DeFi data

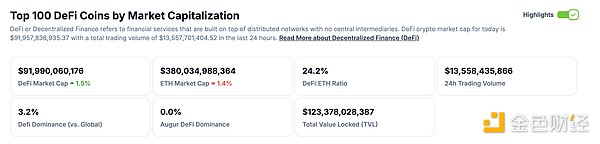

1. Total market value of DeFi tokens: US$91.990 billion

DeFi total market value data source: coingecko

< 2. The transaction volume of decentralized exchanges in the past 24 hours was 13.558 billion US dollars. .cn/7317227_watermarknone.png" title="7317227" alt="QoHSBkDTP3aYs8JYcZ0PtfsgLezUiIfjHyWVfZdu.png">

Trading volume of decentralized exchanges in the past 24 hours Source: coingecko< /p>

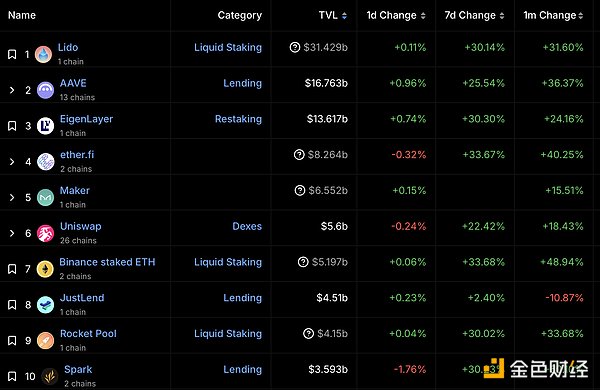

3. Assets locked in DeFi: 105.198 billion US dollars

< img src="https://img.jinse.cn/7317233_watermarknone.png" title="7317233" alt="4yDw6K8PVSR4YVaPfw4cM93yYzqbVR7jqCVnNaGT.png">

The top ten rankings of DeFi projects’ locked assets and locked-in amount data source: defillama

NFT data

1. NFT total market value: 3.124 billion US dollars

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

2.24-hour NFT trading volume: 7.667 billionUSD

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

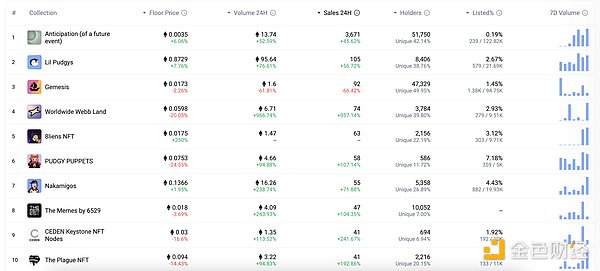

3. Top NFTs within 24 hours

< /p>

< /p>

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

FTX sues Binance and its former CEO Zhao Changpeng, seeking to recover $1.8 billion

FTX filed a lawsuit against Binance Holdings Ltd. and its former CEO Changpeng Zhao to recover nearly $1.8 billion fraudulently transferred by Sam Bankman-Fried.

Binance, Zhao Changpeng and other Binance executives received the funds in a July 2021 stock buyback agreement with FTX co-founder Bankman-Fried, who is now in prison. According to legal documents filed by FTX on Sunday, In the deal, they sold about 20% of FTX's international subsidiary and 18.4% of its U.S. entity.

1. OpenSea users abandon securities lawsuits after market demands arbitration< Golden Finance reported that on November 7, Anthony Shnayderman and Itai Bronshtein filed a voluntary withdrawal of the securities lawsuit against Ozone Networks (doing business under the name OpenSea) in the Florida federal court. Apply. The move comes after Judge Cecilia Altonaga allowed OpenSea’s motion to compel the two to arbitrate in an order last month.

OpenSea has insisted it will compel the two users to arbitrate, claiming in an October filing that they agreed to its Terms of Use that all claims will be resolved by an arbitrator — including whether a claim should be arbitrated in the first place.

In its October filing, the NFT marketplace added that it “intends to move expeditiously to compel plaintiffs to arbitrate their claim” and would appeal any dismissal by the court, thereby putting the case on hold. DeFi Hotspots

1. TON network expansion project TAC completed $6.5 million in seed round financing

Golden Finance reported that TON network expansion project TAC Completed a $6.5 million seed round of financing, led by Hack VC and Symbolic Capital, with participation from Primitive, Paper Ventures, Karatage, Animoca Ventures, Spartan Capital, TON Ventures and Ankr. The valuation and structure of this round of financing were not disclosed.

It is reported that TAC Designed to help TON and Telegram users access Ethereum Virtual Machine (EVM) applications within the app.

2.Bitlayer and Nansen reached a strategic cooperation

11 On the 11th of this month, Bitlayer, a Bitcoin native second-layer project based on Bitcoin finality, announced a strategic partnership with Nansen, a blockchain analysis platform. Nansen will soon integrate Bitlayer on-chain data and open Bitlayer data analysis and real-time tools to users to explore Bitlayer's growing on-chain ecosystem. This strategic cooperation represents Nansen's official expansion of its business into the Bitcoin ecosystem, and Bitlayer becomes the first Bitcoin L2 project integrated and supported by Nansen.

Regarding this cooperation, Charlie Hu, co-founder of Bitlayer, said: “The Bitcoin ecosystem is changing with each passing day, and users are in urgent need of some advanced tools and platforms to track Bitlayer’s data at the macro and micro levels. Nansen’s integration and support for Bitlayer just fills the gap in the current Bitcoin ecosystem. Last week, Nansen CEO Alex Svanevik posted on social media, "After spending a lot of time researching Bitcoin's second layer network (L2), I think we have found a winner. Stay tuned." /p>

3.dYdX "Incentive Plan Restart and Revision" proposal is accepting on-chain voting

The dYdX Foundation announced on the X platform that the "Incentive Plan Restart and Revision" proposal has created an on-chain vote, which will end in the early morning of November 15.

According to the proposal, this is a proposal to modify the dYdX incentive plan. The proposal calls for a 4-month program of $1.5 million per month, with $6 million in DYDX tokens issued every quarter. 60% of the rewards are allocated to market makers and 40% to traders, and the tracking API is enhanced, without trading alliances.

4.Near Near Protocol’s cross-chain AI assistant will soon be available for booking flights or ordering takeout on Web2 websites. A new alpha cross-chain AI agent has been launched that can launch MemeCoins in seconds and purchase products with fiat currency through web searches. Upcoming additional features are expected to enable users to book flights or Order takeout.

What makes Near’s AI assistant unique among current AI agents is its chain abstraction technology, which allows users to exchange any asset for any other asset simply by signing a transaction. The product, called Near Intents, is currently It is in the testing phase and has transaction restrictions. It currently supports native asset exchanges between Bitcoin, Ethereum, Arbitrum, Base, and Near Protocol.

According to news yesterday, NEAR AI launched an Alpha version, including an AI assistant and a research center.

5.YGG tokens are now Launched on Base Network

On November 11, according to the official blog, the blockchain game guild Yield Guild Games (YGG) announced that it would launch on the Base blockchain YGG tokens have been launched, and the YGG/ETH liquidity pool has been set up on Base's native DEX Aerodrome. YGG holders who wish to transfer YGG tokens between Ethereum and Base will soon be able to do so through the official Superchain Bridges, Superbridge and Brid .gg for bridging.

6. DWF Labs staking pool transferred 1.331 million TON to TON: Elector Contract address, worth more than 7 million US dollars

Disclaimer: Gold As a blockchain information platform, the articles published by Caijing are for information reference only and are not intended as actual investment advice. Please establish a correct investment concept and be sure to increase your risk awareness.

Alex

Alex

Alex

Alex Kikyo

Kikyo Joy

Joy Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Joy

Joy Brian

Brian Alex

Alex