DeFi data

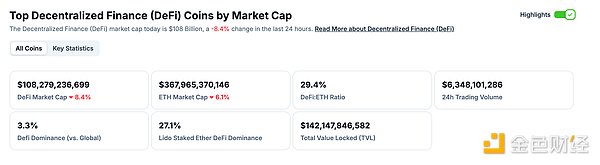

1. Total market value of DeFi tokens: US$108.279 billion

DeFi total market value data source: coingecko

< 2. The transaction volume of decentralized exchanges in the past 24 hours was 6.348 billion US dollars. .cn/7342304_watermarknone.png" title="7342304" alt="NgYh5hW5EGIzrSAhTCmn2ZSa7H6AjQM1urTlJthy.png">

Trading volume of decentralized exchanges in the past 24 hours Source: coingecko< /p>

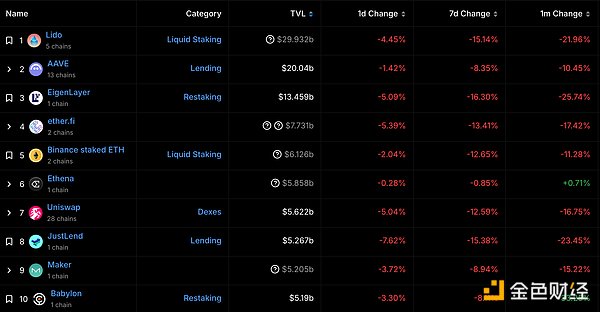

3. Assets locked in DeFi: $115.261 billion -align:center">

The top ten rankings of DeFi projects’ locked assets and locked-in amount data source: defillama

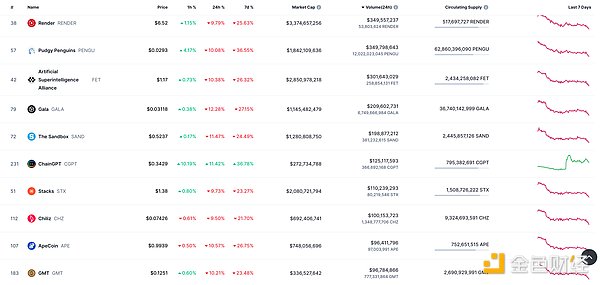

NFT data

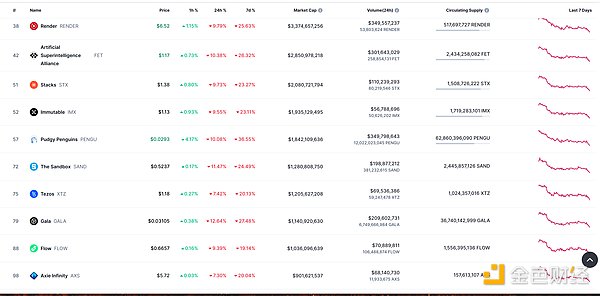

1. NFT total market value: 33.19 billion US dollars

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

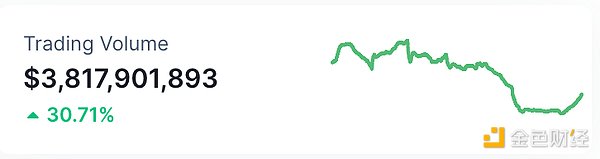

2.24-hour NFT trading volume: 3.817 billionUSD

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

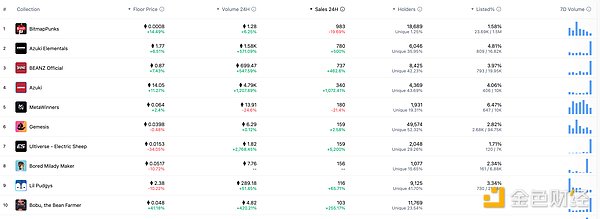

3. Top NFTs within 24 hours

< /p>

< /p>

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Arbitrum changes social media profile picture to Azuki NFTArbitrum has The profile picture of the social media platform X account is changed to Azuki NFT, according to previous news, ANIME tokens will be launched on Ethereum and Arbitrum in January 2025, aiming to transform the animation ecosystem into a community-owned creative economy through cooperation with decentralized brands such as Azuki.

NFT Hotspots

1. Indian Railways will issue NFT tickets on Polygon

Golden Finance reported that Indian Railways has partnered with Chaincode Consulting to issue NFT-based tickets for the MahaKumbh Mela festival and integrated with the Polygon blockchain to achieve Scalability. NFTs will be minted on the Polygon blockchain and made available through real-world assets (RWAs) and traceability platform NFTtrace.

2. SlowMist CISO: The addresses leaked by the OpenSea email service provider in the attack are now completely public

Golden Finance reported that SlowMist Chief Information Security Officer @im23pds posted a message on social media to remind that in 2024, the OpenSea email service provider was attacked and the emails were leaked. After multiple spreads, the current leaked The email address has been fully disclosed. Please be aware of the risks and be wary of phishing emails and other potential cyber attacks, including CZ's email address.

As previously reported, on June 30, 2024, according to OpenSea official news, the NFT transaction The market disclosed that an employee of its email delivery provider Customer.io abused his employee access rights to download user email information and also shared the relevant email addresses with unauthorized external parties. Report the incident to law enforcement.

DeFi Hotspots

1. UniSat: Temporarily suspending the CAT20 market at the request of the CAT protocol team Jinse Finance reported that UniSat Wallet announced that it has temporarily suspended CAT20 market services at the request of the CAT protocol team. We will continue to pay attention to the situation and An update will be provided after further information from the CAT protocol team. The CAT protocol team previously stated that a major protocol update is being launched to fix issues and improve protocol security, user assets are safe, and transactions will resume in a few days.

2. In the past 7 days, Tron and Ethereum mainnet stablecoins have been issued more than 1.16 billion

Golden Finance reported that according to Lookonchain monitoring, in the past 7 days, the stablecoins (USDT and USDC) on the Tron Network have increased by 592 million, and 573 million more stablecoins (USDT and USDC) were issued on the Ethereum mainnet.

3. Chainlink SmartData is adopted by M^0 to convert NAV Data on-chain to support M stablecoin

On January 13, M^0 has adopted Chainlink infrastructure on Ethereum for its " The decentralized stablecoin M provides net asset value (NAV) data. By leveraging Chainlink's SmartData asset service solution suite, they are "improving transparency for $M."

It is reported that M is a fungible token that can be used It is generated “by locking eligible collateral in a secure off-chain facility.” By integrating Chainlink SmartData, it is now possible to “accurately and securely access on-chain net asset value data.”

4. Kadena, a company focusing on Layer1 blockchain technology, announced a partnership with Ownera Cooperation

Golden Finance reported that according to crowdfund insider, Kadena, a company focusing on Layer1 blockchain technology, announced a strategic partnership with Ownera. Through this collaboration, Kadena will use its high-performance blockchain technology to support Ownera’s IOWN Tokenization Platform, aiming to provide global companies with secure and efficient digital asset issuance and management solutions.

5. Fidelity Report: Ethereum Solana leads with strong fundamentals, and its short-term performance is eye-catching. According to Golden Finance, Fidelity Digital Assets stated in its 2025 Outlook Report that Ethereum Due to fundamental factors such as developer activity, total locked value (TVL) and stablecoin supply, Solana is superior to Solana in the long run, but Solana has an advantage in the short term due to its rapidly growing transaction speed and low cost.

The report pointed out that Solana's revenue The growth of ETH and TVL is relatively fast, but its reliance on memecoin transactions is strong in bull markets and may weaken in bear markets. In contrast, Ethereum's fundamentals are less dependent on speculation and have stronger long-term stability. Solana The Firedancer upgrade is planned to significantly increase transaction speeds, while Ethereum’s Pectra upgrade focuses on functionality, scalability, and user security, but has less direct impact on the investment value of ETH.

Disclaimer: Golden Finance is a blockchain information platform. The content of the article is for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

Brian

Brian

Brian

Brian Miyuki

Miyuki Alex

Alex Joy

Joy Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Brian

Brian Alex

Alex