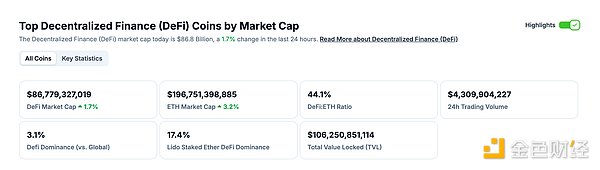

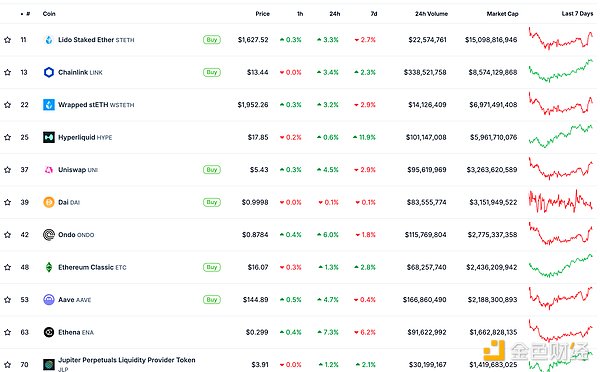

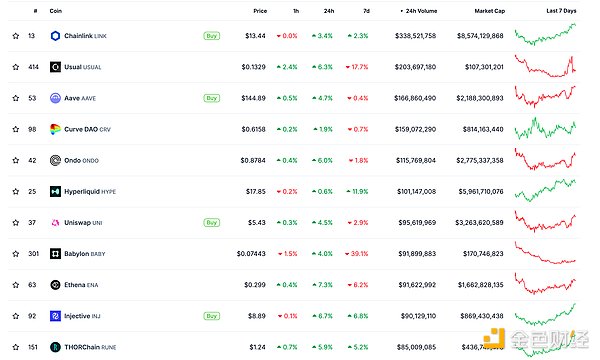

DeFi data

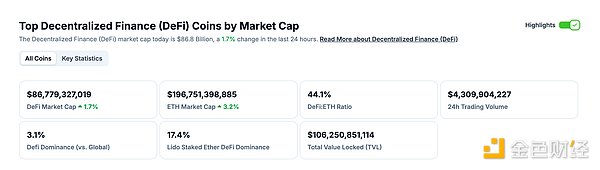

1. Total market value of DeFi tokens: 86.779 billion US dollars

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 4.309 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

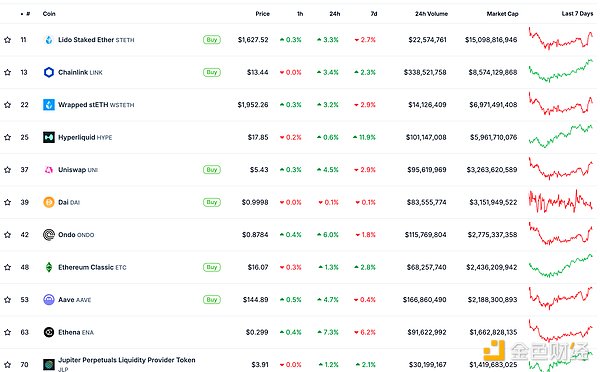

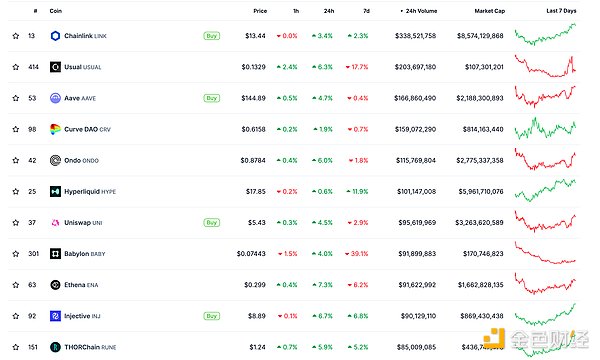

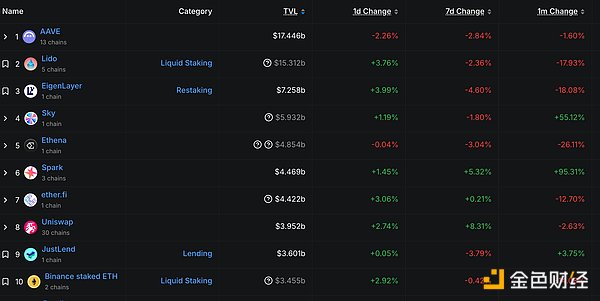

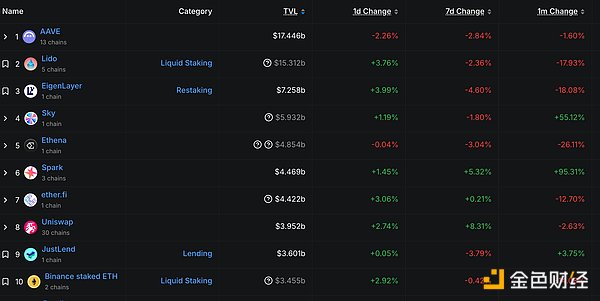

3. Assets locked in DeFi: 90.617 billion US dollars

Top ten rankings of DeFi project locked assets and locked volume Data source: defillama

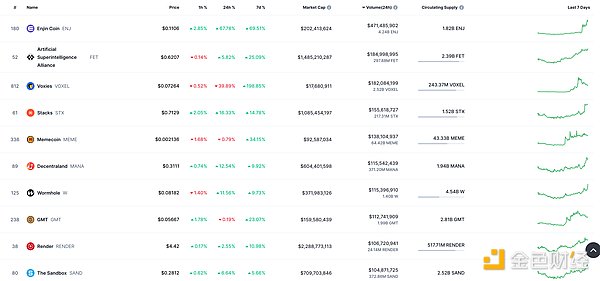

NFT data

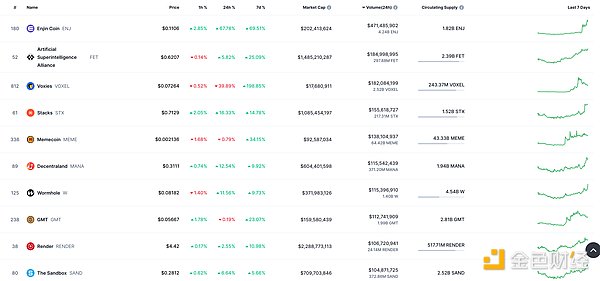

1. NFT total market value: US$18.13 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2.24 hour NFT transaction volume: 3.036 billionUSD

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

3. Top NFTs in 24 hours

Top 10 NFTs with the highest sales in 24 hours Data source: NFTGO

Headlines

Ethereum Foundation adjusts strategic direction to focus on short-term expansion goals

Golden Finance reported that Tomasz K. Stańczak, the incoming co-executive director of the Ethereum Foundation, announced that the Foundation is adjusting its strategic focus and shifting more research efforts to short-term goals. The adjustment is intended to free up Vitalik Buterin to focus more on research rather than daily coordination work. The Foundation will prioritize the development of Layer 1 expansion, support Layer 2 expansion, and improve user experience. These improvements will be achieved in three protocol upgrades: Pectra, Fusaka, and Glamsterdam. At the same time, the Foundation is also exploring how to accelerate projects that are currently expected to take 3-5 years, and strive to achieve some functions through plans such as the next-generation execution layer and consensus layer within 1-2 years.

MEME hot spots

1. TRUMP unlocked 40 million tokens 5 hours ago, worth about 300 million US dollars

Golden Finance reported that TRUMP unlocked 40 million tokens 5 hours ago, worth about 300 million US dollars, accounting for 20% of the circulation (in addition, about 493,000 tokens are unlocked linearly every day, about 4.12 million US dollars).

DeFi hotspots

1. KiloEx releases summary of hacker incident: There is a vulnerability in the TrustedForwarder contract in the smart contract

On April 21, KiloEx The root cause analysis and post-event summary of the hacking incident were released. The cause of the incident was that the TrustedForwarder contract in its smart contract inherited OpenZeppelin's MinimalForwarderUpgradeable but did not rewrite the execute method, causing the function to be called arbitrarily.

The attack occurred from 18:52 to 19:40 (UTC) on April 14. The hacker deployed attack contracts on multiple chains such as opBNB, Base, BSC, Taiko, B2 and Manta to carry out the attack. After negotiation, the hacker agreed to retain 10% of the bounty and has returned all stolen assets (including USDT, USDC, ETH, BNB, WBTC and DAI) to the multi-signature wallet designated by KiloEx.

2. Ethereum Foundation focuses on L1 expansion and UX improvement, Vitalik will focus on research direction

Golden Finance reported that Tomasz K. Stańczak, the new co-executive director of the Ethereum Foundation, wrote that the foundation will shift its research and development focus to L1 expansion, L2 support and user experience optimization, covering protocol upgrades such as Pectra, Fusaka and Glamsterdam. Vitalik Buterin will reduce daily coordination work and focus on research promotion, including RISC‑V, zkVM and privacy. He emphasized that the proposals of Vitalik and other researchers are exploratory content, which requires community discussion and review, and the goal is to accelerate Ethereum's future breakthroughs.

3. Solana's pledged market value briefly surpassed Ethereum, and Lido's high proportion of liquidity pledged raised concerns about centralization

Golden Finance reported that according to Cointelegraph, yesterday the total value of SOL tokens pledged by the Solana network briefly surpassed the market value of ETH pledged by Ethereum. On-chain data showed that 505,938 independent wallets pledged SOL worth $53.9 billion on the Solana network, with an annualized yield of 8.31%; a total of 34.7 million ETH participated in the pledge on the Ethereum chain, worth $53.93 billion.

The high verification threshold of 32 ETH (about $50,000) caused a large number of pledgers to switch from node pledge to liquidity pledge protocols, which is the key reason for the reduction of native pledges on the Ethereum chain. Currently, about US$21.5 billion of funds are involved in liquidity staking on the Ethereum chain, and Lido alone accounts for 88% of the market share, exacerbating concerns about the centralization of Ethereum. Ethereum developers are exploring solutions to promote the decentralization of staking.

4. PlanB: Ethereum is "centralized and pre-mined", and should be ridiculed and eliminated by the market

Golden Finance reported that analyst PlanB posted on the X platform, "Ethereum is a centralized, pre-mined project that uses PoS instead of PoW, and the supply mechanism can be switched at will. I have always believed that this type of altcoin is doomed to fail, and it is reasonable that it is weak now. Such projects should be ridiculed and eliminated by the market."

5. At the current gas fee level, the average Ethereum transfer fee has dropped to about $0.01

Golden Finance reported that Etherscan data showed that the average gas fee of the Ethereum main network has dropped to 0.297gwei, and the average transfer fee has dropped to about $0.01 at the current fee level.

6.ai16z founder: auto.fun's native token is ai16z

On April 21, ai16z founder Shaw said on the social platform that auto.fun's native token is ai16z. Previously reported, ai16z founder Shaw explained in a post regarding his purchase of a token called FUN on pump.fun: There is no official auto.fun token yet, and there is no plan for it. The tokens purchased are only for hype. I will send my supply to the DAO, and I think we will keep it. You can feel free to make it a CTO or something else.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Weiliang

Weiliang