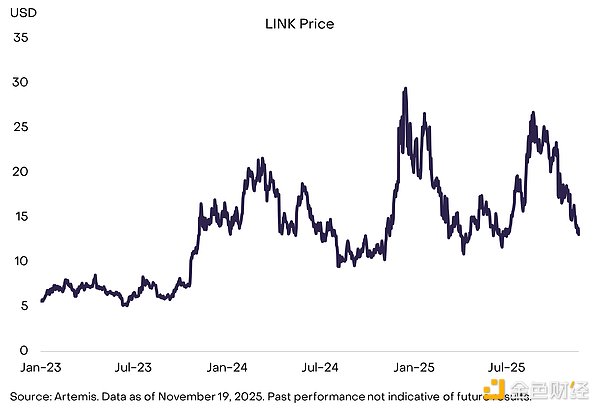

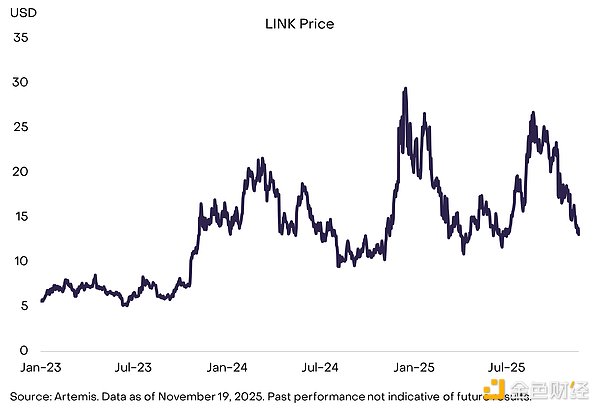

The LINK token issued by this project is the highest-valued token in the "Utility and Service Crypto Assets" category, and also the largest non-Layer 1 network token by market capitalization in the entire crypto space (excluding stablecoins). Because Chainlink serves multiple blockchains rather than a single network, holding LINK tokens means gaining broad exposure to the crypto economy. We believe this characteristic, along with other advantages, makes LINK a key asset to allocate when building a diversified crypto portfolio. Public blockchain technology has the potential to reshape the digital currency and digital finance landscape by weakening the role of centralized intermediaries. However, realizing this vision requires that blockchains be connected to the real world. Currently, almost all financial assets are issued off-chain and, at least in the short to medium term, need to be bridged to the blockchain through tokenization. Furthermore, certain elements of mainstream finance—such as regulatory compliance, dispute resolution, and customer service—will not disappear, so certain types of intermediaries will continue to exist for a long time. This is precisely where Chainlink can play a role. Chainlink is a key link between the crypto world and traditional finance. We believe it has become an indispensable infrastructure in the blockchain-based financial system, and it's hard to imagine how crypto technology could have become mainstream without Chainlink's software suite. Chainlink's broad and continuously growing application prospects, its direct token value accumulation model, and its unique advantages compared to other large crypto assets make LINK a highly attractive allocation option in a diversified crypto asset portfolio (see chart below).

1、Chainlinkand Asset Tokenization

To understand Chainlink's technology and its future growth potential, it's necessary to examine its role in the asset tokenization process. As blockchain becomes more widely adopted, securities may be able to be issued and tracked entirely on-chain. However, currently, beneficial ownership of securities—as well as real estate, physical goods, collectibles, and other tangible assets—is still recorded on traditional off-chain ledgers (usually electronic ledger accounts). Asset tokenization refers to the process of registering asset ownership on blockchain infrastructure, enabling market participants to enjoy the technological advantages of blockchain, including more efficient settlement, smart contract interaction capabilities, and potential cost reductions. We expect Chainlink to play a central role in coordinating the tokenization process, and its announced collaborations with institutions such as S&P Global and FTSE Russell should help achieve this goal. The tokenized asset market is growing steadily: estimates suggest its current size is approximately $35 billion (excluding stablecoins), a significant increase from $5 billion at the beginning of 2023. However, these values remain insignificant compared to traditional asset markets. For example, the current total size of tokenized assets represents only 0.01% (1 basis point) of the total value of global fixed income and equity securities, while stocks and bonds represent only a portion of the global asset base that may eventually be tokenized (see chart below). This continued growth in the market may mean increased demand for Chainlink's unique software solutions. Chainlink's technology will cover multiple stages of the tokenization lifecycle (see the diagram below): Before tokenized assets begin on-chain trading, a **Proof of Reserve** verifies whether they are backed by sufficient off-chain assets; The Automated Compliance Engine (ACE) ensures investors meet KYC/AML requirements; Data Feeds, as on-chain markets develop, provide access to off-chain price information; and the Cross-Chain Interoperability Protocol (CCIP) enables the transfer of tokenized assets across multiple blockchain ecosystems. Tokenization will eventually achieve massive scale and transform how we hold and trade assets, but many practical challenges remain. We believe Chainlink is currently the most compelling crypto project offering solutions to these challenges.

2, Modular Blockchain Solutions

Chainlink is often described as a cryptographic "oracle," that is, a source that provides price data and other information from outside the blockchain (such as Bitcoin prices on exchanges). This is the starting point of the Chainlink project; today its scope has expanded significantly. A more accurate description of Chainlink would be modular middleware—it allows on-chain applications to securely use off-chain data, achieve cross-chain interaction, and meet enterprise-level compliance requirements without the need to integrate solutions from multiple vendors.

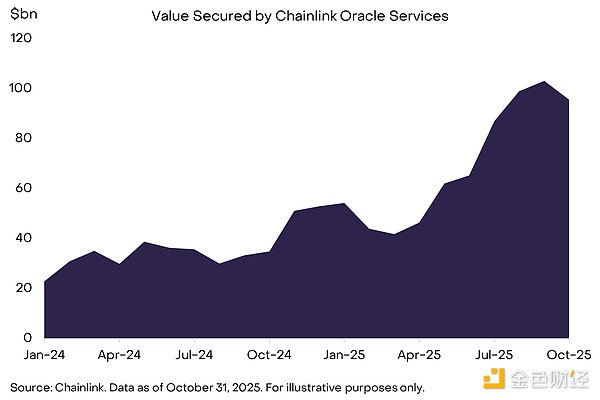

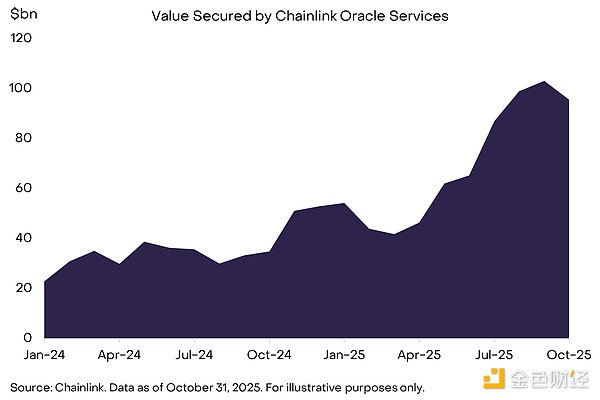

To simplify understanding, Chainlink's numerous modular components can be categorized into three main types: oracles/data feeds, cross-chain interoperability protocols (CCIP), and other solutions. These services are packaged into a toolset called the Chainlink runtime environment. (1) Talking to Oracles: Chainlink Data Feeds Chainlink's original product was its price and data feeds—or "oracles" in crypto terminology. Data feeds are how smart contract applications access off-chain information. In Chainlink's architecture, independent node operators (organized into a decentralized oracle network, DONs) obtain data from multiple high-quality data sources, reach consensus off-chain through off-chain reporting (OCR), and publish the results on-chain for contracts to read. Importantly, these data feeds are run by independent operators—Chainlink itself does not operate any nodes. Because DONs are geographically dispersed and use different infrastructures, data feeds are designed to continue operating even if a single cloud server region experiences an outage. Chainlink is widely considered the default oracle for decentralized finance (DeFi), providing security for major money markets, derivatives, and stablecoins across multiple chains (see diagram below). Aave, the largest DeFi protocol by Total Value Locked (TVL), is also Chainlink's largest customer.

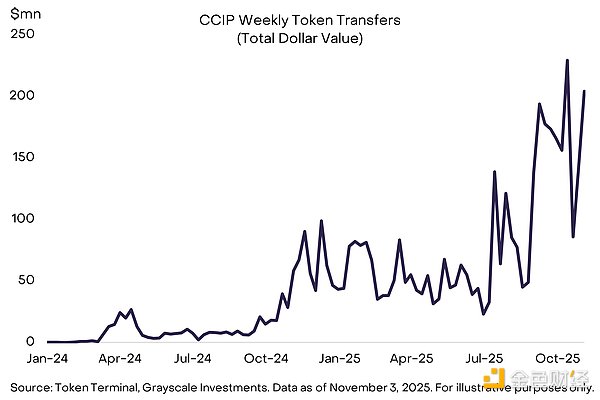

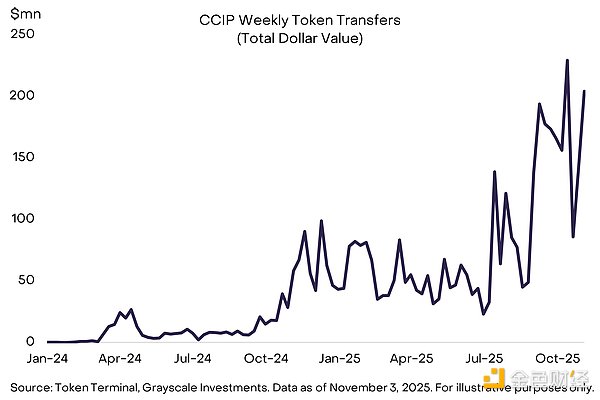

(2 Cross-chain Interoperability: Chainlink CCIP

The Chainlink Cross-Chain Interoperability Protocol (CCIP) is a programmable, bridging-enhanced messaging layer: it enables the transfer of data, tokens, or a combination of both (tokens + instructions) between supported blockchains. Its underlying layer handles cross-chain asset transfers through Chainlink's "TokenPools" standard, while security is jointly ensured by an execution oracle network and an independent risk management network.

(3)Addressing Real-World Challenges: Other Services from Chainlink

In addition to price feeds and CCIP, Chainlink provides a suite of modular services covering data, computation, and operations:

Functions (Function calls): Allows smart contracts to call external APIs and run lightweight off-chain computations through the oracle network;

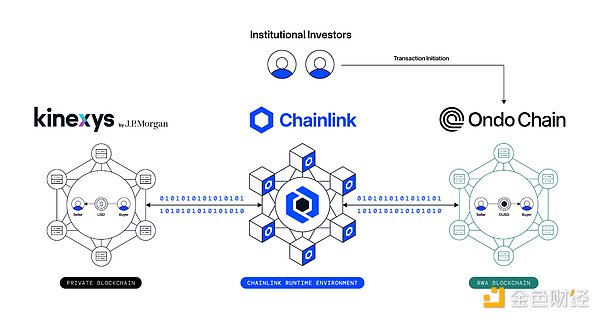

3, Integration and Collaboration: **Chainlink Runtime Environment (CRE)**

Chainlink integrates its numerous services into the Chainlink Runtime Environment (CRE). The CRE can be viewed as a coordinated process that connects these modules, forming an end-to-end auditable workflow. The result is a modular enterprise-grade software technology stack—users can start with a single service, gradually expand as needs grow, and always meet compliance and auditability requirements. ...3, Chainlink Collaborates: **Chainlink Runtime Environment (CRE)**

3, Chainlink Collaborates: **Chainlink Runtime Environment (CRE)** Anais

Anais