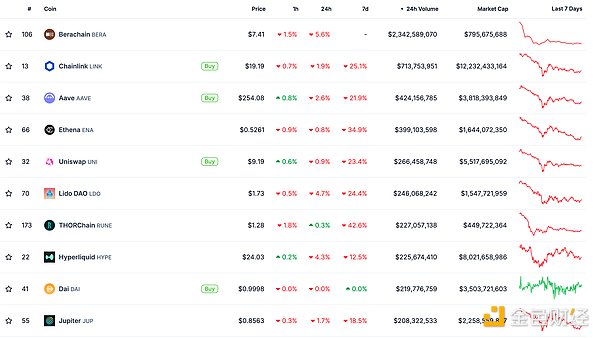

DeFi data

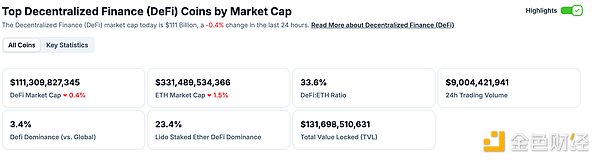

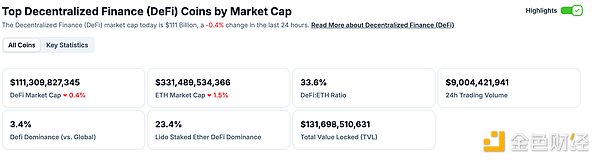

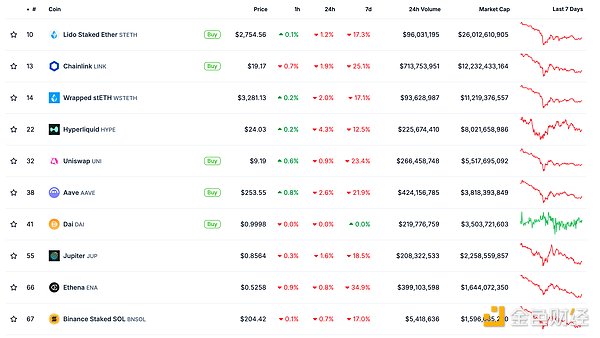

1. Total market value of DeFi tokens: $111.309 billion

DeFi total market value data source: coingecko

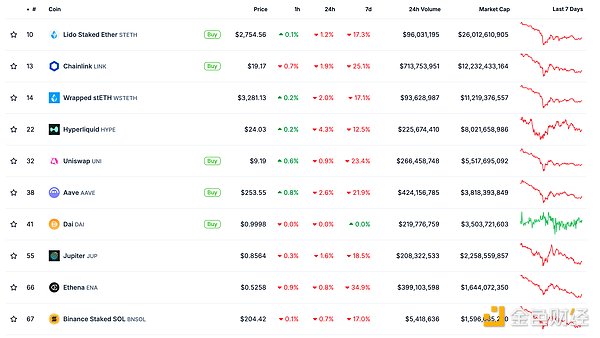

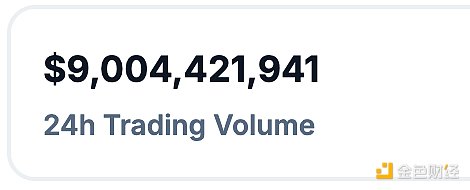

2. The trading volume of decentralized exchanges in the past 24 hours was 9.004 billion US dollars

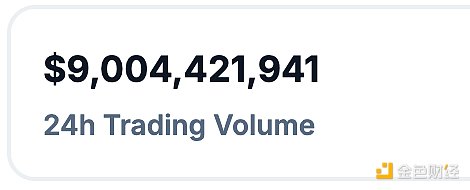

Top ten rankings of DeFi projects with locked assets and locked-in amounts Data source: defillama

NFT data

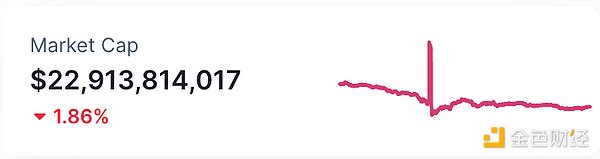

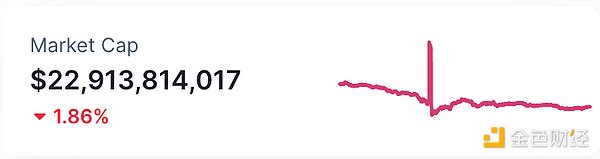

1. Total market value of NFT: US$22.913 billion

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

2.24-hour NFT trading volume: 2.679 billionUS dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

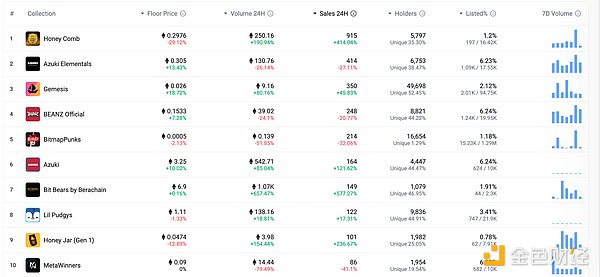

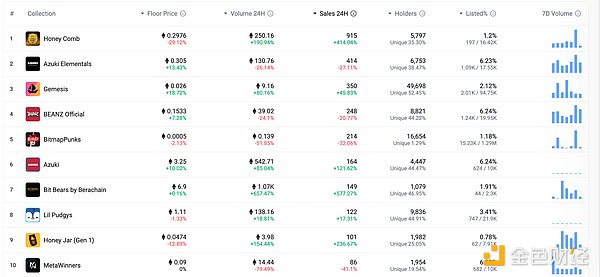

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

TON Foundation Chairman plans to expand the TON network to the United States

MEME Hotspots

1. Trump family crypto project WLFI suspected of using AI to generate discussion content on the AAVE governance forum

Golden Finance reported that the Trump family crypto project World Liberty Financial (WLFI) suspected of using AI to generate discussion posts on the AAVE governance forum. The community found that WLFI discussed the considerations for launching the AAVE lending program in the AAVE governance forum content in November last year. There was a paragraph saying that "Aave is currently not available on BNB Chain", but this is not true because Aave was launched on BNB Chain nearly a year ago (February 2024). Artificial intelligence models often output "outdated" information because most of the text (tags) used for model training contain information that was correct when it was written but is no longer correct now. As of now, World Liberty Financial has not responded to clarify the matter.

2. Data: SHIB's top ten wallets hold 61.3% of its total supply

Golden Finance reported that Santiment released the total supply of the top ten wallets of the four largest altcoins in the cryptocurrency market on the X platform:

SHIB: 61.3% of the total supply

ETH: 46.1% of the total supply

LINK: 33.1% of the total supply

TON: 32.8% of the total supply

When the top 10 wallets hold a large portion of the total supply of a cryptocurrency, such as 61% of Shiba Inu Coin, it means that a small number of holders have a lot of control over the market. If these wallets decide to sell, it may cause a sharp drop in prices, bringing greater risks to smaller investors. However, if these large holders continue to hold or increase their holdings, it usually indicates that they have confidence in the project and may actually bring rewards to traders who collectively hold less power and are more dependent on the behavior of a few key stakeholders.

On the other hand, a more evenly distributed supply, such as Ethereum's 46%, or Chainlink and Toncoin's 33%, is generally considered to be more conducive to the long-term stability of cryptocurrencies. Lower concentration means that no single entity can significantly influence the market alone, which builds trust among investors. Generally speaking, most investors prefer a more decentralized ownership structure because it reduces the possibility of manipulation and makes the market more predictable.

3. Trump family crypto project WLFI plans to create a "strategic reserve" with purchased tokens

Golden Finance reported that Chase Herro, co-founder of World Liberty Financial (WLFI), the DeFi project of US President Trump, said that the platform plans to create a "strategic reserve" with purchased tokens. Herro did not specify what the goal of World Liberty's token reserve is. The topic has been in the spotlight since Trump promised to create a token reserve during his campaign last year. Last month, he signed an executive order to assess the feasibility of creating a digital asset reserve. Donald Trump Jr.'s appearance at the Ondo Summit at Lincoln Center's Jazz Hall on Thursday was the president's latest move to show support for the digital asset industry.

Although World Liberty is promoted as a DeFi lending platform, it has not yet begun operations. So far, the project is known for purchasing niche tokens.

DeFi Hotspots

1. JPMorgan Chase: Ethereum faces "fierce" competition from other blockchain networks

Jinse Finance reported on February 7 that JPMorgan Chase pointed out in its latest report that Ethereum (ETH) has performed worse than Bitcoin (BTC) and other competing chains recently, mainly because it lacks the market appeal of Bitcoin's "digital gold" narrative, and faces fierce competition from blockchains such as Solana. Although Ethereum has launched upgrades such as Dencun, mainnet activities have partially shifted to Layer 2, affecting its growth. The report mentioned that decentralized applications (dApps) such as Uniswap are migrating to exclusive blockchains, which may weaken Ethereum's transaction fee revenue. In addition, increased competition may lead to higher ETH inflation, as fewer transactions will reduce the amount of burning. Despite this, Ethereum still maintains its lead in stablecoins, DeFi and asset tokenization, but competitive pressure is expected to continue.

2.Polymarket predicts that the probability of Solana ETF being approved this year is now 84%

Golden Finance reported that the prediction market Polymarket data showed that the probability of Solana ETF being approved in 2025 is now 84%, and the total trading volume of the prediction contract is currently $65,739.

3.Stacks announced that the growth rate of the developer ecosystem has risen to the seventh in the entire network

On February 7, Stacks announced that it was the 7th fastest growing developer ecosystem according to Electric Capital data.

At the same time, Stacks is the 24th largest asset in the Coinbase Coin50 index; Stacks is the third asset launched by Grayscale Trust; Stacks allows users to earn native Bitcoin income by staking STX.

4.CZ initiates a vote on "Should BNB Chain try to eliminate or actively reduce the MEV problem"

Golden Finance reported that Binance founder Zhao Changpeng (CZ) initiated a vote on the X platform on "Should BNB Chain try to eliminate or actively reduce the MEV problem". CZ then said that he opposed any form of "preemptive" behavior and believed that MEV belonged to this category. Although MEV cannot be completely prevented in a decentralized environment, there are still ways to reduce its impact.

5.Libre Capital opens investment funds to Sui users

Golden Finance reported that according to official news, Libre Capital, a developer of financial tokenization tools and infrastructure, will provide on-chain access to qualified investors on Sui, covering a variety of attractive investment funds, including Nomura's Laser Digital market neutral digital asset strategy-tokenized Laser Carry Fund (LCF). Institutional or qualified investors on Sui can invest through multiple well-known on-chain funds, including leading hedge funds, private credit funds and money market funds.

The infrastructure operated by Libre enables investors to access tokenized versions of real-world assets through public blockchains, such as alternative asset products such as money market funds, private credit and hedge funds. Libre achieves this goal through the on-chain Libre Gateway DeFi apps deployed on each public chain. This enables institutions and qualified investors to directly access top funds on Sui in a compliant manner.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

Catherine

Catherine