DeFi data

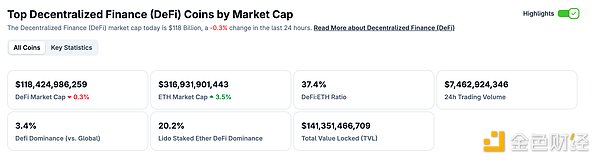

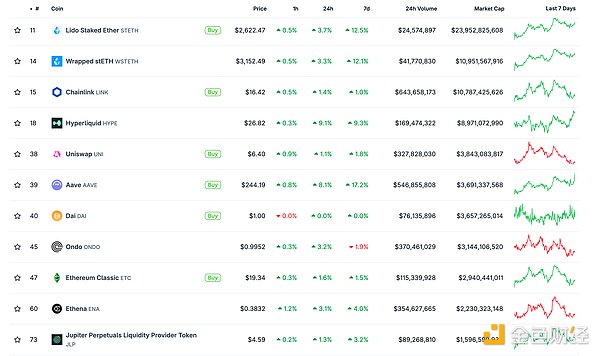

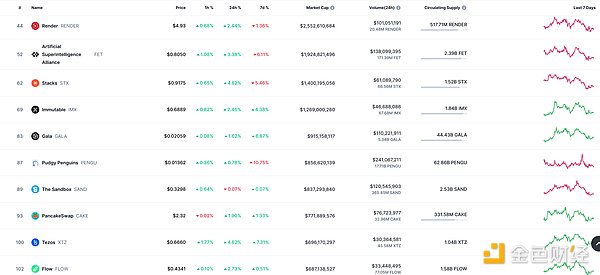

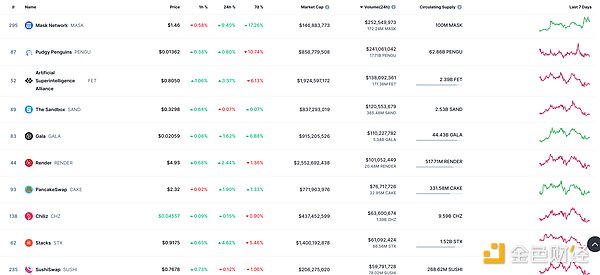

1. Total market value of DeFi tokens: 118.424 billion US dollars

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was 7.462 billion US dollars

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

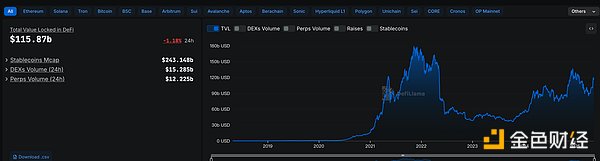

3. Assets locked in DeFi: 115.87 billion US dollars

src="https://img.jinse.cn/7369887_watermarknone.png" title="7369887" alt="g0ahha0LUfP2rspJ2ZcE3JLR6jlnce1H97y17Ubk.png">

Top ten rankings of DeFi projects with locked assets and locked-in volume Data source: defillama

NFT data

1. Total market value of NFT: US$22.558 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2.24-hour NFT trading volume: 2.7 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

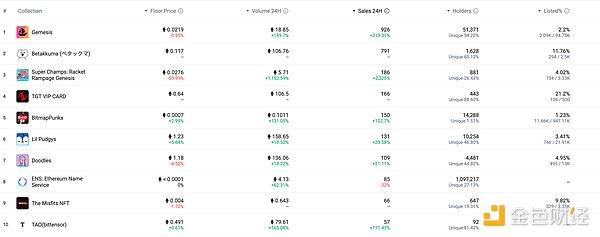

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

Ripple and the US SEC settlement still have a chance of turning around. Ripple's chief legal officer said he would re-discuss the litigation with the court

Golden Finance reported that in response to the U.S. District Court for the Southern District of New York dismissing Ripple and the U.S. SEC’s settlement motion on the grounds of improper procedure, Ripple’s chief legal officer Stuart Alderoty said that this judgment order will not change the final result of Ripple's victory (i.e. XRP is not a security, etc.), Ripple and the US SEC fully agree to resolve the case and will re-discuss the litigation with the court.

According to Eleanor Terrett, a crypto journalist, there is still a chance for this case to turn around. Although Judge Analisa Torres rejected the settlement motion, as long as Ripple and the US SEC can meet legal standards and provide convincing reasons to prove that it is in the best interests of the public and XRP institutional buyers, there is still a chance for settlement.

MEME hot spots

1.WLFi spent $6 million to purchase Vaulta (formerly EOS) tokens

Golden Finance reported that according to Lookonchain monitoring, Trump-supported World Today, the Liberty project purchased 3.64 million EOS with 3 million USDT through PancakeSwap on BSC, and 3.75 million $A tokens with 3 million USDT through 1DEX on the exSat network. EOS has now been renamed Vaulta (codenamed $A).

DeFi Hotspots

1.THORChain will upgrade to v3.6.0 on May 23

On May 16, THORChain plans to upgrade the mainnet to version 3.6.0 at block height 21,210,000 (estimated at 1:00 am on May 23, Beijing time). This upgrade is a small maintenance update, mainly involving the update of the Rujira contract checksum, and does not include key fixes or consensus changes. Block time may fluctuate, and the specific time may be adjusted for several hours.

According to previous news, Binance will support THORChain (RUNE) network upgrades and hard forks.

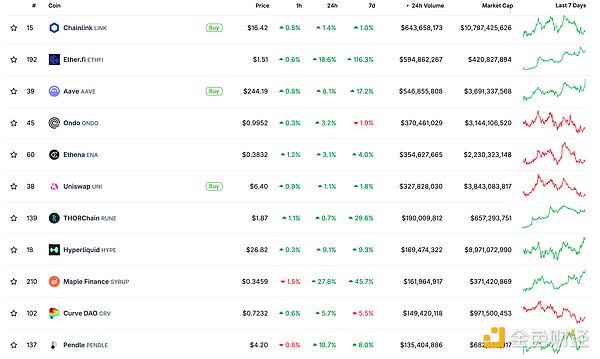

2. Trump family encryption project WLFI has purchased 12 tokens so far, with a total value of US$291 million

Golden Finance reported that according to the monitoring of chain analyst Ember, the DeFi project WLFI supported by the Trump family has spent a total of 347 million USDT to purchase 12 tokens: ETH/WBTC/TRX/LINK/AAVE/ENA/MOVE/ONDO/SEI/AVAX/MNT/EOS. The total value of these tokens is currently US$291 million, with an overall floating loss of US$53.07 million (-15%).

3.Starknet enters the "Stage 1" decentralization stage

Golden Finance reported that Ethereum ZK-Rollup expansion solution Starknet announced that it has entered the "Stage 1" decentralization stage. According to the framework proposed by Vitalik Buterin in 2022, this stage means that the network has established a security committee and a validity proof system, which greatly reduces external intervention. Starknet added that the framework is a "gold standard on-chain tool for analyzing Ethereum expansion solutions" and said that this stage was achieved through changes such as creating a security committee and avoiding censorship mechanisms. StarkWare CEO Eli Ben-Sasson said that the next step will be to advance the goal of "Stage 2" full decentralization and realize that the network is completely autonomous by the community. According to L2beat, only three small Layer2 projects have reached this stage.

4.Abstract may launch an official cross-chain bridge

Golden Finance reported that according to the preview released by Abstract Chain developer @0xCygaar, Abstract may launch an official cross-chain bridge.

5.Pharos Network releases public test network

On May 16, Pharos Network, a new generation of Layer1 public chain focusing on the Real World Assets (RWA) track, announced that its public test network was officially launched (Testnet).

PharosNetwork focuses on institutional-level RWA application scenarios and enterprise-level decentralized financial needs. It is committed to solving the pain points and difficulties of traditional institutions entering Web3 by building a leading modular infrastructure, creating an efficient and low-cost payment network, and promoting the large-scale deployment of decentralized applications and the expansion of tokenized asset scenarios.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase risk awareness.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Joy

Joy Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine Anais

Anais Weatherly

Weatherly Alex

Alex