DeFi data

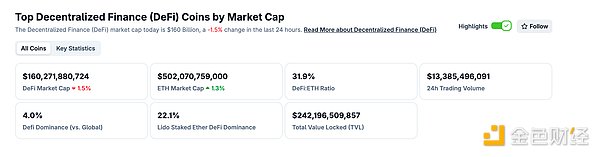

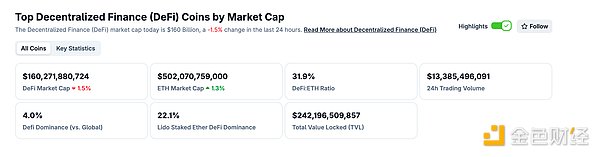

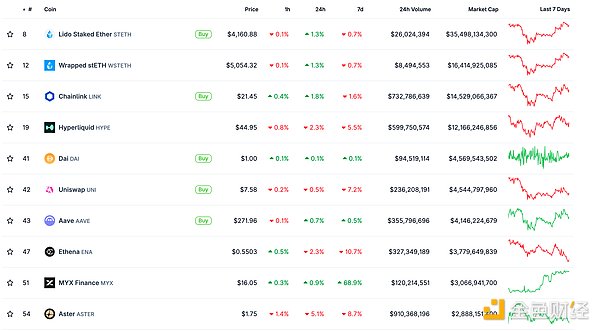

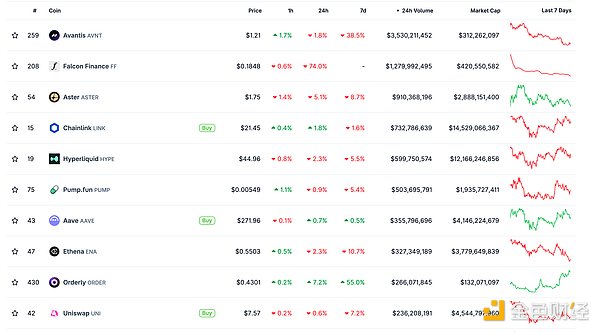

1. Total market value of DeFi tokens: 160.271 billion US dollars

DeFi total market value data source: coingecko

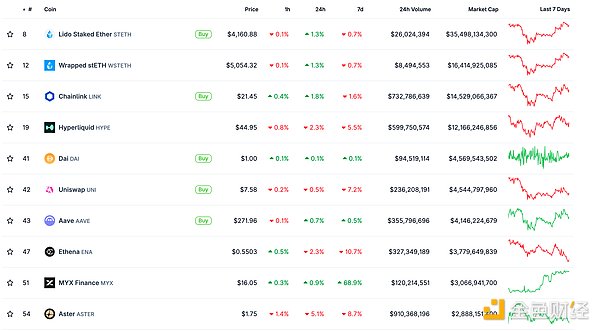

2. The trading volume of decentralized exchanges in the past 24 hours was US$133.85

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

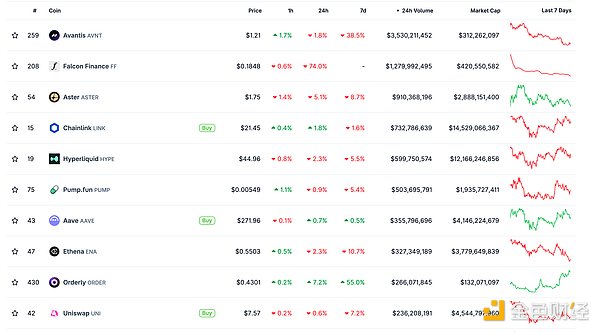

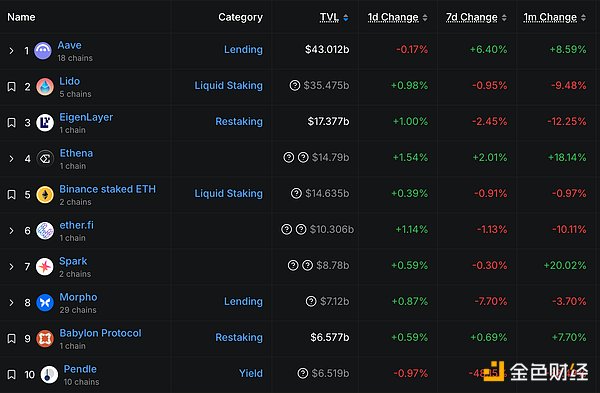

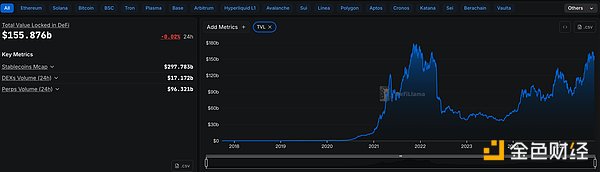

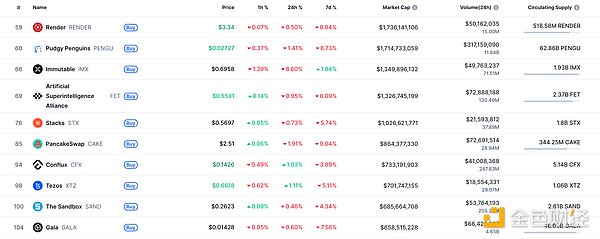

3. Assets locked in DeFi: US$155.876 billion

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

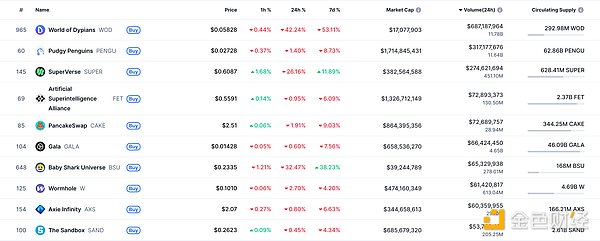

NFT data

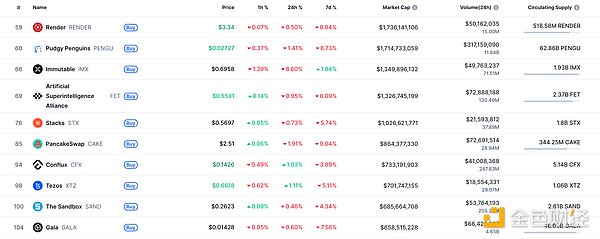

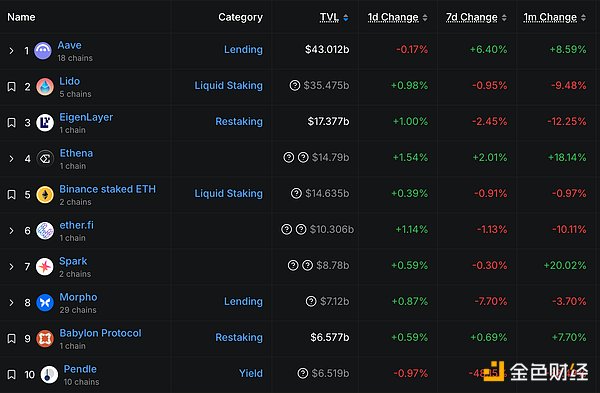

1. Total NFT market value: US$20.243 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

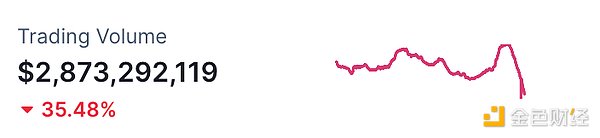

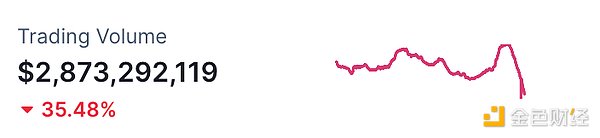

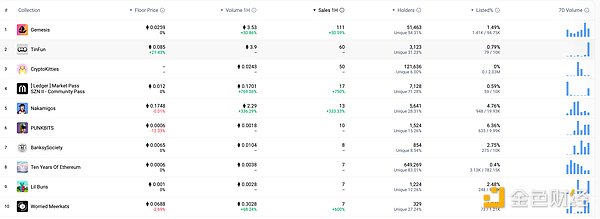

2.24 hour NFT transaction volume: 2.873 billionUSD

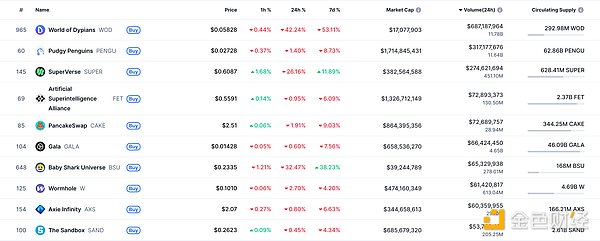

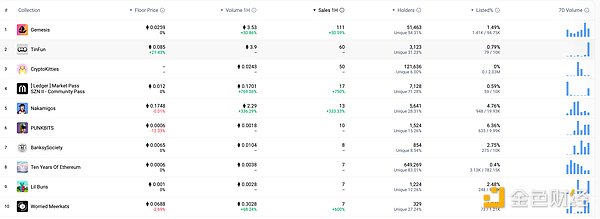

3. Top NFTs in 24 hours

Top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

Tether increased its holdings by over 8,888 BTC, worth $1 billion

DeFi Hotspots

1. Coinbase Adds Syndicate (SYND) to Its Listing Roadmap

Golden Finance Report: According to official news, Coinbase has added Syndicate (SYND) to its listing roadmap.

2.CoreWeave Signs $14.2 Billion Computing Power Agreement with Meta

Golden Finance Report: CoreWeave has signed an agreement to provide Meta Platform with computing power worth up to $14.2 billion, highlighting the enormous cost of developing and running advanced artificial intelligence models.

"They liked our infrastructure in their early contracts, so they came back for more," CEO Michael Intrator said in an interview. He said that as part of the agreement, CoreWeave will provide the social media giant with Nvidia's latest GB300 system. PayPal Capital Markets Head Appointed CFO of Hyperion DeFi Golden Finance reported that, according to Bloomberg, David Knox, head of PayPal Capital Markets, has left the company to join digital asset treasury company Hyperion DeFi as CFO. Hyperion DeFi is a US-listed company dedicated to the long-term strategic reserve of Hyperliquid's native token, HYPE. 4. US SEC Official Website: 19b-4 Applications for Solana, XRP, and Other Tokens and Ethereum-Backed ETFs Withdrawn According to Golden Finance, the US SEC's official website indicates that, in accordance with common listing standards, the 19b-4 applications for Solana, XRP, Cardano, Litecoin, Polkadot, Hedera, and Ethereum-Backed ETFs have been withdrawn.

Previously, the SEC required the issuers of the Litecoin, XRP, Sol, Cardano, and DOGE ETFs to withdraw their 19b-4 applications. Bloomberg ETF analyst Eric Balchunas said: "The universal listing standard renders Form 19b-4 meaningless. Now all that matters is the S-1."

5Starknet Launches Bitcoin Staking and Yield Products as BTCFi Extension

On September 30th, according to The Block, Bitcoin staking has been launched on Starknet. The project claims this is the first trustless Bitcoin staking implementation on a Layer 2 network. Coin holders retain custody of their assets while earning rewards and contributing to network consensus. Starknet calls this "a Bitcoin strategy for veteran Bitcoin holders."

At the same time, the Starknet Foundation will allocate 100 million STRK (US$12 million) to promote the development of the BTCFi ecosystem, including incentivizing Bitcoin-collateralized lending, making Starknet the most cost-effective place to use Bitcoin for collateralization and implementing yield strategies.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and is not intended as actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

Catherine

Catherine