Source: Grayscale; Compiled by AIMan@黄金财经 Key Points: Credibility is paramount for fiat currencies. Today, with high public debt, rising bond yields, and uncontrolled deficit spending, the U.S. government's promise to ensure low inflation may no longer be entirely credible. We believe it's increasingly likely that a strategy to manage the nation's debt burden will involve at least moderately high inflation. If holders of dollar-denominated assets believe this, they may seek alternative stores of value. Cryptocurrencies such as Bitcoin and Ethereum may offer this goal. They are alternative monetary assets based on new technologies. As stores of value, their most important characteristics are a programmatic and transparent supply, and autonomy from the control of any individual or institution. Like physical gold, their utility stems in part from their immutability and independence from political influence. As long as public debt continues to grow unchecked, governments cannot credibly commit to maintaining low inflation, and investors may question the viability of fiat currencies as a store of value. In this environment, macro demand for cryptoassets may continue to rise. However, if policymakers take steps to bolster long-term confidence in fiat currencies, macro demand for cryptoassets may decline. Investing in the cryptoasset class means investing in blockchain technology: a network of computers running open-source software that maintains a public transaction database. This technology is transforming how valuables (money and assets) flow across the internet. Grayscale believes that blockchain will revolutionize digital commerce and have a profound impact on our payment systems and capital markets infrastructure. But the value of this technology—the utility it provides to users—goes beyond improving the efficiency of financial intermediation. Bitcoin and Ethereum are both payment systems and monetary assets. These cryptocurrencies have certain design features that allow them to serve as a safe haven for traditional fiat currencies when needed. To understand how blockchains work, you need to understand computer science and cryptography. But to understand the value of cryptoassets, you need to understand fiat currencies and macroeconomic imbalances. Fiat Money, Trust, and Reputation Almost all modern economies use a fiat currency system: paper money (and its digital representation) has no intrinsic value. Surprisingly, much of the world's wealth is based on worthless physical assets. Of course, the true meaning of fiat money isn't the paper money itself, but the institutions surrounding it. For these systems to work, expectations about the money supply need to be based on something—without any promise to limit the supply, no one would use the paper money. So, governments promise not to increase the money supply excessively, and the public judges the credibility of those promises. It's a system based on trust. However, history is replete with examples of governments violating this trust: policymakers have sometimes increased the money supply (causing inflation) because it was expedient at the time. Therefore, currency holders are naturally skeptical of broad promises to limit the fiat money supply. To lend credibility to these promises, governments typically adopt some kind of institutional framework. These frameworks vary across time and country, but the most common strategy today is to delegate responsibility for managing the money supply to an independent central bank, which then sets a specific inflation target. This structure has been the norm since roughly the mid-1990s and has been largely effective in achieving low inflation (Figure 1). When money fails When fiat currencies have a high degree of credibility, the public doesn't care. That's the goal. While citizens of countries with historically low and stable inflation might find it difficult to understand the value of holding a currency that can't be used for daily payments or to repay debts, there are many parts of the world that clearly need better money (Figure 2). No one questions why citizens of Venezuela or Argentina would want to hold a portion of their assets in foreign currencies or certain cryptoassets—they clearly need a better store of value. Chart 2: Governments Occasionally Mismanage the Money Supply The 10 countries in the chart above have a combined population of around 1 billion, and many of them have turned to cryptocurrencies as a monetary life raft. This includes Bitcoin and other cryptocurrencies, as well as Tether (USDT), a blockchain-based stablecoin pegged to the US dollar. Adoption of Tether and other stablecoins is just another form of dollarization—the substitution of the US dollar for a national currency—which has been common in emerging markets for decades. The world runs on the US dollar, but what if the problem lies with the dollar itself? If you're a multinational corporation, a high-net-worth individual, or a nation-state, you can't escape its influence. The US dollar is both the national currency of the United States and the dominant international currency in the world today. The Federal Reserve, based on a variety of specific indicators, estimates that the US dollar accounts for approximately 60%-70% of international currency use, while the euro accounts for only 20%-25%, and the renminbi accounts for less than 5% (see Figure 3). Figure 3: The US Dollar is Today's Dominant International Currency To be clear, the United States does not suffer from monetary mismanagement, as do the emerging market economies in Figure 2. However, any threat to the dollar's robustness is significant because it affects virtually all asset holders—not just US residents who use the currency for daily transactions. Risks to the dollar, not the Argentine peso or Venezuelan bolivar, are what's driving the largest pools of capital to seek alternative assets like gold and cryptocurrencies. While the potential challenges to the US currency's stability may not be the most severe compared to other countries, they are the most significant. The Debt Problem at Its Core Fiat currencies are built on promises, trust, and credibility. We believe the dollar faces an emerging credibility problem: the US government is increasingly struggling to deliver a credible low-inflation promise. The root cause of this credibility deficit lies in unsustainable federal government deficits and debt. This imbalance began with the 2008 financial crisis. In 2007, the US deficit was just 1% of GDP, while total debt was 35% of GDP. Since then, the federal government has averaged annual deficits of about 6% of GDP. Currently, the US national debt is approximately $30 trillion, equivalent to 100% of GDP—nearly the same level as the final year of World War II—and is projected to continue to grow significantly (Exhibit 4). Chart 4: U.S. Public Debt on an Unsustainable Rise Large deficits have long been a bipartisan concern, persisting even in times of relatively low unemployment. One reason modern deficits are so difficult to address is that revenues now cover only fixed expenditures (e.g., programs like Social Security and Medicare) and interest payments (see Chart 5). Balancing the budget, therefore, may require politically painful spending cuts and/or tax increases. Figure 5: Government Revenue Covers Only Mandatory Spending Plus Interest Interest Expenses: A Tight Constraint Economic theory cannot tell us how much government debt is excessive. Any borrower knows that it's not the amount of debt that matters, but the cost of financing. If the US government can still borrow at very low interest rates, debt growth could likely continue without materially impacting institutional credibility or financial markets. Indeed, some prominent economists have expressed optimism about the recent rise in debt stocks precisely because low interest rates have made financing easier. However, the decades-long trend of falling bond yields now appears to have ended, and as a result, the limits to debt growth are beginning to emerge (Chart 6). Chart 6: Rising bond yields signal that limits to debt growth are starting to take effect Like other prices, bond yields ultimately depend on supply and demand. The U.S. government has continued to issue more bonds, and at some point over the past few years, it appears to have satisfied the demand for these bonds (low yields/high prices). There are many reasons for this situation, but the key is that the US government borrows both from domestic savers and from abroad. US domestic savings are far from sufficient to absorb the full borrowing and investment needs of the US economy. Consequently, the US international accounts contain both a large stock of public debt and a large net debt position (Figure 7). Over the past few years, a series of changes in foreign economies have reduced international demand for US Treasury bonds, which offer lower interest rates. These changes include a slowdown in official reserve accumulation in emerging markets and the end of deflation in Japan. Geopolitical adjustments may also weaken foreign investors' structural demand for US Treasury bonds. As the U.S. government refinances its debt at higher interest rates, a larger portion of its spending goes toward interest payments (Figure 8). Low bond yields allowed the debt stock to grow rapidly for nearly 15 years without significantly impacting the government's interest payments. That has now ended, making the debt problem more pressing. To control the debt burden, lawmakers need to: (1) balance the primary deficit (i.e., the budget balance after deducting interest payments); and (2) keep interest costs low relative to economic growth. The United States has a persistent primary deficit (about 3% of GDP), so even if interest rates are under control, the debt stock will continue to rise. Unfortunately, the latter issue—sometimes referred to by economists as the "snowball effect"—is also becoming increasingly challenging. Assuming a balanced primary deficit, the following conditions hold: 1. If the average interest rate on debt is lower than the nominal growth rate of the economy, the debt burden (defined as the ratio of public debt to GDP) will decline. 2. If the average interest rate on debt is higher than the nominal growth rate of the economy, the debt burden will increase. To illustrate the importance of this point, Figure 9 shows a hypothetical path for the U.S. public debt-to-GDP ratio, assuming the primary deficit remains at 3% of GDP and nominal GDP growth is sustained at 4%. The conclusion: when interest rates are high relative to nominal growth, the debt burden rises faster. Chart 9: Rising Interest Rates Could Snowball the Debt Burden In addition to rising bond yields, many forecasters now expect slower structural GDP growth due to an aging workforce and reduced immigration: the Congressional Budget Office (CBO) projects that potential labor force growth will slow from about 1% per year today to about 0.3% by 2035. Assuming the Fed can achieve its 2% inflation target—still an open question—slower real growth will mean lower nominal growth and faster growth in the stock of debt. How the Story Ends: By definition, unsustainable trends cannot continue forever. The unbridled growth of U.S. federal government debt will eventually end, but no one can be sure of the exact timing. As always, investors need to consider all possible outcomes and weigh their likelihood based on the data, policymakers' actions, and historical lessons. Essentially, there are four possible outcomes, which are not necessarily mutually exclusive (Exhibit 10). Chart 10: Investors Need to Consider Outcomes and Weigh Their Probabilities Default is highly unlikely because US debt is denominated in US dollars, and inflation is generally less painful than not repaying it. Fiscal austerity is possible in the future—and could eventually be part of the solution—but Congress just enacted the "Big Beautiful Act," which commits fiscal policy to maintaining high deficits for the next decade. Reducing the deficit through tax increases and/or spending cuts seems unlikely, at least for now. Booming economic growth would be the ideal outcome, but it is currently weak, and potential growth is projected to slow. While the data haven't yet shown this, the significant productivity gains driven by AI are undoubtedly helping manage the debt burden. This has led to artificially low interest rates and inflation. For example, if the United States could maintain interest rates around 3%, real GDP growth around 2%, and inflation around 4%, it could theoretically stabilize the debt stock at its current level without reducing the primary deficit. The Federal Reserve is structured to operate independently, insulating monetary policy from short-term political pressures. However, recent debates and policymakers' actions have raised concerns among some observers that this independence may be at risk. Regardless, it may be unrealistic for the Fed to completely ignore the nation's fiscal policy issues. History shows that in times of crisis, monetary policy defers to fiscal policy, and the path of least resistance may be to inflate its way out of trouble. Given the range of possible outcomes, the severity of the problems, and the actions taken by policymakers to date, we believe that the long-term strategy for managing the nation's debt burden will increasingly likely result in average inflation above the Fed's 2% target. Back to Cryptocurrencies: In summary, given the massive debt, rising interest rates, and the lack of other viable countermeasures, the U.S. government's promise to control money supply growth and inflation may no longer be entirely credible. The value of fiat currency ultimately depends on the government's credible promise not to increase the money supply. Therefore, if there is reason to doubt this promise, investors in all dollar-denominated assets may need to consider what this means for their portfolios. If they begin to believe that the dollar's reliability as a store of value is diminished, they may seek alternatives. Cryptocurrencies are digital commodities based on blockchain technology. There are many different types of cryptocurrencies, and their uses are generally unrelated to "store of value" currencies. For example, public blockchains have a wide range of applications, covering a wide range of areas, including payments, video games, and artificial intelligence. Grayscale uses the "crypto-sector" framework developed in collaboration with FTSE Russell to categorize crypto assets according to their primary use cases. We believe that a small number of these digital assets can be considered viable stores of value due to their widespread adoption, high degree of decentralization, and limited supply growth. This includes Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization. Like fiat currencies, they are not "backed" by other assets that give them value. Instead, their utility/value stems from the fact that they allow users to make peer-to-peer digital payments without the risk of censorship and from their credible commitment not to increase their supply. For example, Bitcoin's supply is capped at 21 million, currently growing at 450 coins per day, with the new supply halving every four years (Exhibit 11). This is clearly stated in the open-source code, and no changes can be implemented without consensus from the Bitcoin community. Furthermore, Bitcoin is not subject to any external authority (such as a fiscal authority with debt repayment obligations) that could interfere with its low and predictable supply growth targets. A transparent, predictable, and ultimately finite supply is a simple yet powerful concept that has helped Bitcoin grow to over $2 trillion in market capitalization. Chart 11: Bitcoin Provides a Predictable and Transparent Money Supply Like gold, Bitcoin itself does not earn interest and is not (yet) widely used for everyday payments. The utility of these assets lies in what they don't do. Crucially, their supply cannot be increased simply because governments need to repay debts—no government or any other institution can control their supply. Investors today must navigate an environment of significant macroeconomic imbalances, the most significant of which is the unsustainable growth of public debt and its impact on the credibility and stability of fiat currencies. The purpose of holding alternative currency assets in a portfolio is to hedge against the risk of fiat currency devaluation. As long as these risks remain elevated, the value of assets that offer protection against such outcomes should increase. What Could Turn the Tide Around? Investing in the cryptoasset class involves various risks that are beyond the scope of this report. However, from a macro perspective, a key risk to the long-term value proposition of certain cryptoassets could be a strengthened government commitment to managing the fiat currency supply to restore public confidence. These measures could include stabilizing and reducing government debt-to-GDP ratios, reaffirming support for the central bank's inflation target, and taking steps to strengthen the central bank's independence. Government-issued fiat currencies already serve as a convenient medium of exchange. If governments can ensure that they also serve as an effective store of value, demand for cryptocurrencies and other alternative stores of value could decline. For example, gold performed well in the 1970s when the credibility of U.S. institutions was questioned, but underperformed in the 1980s and 1990s as the Federal Reserve controlled inflation (Exhibit 12).

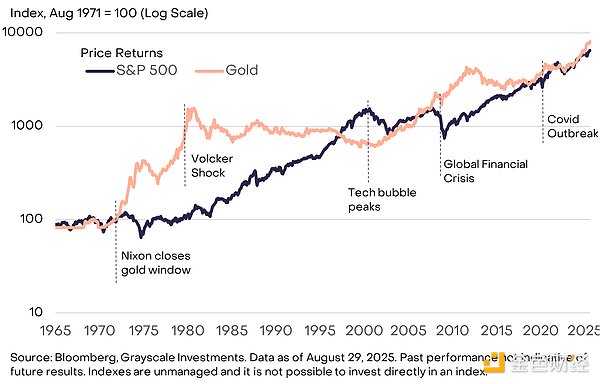

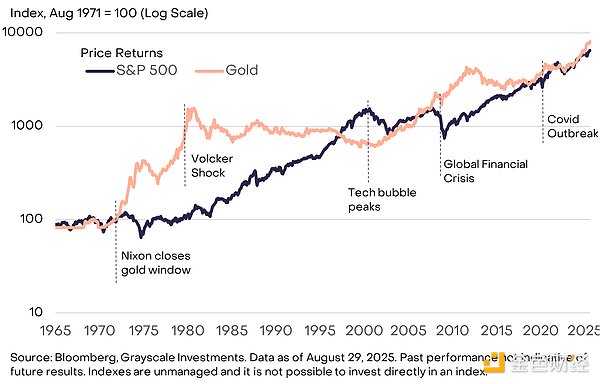

Exhibit 12: Gold underperformed in the 1980s and 1990s as inflation declined

Public blockchains have brought innovation to digital currencies and digital finance. The blockchain applications with the highest market capitalization today are digital currency systems that provide functions distinct from fiat currencies—demand for which is closely tied to factors such as modern macroeconomic imbalances (such as high public sector debt). Over time, we believe that the growth of the crypto asset class will be driven by these macroeconomic factors and the adoption of other innovative technologies based on public chains.

Weatherly

Weatherly