DeFi Data

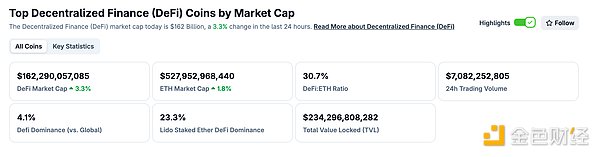

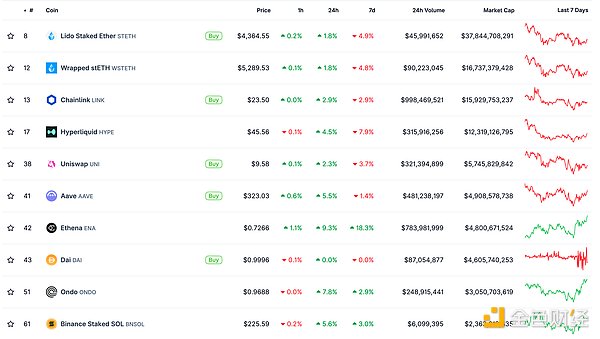

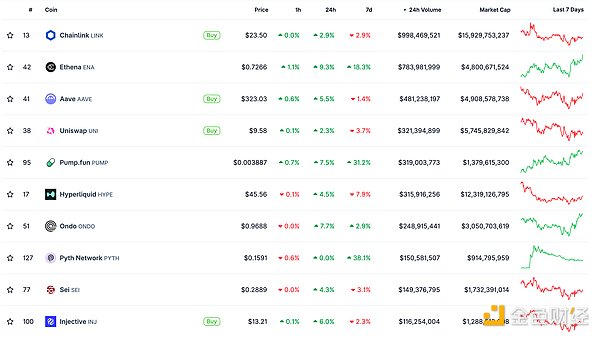

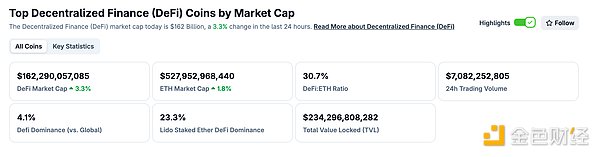

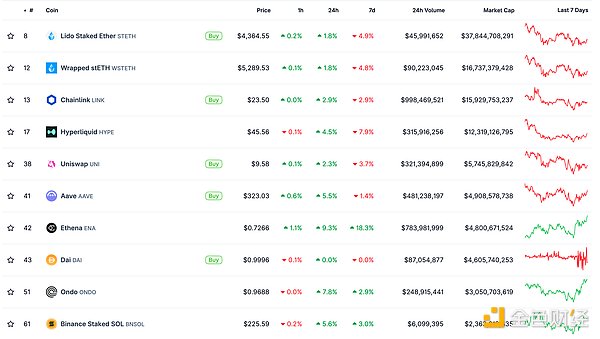

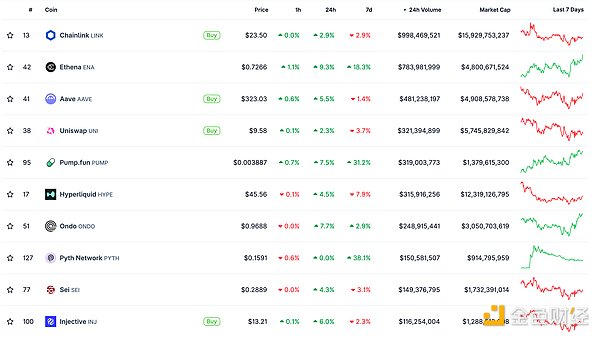

1. Total DeFi Token Market Cap: $162.29 Billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$70.82

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

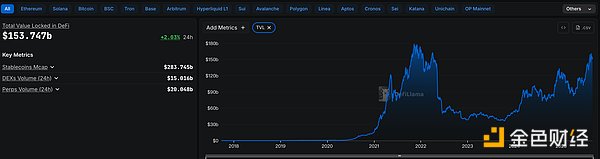

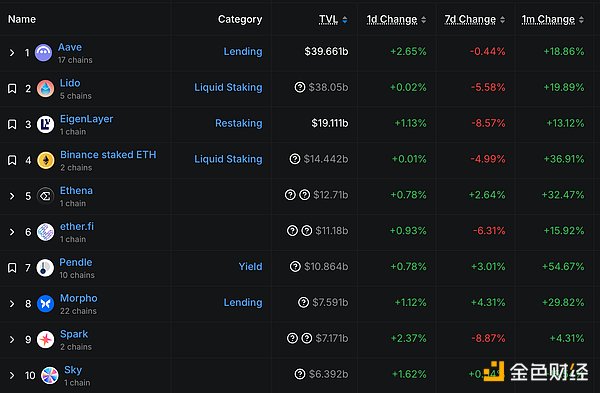

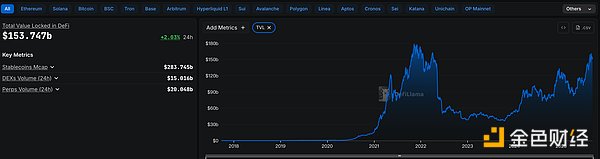

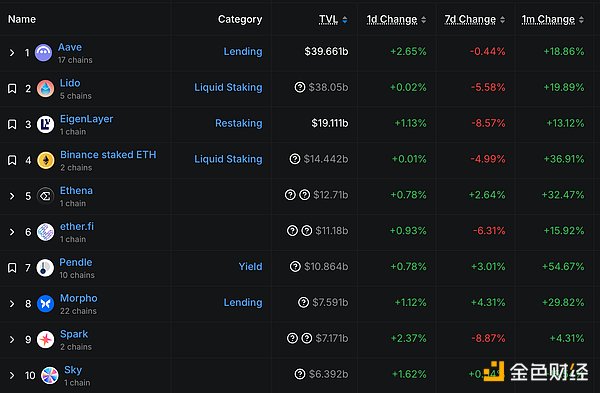

3. Assets locked in DeFi: US$153.747 billion

Top ten DeFi projects by locked assets and locked-in volume. Data source: defillama

NFT data

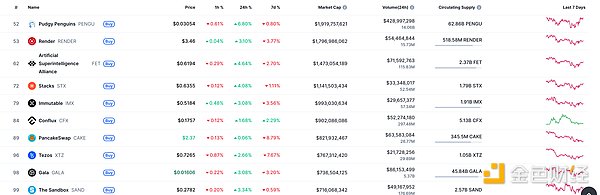

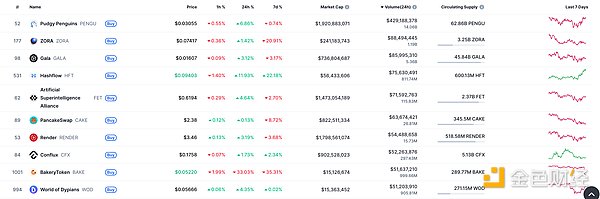

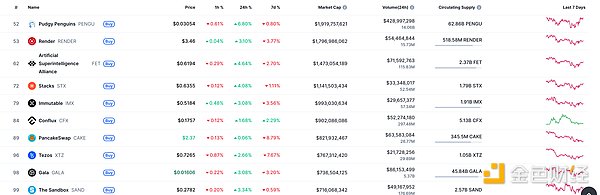

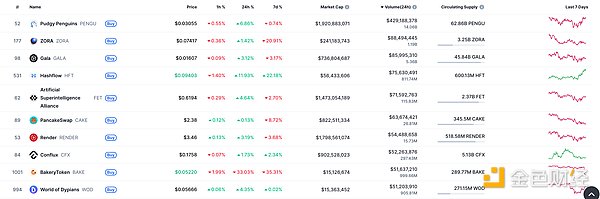

1. NFT total market value: US$21.469 billion

NFT total market value, top ten projects by market value Data source: Coinmarketcap

2. 24-hour NFT trading volume: 1.986 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

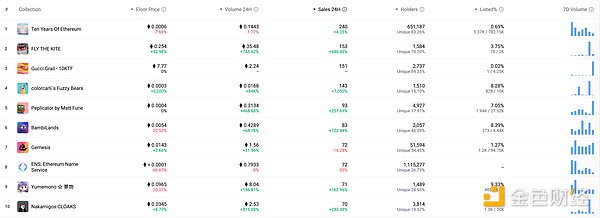

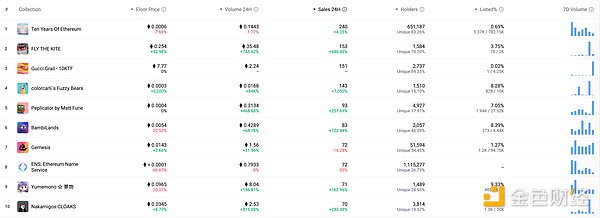

3. Top NFTs in 24 hours

Top 10 NFTs with the Largest Sales Increase in 24 Hours. Data Source: NFTGO

Headline

Ethereum Foundation to Sell 10,000 ETH to Support R&D and Other Work

Jinse Finance reported that the Ethereum Foundation announced in a statement that over the course of several weeks this month, the Ethereum Foundation will convert 10,000 ETH through centralized trading platforms to continue supporting R&D, funding, and donations.

These conversions will be made in multiple small orders rather than in one large transaction.

MEME Hotspots

1. Eric Trump: WLFI's online trading price has increased nearly 20 times compared to the initial offering price, ranking it among the 10th most traded crypto assets in the world

Golden Finance reported that Trump's son Eric Trump tweeted, "The first round of WLFI token issuance was completed only 10 and a half months ago, at a price of $0.015. In the past 24 hours, WLFI's trading price range has been approximately $0.20-0.28, almost 20 times the initial offering price (the trading volume on the first day of listing alone reached approximately $3.1 billion), making us the 10th most traded crypto asset in the world and the 27th in market capitalization."

2. Google searches for "Memecoin" suggest renewed retail interest. According to Golden Finance, Google searches for "Memecoin" have rebounded to 57 after a months-long slump. This indicates a significant increase in retail curiosity, but remains significantly below the peak of 100 reached in January amidst the hype surrounding the Trump memecoin launch. This metric measures relative search interest on a scale of 0 to 100, with 100 representing the highest search volume during a specific time period. Therefore, it serves as a useful indicator of mainstream retail investor participation in speculative crypto assets.

Current readings suggest a modest recovery in interest in memecoins, rather than the explosive growth seen in early 2025, potentially signaling a more sustainable pattern of interest. DeFi Hot Topics 1. Ethereum Infrastructure Company Etherealize Completes $40 Million Funding Round According to Fortune, Ethereum infrastructure startup Etherealize announced the completion of a $40 million funding round led by Electric Capital and Paradigm, with initial funding from Ethereum founder Vitalik Buterin and the Ethereum Foundation.

Founded in January 2025 by Vivek Raman, a former Morgan Stanley and Deutsche Bank veteran, the company aims to develop Ethereum blockchain products and infrastructure for Wall Street financial institutions. Etherealize plans to use blockchain technology to tokenize financial assets such as mortgages, credit, and fixed income, replacing the "Stone Age technology" currently used by Wall Street. 2. Quarterly trading volume of decentralized exchanges (DEXs) exceeded $1 trillion in the second quarter. According to a chart released by unfolded, the quarterly trading volume of decentralized exchanges (DEXs) exceeded $1 trillion in the second quarter. 3. Galaxy Digital will issue tokenized equity on Solana. According to a report by Golden Finance, crypto financial services company Galaxy Digital plans to issue its equity tokens, which have been registered with the U.S. Securities and Exchange Commission (SEC), on the Solana blockchain. 4. Currently, there are 15 XRP-focused ETF applications awaiting review by the U.S. SEC. According to Golden Finance, WF released market information, 15 ETF applications focusing on Ripple (XRP) are currently awaiting review by the U.S. Securities and Exchange Commission (SEC). Binance officially released a notice of changes to the Sonic(S) token economics. Golden Finance reported that Binance officially announced that, based on the approved Sonic proposal, the total supply of Sonic(S) will increase from approximately 3.41 billion to approximately 3.89 billion, and the circulating supply will increase by 472 million (a 14.2% increase). Additional Sonic(S) tokens worth $50 million will be added to the total supply only after a final ETF agreement is reached. Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

Kikyo

Kikyo