DeFi Data

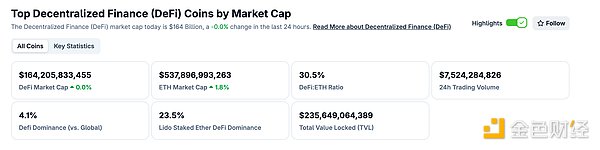

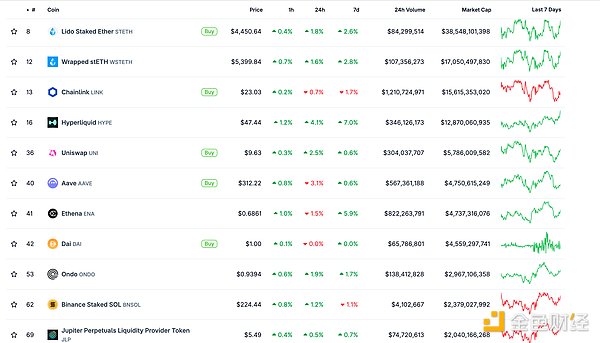

1. Total Market Cap of DeFi Tokens: US$164.205 Billion

DeFi total market capitalization data source: coingecko

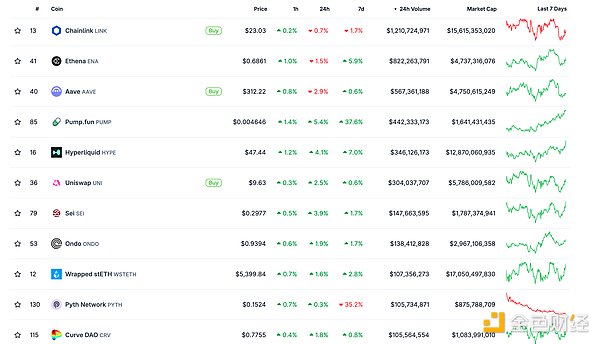

2. The trading volume of decentralized exchanges in the past 24 hours was US$75.24

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

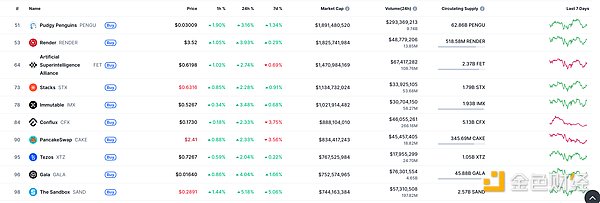

NFT Data

1. Total NFT Market Value: US$21.689 Billion

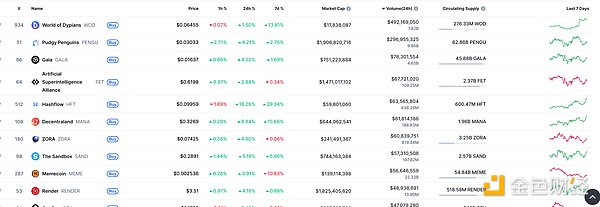

NFT total market value, top ten projects by market value Data source: Coinmarketcap

2. 24-hour NFT trading volume: 2.204 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

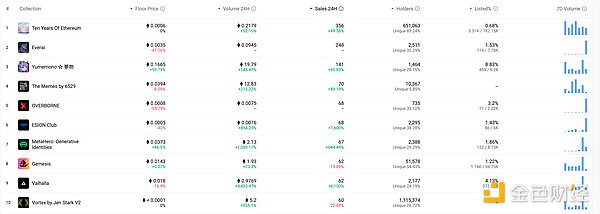

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Hyperliquid will issue stablecoin USDH

Golden Finance reported that Hyperliquid announced that it will release the USDH token symbol currently reserved by the protocol through validator voting for the issuance of USD stablecoins for the Hyperliquid ecosystem. After the network upgrade, validators will use a transparent on-chain voting mechanism to select the best teams to build natively minted, Hyperliquid-first stablecoins. Interested teams can submit proposals on the forum, including the user addresses that will deploy USDH if selected. As a highly demanded regulated token symbol, USDH aims to be a compliant USD stablecoin designed specifically for the Hyperliquid ecosystem. Once approved teams secure a quorum of validators, they will still need to participate in the regular spot deployment gas auction process.

MEME hot spots

1. The largest individual holder of WLFI transferred another 100 million WLFI, worth 18.24 million US dollars

Golden Finance reported that according to the monitoring of the on-chain analyst Aunt Ai, 10 minutes ago, moonmanifest47.eth transferred another 100 million WLFI to the new address 0x6E7...4d7c4, worth 18.24 million US dollars. DeFi Hot Topics 1. SharpLink: Fully Compliant with Nasdaq Regulations, No Shareholder Approval Required for ATM Program to Purchase Ethereum According to Golden Finance, according to an official announcement, SharpLink stated that it is fully compliant with Nasdaq regulations and no further shareholder approval is required if it chooses to fund its Ethereum purchase through the ATM program.

SharpLink remains strictly committed to compliance and transparency, ensuring all transactions are conducted in accordance with Nasdaq regulations and industry best practices. 2. Omni Network Officially Renamed Nomina, with a 1:75 Token Migration Ratio. On September 5th, Omni Labs announced its name change to Nomina and the launch of a new brand identity and visual system. The goal of this rebranding is to simplify the cryptocurrency experience and make DeFi accessible to a wider user base.

The original $OMNI token will be migrated to the new $NOM token at a 1:75 ratio. The new token will have a circulating supply of 2.9 billion and a total supply of 7.5 billion. The Omni team is developing a migration application; existing holders do not need to take any action at this time. $NOM staking will not be available at launch, and $OMNI staking will be suspended after $NOM is released.

3. Ethereum Foundation Completes Partial Sell-off, Withdraws 3.387 Million DAI from CEX

Golden Finance reports that according to @EmberCN, the Ethereum Foundation transferred 10,000 ETH to Kraken for sale the day before yesterday and withdrew 3.387 million DAI from Kraken 20 minutes ago. This means that some of these 10,000 ETH have already been sold. 4. Binance HODLer Airdrop Launches OpenLedger (OPEN) Golden Finance reports that Binance HODLer Airdrop has launched its 36th project – OpenLedger (OPEN), an AI blockchain designed to bring liquidity to the monetization of data, models, and agents.

Binance will list OPEN at 9:00 PM (GMT+8) on September 8, 2025, and will open trading pairs with USDT, USDC, BNB, FDUSD, and TRY, subject to seed tag trading rules. OPEN deposits will open at 5:30 PM (GMT+8) on September 5, 2025. 5. xBTC has exceeded 875 minted on Sui and will be listed on the X Layer. On September 5th, OKX CEO Star stated in a post on the X platform that xBTC is releasing Bitcoin liquidity for the on-chain world, with over 875 minted on Sui. Star emphasized that this is just the beginning, saying that developers and users now have a new way to participate in DeFi and earn more returns through liquidity release. Furthermore, according to user @erikaleetv, users who provide liquidity to designated xBTC-related pools can achieve an annualized return of up to 77%.

Star revealed that xBTC will soon be listed on the X Layer and will be working with leading DeFi partners. Team building never stops; this is just the beginning, with more partners joining soon.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and is not intended as actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

Alex

Alex

Alex

Alex Brian

Brian Kikyo

Kikyo Joy

Joy Alex

Alex Hui Xin

Hui Xin Joy

Joy Alex

Alex Alex

Alex Kikyo

Kikyo