As blockchain technology becomes increasingly integrated with traditional finance, the demand for more sophisticated privacy tools is becoming more prominent. As 2025 draws to a close, the dominant themes in the cryptocurrency market include: (i) the potential passage of US market structure legislation (which we believe will become law); and (ii) the threat of quantum computing to blockchain (which we believe is misleading for the market outlook in 2026). In the fourth quarter of 2025, the upward momentum of cryptocurrencies slowed, with the market digesting previous gains and readjusting its expectations for the coming year. After a generally positive third quarter, returns across the crypto asset class generally declined, reflecting a more cautious market sentiment under the influence of evolving regulatory and technological factors. In this environment, different crypto markets performed differently, with privacy-related assets outperforming other sectors this quarter, as reflected in our “Crypto Sector” framework. The crypto asset class comprises a wide variety of investable tokens, all of which are linked to public blockchain technology. Their underlying software technology can be applied to fields such as consumer finance, artificial intelligence (AI), media, and entertainment. To facilitate organization, Grayscale Research uses a proprietary classification and index system called the "Crypto Sector," developed in partnership with FTSE/Russell. The "Crypto Sector" framework covers six distinct market segments (see Chart 1). As of the rebalancing in December 2025, these segments comprised 208 tokens with a total market capitalization of $2.63 trillion.

Chart 1: Crypto Sector Framework Helps Organize the Digital Asset Market

Measuring Blockchain Fundamentals

Blockchains are not businesses, but we can use similar methods to measure their economic activity and financial condition.

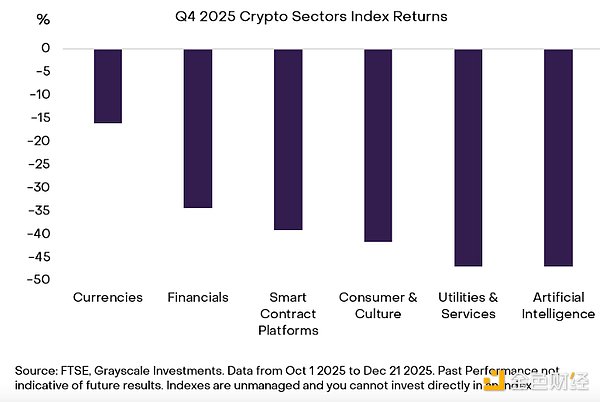

The three most important metrics for on-chain activity are user count, transaction volume, and transaction fees (see Chart 2). Due to the anonymity of blockchain, analysts often use "active addresses" (blockchain addresses with at least one transaction) as an approximation of user count, but this approach is not perfect. In Q4 2025, fundamental metrics for blockchain health generally deteriorated. Total fees for smart contract platforms declined both sequentially and year-over-year. Application layer fee revenue also showed a similar downward trend. Other fundamental metrics, such as the number of active addresses in the cryptocurrency and smart contract platform sectors, also declined compared to the previous quarter. The contraction in on-chain activity largely coincided with the downward trend in asset prices during the same period. While on-chain activity slowed in Q4 2025, similar declines in metrics have historically occurred during market downturns, and this does not necessarily indicate a long-term structural deterioration in blockchain fundamentals. Compared to the peak activity in Q4 2024 and Q1 2025, the recent decline in metrics reflects a reduction in speculative activity—particularly Meme coin trading—which aligns with a trend of increased market risk aversion. While the overall quarter-over-quarter trend is downward, there are some positive signs. Trading volume in the cryptocurrency sector saw a slight increase, primarily driven by increased Bitcoin trading activity since the first half of 2025. The long-term trend also remains encouraging. Although application-layer fees declined quarter-over-quarter, application-layer protocol fee revenue in Q4 2025 was more than double that of Q3 2024 and significantly higher than previous quarters. This long-term trend highlights the continued maturation of this asset class, with increasing trading activity and fee revenue shifting to the application layer as new use cases and applications are developed. Chart 2: Blockchain Fundamentals Declined Sharply in Q4 2025 [Image of chart 2: Price Performance] Following positive returns across all cryptocurrency sectors in Q3, all six major cryptocurrency sectors experienced negative returns in Q4 2025 (see Chart 3). The currency sector outperformed other sectors, primarily due to the strong performance of several privacy tokens (see below), indicating a strengthening of defensive strategies in the overall cryptocurrency market. Application layer sectors underperformed, with the artificial intelligence sector showing the lowest returns, reflecting investors' high sensitivity to risk appetite and the fact that many assets in this sector are still in their early stages of development. Chart 3: All sectors had negative returns in Q4 2025

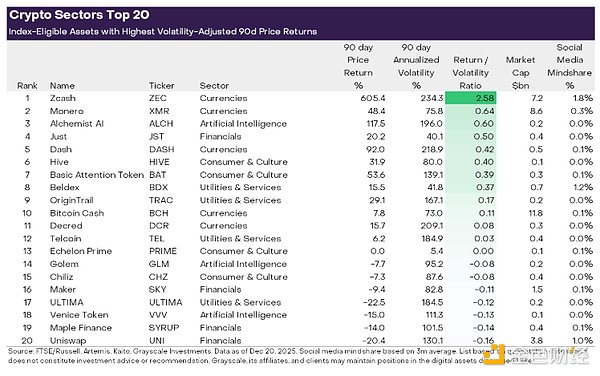

The diversity of crypto asset classes means that dominant themes and market leadership often change. Chart 4 shows the top 20 index-eligible tokens in Q3 2025 based on volatility-adjusted price returns.

Given the overall poor performance in Q4, only a few specific thematic assets achieved positive risk-adjusted returns.

This contrasts sharply with the third quarter, when top performers included several large-cap assets such as Ethereum, Solana, Chainlink, BNB, and Avalanche. Among the top 20 tokens in the fourth quarter, several are privacy-related, including Zcash (ZEC), Monero (XMR), Dash (DASH), Decred (DCR), Basic Attention Token (BAT), and Beldex (BDX). These tokens dominate user awareness (see Chart 4), indicating that their price performance is at least partly driven by strong narrative momentum. Meanwhile, usage of several privacy networks, including Zcash and Dash, continues to grow.

Besides privacy, the top 20 also includes some AI-related protocols, such as Alchemist (a Solana-based no-code tool platform for developers to create applications and games), OriginTrail (a decentralized knowledge graph for AI-based knowledge sharing), and Golem (a decentralized computing network).

Chart 4: Price Performance of Top 20 Tokens Privacy Token Highlights

Preference for Privacy

Privacy was the dominant theme in cryptocurrency investment in the fourth quarter.

As we discussed in our 2026 Outlook Report, privacy is an inherent part of the financial system: almost everyone expects their wages, taxes, net worth, and spending habits not to be publicly disclosed on a public ledger. However, most blockchains are transparent by default. If public blockchains are to integrate more deeply into the financial system, they need stronger privacy infrastructure—a point that is becoming increasingly clear as regulation (through market structure legislation) facilitates this integration. This growing focus on privacy drove the strong performance of crypto assets with these features in the fourth quarter, particularly Zcash (ZEC). Zcash is a decentralized digital currency similar to Bitcoin, but it incorporates optional privacy features by “shielding” accounts and transactions. The percentage of shielded balances relative to the Zcash token supply increased in 2025, indicating growing market demand for the protocol's privacy protection features (Chart 5). Chart 5: Increased Usage of Zcash Privacy Features [Image of Zcash privacy features] Several other privacy protocols also outperformed others in Q4 2025. Monero (XMR) is a network that uses hidden addresses and confidential transaction details. Monero has historically been the highest-valued cryptocurrency privacy asset, but Zcash's recent success poses an increasing challenge to its long-term market share dominance. Decred (DCR) is a digital currency network that offers user governance and privacy enhancements through the CoinShuffle++ feature. Dash (DASH) is a digital payments platform with an optional privacy feature called PrivateSend, and its daily transaction volume more than doubled in the fourth quarter. Basic Attention Token (BAT) is a blockchain-based advertising platform and internet browser. BAT is the native token of the Brave browser ecosystem, a privacy-focused web browser that surpassed 100 million monthly active users last quarter. Beldex (BDX) is a network offering a full suite of privacy-oriented products, including an encrypted messaging application, private browsing, and payment services. Beldex recently integrated with LayerZero, enabling cross-chain interoperability. 2026 Q1 Crypto Industry Outlook

As 2025 draws to a close, cryptocurrency investors are currently discussing two main themes: (i) market structure legislation in the U.S. Congress and (ii) the vulnerability of traditional cryptographic methods to quantum computing.

Grayscale anticipates that a bipartisan cryptocurrency market structure bill will officially take effect in 2026. The House of Representatives passed its version of the bill—the Clarity Act—in July 2025, and the Senate has also initiated related procedures. While many details still need to be finalized, overall, the bill provides a set of traditional financial rules for the cryptocurrency capital market, including registration and disclosure requirements, crypto asset classification, and insider rules.

2026 Q1 Crypto Industry Outlook

In fact, in the US and other major economies, a more robust regulatory framework for crypto assets could mean that regulated financial services firms will be required to disclose digital assets on their balance sheets and begin trading on blockchains (for more details, see "Digital Asset Outlook 2026: The Dawn of the Institutional Era"). Quantum computing is a significant topic, but we ultimately expect it to become a "distraction" factor in 2026—a topic that will generate much debate but is unlikely to impact prices. If advancements in quantum computing continue, most blockchains will eventually need to update their cryptography. Theoretically, a sufficiently powerful quantum computer could derive private keys from public keys and then use those private keys to create valid digital signatures to spend a user's cryptocurrency. Therefore, Bitcoin and most other blockchains—and virtually everything else in the economy that uses cryptography—will eventually need to be updated to accommodate post-quantum era tools. While these risks may seem distant at present, markets may begin to assess them based on blockchains' ability to meet quantum challenges. In conclusion, these debates highlight the regulatory and technological landscape that will shape the cryptocurrency market in 2026. Catherine

Catherine

Catherine

Catherine Kikyo

Kikyo Jasper

Jasper Hui Xin

Hui Xin Catherine

Catherine Alex

Alex Clement

Clement Joy

Joy YouQuan

YouQuan Clement

Clement