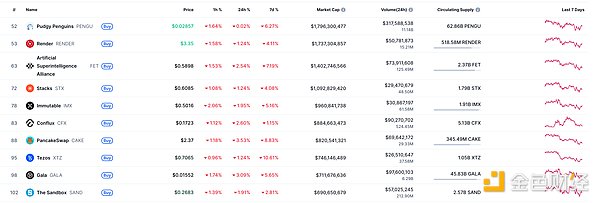

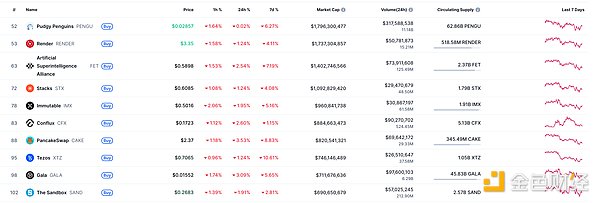

DeFi data

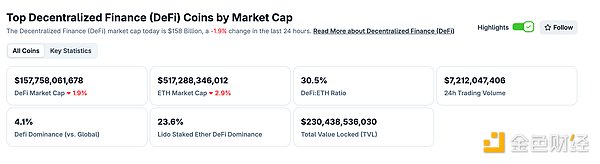

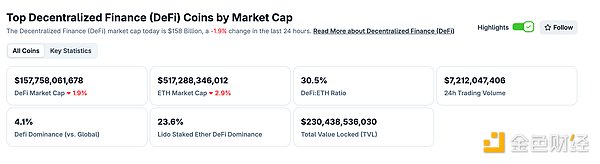

1. Total market value of DeFi tokens: 157.758 billion US dollars

2. The trading volume of decentralized exchanges in the past 24 hours was US$72.12

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

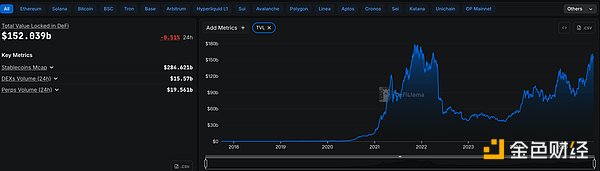

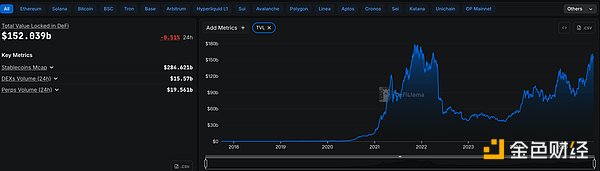

3. Assets locked in DeFi: US$152.039 billion

img src="https://img.jinse.cn/7396214_watermarknone.png" title="7396214" alt="qxOIwm5zilfX0TspAAiMDPV3Qiq4l9UT0LjAjHdI.png">

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

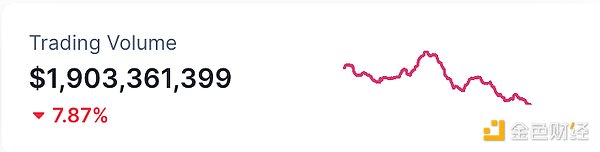

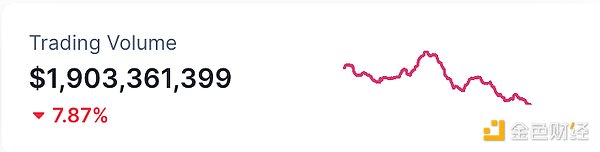

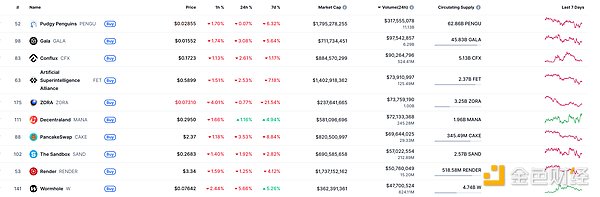

NFT Data

1. Total NFT Market Value: US$20.87 Billion

NFT total market value, top ten projects by market value Data source: Coinmarketcap

2. 24-hour NFT trading volume: 1.903 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

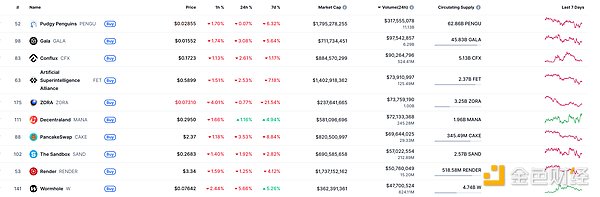

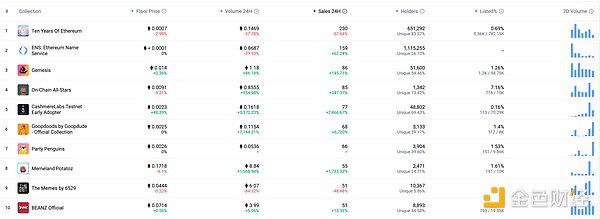

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Gemini announces the launch of its initial public offering

Golden Finance reported that the cryptocurrency platform Gemini announced today that it will issue 16,666,667 shares of Class A common stock for the first time, according to the S-1 registration statement filed with the U.S. Securities and Exchange Commission. In connection with this offering, Gemini and its selling shareholders intend to grant the underwriters a 30-day option to purchase up to an additional 2,396,348 and 103,652 Class A common shares, respectively, to cover over-allotments. The initial public offering price is currently expected to be between $17.00 and $19.00 per Class A common share. Gemini has applied to list on the Nasdaq under the symbol "GEMI." Goldman Sachs and Citigroup are the lead underwriters.

MEME hot spots

1. Caixin: Several Chinese participated in the Trump family encryption project WLFI

Golden Finance reported that according to Caixin.com, the World Liberty Financial project token WLFI, which is associated with US President Trump and his family, has been launched on almost all centralized cryptocurrency exchanges such as Binance, OKX, and Coinbase on September 1, 2025, Eastern Time. It is worth noting that many Chinese have also participated in the project, including Ryan Fang, founder of cross-chain platform Ankr, Rich Teo, co-founder of exchange Paxos, Sandy Peng, founder of Ethereum expansion project Scroll, and Falcon Finance, an exchange invested by DWF Labs, a market maker with Chinese background. In addition, Justin Sun has invested US$75 million in the World Liberty Financial project. 2. 80% of WLFI's top 10 individual holders chose to take partial/full profits. According to Golden Finance, on-chain analyst @ai_9684xtpa, the selling patterns of the top 10 WLFI individual holders are as follows:

80% of holders chose to take partial/full profits, with only the top 2 and 5 remaining holders not transferring or selling any tokens.

The top holder, moonmanifest.eth, retained the vast majority of its tokens. While its paper profit of 1 billion tokens has significantly declined with the decline in WLFI, it is still worth $230 million at the current price of $0.2318.

The top 6 holder, convexcuck.eth, sold $3.8 million worth of WLFI to 36 buyers via Whales Market, likely the primary source of WLFI OTC trading on the platform.

DeFi hot spots

1. Starknet has been down again, and engineers are fixing related problems

Golden Finance reported that Starknet’s official Twitter account stated that the Starknet network has been down again, and the engineering team has started to repair it. The detailed cause has not yet been announced, and progress will be updated later. 2. ETHZilla Plans to Deploy $100 Million in ETH to EtherFi for Restaking According to Golden Finance, Nasdaq-listed ETHZilla Corporation (Nasdaq: ETHZ) announced today plans to deploy approximately $100 million in Ethereum (ETH) to the liquidity restaking protocol EtherFi to increase its treasury yield. The company currently holds 102,246 ETH, with a total value of approximately $456 million, at an average purchase price of $3,948.72. 3. Venus Protocol Has Been Suspended According to community user feedback on September 2nd, the Venus Protocol has been suspended. Earlier news, Paidun reported that Venus Protocol users suffered a phishing attack, losing approximately $27 million in cryptocurrency.

4. Venus Protocol Attacked, Losing $30 Million

Golden Finance reported that the lending protocol Venus was attacked, resulting in losses of approximately $30 million.

5. Mastercard European Executive: Does Not Rule Out the Possibility of Developing Its Own Blockchain in the Future

Golden Finance reported that, according to TheBigWhale, Mastercard's European Head of Crypto Business, Christian Rau, stated in an interview that the company views crypto assets as a potential payment technology, rather than a disruptive innovation. Mastercard has already deployed cryptocurrency on-chain and off-chain services and a cryptocurrency payment card business, and is collaborating with organizations such as MetaMask, Bitget, and Moonpay to promote the adoption of crypto payments at merchants.

Rau noted that although stablecoin transaction volume has surpassed Mastercard's, the company views them as a settlement tool rather than a threat. Mastercard processes approximately 5,000 transactions per second, and its value lies not only in transaction speed but also in its supporting service systems such as anti-fraud, compliance, and recovery.

The report stated that while Mastercard does not have its own public blockchain project, it has not ruled it out: "We prefer interoperability with existing solutions. However, if none meet our needs, we will consider it."

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. We encourage everyone to cultivate sound investment practices and maintain a high level of risk awareness.

JinseFinance

JinseFinance