DeFi data

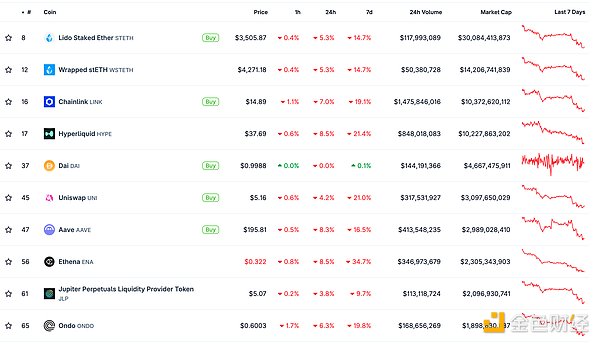

1. Total market value of DeFi tokens: 124.288 billion US dollars

2. Trading volume of decentralized exchanges in the past 24 hours: $105.13

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

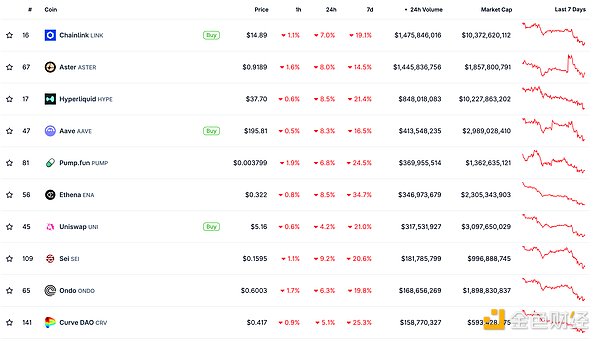

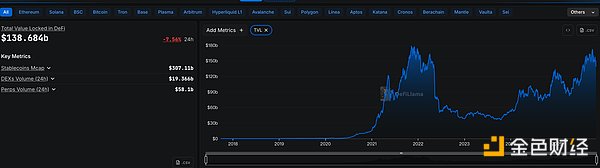

3. Assets locked in DeFi: $138.686 billionbillion

![]() Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

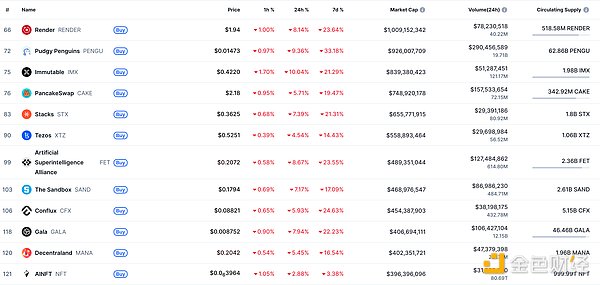

NFT Data

1. Total Market Cap of NFTs: $13.199 billion

alt="Ui5NYgX7dFqCVZwZIZ1FmRn1e4dbG9KJNxhR0etC.png">

NFT Total Market Capitalization, Top Ten Projects by Market Capitalization Data Source: Coinmarketcap

2.24-hour NFT Transaction Volume: $2.2 billionUSD

![]()

DeFi Hot Topics

1. AEON Releases x402 SDK V2 on BNB Chain

On November 4th, the crypto payment protocol AEON announced the launch of x402 SDK V2 on BNB Chain, enabling AI agents and API service providers to natively initiate and receive x402 payments within the BNB ecosystem. Developers can obtain the SDK and technical documentation through AEON's official GitHub to build AI and service applications that support autonomous payments, enabling the creation, authorization verification, and on-chain settlement of x402-based payments.

DeFi Hot Topics

1. AEON Releases x402 SDK V2 on BNB Chain

2. Opinion: Ethereum is entering the final adjustment phase and may still fall to the $3400 range. On November 4th, renowned crypto analyst @IamCryptoWolf posted on the X platform that Ethereum is entering the final phase of the adjustment that began in August, and this is all part of a larger pattern that started around $1500. If Ethereum cannot return to $3900 soon, then it is expected that it can be bought at $3400. 3. Aave DAO approves permanent buyback plan proposal, investing $50 million annually. According to Jinse Finance, citing The Defiant, Aave DAO has approved a permanent token buyback plan, allocating $50 million annually from protocol revenue to buy back AAVE tokens. The proposal, put forward by the Aave Chan Initiative (ACI) on October 22, passed unanimously. Under the new plan, the Aave Finance Committee (AFC) and Token Logic can repurchase between $250,000 and $1.75 million worth of AAVE weekly, depending on market conditions and protocol revenue. Currently, Aave's total value locked (TVL) is $36.4 billion, with $12.7 million in revenue over the past 30 days. This move makes Aave one of the few DeFi projects to adopt a permanent revenue buyback program. According to a Keyrock report, token buybacks and revenue distribution have increased more than fivefold since 2024, with projects returning an average of 64% of revenue to holders, indicating that crypto projects are shifting towards the preferred shareholder returns model of traditional corporations.

4. Aster: 1.5% of the total supply will be allocated to S4

According to Jinse Finance, Aster tweeted that the third phase of Dawn will end on November 9th at 23:59 UTC, and the fourth phase of the airdrop will then begin, lasting for 6 weeks and ending on December 21st at 23:59 UTC. 1.5% of the total supply will be allocated to S4, evenly distributed across 6 epochs, with users having the opportunity to share 0.25% of the tokens in each epoch.

4. Aster: 1.5% of the total supply will be allocated to S4, evenly distributed across 6 epochs, with users having the opportunity to share 0.25% of the tokens in each epoch.

5. Solana Foundation President Lily Liu: On-Chain Native IPOs May Be Realized Within a Few Years

November 4th news: The Finternet 2025 Asia Digital Finance Summit, supported by the OSL Group, was held in Hong Kong today. Lily Liu, President of the Solana Foundation, stated that Solana is promoting the creation of an "internet capital market" and plans to achieve on-chain native IPOs in the next few years. She stated that Solana will also collaborate with institutions such as Western Union to deepen the application of blockchain in the fields of payments and stablecoins, and pointed out that the essence of blockchain is a technology platform serving the financial system, and the core of future financial infrastructure lies in "liquidity, speed, and cost." Lily continued that if we want to find stablecoins and financial infrastructure that can be used in the long term, we must focus on two key elements: performance and decentralization.

Disclaimer: Jinse Finance, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish sound investment principles and be sure to enhance your risk awareness.

Catherine

Catherine

Catherine

Catherine Hui Xin

Hui Xin Catherine

Catherine Kikyo

Kikyo Jasper

Jasper Catherine

Catherine Jasper

Jasper Davin

Davin Jasper

Jasper Davin

Davin