Source: CoinTelegraph; Compiled by: Baishui, Golden Finance

1. Quantitative Easing (QE) Explanation

Quantitative Easing (QE) is an unconventional monetary policy tool used by central banks, especially when interest rates are already low and cannot be lowered further.

It became popular during the 2008 global financial crisis, when traditional monetary tools such as lowering interest rates were not enough to stimulate economic growth.

The main goal of quantitative easing is to boost the economy by increasing the money supply. It is achieved by encouraging banks to increase lending and reducing borrowing costs for consumers and businesses. When a central bank implements quantitative easing, it buys government bonds or other securities from the market to inject cash into the financial system.

Although people sometimes say that quantitative easing is like "printing money," it is different from making new physical money. Instead, it increases the amount of digital money in the economy, that is, the balance in bank accounts. This is not a cryptocurrency; it is regular money created by the central bank, which banks use to increase lending, which helps stimulate spending and investment.

Quantitative easing also pushes up the prices of assets such as stocks and bonds, as extra money seeking a return pushes up demand. Governments have also used quantitative easing to keep their economies afloat and support growth during the COVID-19 pandemic.

How does quantitative easing work?

To understand how quantitative easing works behind the scenes, it’s important to understand the step-by-step mechanisms that drive it.

Quantitative easing doesn’t work through a single action—it works through a chain of events that starts with the central bank and ends up affecting day-to-day economic activity. The process typically goes something like this:

Asset purchases: The central bank buys government securities, such as Treasury bonds, from banks and financial institutions.

Increases in the money supply: These purchases flood the financial system with liquidity.

Lowering interest rates: With more cash on hand, banks lower interest rates, making loans cheaper.

Promote lending and spending: Cheaper loans mean more business investment and consumer spending, which are the main drivers of economic growth.

III. Quantitative Easing in Practice: Historical Examples

Quantitative easing is not just a theory—it has been used by major central banks during tough economic times.

Here are some real-world examples:

United States (2008-2014; 2020): Global Financial Crisis

The U.S. economy fell into a deep recession after the housing market collapsed in 2008. The following measures can help:

The Federal Reserve launched three rounds of quantitative easing (QE1, QE2, QE3).

It bought trillions of dollars worth of government bonds and mortgage-backed securities.

This helped lower interest rates, support lending and boost stock markets.

When the coronavirus pandemic shut down the global economy, the Fed acted quickly:

It reintroduced quantitative easing, buying $120 billion in bonds a month at its peak.

The aim was to keep borrowing costs low and support businesses and households.

Japan (2001-2006, and 2013 to present): Fighting Deflation

Japan has been struggling with low inflation and weak growth for years. The Bank of Japan (BoJ) said it:

Eurozone (2015-2022): Post-Debt Crisis Recovery

After the debt crises in Greece, Italy, and Spain, the European Central Bank (ECB) introduced quantitative easing:

Fourth, How Quantitative Easing Affects the Cryptocurrency Market

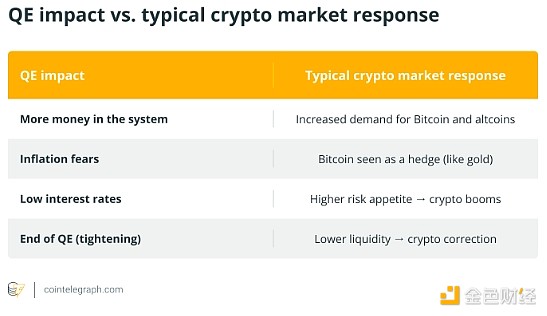

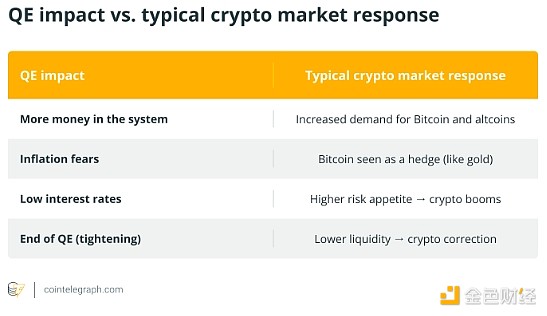

Quantitative easing not only affects traditional financial markets, but also the cryptocurrency market.

When central banks inject more money into the economy, some of it flows into alternative assets such as Bitcoin and altcoins, pushing up their prices. With more money available for investment, the surge in liquidity typically pushes up prices for all assets, including cryptocurrencies.

How Quantitative Easing Affects the Cryptocurrency Market

Quantitative easing affects not only traditional financial markets, but also the cryptocurrency market.

When central banks inject more money into the economy, some of it flows into alternative assets such as Bitcoin and altcoins, pushing up their prices.

How Quantitative Easing Affects the Cryptocurrency Market

Quantitative easing affects not only traditional financial markets, but also the cryptocurrency market.

When central banks inject more money into the economy, some of it flows into alternative assets such as Bitcoin and altcoins, pushing up their prices.

As more money becomes available for investment, the surge in liquidity typically pushes up prices for all assets, including cryptocurrencies.

In addition, during quantitative easing, fiat currencies may depreciate due to the increase in money supply, causing some investors to seek cryptocurrencies to hedge against the risk of inflation or currency depreciation. Bitcoin, in particular, is often seen as a store of value similar to gold.

For example, during the 2020 COVID-19 pandemic, the Federal Reserve launched an aggressive quantitative easing policy. Meanwhile:

In March 2020, Bitcoin traded below $5,000.

By the end of 2021, this price had soared to over $60,000.

Key factors for Bitcoin's rise during quantitative easing include increased inflation concerns and low interest rates prompting investors to turn to alternative assets. One major driver may be the search for a store of value outside of traditional finance. Therefore, quantitative easing can indirectly promote the prosperity of the cryptocurrency market by affecting investor sentiment and liquidity.

The other side: cryptocurrencies may be affected after quantitative easing ends.

When central banks end quantitative easing or start raising interest rates (tightening policy), liquidity decreases and borrowing costs rise. This could lead to a pullback in risky assets, including cryptocurrencies.

For example, in 2022, the Federal Reserve began quantitative tightening to combat inflation. Bitcoin prices fell from about $47,000 in March to below $17,000 in December - this could be due to investors turning to safer assets and a decline in risk appetite due to rising interest rates.

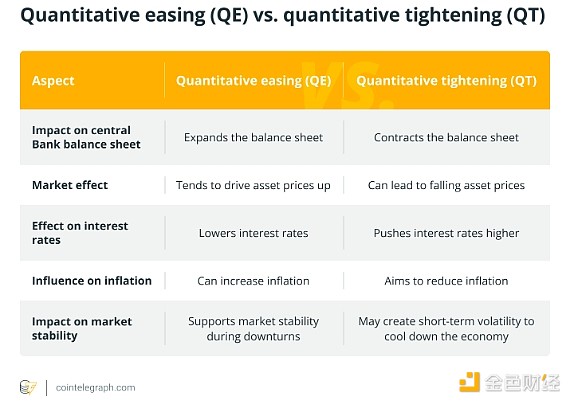

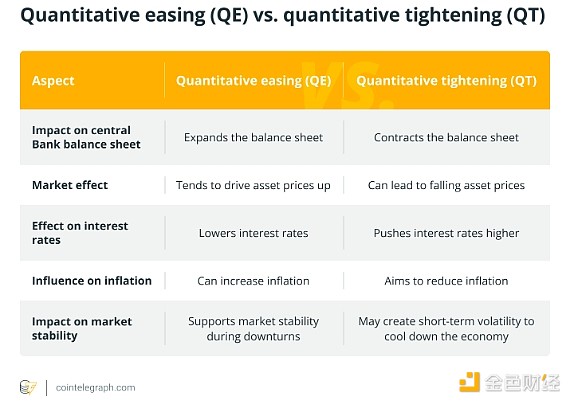

Five, Quantitative Easing (QE) and Quantitative Tightening (QT): Main Differences

Quantitative Easing (QE) and Quantitative Tightening (QT) are two opposite monetary policies adopted by central banks.

Quantitative easing refers to the process of expanding the money supply by purchasing assets such as government bonds, thereby injecting cash into the economy to stimulate economic growth. Its main purpose is to lower interest rates and encourage lending when the economy is in trouble.

Quantitative easing (QT) is the process by which a central bank shrinks its balance sheet. It involves selling assets or letting them mature, thereby reducing the money supply. The goal of quantitative easing is to cool an overheated economy and prevent inflation from rising too quickly.

The key difference between quantitative easing (QE) and quantitative tightening (QT) is their impact on the central bank's balance sheet: quantitative easing expands the balance sheet, while quantitative tightening shrinks it. In terms of market effects, quantitative easing tends to push up asset prices, while quantitative tightening can lead to lower asset prices and higher interest rates. Both policies can significantly affect inflation and market stability.

Is tapering the Fed's bond purchases the same as quantitative easing?

No, tapering and quantitative easing are not the same - but they are linked.

Quantitative easing refers to the Fed's active purchases of assets such as government bonds to inject money into the economy and lower interest rates.

Tapering refers to the Fed slowing its asset purchases - this is the beginning of the end of quantitative easing, not a reversal.

Six, will the Fed tighten or ease in 2025?

As of April 2025, the Federal Reserve is facing a complex economic landscape characterized by persistent inflationary pressures and slowing economic growth.

In response, the Fed maintained its benchmark interest rate in a range of 4.25%-4.50%, indicating a cautious approach to monetary policy adjustments.

While the Fed has not yet fully shifted to an accommodative stance, it has begun to slow down its quantitative easing efforts. Specifically, starting in April, the Fed will reduce its monthly issuance of U.S. Treasury bonds from $25 billion to $5 billion, while continuing to allow $35 billion of mortgage-backed securities to mature without reinvestment.

Looking ahead, the Federal Open Market Committee (FOMC) expects that two rate cuts may be made later in 2025, depending on economic conditions. This forecast reflects the Fed's attempt to balance its dual mandate of controlling inflation and supporting employment amid a number of uncertainties, including the impact of recent tariff policies.

VII. Advantages and Disadvantages of Quantitative Easing

Quantitative easing can promote growth and reduce borrowing costs, but excessive use may exacerbate inflation, asset bubbles and long-term policy challenges.

Advantages

Quantitative easing helps promote economic activity by increasing the money supply and encouraging lending and investment.

By purchasing government bonds, quantitative easing lowers interest rates, making borrowing cheaper for businesses and consumers.

By injecting liquidity into the economy, quantitative easing helps stimulate demand and support price stability, preventing deflation.

Disadvantages

Excessive increases in the money supply can lead to currency depreciation and push up inflation.

Loose monetary policy can push up asset prices, leading to overvaluation of stocks, bonds or real estate.

QE increases national debt and makes it more difficult for central banks to manage inflation or interest rates in the future.

Finally, QE remains a powerful but double-edged tool: it can stabilize economies in crisis, but it also carries long-term risks that must be managed carefully to avoid a repeat of past mistakes.

Alex

Alex