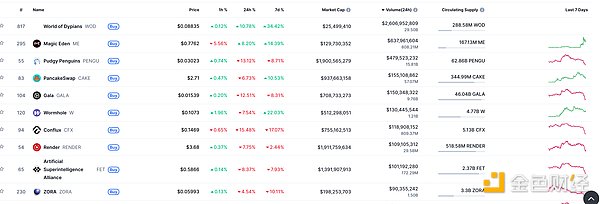

DeFi data

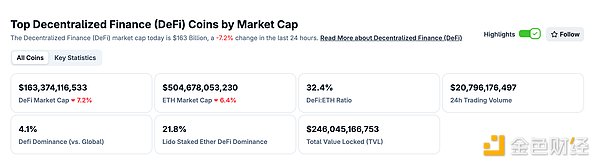

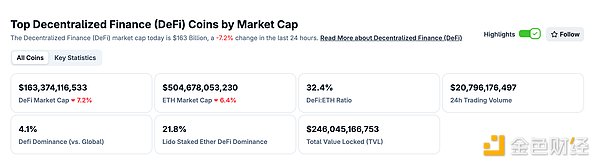

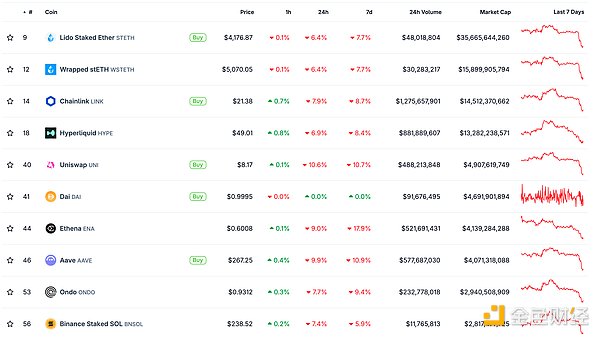

1. Total market value of DeFi tokens: 163.374 billion US dollars

2. The trading volume of decentralized exchanges in the past 24 hours is US$207.96

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

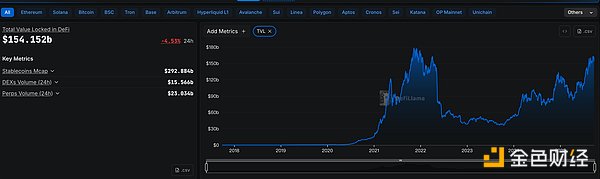

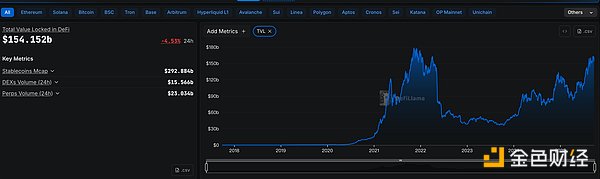

3. Assets locked in DeFi: US$154.152 billion

img src="https://img.jinse.cn/7401655_watermarknone.png" title="7401655" alt="cTEKVQE6VzBYoEaszdpuLs7xNEShR87wxhPmc2t1.png">

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

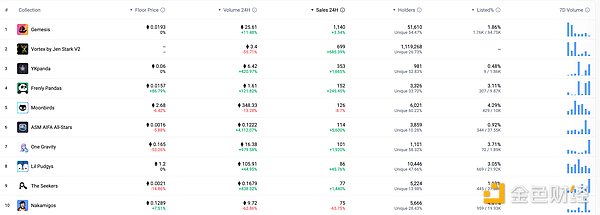

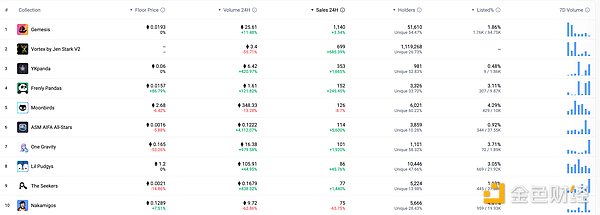

NFT Data

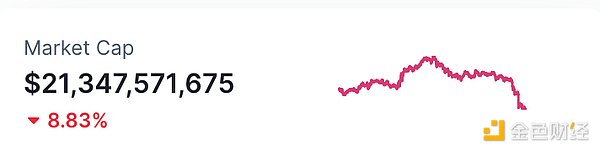

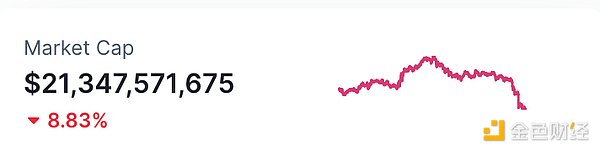

1. Total NFT Market Value: US$21.347 Billion

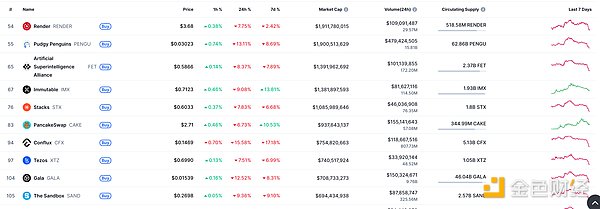

NFT total market value, top ten projects by market value Data source: Coinmarketcap

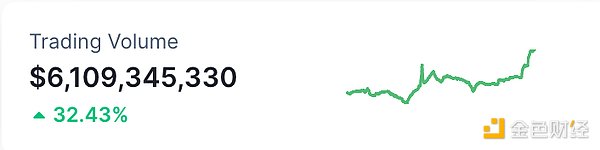

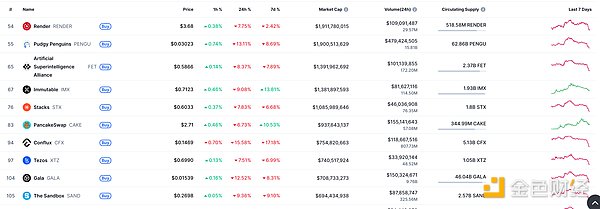

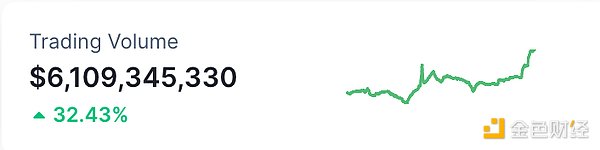

2. 24-hour NFT trading volume: 6.109 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

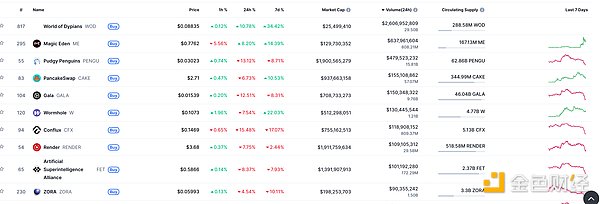

3. Top NFTs in 24 hours

Top 10 NFTs with the highest sales in 24 hours Data source: NFTGO

Headline

Institution: The prospect of a Fed rate cut may boost the bond market

Golden Finance reported that analysts at Swiss Rothschild Asset Management said in a report that expectations of further Fed rate cuts may boost the bond market. LSEG data shows that the market expects the Fed to very likely cut interest rates twice more before the end of 2025.

MEME Hotspots

1. Analysis: Solana Chain Meme Coin Trading Volume Declines Sharply as Traders Shift to Stable Assets

Golden Finance reports that the once-booming meme coin market on the Solana chain is showing signs of fatigue. Data from multiple analysis platforms indicates that meme coin trading, which previously accounted for over 60% of Solana's decentralized exchange (DEX)* activity earlier this year, has now fallen below 30%. This sharp decline follows a wave of speculative frenzy that propelled new tokens to viral success but also resulted in losses for many retail traders.

Analysts now suggest that after months of overextension, the market is undergoing a correction, with liquidity and trading enthusiasm shifting away from speculative tokens. Traders appear to be reallocating funds to more mature markets. Stablecoin trading pairs are gaining share on the Solana DEX, while derivatives for major tokens like SOL and ETH maintain stable liquidity. Kaiko analysts believe this shift reflects broader macro trends, including a rising demand for stability and yield opportunities, as well as ongoing concerns about the high volatility of the meme token sector.

DeFi Hotspot

Golden Finance reported that according to DeFiLlama data, the trading volume of DEX on the BSC chain reached 4.258 billion US dollars in the past 24 hours, surpassing Solana (3.861 billion US dollars) to rank first.

2. Mira announced that the name of the token is MIRA

On September 22, the decentralized AI infrastructure Mira announced that the name of the token is MIRA. As previously reported, on August 27, Mira announced the establishment of a foundation. The foundation will serve as the long-term manager of the Mira Network, focusing on decentralized network and protocol governance, and providing tool support for developers, researchers and the community.

3. Pancake Swap extends cross-chain exchange function to Solana

Golden Finance reported that according to official news, Pancake Swap will extend the cross-chain exchange "Crosschain Swaps" function to Solana. With the support of Relay technology, a single transaction on PancakeSwap can complete seamless transactions across 7 major blockchains.

4. Upheaval releases roadmap, including JumpPad and governance

On September 22, HyperEVM’s AMM DEX Upheaval released a roadmap, which includes JumpPad (no permission required to launch tokens), aggregator (Upheaval aggregator becomes Hyperliquid’s default router, aggregating all pools and venues to ensure that every exchange goes through Upheaval by default), Fiat On-Ramp (unlocking capital inflows), Liquidity Hub (providing liquidity support for new tokens), veUP governance (users lock UPHL to obtain veUPHL, reducing liquidity supply and continuously pushing up token prices; veUP holders vote on the direction of reward distribution, and project parties compete for voting rights by bribing holders.)

![]()

Catherine

Catherine