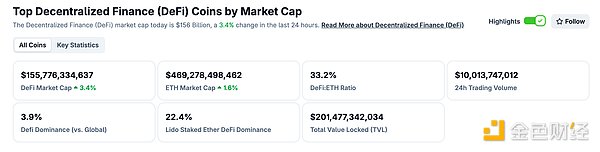

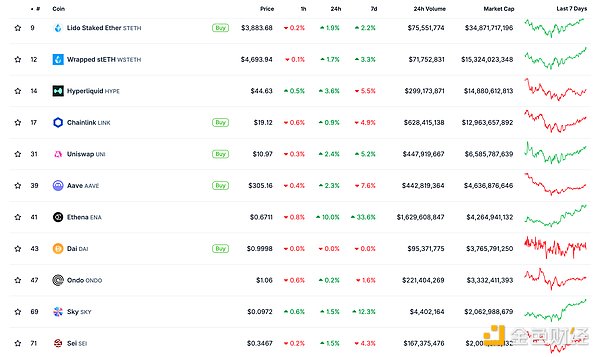

DeFi data

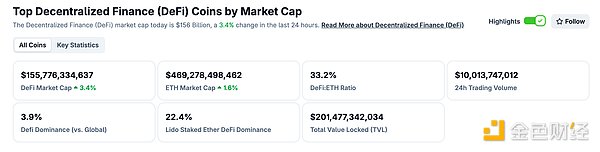

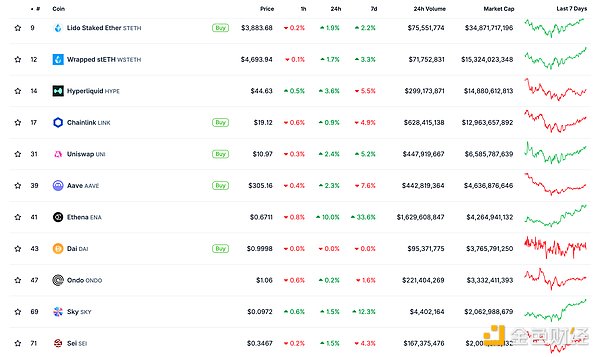

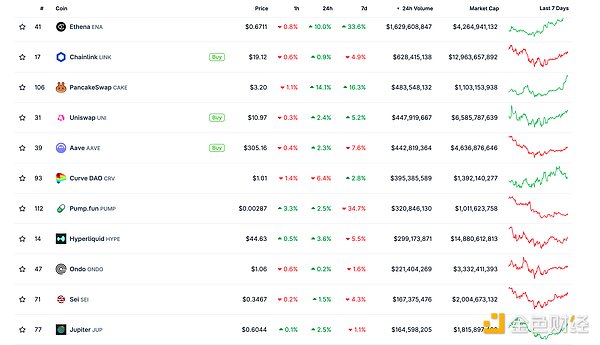

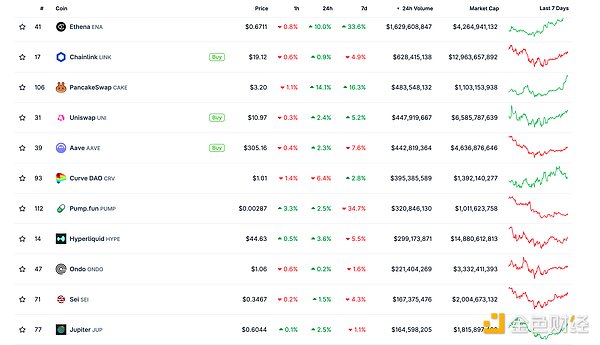

1. Total market value of DeFi tokens: 155.776 billion US dollars

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was 10.013 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

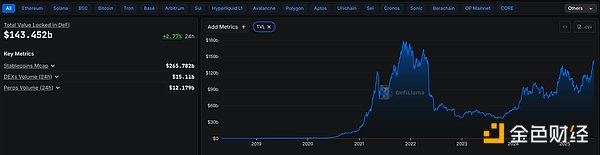

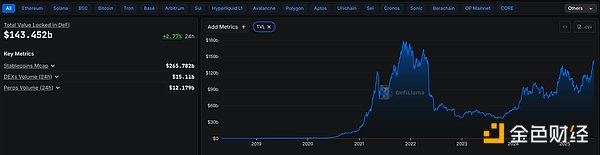

3. Assets locked in DeFi: 143.452 billion US dollars

src="https://img.jinse.cn/7386937_watermarknone.png" title="7386937" alt="18KFAiXUpnKw8l3CGFv0qHkhg2Yn9VGOH9pxmadB.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

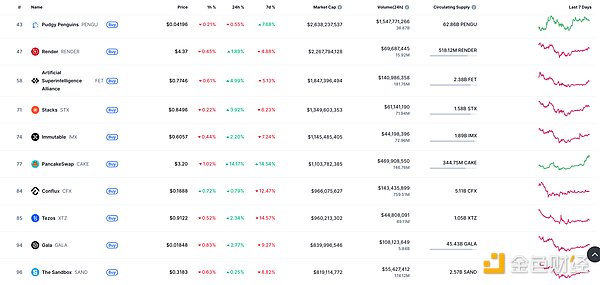

NFT data

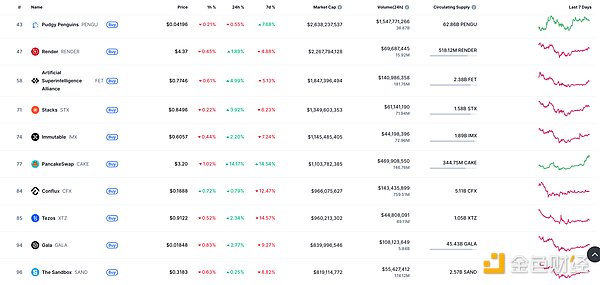

1. Total market value of NFT: US$25.686 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2. 24-hour NFT trading volume: 5.012 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

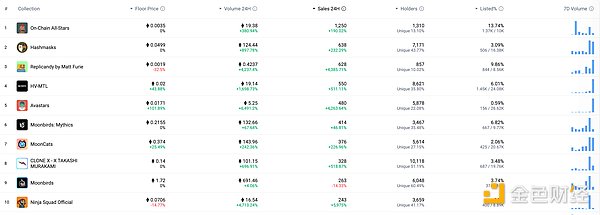

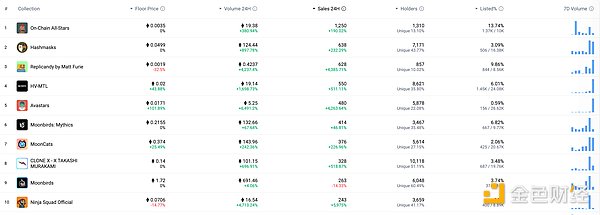

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Industrial Bank proposed to study stablecoins at its semi-annual work conference

Golden Finance reported that according to 21st Century Business Herald, the bank recently held its 2025 semi-annual work conference, proposing to embrace technological change, study stablecoins, carry out "artificial intelligence +", promote "data element X", do a good job in basic work, take greater steps on the road of smart transformation and digital transformation, and accelerate the transition from "digital industrial bank" to "smart industrial bank".

MEME Hotspots

1. The "meme stock" craze caused short sellers to lose $2.5 billion

Golden Finance reported that for traders who are short on high-risk US stocks, July was "tragic". According to S3 Partners, as of last Thursday, investors had lost $2.5 billion on the 50 listed stocks with the highest short positions in the United States in July. These companies include "meme stocks" representative Kohl's Corp., and the average loss of shorting these targets is four times the average shorting loss of the U.S. stock market as a whole. As retail investors' enthusiasm for speculative stocks grows, many highly shorted stocks have been strongly pulled up, putting pressure on short sellers. Although key events such as the tariff deadline, the Federal Reserve's decision, and non-agricultural employment this week pose a major test to risk appetite, strategists generally believe that this round of "meme stock" craze still has room to continue. Data from Vanda Research shows that retail investors' net purchases of "meme stocks" such as Opendoor and Krispy Kreme continue to rise, and trading activity is also accelerating.

DeFi Hotspots

1. BNB Chain Foundation purchased $25,000 worth of SOLV and CA

Golden Finance reported that according to official news, the BNB Chain Foundation incentive address bought SOLV and CA tokens worth $25,000 respectively.

2. Tether minted 1 billion USDT on the Tron network

Golden Finance reported that according to WhaleAlert monitoring, Tether Treasury minted 1 billion USDT on the Tron network at 16:13:42 Beijing time.

3. ARO Network, a decentralized edge cloud project, completes $2.1 million in Pre-Seed round of financing

Golden Finance reported that ARO Network, a decentralized edge cloud project, announced the completion of a $2.1 million Pre-Seed round of financing, aiming to accelerate its creation of a decentralized edge cloud network designed for peer-to-peer content distribution and AI computing.

This round of financing was led by NoLimit Holdings and Dispersion Capital, with participation from Escape Velocity, Maelstrom and several strategic angel investors.

ARO Network is a decentralized edge cloud project that allows users to convert idle Internet resources into income by running nodes. Users can earn ARO tokens by running ARO nodes, which supports real-time AI computing.

4. Noble, Eclipse and Solana ranked the top three in cross-chain bridge net inflows in the past week

Golden Finance reported that according to DefiLlama data, Noble's cross-chain bridge net inflows reached $129 million in the past week, ranking first among all public chains. Eclipse and Solana followed with net inflows of $112 million and $45.27 million, respectively.

Ethereum, Arbitrum and Hyperliquid had net outflows of $223.9 million, $148.1 million and $20.49 million, respectively.

5. It only takes 30 seconds to create a fully functional SPL token on Solayer's InfiniSVM developer network

Golden Finance reported that according to on-chain analyst Ember's monitoring, it only takes 30 seconds to create a fully functional SPL token on Solayer's InfiniSVM developer network, and the creation fee is as low as $0.05.

InfiniSVM is fully compatible with Solana Virtual Machine (SVM), with the same CLI, the same tools, and the same commands. Developers can:

Deploy existing Solana programs with no or minimal code changes;

Use familiar Solana development tools and libraries;

Leverage existing knowledge of Solana programming patterns.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

Alex

Alex