Cardano Founder Addresses Journalist's Allegations of ‘Damning’ Evidence

An older video has resurfaced, featuring journalist Laura Shin claiming to possess potentially damaging information regarding Charles Hoskinson, Cardano’s founder.

Kikyo

Kikyo

Source: Grayscale Research; Compiled by: AIMan@黄金财经

● Stablecoins are digital tokens pegged to the US dollar and issued on the blockchain. Through this structure, tokenized digital dollars can benefit from the features of the blockchain, including borderless payments, near-instant settlement, potentially lower transaction costs, and a high degree of transparency.

● Stablecoins are ubiquitous in the cryptocurrency trading world, but are now also being used for traditional payments. Currently, there is about $250 billion in stablecoins in circulation, and stablecoin issuers are currently the main holders of US Treasury bonds. Blockchain processes more than 100 million stablecoin transactions per month.

● While traditional payment systems are mostly very efficient, some elements can be cheaper, faster, and/or provide more functionality. Based on their comparative advantages, Grayscale Research expects stablecoins to make the most progress in the following areas: (1) cross-border payments; (2) domestic payments in credit card-dominated markets such as the United States; and (3) value transfer between AI agents.

● Stablecoins are a core use case for public blockchains, and rising stablecoin adoption is likely to benefit nearly all aspects of the crypto asset class to some extent.

● Among specific blockchains, Ethereum appears poised to benefit from rising stablecoin adoption, as it already has the largest number of stablecoins and processes the most stablecoin transactions. This trend should extend to the Ethereum Layer 1 blockchain and its Layer 2 ecosystem. Other beneficiaries may include certain high-performance Layer 1 blockchains, related decentralized finance (DeFi) applications, and traditional financial services companies that adopt stablecoin infrastructure.

●Grayscale Research believes that the passage of the GENIUS Act, which establishes a comprehensive regulatory framework for US stablecoins, is a milestone for the cryptocurrency industry. The bill aims to promote the integration of stablecoins into the US financial system while establishing safeguards to support financial stability, protect consumers and curb illegal activities.

The improvement of the efficiency of the payment system of an economy benefits everyone, but fundamental changes are difficult to achieve. The payment system is essentially a network composed of many participants, so reform efforts may face huge coordination challenges. Even seemingly obvious improvements - such as universal information transmission standards and overlapping business hours between global banks - are difficult to implement. Over the past five years, the Group of Twenty (G20) has been explicitly committed to improving cross-border payments - which is particularly frustrating for users - but progress has been slow.

Stablecoins are an emerging innovation in the field of digital payments based on blockchain technology. Like most crypto applications, stablecoin adoption is a bottom-up phenomenon: a diverse range of users around the world have benefited from using stablecoins to transact and/or store value. The GENIUS Act, signed into law by President Trump on Friday, July 18, provides a comprehensive regulatory framework for payments stablecoins in the United States. This legislation, along with similar efforts in other countries, will enable stablecoins to be more deeply integrated into the traditional financial system while establishing appropriate safeguards for financial stability, consumer protection, and prevention of illicit activity. Grayscale Research believes that stablecoins have the potential to disrupt certain aspects of the global payments industry by offering lower costs, faster settlement times, and greater transparency. We expect stablecoins to make the most inroads in the following areas: (1) cross-border payments; (2) domestic payments in credit card-dominated markets such as the United States; and (3) value transfer between AI agents. Stablecoins are also a way to hold digital value and have the potential to partially disintermediate commercial bank deposits. In the crypto ecosystem, the biggest beneficiaries are likely to be stablecoin issuers and their distribution partners (who earn the net interest margin NIM), as well as blockchains in the Ethereum ecosystem, certain other high-performance Layer 1s, and related decentralized finance (DeFi) applications such as oracles and decentralized exchanges (DEXs).

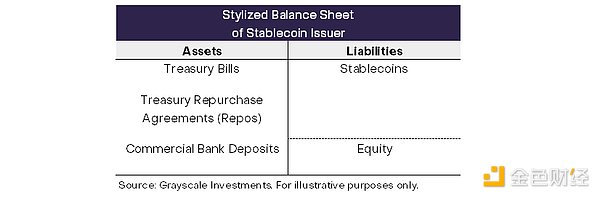

A stablecoin is a digital token that is pegged to the U.S. dollar and issued on a blockchain. There are many types of stablecoins (described below), but mainstream users will likely only be exposed to one specific type: fully collateralized, fiat-backed stablecoins. These instruments are very similar to government-only money market mutual funds: they are tokens that stabilize the value of the U.S. dollar and are fully backed by Treasury bonds or similar collateral (Exhibit 1). Stablecoins are able to maintain their peg to the dollar because the stablecoin issuer is ready to redeem the stablecoin at par or issue more stablecoins in exchange for cash. This is a very simple structure and not a particularly interesting innovation in itself. However, when tokenized digital dollars are deployed on a public blockchain, they gain the capabilities of blockchain, including borderless payments, near-instant settlement, potentially low costs, and a high degree of transparency.

Figure 1: A regulated U.S. payment stablecoin will have a simple structure

Today, stablecoins are ubiquitous in cryptocurrency trading. For example, stablecoins account for 70%-80% of the trading volume of crypto tokens traded on centralized exchanges (CEXs). Thus, growth in cryptocurrency trading volume is likely to lead to growth in stablecoin balances and trading volume. Stablecoins are also the primary tool for users to access DeFi applications such as decentralized lending protocols. However, stablecoins are now also being used for traditional digital payments, especially in emerging market economies. This use case is unrelated to speculative cryptocurrency trading and therefore may support sustainable growth in blockchain applications.

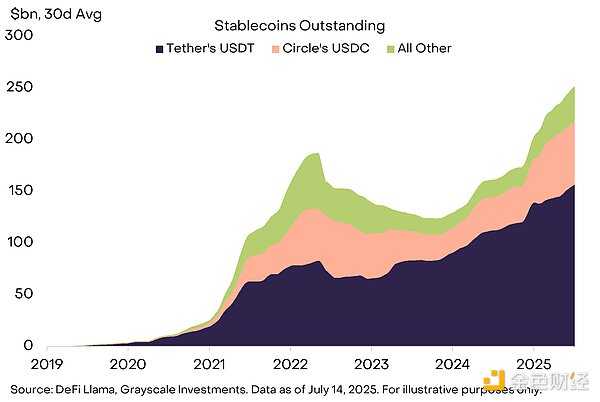

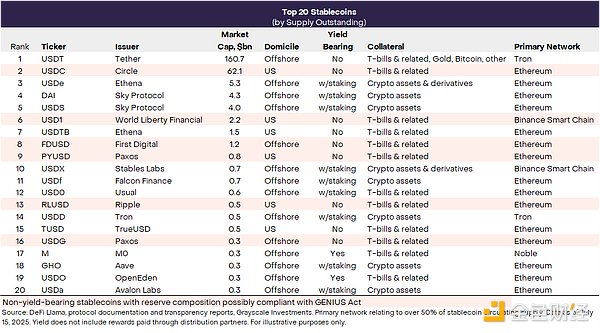

Although issuers have created stablecoins for a variety of currencies, almost all of the $250 billion in stablecoins in circulation are US dollar stablecoins. Two issuers dominate the US dollar stablecoin market: Tether, the issuer of the USDT stablecoin, and Circle, the issuer of the USDC stablecoin (see Figure 2). Tether is registered overseas and its USDT accounts for about 60% of the total stablecoin "market value". Circle is registered in the United States and its USDC accounts for about 25% of the total stablecoin market value. Tether reserve assets are currently the leading holder of US Treasury bonds: if it were a country, it would be the 18th largest foreign holder of US Treasury bonds, second only to Saudi Arabia and ahead of South Korea.

Figure 2: The largest stablecoins are USDT and USDC

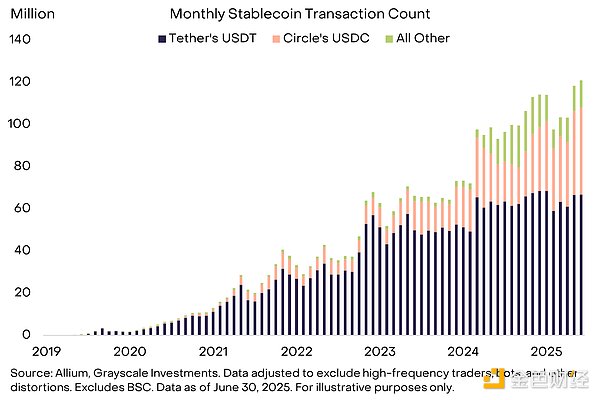

There is no perfect metric for measuring stablecoin transaction volume, but a consortium of crypto data experts worked with Visa to create a widely used benchmark that aims to eliminate certain types of bias (such as high-frequency traders and robots). According to these estimates, users conducted more than 120 million stablecoin transactions in June 2025 (Chart 3). The total value transferred is about $800 billion, or nearly $10 trillion at an annualized rate. By comparison, the Visa network will process about $13 trillion in payments in 2024. To be clear, these transactions involve both crypto and payment use cases, and it is impossible to distinguish them based on on-chain data alone. At present, the vast majority of stablecoin transactions are likely still related to crypto transactions (perhaps as high as 90%), rather than payments for goods and services.

Figure 3: More than 100 million stablecoin transactions per month

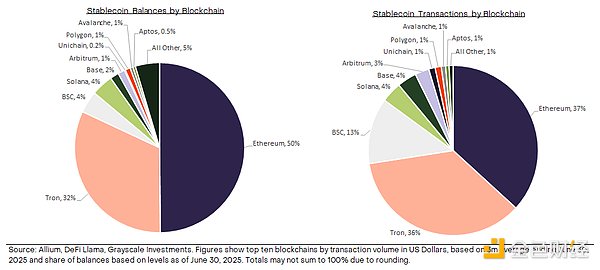

Most smart contract platform blockchains use stablecoins, but the current leaders in this category are Ethereum and TRON (Figure 4). About half of the stablecoin balances are on Ethereum, including USDT and USDC; almost all of the stablecoin balances on TRON are composed of USDT. Ethereum and Tron have processed ~$1.7T in stablecoin transactions so far this year; most transactions on Tron use Tether’s USDT stablecoin (>99%), while most transactions on Ethereum use Circle’s USDC stablecoin (~65%).

Figure 4: Ethereum and Tron are the leading stablecoin blockchains today

The modern global economy cannot do without an effective payment system, and the existing infrastructure is working well enough to keep it running smoothly. At the same time, there is still room for improvement in some areas. The most obvious example is cross-border payments - which is why the G20 has explicitly focused on this issue - but some domestic payment networks are also inefficient. In addition, the growth of AI-agent transactions will place new demands on economies' payment infrastructure. Stablecoins can help make the global payments landscape more efficient and potentially reduce costs for consumers and businesses.

Cross-border payments involve financial institutions (and their regulation) in multiple countries and are therefore often more complex than domestic payments. Because of this complexity, cross-border payments tend to be more costly, settle more slowly, and are often less transparent to users. The most common type of cross-border payment involves correspondent banks, which open accounts for partner banks in various domestic markets and settle transactions between them (Figure 5). In some cases, multiple correspondent banks connect financial institutions in distant markets.

Figure 5: Cross-border payments involve multiple intermediaries

Source: Grayscale Investments. For reference only.

Each additional intermediary in the process increases potential costs and delays. The Financial Stability Board (FSB), an international body, reports aggregate data on the costs of cross-border payments in its annual report. Excluding remittances, the average cost of cross-border payments from person to business in 2024 will be 2%, and the average cost of cross-border payments from person to person will be about 2.5%. For remittances, the average cost is about 5%. For many cross-border payments, speed is not an issue: according to the FSB's annual report, about 70% of retail payments can be settled within one business day of the payment being initiated. However, there are also payment corridors where the average processing time is more than two days, and can be as long as 10 days. In these cases, stablecoins can provide lower costs and faster settlement times.

We believe there is also room for improvement in domestic payment systems such as the United States, which are currently dominated by credit card networks. Credit card networks are highly concentrated, which may enable providers to maintain profits, and regulators and elected officials often explore ways to reduce costs. Stablecoins can increase competition in these markets and help reduce costs for users.

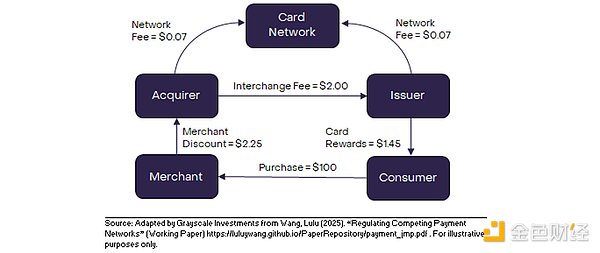

The figure below shows the structure of a typical US credit card payment and the flow of its associated fees. When a consumer spends $100, the merchant typically receives $97.75 and pays the remaining $2.25 (the so-called merchant rebate) to the card issuer (the financial institution that processes the transaction on behalf of the merchant). A portion of this amount ($1.45) is returned to the consumer in the form of credit card rewards. The remainder ($0.80) is earned as revenue by the banks and credit card companies that make up the card network. While many consumers like the credit card rewards that come with this system, merchants may be motivated to find other forms of digital payments. In addition, policymakers may worry that this system benefits cardholders (who receive rewards) while harming cash users (who still pay the same final retail price in most cases).

Exhibit 6: Credit card payments involve a variety of different fees

Finally, traditional payment systems are not well suited for AI agents—autonomous software that can act independently and execute complex instructions. As non-human actors, AI agents cannot legally own or operate bank accounts. In contrast, blockchain allows AI agents to autonomously control wallets and allocate financial resources. Blockchain also supports near-instantaneous microtransactions, while traditional systems require multi-day settlement times and high fees. Therefore, stablecoin payments on blockchains can both improve the functionality of AI agents and significantly expand their scope. While this is a new use case for the global payment system, some analysts expect it to grow rapidly in the coming years, which could make AI-agented payments a major use case for stablecoins.

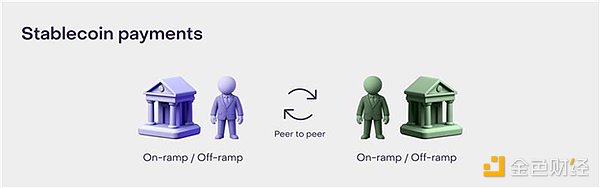

Stablecoins on public blockchains offer a radically different architecture for digital payments. In payments industry parlance, stablecoins are an innovation on the “back end” (the underlying infrastructure layer), whereas many other recent innovations have focused on the “front end” (the user interface layer). Stablecoin transfers on the blockchain are entirely peer-to-peer, with no intermediaries processing transactions (Figure 7). However, users may need to first “send” funds into the blockchain through a financial institution and then “send” the funds out to use. Users will choose stablecoin payments if they can offer (1) lower end-to-end total costs, (2) faster speeds, and/or (3) lower risk of payment failure.

Figure 7: Stablecoin payments are peer-to-peer

Source: Grayscale Investments. For reference only.

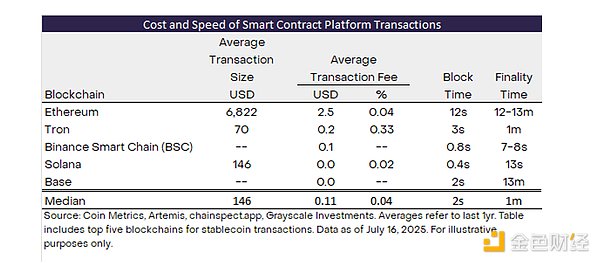

Smart contract platform blockchains process transactions relatively quickly and at a relatively low cost (Figure 8). Blockchain transaction costs do not grow 1:1 with transaction value, so high-value transactions tend to have lower fee percentages. For users who do not need to deposit or withdraw funds, stablecoins on public chains are already an efficient way to transfer digital value globally. If the adoption rate of stablecoins continues to grow and more merchants accept stablecoins to pay for goods and services, the need to use bank payment channels may decline, allowing more users to enjoy the benefits of stablecoin transactions on the blockchain.

Figure 8: Smart contract blockchain provides fast and cheap transactions

But in reality, most merchants have not yet accepted stablecoin payments, and users need to transfer funds out before they can use them. Therefore, when transacting with stablecoins, users need to consider the full end-to-end costs, including deposit/withdrawal costs. While technically this is a simple process, financial institutions often charge deposit/withdrawal fees to cover compliance costs: intermediaries are responsible for implementing anti-money laundering (AML) and countering the financing of terrorism (CFT) policies and procedures, as well as any applicable sanctions-related restrictions and other capital controls. Intermediaries may also need to bear costs associated with payment fraud and other administrative expenses. For all these reasons, the end-to-end costs of stablecoin transactions are not cost-competitive with traditional payment methods in all cases.

Many large crypto financial institutions, such as Coinbase (the largest exchange in the United States) and Mercado Bitcoin (the largest exchange in Latin America), offer zero-fee deposits and withdrawals for stablecoins and other assets. For transactions with zero-fee deposits and withdrawals, stablecoin transactions can be much cheaper than traditional payment methods. In other cases, deposit and withdrawal fees are around 1% per transaction, in which case the cost/benefit will depend on the specific circumstances. In some other cases, these fees can exceed 5%, in which case stablecoins may not be as cost-effective as traditional alternatives. Low average deposit and withdrawal costs could be a factor supporting continued adoption of stablecoins over time.

Grayscale Research expects stablecoins to penetrate the traditional payments space, but they are unlikely to be competitive in all segments (especially in the near term, as some of the relevant blockchain infrastructure is still under development). Stablecoins are already dominant in the cryptocurrency trading space and are likely to grow further. In terms of payment use cases, we expect stablecoins to be most competitive in three areas:

1. Digital payments are relatively slow, costly, and/or involve a large number of financial intermediaries - most importantly cross-border payments.

2. Network effects or a lack of competition allow intermediaries to maintain high-margin digital payments. This again includes cross-border payments, but we believe it also includes domestic card-centric payment systems like the United States.

3. Public blockchain infrastructure offers unique advantages for digital payments, such as programmable payments and the ability to create new accounts with the permission of banks. These features are critical for AI-agent payments.

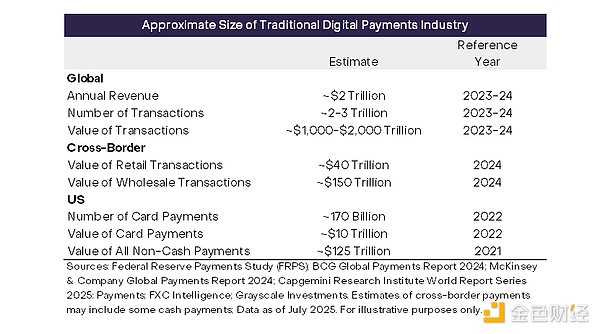

It is not easy to accurately estimate the potential market size (TAM) of stablecoins, but data from existing payment systems can give us a rough idea of its possible size. Figure 9 shows our rough estimate based on multiple sources. The global payment industry processes 2-3 trillion transactions per year, with a total value of $100-200 trillion (or $1-2 quadrillion) per year. The industry's revenue is about $2 trillion, roughly divided into net interest margin (NIM) and transaction fees.

Figure 9: The global payment industry processes 2-3 trillion transactions per year

In contrast, the stablecoin industry is still small. Currently, the total number of stablecoin transactions is about 100 million per month (about 0.05% of traditional payments), and the total value is about US$800 billion per month (about 0.5%-1.0% of traditional payments).

Based on a 4%-5% US cash rate and $250 billion in non-interest-bearing stablecoins, stablecoin issuers could potentially earn around $10 billion to $12 billion in gross interest income per year. Most stablecoins pay no interest, so gross interest and net interest income (NIM) are likely comparable (although stablecoin issuers have other operating expenses). We separately estimate that blockchains processing stablecoin transactions may only earn around $500 million per year from such activity (i.e., excluding fees from other transactions). Thus, total stablecoin industry revenues are only around 0.5% of traditional payments industry revenues.

Increasing stablecoin adoption should support both NIMs and transaction revenues. Under the GENIUS Act, US regulated payment stablecoins cannot pay interest directly. As a result, stablecoin issuers may be able to maintain healthy NIMs for now. However, competitive pressures could eventually lead to some interest income being shared with distribution partners (e.g., Circle’s partnership with Coinbase) and, ultimately, with users. As a result, net interest income is likely to grow slower than the supply of stablecoins. Net interest income (NIM) earned from stablecoin issuance comes primarily at the expense of commercial banks, which currently issue digital dollars for the public to use in transactions.

In contrast, we believe that transaction income should grow roughly in sync with transaction volume. For example, if stablecoins account for 20% of the transactions processed by traditional payment channels, then the number of transactions per year would reach about 500 billion. At a weighted average fee of $0.10 (see Exhibit 8), 500 billion transactions would equate to $50 billion in transaction fees per year—roughly 100 times the revenue that smart contract platform blockchains currently earn from stablecoin activity.

Ethereum hosts the largest number of stablecoins and processes the most stablecoin transactions. It also hosts USDC, USDT, and a number of smaller stablecoins. As a result, the Ethereum ecosystem is likely to benefit from the popularity of stablecoins. This includes Ethereum Layer 1 (which may be more suitable for high-value transactions and transactions with the highest security requirements) and Ethereum Layer 2 (which provides low-cost and high-speed transactions). Currently, the largest Ethereum Layer 2 stablecoin networks are Base, Arbitrum, and OP.

However, stablecoin activity is unlikely to be limited to the Ethereum ecosystem. We believe that other high-performance blockchains may also see an increase in stablecoin activity, including Solana, Avalanche, Sui, and many others. These blockchains are popular with many users due to their low costs, high transaction throughput, and/or excellent end-user experience. Especially in consumer-facing applications, these alternative Layer 1 blockchains may have advantages over Ethereum Layer 1 or Ethereum Rollup. Tron is closely associated with Tether's USDT stablecoin, so its competitive position may depend on whether Tether will take steps to qualify USDT as a regulated payment stablecoin under the new GENIUS Act framework, or whether Tron can effectively diversify into other stablecoins.

Applications that form the core infrastructure of DeFi should also benefit from the adoption of stablecoins. There are many specific examples, but we highlight Chainlink, a leading oracle and messaging service, and Uniswap, a leading Ethereum decentralized exchange. Specialized service providers focused on stablecoins, such as Paxos, Ethena, and M0, are also expected to further their popularity.

Traditional financial technology companies, as well as increasingly traditional financial services companies, have not missed the stablecoin opportunity. Earlier this year, leading payments company Stripe finalized a $1.1 billion deal to acquire stablecoin infrastructure provider Bridge, its largest acquisition to date. Bridge enables enterprises to issue, use, and transfer stablecoins globally through its API. Today, Bridge's customers range from startups to multinational companies, such as SpaceX, which uses stablecoins for fund management, and ScaleAI, which uses stablecoins to pay its global contractors.

Stripe also recently acquired Privy, a crypto wallet and deposit and withdrawal service provider. Stripe's vision is to make stablecoins an "extension layer" on top of the fiat currency system, thereby reducing the traditional financial friction faced by enterprises and artificial intelligence applications.

In addition to Stripe, other leading fintech companies involved in the development of stablecoins include PayPal (which launched its own stablecoin PYUSD in 2023 and is currently the tenth largest stablecoin by market value)[30], Fiserv (recently launched its FIUSD stablecoin), Robinhood, and Revolut (which is actively exploring launching a stablecoin). Stablecoins have also been directly integrated into the platforms of several fintech companies, including Robinhood (to support weekend settlement), MoneyGram, Visa, and Mastercard.

Beneficiaries of the popularity of stablecoins may include some existing companies that issue their own stablecoins and are able to take advantage of distribution, or companies that integrate third-party resources to improve product services. We believe that key winners may include infrastructure providers such as Stripe and Paxos, as well as low-cost deposit and withdrawal service providers such as Coinbase and Mercado Bitcoin.

The GENIUS Act provides a comprehensive regulatory framework for stablecoins in the United States, which is expected to support the popularity of stablecoins while maintaining financial stability, protecting consumer rights and preventing the financial system from being used for illegal activities. However, it is important to emphasize that before a comprehensive regulatory framework is established, most stablecoins have proven to be able to effectively maintain their pegs to the US dollar. In addition, global regulators have provided detailed compliance guidance to stablecoin issuers and related service providers, and these agencies regularly cooperate with law enforcement.

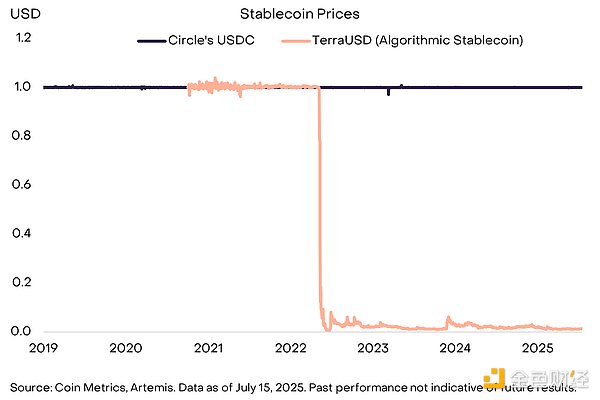

The collapse of the Terra USD stablecoin in 2022 after its circulating supply grew to over $18 billion was a major stain on the stablecoin industry. Under the GENIUS Act, such “algorithmic” stablecoins cannot be used as regulated payment stablecoins or integrated into mainstream consumer finance applications. Stablecoins that are fully collateralized by fiat assets (e.g., Treasuries and cash), such as Circle’s USDC, have been able to effectively maintain their pegs (Exhibit 10). For example, since September 2018, the price of USDC has fallen more than 0.25% from $1.00 in less than 1% of the time, and has fallen more than 1% from $1.00 on only one day. Like government money market mutual funds and “currency boards” in foreign exchange, stable value instruments backed by safe and liquid collateral are generally able to effectively maintain their pegs. Moreover, these narrow structures do not require a system of deposit insurance and central bank discount window lending that supports risk-taking commercial banks.

Figure 10: Failed stablecoins are the exception, not the norm

According to the GENIUS Act, institutions permitted to issue stablecoins must hold reserves equal to at least 100% of the issued stablecoins in the form of clearly identifiable assets. Acceptable reserve assets include U.S. dollar currency, demand deposits, short-term Treasury bills (maturity ≤ 93 days), repurchase and reverse repurchase agreements backed by Treasury bills, government money market fund shares, and central bank reserve deposits.

Under the GENIUS Act, stablecoins that are collateralized by other stablecoins (e.g., stablecoins that include Circle’s USDC in their reserves) would not qualify as regulated payment stablecoins. Based on their current reserve composition, stablecoins backed by crypto assets (e.g., DAI) and/or that include derivatives (e.g., USDe) would not qualify as U.S. payment stablecoins (although they could take steps to qualify). This means that the number of stablecoins that appear to qualify as regulated U.S. payment stablecoins based on their reserve composition is relatively small (although issuers would also need to register with regulators, maintain various compliance policies, and meet other requirements of the new law). Non-yielding stablecoins with potentially compliant reserve structures include Circle’s USDC, World Liberty’s USD1, First Digital’s FDUSD, PayPal’s PYUSD, Ripple’s RLUSD, and Paxos’ USDG (Exhibit 11).

Chart 11: Top 20 Stablecoins

In addition, the Financial Action Task Force (FATF), a global regulator responsible for developing anti-money laundering and counter-terrorist financing policy rules, has issued guidance on digital assets for about 10 years. In fact, financial institutions engaged in digital asset operations must apply almost all standard FATF policies, including Know Your Customer (KYC) policies and ongoing customer due diligence. This includes the Travel Rule, which requires service providers to record and transmit specific identity information about participants in crypto transactions. Stablecoin issuers must cooperate with law enforcement and freeze funds when requested. For example, in 2023, Tether froze $225 million worth of USDT at the request of law enforcement; more recently, Circle froze $58 million associated with a memecoin.

The GENIUS Act similarly treats each institution approved to issue stablecoins as a "financial institution" under the U.S. Bank Secrecy Act (BSA), making it subject to comprehensive anti-money laundering and sanctions rules. Issuers must maintain a risk-based anti-money laundering/counter-terrorist financing (AML/CFT) program, designate a compliance officer, monitor transactions and file suspicious activity reports (SARs), keep records, verify customers under a KYC system, and establish technical controls to block, freeze, or deny illegal transfers. The Treasury Department is directed to develop targeted regulations, but the statutory duties—customer due diligence, SAR filings, and sanctions screening—are the same as those of banks.

Stablecoins are a welcome innovation in global payment infrastructure, and we expect they will help reduce costs and bring new benefits to consumers. However, there are still limitations to the adoption of stablecoins, in part because some competing payment innovations have proven to be effective. In addition, the underlying blockchain infrastructure lacks the functionality that some stablecoins need to reach their full potential.

Many large countries have already seen the emergence of fintech platforms that offer low-cost, near-instant retail payment services. These platforms include Alipay and WeChat Pay in China, UPI in India, and Pix in Brazil. In addition, there are companies working to connect these systems to enable more efficient cross-border payments. Other fintech companies focus on cross-border payments, including Revolut, Remitly, and Wise. These services can provide cheap and fast cross-border payments when both participants have accounts on the platform. Finally, stablecoins may eventually have to compete with tokenized deposits, an alternative structure for digital dollars on the blockchain. Tokenized deposits are a bank-centric framework that lacks some of the advantages of stablecoins (which circulate as digital bearer assets), but it is favored by some regulators (and certainly by some banks).

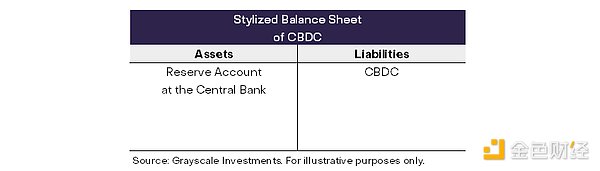

Ultimately, consumers may also have a choice between stablecoins and central bank digital currencies (CBDCs). The many possible types of CBDCs are beyond the scope of this report. However, in simple terms, a CBDC is another digital token, but one that is more directly pegged to the U.S. dollar because it holds a claim on central bank money (see Figure 12). CBDCs may or may not circulate on a public blockchain such as Ethereum. The main advantage of a CBDC over a stablecoin is that the digital token is more directly tied to the economy’s monetary system (rather than indirectly through secure collateral). However, some policymakers worry that CBDCs could lead to reduced privacy or introduce other risks. The U.S. House of Representatives also considered anti-CBDC legislation last week; the bill passed the House by a vote of 219 to 210, with two Democrats voting in favor and a Republican majority.

Figure 12: CBDC can directly obtain central bank money

Perhaps the biggest limitation to the recent adoption of stablecoins comes from the underlying blockchain infrastructure itself. In the decade since Ethereum was launched, smart contract platforms have made great progress, successfully processing millions of transactions every day. However, they still have some weaknesses in payments. For example, most blockchains do not have privacy by default - every transaction is recorded on a public ledger - and users may not want to reveal their historical spending patterns every time they make a payment. To realize the full potential of stablecoins, blockchains may need systems that combine verifiable identities with elements of privacy. Some researchers have proposed using zero-knowledge proofs to embed this logic directly into the blockchain.

Like stablecoins, blockchain is an emerging technological innovation that is still evolving. As blockchain technology moves beyond adolescence and matures with the support of a better regulatory framework, we believe it will bring many benefits to consumers and help make digital payments and other financial services more efficient.

An older video has resurfaced, featuring journalist Laura Shin claiming to possess potentially damaging information regarding Charles Hoskinson, Cardano’s founder.

Kikyo

KikyoAxie Infinity is showing strong signs of revival, with a notable 43% price increase and a spike in active user addresses over the past 10 days. The growth is not just a ripple effect from the broader crypto rally but seems underpinned by genuine gaming activity and trading of in-game assets.

YouQuan

YouQuanBNB Chain Unveils Secure Multi-Signature Wallet Service Using Gnosis Safe Protocol, Available on Both BSC and opBNB Networks.

Jixu

JixuThe looming prospect of a US Bitcoin Exchange-Traded Fund (ETF) has ignited optimism within the crypto industry, but it has also raised concerns among Bitcoin mining firms.

Jasper

JasperCrypto exchange-traded products (ETPs) attracted their highest weekly inflows in more than a year, totaling $326 million, as investors increasingly opt for ETPs to gain exposure to major cryptocurrencies without direct ownership.

Jixu

JixuThe world of cryptocurrencies witnesses a resurgence as memecoins regain prominence alongside the broader market's upward trajectory, primarily fueled by the anticipation of Bitcoin exchange-traded funds (ETFs).

Jasper

JasperBRICS accelerates de-dollarisation efforts with digital Yuan amid expanding influence.

Hui Xin

Hui XinThe Jonum regime seeks to strike a balance between encouraging innovation in French startups and ensuring user protection.

Clement

ClementBy establishing AI safety standards, prioritising privacy, and fostering global collaboration, this directive aims to ensure the ethical development of AI.

Catherine

CatherineUnibot, a trading bot on Telegram, suffered a contract exploit that led to the theft of roughly $560,000 in various cryptocurrencies. The incident caused the UNIBOT token's price to plummet by over 40%, although recovery efforts are underway.

YouQuan

YouQuan