Author: Sasha Shilina, Cointelegraph; Compiler: Deng Tong, Golden Finance

1. The role of digital currency investment products

Cryptocurrency investment products play an important role in democratizing digital currency and It plays a vital role in diversifying investment portfolios, promoting institutional adoption, ensuring compliance and promoting market liquidity, thereby supporting the mature development of the Web3 ecosystem.

In the contemporary financial field, digital currency investment products are crucial. They break down barriers and provide inclusive access to the world of blockchain and cryptocurrency, ensuring that its potential benefits reach a wider audience beyond exclusivity.

For investors seeking portfolio diversification, these products provide the opportunity to interact with unique and uncorrelated asset classes. Including Bitcoin in a diversified digital asset portfolio can serve as a risk mitigation strategy amid uncertainty in traditional financial markets.

Customized for institutional investors, these products contribute to broader digital currency adoption, increase market legitimacy, and accelerate the prosperity of the entire crypto ecosystem. Many products adhere to regulatory frameworks, providing a compliant and secure pathway, which is vital for prudent investors building trust in the ever-evolving cryptocurrency market.

These products also increase market liquidity and trading volume, attracting a wider range of investors through regulated investment vehicles, thereby enhancing overall market stability.

Furthermore, the availability and success of these investment products demonstrates the maturity of the cryptocurrency market and contributes to the evolving financial market’s inclusion of digital currency assets.

2. Understand Grayscale Bitcoin Trust

GBTC is a digital financial instrument designed to provide individuals interested in cryptocurrency with investment opportunities in the Bitcoin market, eliminating Direct access to underlying assets.

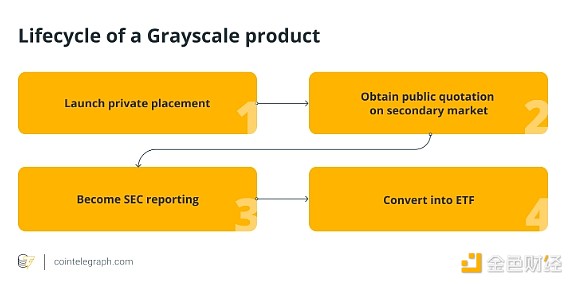

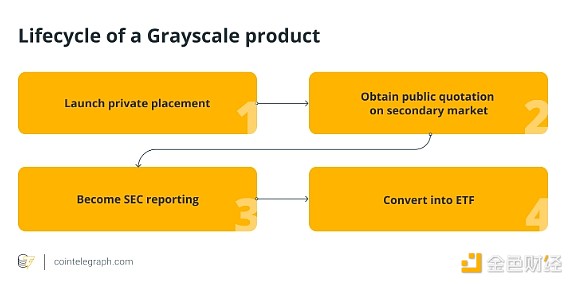

Grayscale has played a pioneering role in Bitcoin (BTC) accessibility with the launch of the Grayscale Bitcoin Trust (GBTC), marking the creation of this first-of-its-kind Bitcoin fund that enables investors to Access BTC through a familiar investment tool.

Established in September 2013 as a private open-ended trust for qualified investors, it represents a diversified collection of investor funds and has the ability to issue an unlimited number of shares.

GBTC received approval from the U.S. Financial Industry Regulatory Authority (FINRA) in 2015 to trade on a publicly traded basis, allowing investors to buy and sell shares under the ticker symbol GBTC. The trust is passively invested in Bitcoin, providing investors with exposure to BTC as a security without the complexity of purchasing, storing and protecting Bitcoin directly. GBTC shares are designed to track the BTC market price with low fees and expenses.

Originally only available as a private offering, GBTC became publicly traded on the over-the-counter market OTCQX in 2015, following the alternative reporting standards for companies that do not have to register with the U.S. Securities and Exchange Commission (SEC).

Modeled after the SPDR Gold Trust, a gold exchange-traded fund (ETF) backed by physical gold, GBTC has expanded its product line to include Ethereum (ETH), Litecoin ( LTC) and other cryptocurrencies.

3. Spot bits Coin ETF Approval

The U.S. Securities and Exchange Commission’s approval of a spot Bitcoin ETF marks an important milestone, increasing the legitimacy of the crypto industry and increasing mainstream acceptance of Bitcoin.

An ETF is an investment product that represents a single asset or a package of a basket of assets such as stocks or bonds. ETFs trade on stock exchanges and provide investors with a convenient way to obtain a diversified portfolio without purchasing individual securities. They provide liquidity, flexibility and transparency, with prices constantly changing throughout the trading day.

Like GBTC Spot Bitcoin exchange-traded funds (ETFs) eliminate the need for investors seeking Bitcoin exposure to identify cryptocurrency exchanges, create wallets, link bank accounts and manage Bitcoin storage. Instead, investors can invest in ETFs through GBTC through their existing brokerage accounts.

In 2017, Grayscale aimed to convert GBTC into an ETF to increase accessibility to retail investors. Despite repeated rejections from the SEC, citing concerns about market manipulation and investor risk, the regulatory environment changed in January 2024. The SEC approved Grayscale’s spot Bitcoin ETF application, along with 10 other ETFs, resulting in GBTC being listed as an ETF on NYSE Arca on January 11, 2024.

As of early January 2024, GBTC accounts for approximately 3% of the total Bitcoin supply. Since becoming an ETF, redemptions from GBTC have exceeded its assets under management (AUM) as of January 31 by more than $5 billion. However, outflows from GBTC slowed at the end of January, and the fund still holds around $22 billion in AUM, surpassing all other competitors, including BlackRock, which holds $2 billion in AUM.

The value of the GBTC portfolio is declining due to large outflows and falling Bitcoin prices, despite strong demand from rival Bitcoin ETFs. Additionally, assets of failed cryptocurrency exchange FTX and hedge fund Alameda Research reportedly sold more than two-thirds of their GBTC shares by January 22, 2024.

In contrast, competing Bitcoin ETFs launched by BlackRock and Fidelity have experienced growth. Unlike GBTC, these ETFs attracted net daily inflows. Some attribute GBTC’s decline in assets to its 1.5% annual management fee, which is still higher than competing products.

4. How does Grayscale Bitcoin Trust work?

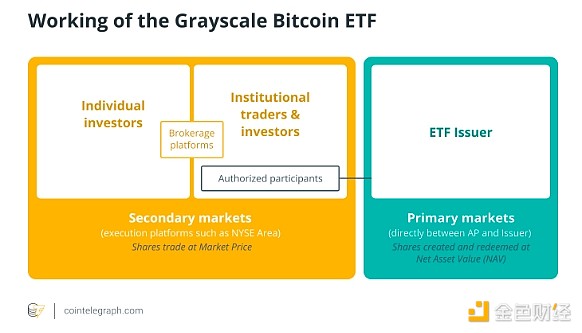

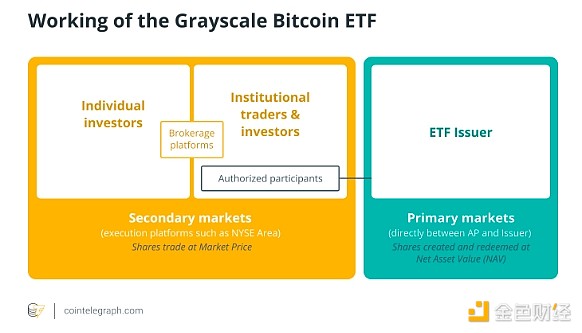

GBTC, as an ETF, enables institutional investors to invest in the primary market and provides retail investors with regulated access to Bitcoin in the secondary market, where share prices may dynamically fluctuate based on demand .

Before receiving approval as a spot Bitcoin ETF, GBTC initially operated only in the over-the-counter market; subsequent regulatory disputes led to the SEC approving Grayscale’s application to convert the trust into an ETF. As an ETF, GBTC shares can be traded on the primary and secondary markets, with access to the primary market restricted to select institutional investors.

Authorized partners who wish to invest in GBTC can purchase Bitcoin on the primary crypto market through Grayscale and issue a corresponding number of GBTC shares to obtain funds. These shares can then be sold to retail investors on the stock market.

GBTC charges a 1.5% annual management fee, which covers all costs associated with managing and protecting the underlying Bitcoin. There are no other additional charges.

By tracking the price of Bitcoin on the XBX Index, GBTC’s performance is benchmarked against the index. Although the trust holds a large amount of actual Bitcoin, the price of GBTC shares is designed to reflect the value of each share of Bitcoin held.

However, GBTC shares often trade at a significant premium or discount to the actual value of the underlying Bitcoin, which is its net asset value (NAV). Various factors, including supply and demand dynamics, investor sentiment and market conditions, can affect this difference between share price and NAV.

After a six-month lock-in period, investors can retain or sell their shares to retail investors in the secondary market. In the secondary market, GBTC shares identified by the ticker symbol GBTC often trade at a premium influenced by investor demand. For example, during periods of significant increases in the value of Bitcoin, demand for GBTC shares typically rises, causing its market price to rise.

5. Advantages and Disadvantages of GBTC

GBTC provides easily accessible exposure to Bitcoin, but suffers from trading premiums, high asset management fees and potential deviation from the underlying asset value. criticize.

GBTC provides a streamlined path for individuals new to cryptocurrencies to trade Bitcoin shares in a traditional brokerage account without the complexity of directly owning the asset. The trust’s ease of accessibility extends to tax-advantaged accounts, which may result in potential tax advantages compared to traditional cryptocurrency investments.

GBTC has enhanced security measures and follows industry standards, mitigating the risks associated with storing assets on vulnerable exchanges. Investors can be indirectly exposed to Bitcoin price fluctuations without having to manage a digital wallet, making it a convenient option for those exploring the crypto space.

However, GBTC has come under scrutiny for trading at a significant premium or discount, which affects actual returns and has attracted criticism. The trust's 1.5% annual management fee is considered high and could erode returns, especially in a bear market, making it less cost-effective than other options.

Despite these issues, GBTC remains a bridge between traditional finance and the cryptocurrency market, providing liquidity, fractional ownership options, and tax-efficient cryptocurrency trading. Managed by reputable firm Grayscale Investments, GBTC remains a popular choice among investors seeking to gain exposure to Bitcoin within the regulatory framework of traditional financial markets.

6. Future Prospects

GBTC plays a vital role in the evolving landscape of digital finance and continues to promote the mainstream adoption and integration of cryptocurrencies into traditional investment portfolios.

GBTC is unique in the cryptocurrency world. Its enduring success reflects growing investor interest in the cryptocurrency space, as well as the Trust’s commitment to navigating the complexities of the regulatory framework.

As the cryptocurrency space evolves, GBTC remains a cornerstone for those embracing cryptocurrency diversification strategies. Its role in providing investors with seamless access to Bitcoin and its commitment to risk management in the crypto space underscores its importance in the expanding world of digital assets.

In an ever-changing market, GBTC remains a key player, shaping the narrative of cryptocurrency investment and influencing the wider adoption of digital assets.

JinseFinance

JinseFinance