the long term, bank wealth management products, public funds, and private equity funds have all been increasing their holdings in "gold plus" products. Many bank wealth management products maintain a gold allocation ratio of 5%-10%. Among private equity funds, one insurance asset management company's global allocation fund (FOF) has allocated 15% to gold ETFs; the performance benchmarks of insurance asset management companies' gold-driven products even set a 30% gold allocation. "Gold plus" products generally refer to multi-asset portfolios that allocate at least 5% to gold within their performance benchmark or asset allocation strategy. Investor sentiment regarding gold prices is crucial. Many investors believe that despite recent price fluctuations, gold still has significant potential for long-term upside. UBS Wealth Management stated in its latest report that, under its baseline scenario, its target price for international gold is $3,500 per ounce, with the possibility of prices rising to $3,800 per ounce not ruled out. In a July 13th report, Goldman Sachs stated that driven by factors such as a pullback in speculative funds and central bank buying, the international gold price could reach $3,700 per ounce by the end of 2025 and $4,000 per ounce by mid-2026. Wang Lixin, CEO of the World Gold Council China, told Caixin that for ordinary Chinese investors, investing in gold can globalize their asset allocation. Furthermore, given China's relatively low interest rates, it can also increase their overall investment returns. "Generally speaking, for ordinary investors, gold investment faces three difficulties: decision-making, as it is difficult for ordinary investors to fully grasp the gold investment strategy; timing, as it is difficult to know when to enter the market; and holding, as it is difficult to hold on to gold after buying it. Incorporating 'gold+' into bank wealth management and fund products, or to a certain extent relying on the management of professional institutions, can help investors cope with the above challenges."

Outflows from China's gold ETFs accelerate

In addition, data from the World Gold Council shows that for long-term funds, such as insurance funds, insurance asset management companies are already allocating funds to private equity products containing gold. This is driven by institutional investors seeking long-term, stable returns. Furthermore, the further opening of the gold market is also a driving force. In February, the insurance industry launched a pilot program for gold investment, with 10 companies potentially investing 200 billion yuan. Globally, many overseas long-term funds have already invested in gold. For example, Bridgewater Associates will launch an "All Weather ETF" in 2025, with a 14% allocation to gold. Furthermore, Japan's Nikko Asset Management has issued a multi-asset asset management product with a gold allocation of approximately 20%.

Is it still worth investing?

Perceptions of gold prices influence investor decisions. Many investors believe that despite recent consolidation in gold prices, there is still significant room for medium- to long-term upside. UBS Wealth Management stated in its latest report that it remains bullish on gold within global asset allocation. Under its baseline scenario, its target price for international gold is $3,500 per ounce. If geopolitical or economic conditions deteriorate, a rise to $3,800 per ounce is not ruled out. Goldman Sachs, in a July 13th report, predicted that international gold prices could reach $3,700 per ounce by the end of 2025 and $4,000 by mid-2026. Goldman Sachs believes that the pullback in speculative positioning is creating space for structural funds (i.e., inflows into gold ETFs and continued central bank purchases) to flow into the gold market, which is becoming a key support for gold demand. Regarding central bank demand, UBS stated that the current pace of central bank gold purchases remains well above the average level from 2010 to 2021. Looking at China, data from the State Administration of Foreign Exchange (SAFE) shows that as of the end of July, the People's Bank of China's gold reserves stood at 73.96 million ounces, a month-on-month increase of 60,000 ounces, marking the ninth consecutive month of increases in official gold reserves. Looking ahead, the recently released World Gold Council Central Bank Gold Reserves Survey 2025 shows that nearly all respondents (69 out of 73) expect to increase their gold reserves or maintain them stable. A record high of 43% plan to increase their holdings in 2026 (compared to 29% in the 2024 survey). UBS predicts that central bank demand is expected to remain stable in the second half of 2025, with annual purchases potentially reaching 900 to 950 tons. Jia Shuchang, Head of China Research at the World Gold Council, told Caixin that the significant increase in international gold prices compared to previous years has, to some extent, impacted the current pace of central bank gold purchases. However, central bank gold purchases are driven more by diversifying their foreign exchange reserves, which will influence their gold purchasing trends in the medium and long term. From a gold investment perspective, UBS notes that US President Trump's "high-handed" approach to tariff negotiations has revived sentiment in riskier assets. However, gold prices currently factor in improved risk sentiment, a strong rebound in the US dollar, and a delay in the Federal Reserve's interest rate cut. However, unexpected weakness in the US job market, coupled with renewed escalation in tariff conflicts, has led to a resurgence in risk aversion, prompting investors to turn their attention to gold. In July, US non-farm payrolls increased by 114,000, the lowest monthly increase since December 2020. The unemployment rate rose by 0.2 percentage points to 4.3%, the highest level since October 2021. Furthermore, tariff conflicts between the US and countries like India and Switzerland have recently escalated. From a medium- to long-term perspective, Li Gangfeng believes the most important factor is the US dollar index. If Trump's tariff policy triggers a US recession and escalates trade tensions between countries, it could prompt central banks and investors to reduce their holdings of US dollar assets. This view echoes many others. Jia Shuchang also stated that at present, the three major international credit agencies, Standard & Poor's, Fitch and Moody's, have all downgraded the United States' AAA sovereign credit rating. The credit problem of the US dollar has become a key factor driving the gold trend. Catherine

Catherine